Every investor dreams of finding that perfect stock early in their life that they can hold forever, let compounding work its magic, and never think twice about.

For many years, I thought TransDigm (NYSE:TDG) was that stock for me. Since the company's IPO in 2006, shares have been on a steady climb higher:

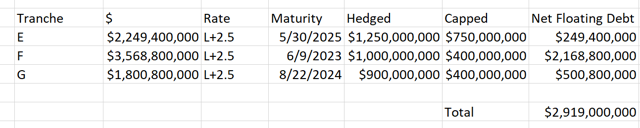

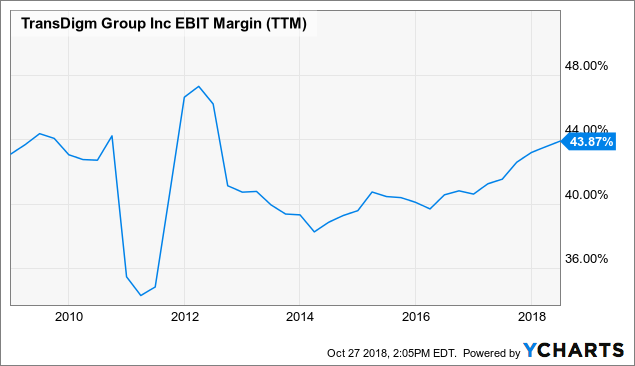

But more importantly, business has been humming along as well.

Source: TransDigm Investor Relations

Source: TransDigm Investor Relations

It seems there is nothing that can stop TransDigm. How is growth so strong?

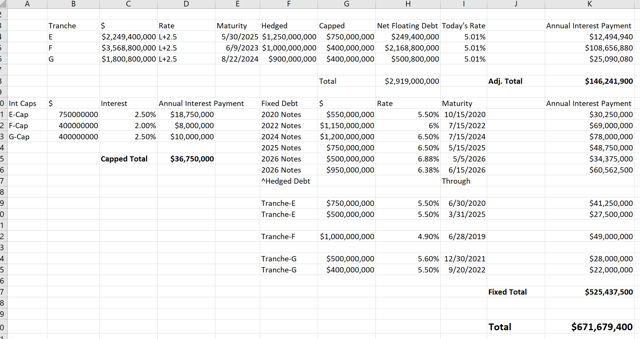

The company receives 90% of its revenue from propriety products, and 80% of its revenue from products in which it is the sole provider. These are products that the company sells with no competition.

Source: Company's latest analyst day presentation

Source: Company's latest analyst day presentation

This helps to explain the company's high margins and strong recurring revenues.

The company's 43.87% EBIT margins are very high. As a comparison, one of TransDigm's largest competitors, HEICO (HEI) has EBIT margins of "just" 21%.

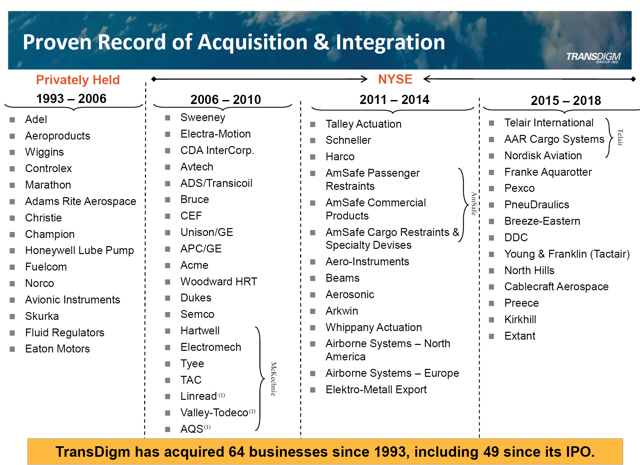

In addition, the company is a serial acquirer, making frequent M&A deals to add products to its pipeline:

Source: Company's latest analyst day presentation

Source: Company's latest analyst day presentation

But even with all this good news and the company's stellar track record, I have been reducing my holdings of TransDigm, because there is one part of the business that concerns me.

