Author's Note: This article is intended for investors oriented towards value/deep-value/distressed asset investing. Those seeking moderate - to high-risk value investments may have an interest in this article. Investments in this company at any level of the capital structure are unsuitable for those seeking retirement income, and I strongly discourage purchase of securities related to this company for retirement income accounts where a focus on risk aversion should be paramount.

On December 20th, 2018, Wheeler Real Estate Investment Trust ("Wheeler") (NASDAQ:WHLR) announced that it would suspend the dividends on the three series of Preferred Shares to help management "accelerate its efforts to reduce short-term, higher cost debt where accretive and complete strategic dispositions and refinancings, while continuing its efforts to improve portfolio occupancy. The Company continues to work through strategic alternatives with its advisors." (Wheeler Press Release, Wheeler Real Estate Investment Trust Investor Relations website).

All of the publicly-traded securities for Wheeler dropped precipitously from the close on December 19th (day prior to the announcement) to the close on December 21st (the day after the announcement) representing a 35% decline for the common shares (WHLR), a decline of 55% for the Preferred "B" Shares (NASDAQ:WHLRP) and a decline of 45% for the Preferred "D" Shares (NASDAQ:WHLRD).

Since that point, the Preferred Shares have retraced the decline by about 50%, while the common shares have remained near the lows. Is the current market pricing justified or did the drop in share value for either the preferred shares or the common (or both) create a buying opportunity for experienced, distressed asset investors?

To determine if there are assets that are currently being undervalued, one begins with the balance sheet to identify what is owned, what is owed, and what net value might exist for investors at either capital tier, common or preferred.

The Balance Sheet:

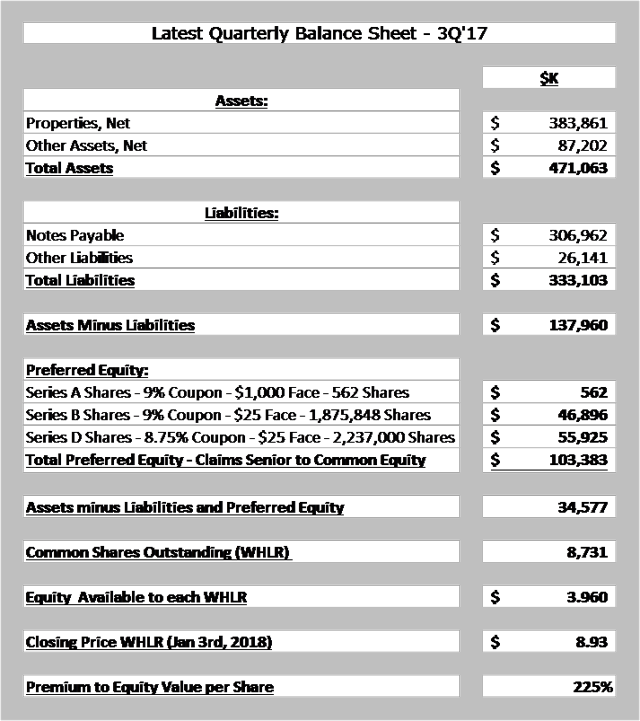

The latest balance sheet published was for Q3'19, shown here:

(This table and those following were produced by the author using publicly available financial information from Wheeler Real Estate Investment Trust, obtained from the Wheeler Investor Relations website and from Wheeler's 10Q filings with the SEC).

(This table and those following were produced by the author using publicly available financial information from Wheeler Real Estate Investment Trust, obtained from the Wheeler Investor Relations website and from Wheeler's 10Q filings with the SEC).

