Vertex's Products And Pipeline

Vertex Pharmaceuticals (NASDAQ:VRTX) is focused on developing and commercializing therapies for the treatment of cystic fibrosis, or CF, with some early-stage pipeline in other diseases. The three marketed CF products are KALYDECO (ivacaftor), ORKAMBI (lumacaftor in combination with ivacaftor) and SYMDEKO (tezacaftor in combination with ivacaftor). The company claims that those three products are approved to treat approximately 45% (34,000) of the 75,000 CF patients in North America, Europe, and Australia:

Source: Vertex investor presentation

Company’s late-stage pipeline is focused on expanding the use of existing CF medicines by adding additional agents, such as VX-659 and VX-445, to form a triple combination regimen for CF treatments. The NDA submission for those “triplets” is expected by mid-2019:

Source: Vertex investor presentation

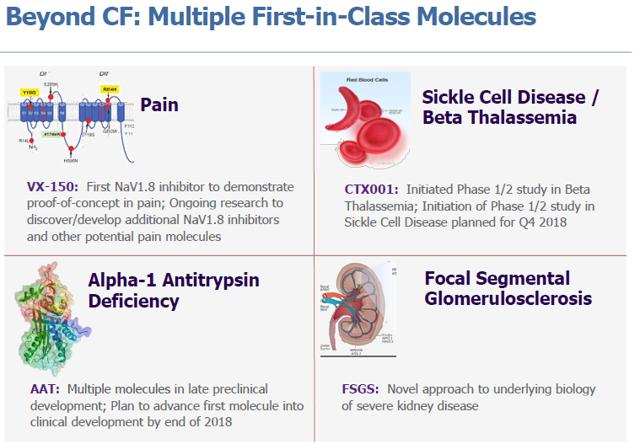

On top of well-selling CF treatments and late-stage pipeline, the company has early-stage investments in pain, sickle cell disease, alpha-1 antitrypsin deficiency, glomerulosclerosis as well as out-licensed oncology and influenza assets:

Source: Vertex investor presentation

We will mostly focus our discussion on CF as we believe CF constitutes the major part of Vertex valuation.

Vertex Management

Jeff Leiden, MD, PhD, Vertex CEO, President and Chairman is a talented leader, respected physician and experienced venture capitalist. We think that part of the reason why investors are so oversubscribed into Vertex stock and firmly believe in the future of the company is because of the leadership of Jeff Leiden. Below are some experiences of Dr. Leiden that contribute to investors’ appeal:

- Harvard Medical School professor. When a company is run by a Harvard professor, the Harvard brand name itself adds some percentage points to the valuation.

- CEO, President, and Chief Scientific Officer at Abbott (2000-2006). An architect of Humira – the drug ended up scoring more than $18 bn in 2017 and making a history as the top-selling