The debt.

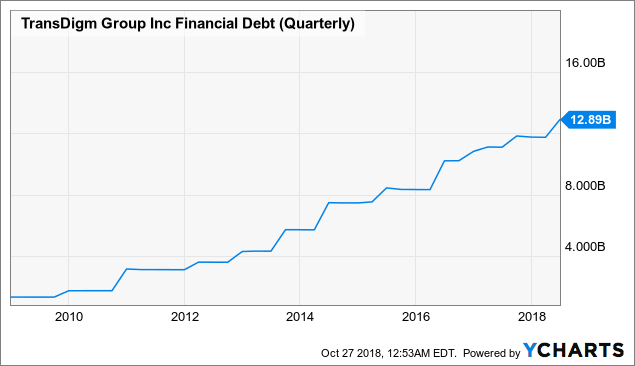

TransDigm's Growing Debt

As TransDigm has made the acquisitions that allowed its stellar growth, another part of its balance sheet has been growing as well - The company's liabilities.

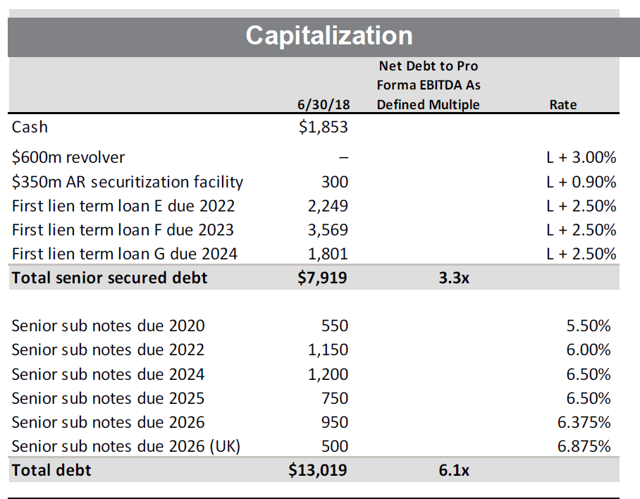

In total, the company now has more than $13 billion in debt:

Source: TransDigm's latest earnings presentation

Source: TransDigm's latest earnings presentation

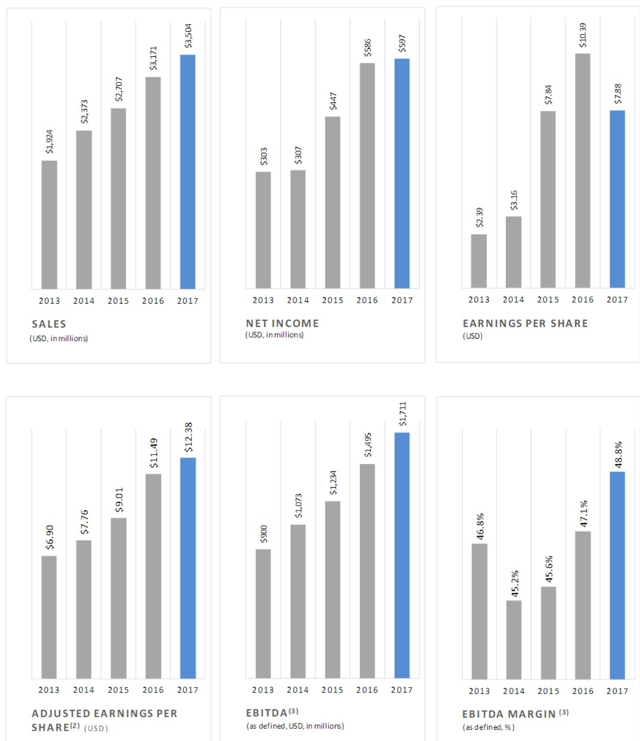

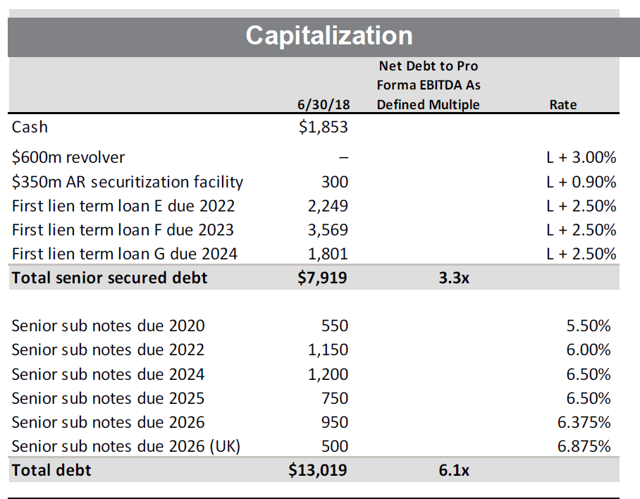

TransDigm's debt is split between a series of fixed rate notes and floating rate loans.

The fixed portion of the company's debt is easy to model into the future. But on the floating rate side, there are a series of different loans, interest rate swaps, and interest rate caps that the company has put in place to help hedge the effects of rising interest rates.

Do rising rates pose a threat to TransDigm?

Rising Rates Effect on TransDigm's Debt Payments

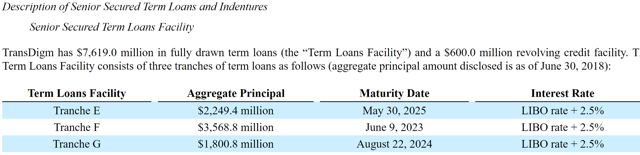

TransDigm has $7.919 billion in loans that have interest rates based on LIBOR.

A majority of that debt, $7.619 billion, is from the company's "term loans facility" at a LIBOR +2.5% rate, and $300 million is from the company's AR Securitization Facility, which is at a LIBOR + 0.90% rate.

Source: Transdigm's most recent 10-Q

Source: Transdigm's most recent 10-Q

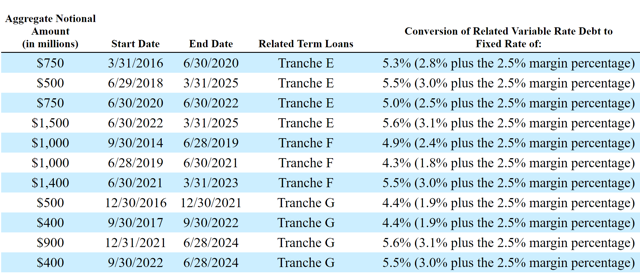

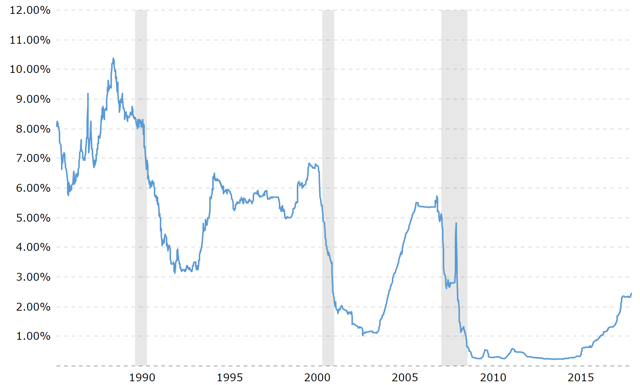

However, TransDigm has a substantial amount of derivatives to hedge against rising interest rates.

TransDigm has purchased interest rate swaps that currently convert $3.15 billion of the $7.62 billion into fixed rate loans with interest rates between 4.4% and 5.5%.