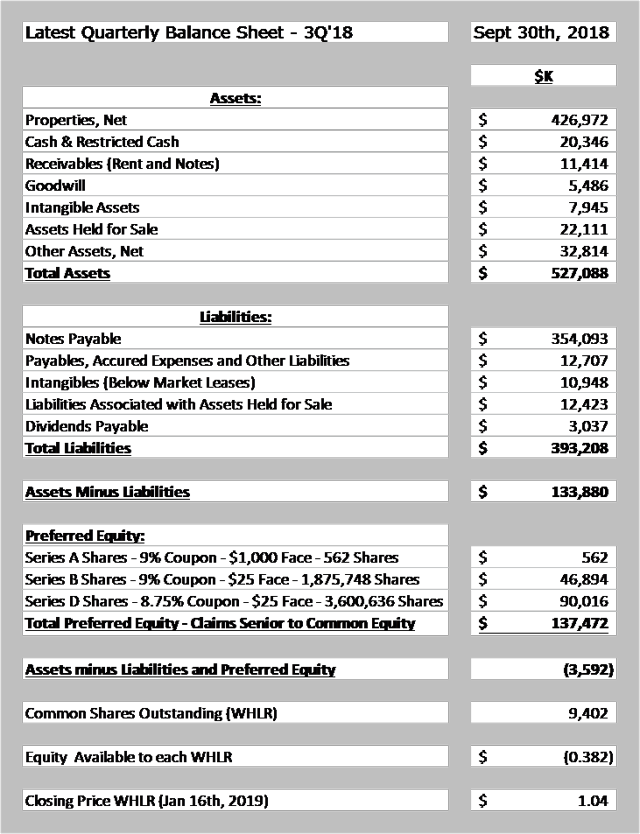

The state of the balance sheet shows a marked deterioration from the balance sheet just one year earlier, as shown here, taken from an earlier article on Wheeler (found here):

While the assets net of liabilities decreased only slightly, the total claims by the preferred shares series, senior to the common shares, increased by about a third, with no other apparent increase in assets offsetting this increase.

What happened?

The JANAF Acquisition and Its Impact:

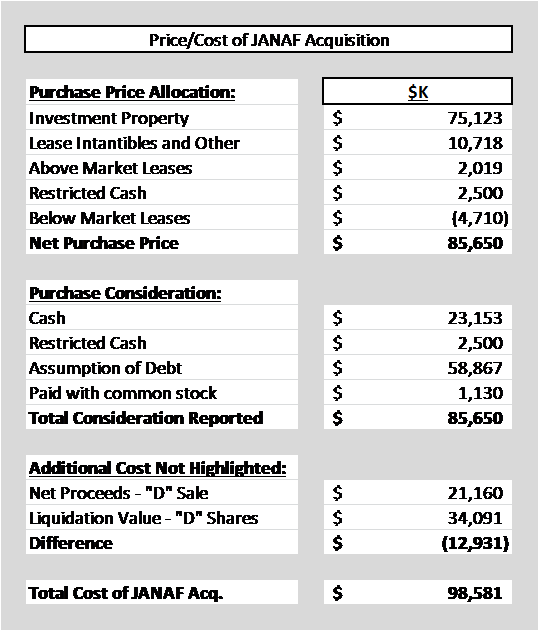

The JANAF acquisition happened, which can be shown to have done substantial damage to the value underpinning the common shares. It is easiest to understand by looking at the next table, highlighting the assets acquired from this acquisition as well as the price and total cost of securing these assets:

The most recent 10Q had the first two sections highlighted, showing the details of the JANAF acquisition. This first section of the table shows the assets purchased in this transaction, while the second section shows the consideration used to pay for the transaction. I had written a blog article on January 16th, just after the acquisition, estimating these values to show the true cost of this ill-conceived acquisition, but the reporting of the 10Q provides the exact values which are used here. The 10Q provides the data shown in the first two sections of the table: Purchase Price Allocation and Purchase Consideration.

The most recent 10Q had the first two sections highlighted, showing the details of the JANAF acquisition. This first section of the table shows the assets purchased in this transaction, while the second section shows the consideration used to pay for the transaction. I had written a blog article on January 16th, just after the acquisition, estimating these values to show the true cost of this ill-conceived acquisition, but the reporting of the 10Q provides the exact values which are used here. The 10Q provides the data shown in the first two sections of the table: Purchase Price Allocation and Purchase Consideration.

What is not highlighted in the 10Q is the very "expensive cash" used as part of the purchase consideration, which is illustrated in the third section of the table (and in my earlier blog). About 90% of the cash used for the purchase was raised by selling substantially discounted Series "D" Preferred Shares, a $25 face value (i.e., liquidation value) preferred shares, which was sold to raise the cash for a nominal $16.50/share (including underwriting fees, Wheeler collected $15.52/share for each share). In effect, this increases the actual purchase price of the JANAF assets by nearly $13M, as shown in the table, resulting in a total cost of the JANAF acquisition to be actually nearly $99M, rather than the $86M discussed.

The 1,363,636 shares carry a total liquidation value of $34M, explaining the increase of preferred share claims. Because they were sold at a discount, the preferred series claims increase by the $34M, but book assets increase by only $21M, reducing remaining claims by common shares on book assets by nearly $13M.