Source: Transdigm's most recent 10-Q

Source: Transdigm's most recent 10-Q

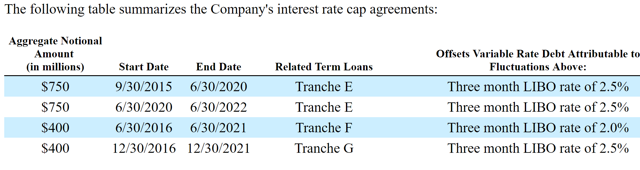

The company also has several interest rate caps in place for a small portion of the company's debt, which are just beginning to take effect as 3 month LIBOR breaks 2.50%:

After applying Transdigm's current interest rate swaps and caps, TransDigm has $2.919 billion in debt that is still subject to a floating interest rate.

After applying Transdigm's current interest rate swaps and caps, TransDigm has $2.919 billion in debt that is still subject to a floating interest rate.

This $2.919 billion is all at an interest rate of LIBOR + 2.5%.

Today, 3 month LIBOR is around 2.5%, what if the current rise in rates continues, and LIBOR reaches 6%, near where it was prior to the financial crisis?

Source: 3 Month LIBOR chart from Macrotrends

Source: 3 Month LIBOR chart from Macrotrends

That rise sounds significant, but it is about the same magnitude of rate increases that we saw from 2004-2006.

A 3.5% rise in LIBOR (to 6%) would lead to $102 million in extra annual interest payments for TransDigm. Keep that number in mind as we look at TransDigm's current interest expense and the cash its business generates.

Based on the company's current debt, interest rate swaps, and caps, I estimate the company's total annual interest expense is about $672 million:

In 2017 TransDigm generated $788 million in cash from its operations, and had interest expense of $581 million.

This year based on the company's guidance, and assuming the company's margins remain steady from last year, cash from operations is projected to be between $831-$840 million, with interest expenses of $672 million. That is a 6.6% annual increase in cash from operations and a 15.6% increase in interest expense.

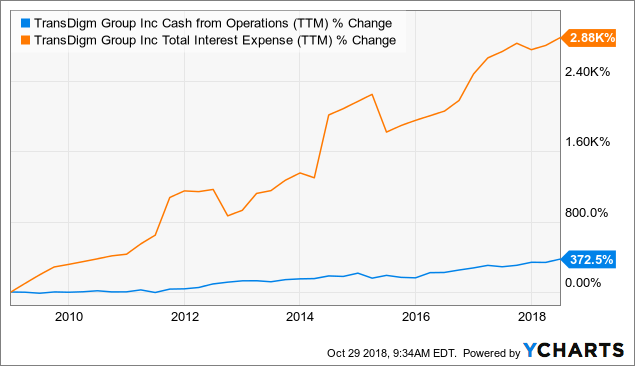

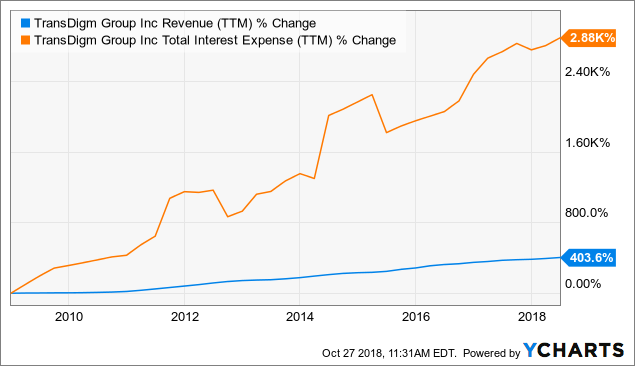

This trend has been continuing for a long time. Over the last 10 years, the company's interest expenses have risen at a much faster rate than the company's cash from operations:

And it has the potential to get worse.

If LIBOR returns to its 2006 levels, even if the company took on no additional debt, TransDigm's annual interest expenses would jump another 15.1%, to $774 million.

This leads me to question whether the company should begin to limit new debt issuance and focus on deleveraging.

But that's not what they did. In fact, they just announced one of their largest acquisitions in history.

Added Debt - The Esterline Acquisition

TransDigm recently made news by announcing its latest acquisition - Esterline Technologies (ESL) for $4 billion.

The acquisition will be paid for with a combination of cash and, of course, new debt.