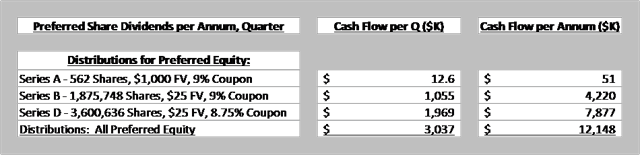

The substantial amount of Preferred Shares not only results in the preferred capital tier laying a senior claim to essentially all of the book assets of Wheeler, leaving none for the common, but also results in a substantial demand for distributions to the Preferred Shares as a percent of available cash flow. With annual distributions now being increased due to the additional 1,363,636 "D" shares by nearly $3M annually, distributions owed to satisfy the dividends for all three series of Wheeler preferred shares series now consumes a bit above $3M per quarter or $12M per annum, as shown here:

Add this burden to a relatively high interest expense and one finds the remaining cash flow available for debt redemption and other purposes is limited relative to current need. The interest on the outstanding debt assumed in the JANAF/JANAF BJ's purchases (4.49% on $52,656K for JANAF plus 4.95% on $5,091K for the BJ's, summing $2,364K plus $252K to $2,616K) result in an additional interest expense of over $2.6M, as well as the $3M in additional dividend payments created through the additional issuance of "D" shares, create a high financing cost for this acquisition.

Add this burden to a relatively high interest expense and one finds the remaining cash flow available for debt redemption and other purposes is limited relative to current need. The interest on the outstanding debt assumed in the JANAF/JANAF BJ's purchases (4.49% on $52,656K for JANAF plus 4.95% on $5,091K for the BJ's, summing $2,364K plus $252K to $2,616K) result in an additional interest expense of over $2.6M, as well as the $3M in additional dividend payments created through the additional issuance of "D" shares, create a high financing cost for this acquisition.

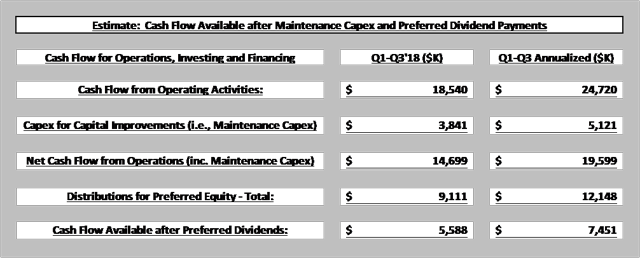

The impact of Maintenance Capex and Preferred Distributions on the cash generated through operations through the first three quarters of 2018 (as well as annualized) is shown here:

It is worthy of note that the Cash Flow from Operations (CFFO) for 2018, after the JANAF purchase, was $18,540K while the CFFO for 2017, prior to the JANAF purchase, was $18,820K; in addition, that figure is calculated before factoring in the extra $3M in additional dividend distributions created from the issuance of the "D" shares. Annualizing this data shows that there is only about $7.5M available in cash to improve properties or, perhaps more importantly, begin to pay down debt after factoring in necessary capex plus simply paying the preferred shares dividend. This small amount of cash flow available for other purposes is likely to limit the "degrees of freedom" afforded Wheeler to work out of their relatively deep leverage "hole".

It is worthy of note that the Cash Flow from Operations (CFFO) for 2018, after the JANAF purchase, was $18,540K while the CFFO for 2017, prior to the JANAF purchase, was $18,820K; in addition, that figure is calculated before factoring in the extra $3M in additional dividend distributions created from the issuance of the "D" shares. Annualizing this data shows that there is only about $7.5M available in cash to improve properties or, perhaps more importantly, begin to pay down debt after factoring in necessary capex plus simply paying the preferred shares dividend. This small amount of cash flow available for other purposes is likely to limit the "degrees of freedom" afforded Wheeler to work out of their relatively deep leverage "hole".

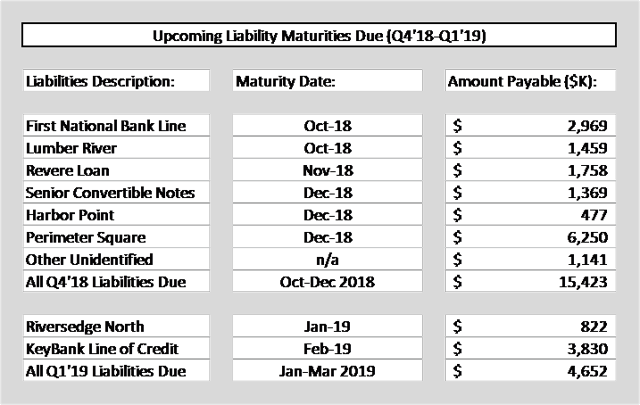

Compare that $7.5M of cash flow beyond capex and preferred distributions to the debt maturities which came up in Q4'18 and will come up in Q1'19. The reader can see why the dividends on the preferred shares needed to be suspended:

$15M came due in Q4'18 and another $4.7M is coming due in Q1'19. With only a small amount of unrestricted cash on the balance sheet, one begins to see why all of us should have been expecting this preferred distribution suspension.

$15M came due in Q4'18 and another $4.7M is coming due in Q1'19. With only a small amount of unrestricted cash on the balance sheet, one begins to see why all of us should have been expecting this preferred distribution suspension.

For all of 2019, there will be $80M of debt maturities coming due, including two large tranches of $22,260K due to Rivergate and $48,272K due to KeyBank in December. This means that, between Oct. 1st, 2018, and January 1st, 2020, Wheeler will need to either redeem or refinance $95M of debt maturities due in that period while generating internally only $9M of cash not otherwise spoken for by capex or preferred distributions. Many of these debt maturities will be refinanced, but perhaps not all, and it would be in Wheeler's best interest to take out some of the very expensive financing (e.g., the Revere Loan at 9% as well as the Senior Convertible Notes at 9%) to begin to pull down the interest expense where possible.

While one cannot determine for certain the decisions that management will take, there do appear to be some trends taking shape:

- Asset sales will continue to be critical to the effort by Wheeler management to de-lever their balance sheet sufficiently as there will not be sufficient cash generated internally to accomplish the necessary de-levering.

- Over the five quarters starting Q4/18, Wheeler will be under particular pressure to manage upcoming debt maturities. The debt maturities represent a total amount ten times the cash available to manage them from Q4'18 through the end of 2019 (i.e., $95M of debt maturing versus $9M in "free cash" after maintenance capex and preferred distributions).

- Given this pressure, distributions for the preferred shares may not resume immediately, even as management said that they would look at the dividend again in Q1'19. I cannot read the board's mind and cannot be sure whether dividend distributions will resume in Q1'19 or not. However, from my vantage point, I would be focused on de-levering the balance sheet and would worry about the preferred distributions later, and I suspect management and the board will also have this same view.

- With substantially less debt maturing in 2020 ($19.6M), 2021 ($10.6M) and 2022 ($8.1M), summing to half of what is due just in 2019 alone, there may be some financing "breathing room" once 2019 has been survived.

- As there are asset coverage covenants on the "D" shares, the dividend cannot continue to accrue forever, but it can be accrued for some time until it becomes problematic for the asset coverage covenant (it includes accumulated depreciation, increasing apparent assets by about 10%).

The bitter irony is that the divestitures now being made under duress, for which the best prices can probably not be secured, were brought on by an ill-conceived acquisition for which incredibly expensive financing (in the form of the sale of preferred sales sold at a 38% discount to face) was employed. The driving need to divest properties at presumptive "fire sale" prices is a result of an making an acquisition financed using "Rolls Royce" terms. In the final analysis, Wheeler will end up both smaller and poorer due to the effort to get bigger and richer with the JANAF acquisition, presumably not what was intended.

The board was right to fire Mr. Wheeler, even if his name was on the door. If Wheeler management is not deft and nimble in working through this difficult situation, Mr. Wheeler's name will also be on the tombstone.

Implications of the Current State of the Balance Sheet and Cash Flow on Investments in the Common or Preferred Equity in Wheeler:

Given this setup, are there any Wheeler securities that represent sufficient value for taking the considerable risk? To answer this question, one would need to know what type of investor the reader is:

a. If the reader is not an experienced, deep-value investor that can tolerate the volatility of deep value or distressed investments, neither the common shares nor the preferred shares would be recommended, and I would look elsewhere for investments. Indeed, investors have already seen in 2018 just how volatile both the common and the preferred shares are, and this trend does not appear to be changing anytime soon. If an investor cannot handle this degree of volatility, and many cannot, then these securities are not suitable for that investor.