At the time of company's latest 10-Q filing, the company reported $1.85 billion in cash. That balance may be as high as $2.25 billion today factoring in cash generated this quarter, as previous quarters have generated between $160 million and $292 million in net operating cash.

Regardless of how TransDigm specifically splits the $4 billion cost between its cash on hand and new debt - There is no doubt it will have to add a significant amount of new debt.

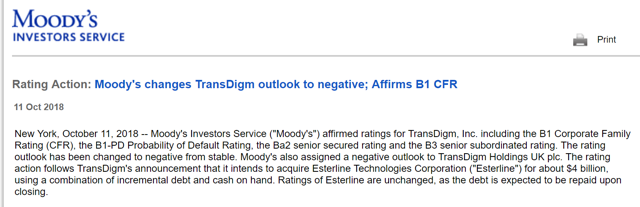

And that has raised some eyebrows. Moody's immediately changed the company's debt outlook to negative:

Source: Moody's

Source: Moody's

Investors should be looking closely at the company's next earnings announcement to see if the terms of this new debt are similar to their current debt, or if they will now be forced to pay a significantly higher interest rate.

As an estimate, assuming the company adds $2 billion in debt at a 5% interest rate, the company will have an extra $100 million in annual interest rate expenses. But, should generate an extra $250 million in EBITDA as long as Esterline's product sales remain steady.

TransDigm has no problems paying for its loans today. The company has made some great derivative purchases that will save the company a lot of money if interest rates continue to rise. So what's the worry?

I worry that over the long term, as the company takes on new debt (like with their Esterline acquisition), interest swaps expire, and loans need to be refinanced, somewhere down the line the good times for TransDigm will end.

Is TransDigm's Debt Load Sustainable?

To me, the question is: 'How long can the company keep increasing its debt load?'

Because the cost for TransDigm to service this debt load has been increasing at a very rapid rate:

As the large principal payments of company's big loans come due, TransDigm will have some decisions to make.

Recall TransDigm's debt schedule:

Source: TransDigm's latest earnings presentation

Source: TransDigm's latest earnings presentation

If the company does not want to refinance its debt:

In 2022, the company will need $3.399 billion (term loan E + 2022 notes).

In 2023 the company will need an additional $3.569 billion.

In 2024 the company will need an additional $3.01 billion.

In total, the company needs $9.97 billion by 2024 just to pay off its principal debt. Is it able to generate that amount of money?

If the company wants to pay off these loans instead of refinancing them, it needs to begin to save its profits.

The company's cash from operations in 2018 should be $840 million.

If we assume that rises 25% annually, which is very optimistic, the company's future cash generation levels would be:

| Year | Cash from Operations (Millions) |

| 2018 | $840 |

| 2019 | $1,050 |

| 2020 | $1,313 |

| 2021 | $1,641 |

| 2022 | $2,051 |

| 2023 | $2,563 |

| 2024 | $3,204 |

For a total of $12.66 billion, enough to cover the company's full principal payments.

And remember, this is before accounting for the new loans from the Esterline purchase, which will likely add at least $1.5 billion to the company's debt total.

That would require the company saving nearly every penny of its cash generated from now until 2024.

Of course, the easy solution is to have TransDigm refinance the debt and push the principal payments out further. That creates an obvious potential for danger if that happens to occur that the same time as the next recession when credit markets are tighter.

It also introduces the possibility of TransDigm paying much higher interest rates in the future. Interest rates are rising, TransDigm's credit rating is declining, and many of its derivatives begin to expire.

What I worry is that TransDigm is no longer using credit for growth at its option, but is now dependent on credit to continue.

The Alternative - Slowing Growth

If it stops making acquisitions and business remains steady, it should be able to generate the cash flow needed to repay its big loans due in 2020 through 2024.

But I believe the company has put itself between a rock and a hard place, because building up the cash to repay its loans means halting the engine of growth for TransDigm.