b. If the reader is looking for a deep-value investment (with the stomach for substantial volatility) that has the potential of delivering very high potential appreciation, as is the author, then the preferred shares might look as interesting to the reader as they are to the author. Currently, a liquidation analysis shows a recovery of 97% of the face value of the preferred shares based upon net book value, up ca. 100% from the current market price for the "D" Shares and up nearly 150% from the current price of the "B" Shares. While I expect the dividends to be accrued at least over the next few quarters before they begin to be paid out, there still represents strong upside and a potential for a 15-20% yield. In the view of the author, there is a substantial asymmetry for these securities to the upside.

c. The common shares appear highly speculative, with reasonable probabilities to capture exceptionally high appreciation, but also a reasonable probability to go to zero. Some investors use such leveraged situations in their investments, but the common shares appear to the author to be junior to the fulcrum securities, the preferred capital tier. As such, the author is not recommending nor is taking such an approach. On the other hand, the author can understand those investors who would pursue such a strategy with a limited amount of capital to treat the common shares as call options on a recovery of Wheeler. The common shares represent a very cheap call option, with no expiration, on the reasonable probability that the management team can work their way out of the current malaise and create additional asset value over time, for which would accrue predominantly to the common shares. While the common shares currently have claim on no net assets on the balance sheet at the present time (as the preferred share liquidation value exceeds the assets net of liabilities, leaving nothing for the common), the value of the real estate portfolio would not have to exceed book value by much to create substantial value for the common shares. However, like true call options, they frequently expire worthless, and the common shares could also meet that fate.

It is at this point that some investors would criticize of the use of book value being used here and will argue against this approach. In fact, there will be two arguments about the use of book value:

a. The securities are not worth book value as Wheeler's real estate is not very good and is not worth what the book value suggests, or

b. The securities are not worth book value as Wheeler's real estate, like the real estate of other property companies, understates the value of the real estate due to accelerated depreciation.

The two schools of critics will agree that book value is worthless, then come to two diametrically opposed conclusions (that Wheeler is both worth more and less than book value).

So, I agree that net book value will not provide an exact value of the company, nor should it be used in and of itself to provide a mechanical valuation without additional analysis. However, I disagree when critics say it is worthless. What it does provide is an unemotional, historical landmark from which analysts can work to determine if a company's securities should be valued at higher or lower prices from this quantitative milepost, inferring a reasonable valuation for the company. Therefore, even the critics of the net book value should use book value as a starting point, then use their best estimates of the degree to which value should be increased or increased to reflect the specific situation for the company being analyzed.

Typically, I simply use book value even as I believe that book value structurally understates market value (for real estate companies). That is, I use book value as an estimate for recovery value even as I believe that, in the case of Wheeler as in the general case, book value underestimates the value of the property in aggregate and am therefore estimating low. This provides the author with a margin of safety on the targeted distressed investments equal to the difference between net book value and actual market value for the portfolio.

This is also suggested by recent sales of property discussed on page 16 in the Q3'18 10Q. Most notably, the company booked a gain of $1,270K for the Shoppes at Eagle Harbor on a sale price of $5,705K, suggesting a $1,270K gain on a $4,435K basis, a 28% gain relative to the book value of the asset. A ground lease and a parcel of land sold for larger relative gains (46% and 457%) relative to their book value. While these anecdotes may not be representative of the entire portfolio and do not prove that the entire portfolio would go at a gain, it suggests that properties owned by Wheeler can be liquidated at near book value valuations in many cases, with book value being a reasonable measure of recovery value.

Therefore, since that book value would suggest that it represents a reasonable recovery value and since 97% of the preferred face value could be recovered in a liquidation with that assumption, then it appears to this author that the preferred shares represent the best reward-risk ratio, given current market pricing for these shares. A 97% recovery can be secured on assets selling at 40-50% of face value and delivering a 15-20% dividend (albeit accruing at the present time).

However, there are two very different preferred share offered in the market, so which would be the preferable series to purchase if one were interested in buying a Wheeler preferred?

Wheeler Preferred Shares Series:

Wheeler has issued three Preferred Shares Series, two of which trade on public markets:

i. The "A" Shares: There are 562 shares outstanding with a face value of $1,000 each, resulting in a liquidation value of $562,000 for this share series. They yield 9.0%, resulting in distributions of $90/share annually or $22.50/share by quarter. As far as I have found, I do not find this share series trading in public markets.

ii. The "B" Shares (or ticker WHLRP): There are 1,875,748 shares outstanding with a face value of $25 each, resulting in a liquidation value of $46,894K for this share series. They yield 9.0%, resulting in distributions of $2.25/share annually or $0.5625/share by quarter. They are cumulative, so if the dividend is not paid when due, as is the case today, it must be paid before the common shares can receive any distributions. In a liquidation, dissolution or windup, the owner of each share will receive full face value plus dividends due or accrued, if any, in cash, prior to any recovery for the common shares; however, it is important to note that a merger or consolidation does not constitute a "windup" of the company nor does the sale of some or all of the assets to another party. These shares can be converted to common stock at $40/share and must be converted to common shares if the market price exceeds $58/share on a volume-weighted average closing price over twenty days (unlikely given the current market share price for the common at about $1/share). There are not the protective covenants included for this share series that one will see in the next series.

iii. The "D" Shares (or ticker WHLRD): There are 3,600,636 shares outstanding with a face value of $25 each, resulting in a liquidation value of $90,016K for this share series. They yield 8.75%, resulting in distributions of $2.1875 annually or $0.546875/share by quarter. They are cumulative, so if the dividend is not paid when due, as is the case today, it must be paid before the common shares can receive any distributions. In a liquidation, dissolution or windup, the owner of each share will receive full face value plus dividends due or accrued, if any, in cash, prior to any recovery for the common shares; however, it is important to note that a merger or consolidation does not constitute a "windup" of the company nor does the sale of some or all of the assets to another party. There are a number of protective covenants incorporated in this share series:

- Voluntary Conversion: Holders of "D" Shares can convert their preferred shares into common shares at any time at a conversion rate of $16.96/share (unlikely given the current market share price for the common of $1).

- Change of Control/Delisting Covenant: If a change of control occurs and the company does not redeem this share series, the holder has the option to cause the issuer to redeem the shares, solely in cash, for the full face value plus any dividends owed or accrued.

- A "Failure to Redeem" clause: If the company does not redeem these shares for face value plus dividends owed or accrued by September 23rd, 2023, the coupon rate on the dividend will increase by 2% each year to a maximum dividend rate of 14%. Owners of this share series will either get back face value for their currently heavily discounted shares or will be getting substantially higher distributions going forward from September 2023. These punitive rates suggest to the author that these shares will be redeemed as of September 2023.

- Ability to Cause Wheeler to Redeem Shares after September 23rd, 2023: Commencing on September 23rd, 2023, the holders of the "D" Share will have the option to cause the company to redeem their shares at face value plus all accrued plus unpaid dividends, if any, if the company does not choose to redeem the stock as discussed above. Be aware that the company retains the option to pay those shares "put" to them by owners in either cash or in stock on the basis of a weighted average price at the close of the prior twenty days, or a combination of both cash plus common shares.

- Ability to Elect Board Members if Dividend Not Paid for Six Quarters: If dividends are not paid for six or more consecutive quarters, the number of directors for Wheeler's board will be increased by two positions to be elected by holders of the "D" Shares.

- Mandatory Redemption for Asset Coverage: Wheeler is required to maintain a 200% coverage of assets to the value of the "D" Shares, calculated by Total Assets plus Accumulated Depreciation minus Total Liabilities and Indebtedness minus Term Preferred Stock or Preferred Stock providing for a Fixed Mandatory Redemption Date or Maturity Date (which the "D" Shares have, but not the "B" Shares nor the "A" Shares).

I am not sure that Wheeler is in compliance with the Mandatory Redemption covenant and JCP Investment Partnership has filed suit in Baltimore, alleging that Wheeler is required to redeem these shares at $25 plus accrued dividends as they have not lived up to this clause.

I have tried to reproduce the calculation here ($K) based upon Q3'18 values:

| Total Assets | $527,088 |

| Accumulated Depreciation | $ 36,190 |

| Sum of Assets and Depreciation | $563,278 |

| Total Liabilities | $393,208 |

| Sum of Assets and Depreciation minus Liabilities | $170,070 |

| Redeemable/Term Preferred Shares Liquidation | $ 90,016 |

| Difference | $ 80,054 |

| Redeemable/Term Liquidation plus Accrued Dividend | $ 90,016 |

| Coverage (Must be > 200%) | 89% |

It appears to me that the company is coming up short on this calculation, so either there must be a nuance in the definition of one or more of these elements that I did not reflect properly or the company is far out of compliance. It appears to me that JCP has a point about this covenant and whether redress is needed. This will be worked out in court.