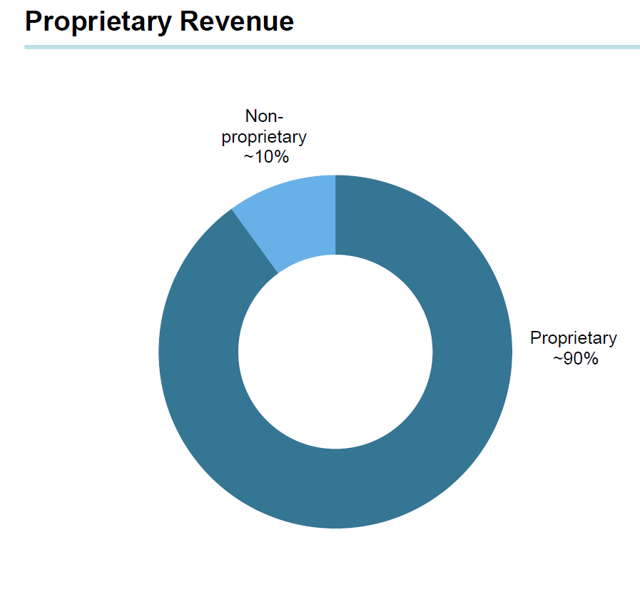

Without the leverage and new acquisitions, TransDigm's organic sales are growing in the mid-single digits:

Source: TransDigm's latest earnings presentation

What multiple is TransDigm worth at a mid single digit growth rate compared to today's 20+% growth rate? My guess is much lower than what it trades at today.

Ultimately, I believe this gives the company 2 options:

1) Continue to lever up, take on more debt, and be forced to always refinance debt that is due, leaving the company at the mercy of the credit markets in the future. Or,

2) Slow the growing debt load while sacrificing revenue and cash flow growth, leaving investors stuck with a low growth, high debt company (and likely decreased share price!)

One last concern:

The Wild Card - Margin Compression

TransDigm is only able to do what it is currently doing because of its sky high margins. If margins drop, TransDigm's ability to generate cash disappears.

Now that's a big if, I admit. But it would be incredibly damaging to TransDigm.

Andrew Left of Citron research said ran the numbers and found:

"If TransDigm were to operate with the same EBIDTA margins as HEICO, their next closest competitor on EBITDA margin, which is still double that of the rest of their peer group, its EPS falls 85%."

What could cause that margin decline?

Just yesterday, there was a surprise announcement from President Trump:

Source: BreakingDefense

Source: BreakingDefense

Where does the Pentagon begin cutting expenses? The easy target is putting pressure on companies that are raising prices significantly and operating at 40+% margins.

Its hard to imagine TransDigm not already under the microscope. Now I suspect they will be even more so.

Every one of TransDigm's customers is under pressure to reduce costs, its part of the market. How long can TransDigm continue to demand the highest prices in the industry?

I don't know how to quantify this risk, but it is obviously there. TransDigm can only operate if it maintains the highest margins in the industry. Any chances of increased regulatory or competitive competition, and TransDigm will be severely hurt.

In Summary

I don't doubt TransDigm's business model, management, or the company's products. But there is an inherent risk in investing a company so heavily dependent on debt to continue its operations.

Its hard to imagine TransDigm's business slowing significantly due to its proprietary products, huge backlogs at its customers like Boeing, and the steady budget of the U.S. military.

But as investors we need to expect the unexpected, or at the very least plan for it. History has taught us that what once seemed untouchable is often the opposite. TransDigm's high and growing leverage is leaving less and less room for the company to maneuver should a slowdown or margin compression occur.

I don't know what will happen with TransDigm, I think there is a very good chance that TransDigm continues to climb higher. But I do know that with its current leverage, one small slip could result in a world of hurt for investors - so I'm staying clear.

One quote that I keep coming back to again and again when looking at TransDigm is from Warren Buffett:

"Over the years, a number of very smart people have learned the hard way that a long string of impressive numbers multiplied by a single zero always equals zero.”

TransDigm has put up very impressive numbers over the last decade. But the significant leverage increases the chances of TransDigm putting up much less impressive numbers in the future.