If the full liquidation value of the "D" Shares were paid out with accrued and unpaid dividends, then that will leave the nominally "pari passu" Preferred Shares in a more confined position. However, my reading of the respective Prospectuses suggest that, if the dividends are paid out by the company to the "D" Shares (in order to redeem the stock), then the dividends on the "pari passu" "B" Shares must also be paid out.

One Final Point: the "D" Shares have a substantial "liquidity" advantage since the "D" Series has roughly double the market value of the "B" Series ($90M versus $47M), making the "Ds" more liquid and more easily traded.

It is the author's view that the "D" shares are the preferable way to invest in this admittedly risky situation. Even as the "D" Shares sell at a 16% "premium" to the "B" shares (at market close on January 22nd, WHLRD was $12.24/share and WHLRP was $10.54/share), the protective clauses in the "D" Shares may well be needed to ensure that value can be secured as time goes on.

What Is The Owl Doing?

In my previous article on Wheeler, published on January 8th, 2019:

At $20/share, I will be receiving a dividend stream of 10.9%, above my target yield level of 10%. In addition, given an expectation of these shares being redeemed on 09/21/2023, 5.6356 years away, an additional 4% per annum capital gain will be secured. Adding the cash income return and the capital appreciation together, a near 15% return per year will be secured on a security where the risk is more than compensated by the total return.

Experienced value investors, who can tolerate volatility of principle, should consider these shares to secure high income over the next 5 ½ years. Given the volatility in price expected, "sip, don't gulp" and don't feel the need to buy at once; rather, buy some and watch how the issue fares in the market before additional commitments (which is the approach that I am taking and continue to take). Even with a volatile price over the period up to being called, given the concerns about Wheeler, the market price should converge on a $25 price as 09/21/2023 nears. The "failure to redeem" feature of this share series kicks in on that date, making it highly probable that these shares will be redeemed at face value (plus any accrued dividends not yet paid); otherwise, the holder of these shares will receive ever increasing dividends up to 17+% on $20/share, again more than compensating for the actual risks being taken."

Unfortunately, this was published seven days prior to the announcement of the ill-begotten JANAF Acquisition, an ill-advised transaction that I did not, nor could not, anticipate. I will leave it to the reader whether such a reckless, value-destroying approach could be anticipated reasonably by any analyst.

Be that as it may, this acquisition and the approach used to fund resulted appropriately in an appropriate downgrading of the market value for all Wheeler common and preferred shares, including the "D" Shares, since the Company themselves were selling "D" Shares for a nominal $16.50/share. In early May, I bought more shares at $16.68/share, bringing my current position to about 60% of my target position at a price close to the offering price of the "D" Share to fund the acquisition. The "sip, don't gulp" advice offered earlier turned out to be very important as it frequently is for deep value or distressed assets of this type.

I considered purchase of the "D" Shares again after the dividend suspension announcement as they plunged by another 50% to a low price of $7 on December 21st, the day after the announcement of the dividend suspension. This plunge happened at the time of a very negative tape, culminating in the Christmas Eve plunge to recent lows. While I considered buying Wheeler, I held back to take another look at the state of the finances for Wheeler to determine if I wanted to add to the position or not (and looked at other attractively priced securities in parallel).

I continue to hold the "D" Shares and expect to add to them over time, but I am not planning on significant additional purchases until I can see the Q4'18 and full year 2018 results, especially the balance sheet. While there were attractive prices in late December, I still expect to retest the December 2018 market lows later in 2019, providing an opportunity to pick up Wheeler (and other securities) at prices even more attractive than they are today. If Wheeler restores the dividend, then I may lose the chance to secure more shares at this price, and it will have been an opportunity lost; however, if the dividend is again not paid, but continues to be accrued, I expect the prices on Wheeler securities to remain low, offering the ability to accumulate at a steady pace in small increments to reduce risk.

My expectation will be that Wheeler will continue to avoid dividend distributions at least through December of 2019, to manage the $70m-ish in debt redemptions/refinancing to take place that month. I obviously don't know what the board will decide to do, but the limited cash flow would suggest that what is available is needed more urgently elsewhere than preferred distributions.

My focus will remain on the "D" Shares instead of the "B" Shares. However, if the "B" shares returned to a sub-$9 price (and at a 25+% discount to the "D"s), I might put place part of the portfolio targeting Wheeler into the "B" shares. The "B" Shares are "pari passu" with the "D" Shares in any bankruptcy or liquidation (even if they are purchased at a lower price) and a payment to the "D" Share by the Company would need to be provided pro rata to the "B" Shares as well for dividends (but not, in my view, for a call on the "D" Shares other than a payment for the dividend). I would not put more than a third of the money targeting Wheeler into the "B" Shares as they carry some risks against which the "D" Shares are better protected and for which the current discount does not offer an adequate offset.

Going forward, my plan is:

- Buy a small amount of "D" Shares in the upcoming days, increasing my position by about 20% at near current prices, waiting to add more for yet better prices to complete the investments focused on Wheeler,

- Add "D" Shares slowly over time as better prices appear,

- Continue to focus on the "D" Shares unless the "B" Shares drop to a 25-30% discount; even then, I will limit "B" Share purchases to about a third of my total purchases,

- Avoid purchase of the common shares,

- Hold both the "B" and "D" Shares to the likely redemption point of September 23rd, 2023, at which time I expect the "D" Shares to be redeemed, requiring any cumulative dividends to be paid (if they have not been paid prior to that point),

- Payment of cumulative dividends on the "D" Shares would trigger a requirement to pay the cumulative dividends on the "B" Shares as well (at least, according to my reading of the two Prospectuses), again if they have not been already paid. Paying out the "B" Shares cumulative dividends at the end of Q3'23 means that $8.44/share of distributions would be made on Shares currently costing $10.11 at the close of trading on January 23rd, 2019 (if the shares were purchased before the ex-dividend date for the Q1'19 dividend which I believe will be March 26th, 2019).

- If the company liquidates, winds-up or goes into a re-organization process, then the "B" Shares represent a cheaper call on the assets of the company, suggesting that a mix of "B" and "D" Shares, in spite of the protections of the "D" Shares, represent the best approach if the "B" Shares discount increases significantly at some point in the future. However, they must be limited in proportion to avoid other risks attendant to the "B" Shares.

Summary:

- The current (Q3'18) view of the balance sheet shows that the preferred shares have a senior claim on essentially all net assets (total assets minus liabilities) and that those net assets nearly equal the liquidation value of all three preferred shares series.

- In contrast, common shares can lay claim to no net assets on the balance sheet, given the funding mechanism of the JANAF Acquisition and the implications of it.

- Wheeler can deliver only a small amount of cash flow that can be used for other purposes (property upgrades, debt reduction) other than that currently employed for maintenance capex and preferred dividend distributions.

- Wheeler will be facing $95M of debt refinancing or redemptions from October 1st, 2018, through December 31st, 2019, needing every penny of cash available to work through this "Valley of Debt".

- As such, the author suggests that dividend distributions may be suspended throughout that same period to provide some of that cash.

- Even with all of these challenges, the Wheeler "D" Shares (ticker WHLRD) offers experienced value investors a 100+% upside on appreciation, a 17+% yield at current prices (even if the dividend is being accrued) and protective clauses that provide a powerful incentive to redeem these shares by September 2023, including face value plus all accrued dividends.

- While the Wheeler "B" Shares sell at a modest discount to the already heavily discounted "D" Shares, the protective covenants for the latter offer sufficient protections to many potential risks that they are worth the extra cost.

- Should the "B" Shares decline to a larger discount, or drop below $9/share again, then adding some "B" Shares in addition to the "D"s may offer a better solution across a broad spectrum of potential outcomes, especially as the company might approach a re-organization process or build up substantial amounts of cumulative dividends.

- Investors ought not view either Shares series as an income vehicle at this point as I expect the dividend suspension to remain in effect throughout 2019 to enable Wheeler to deal with the 2019 maturities, especially near year-end.

- As these shares are likely to remain very volatile during what I expect to be a difficult 2019, especially for credit, purchases of these securities should be limited to experienced value or distressed investors accustomed to significant volatility.

(All charts, tables and graphs have been created by the author from information obtained from the Investor Relations page on the Wheeler Investor Relations website, citing SEC Filings and Press Releases, or from information obtained from the Yahoo Finance site.)

Disclaimer: No guarantees or representations are made. The Owl is not a registered investment adviser and does not provide specific investment advice. The information is for informational purposes only. You should always consult an investment adviser.