Orion Engineered Carbons (NYSE:OEC) is a Luxembourg-based global producer of specialty and rubber carbon black. Specialty carbon black is used for coatings, ink, plastics, and a variety of other products. Rubber black, a commoditized product, is used in high-performance tires.

Historically, Orion's largest customer base has been tire manufacturers, a cyclical business. The current strategy has been to diversify into other applications for rubber black. In this article, I will discuss how the company is achieving their stated goal, the catalysts, the stock technical pictures, fundamentals, and set a price target.

Strategy

Orion's ongoing strategy has been to expand into markets where they already operate as well as in markets that are not fully developed.

An excellent example of expansion into markets where they already serve is the late 2015 acquisition of OECQ, a Chinese carbon black manufacturer. Prior to the acquisition, Orion had a small footprint in China but was not in a position to grow its market share. Subsequent to this acquisition, Orion has increased their ability to be selective about its Chinese expansion focusing on high-end carbon black sales without concerns over tariffs or a slowdown in the Chinese economy.

The acquisition of French Acetylene Carbon Black manufacturer, Société du Noir d'Acétylène de l'Aubette (SN2A), in late 2018 is an example of how the company is expanding into more lucrative markets that are not fully developed. Rising demand for better batteries for electric vehicles as well as driverless cars and energy production is unquestionable. This is how the CEO, Corning Painter, at the recent earnings call, explains how he is pursuing the opportunity:

There are three primary battery segments in the market. The first segment is DryCELL technology which SN2A supplies with Acetylene Carbon Black today. The second segment is lead-acid and advanced lead-acid batteries which we supply with Specialty Carbon Black.

The third segment is lithium-ion batteries which are an exciting opportunity. Lithium-ion batteries are used in increasingly broad set of applications, including, of course, in transportation and mobility where we see a big opportunity in the future. As is the case with many early-stage Specialty Chemicals, Carbon Black for these batteries is a relatively small niche market today, but we expect it to grow rapidly.

Catalysts

Demand for carbon black has been growing at a faster clip than production. Orion has done a great job at managing its prospects as it in constant transition. It recently closed its less profitable operations in Korea and France and has expanded its facilities in Italy to maximize opportunity.

Tire manufacturing is growing in the U.S. Several companies are building factories here for the first time and others are expanding. Kumho began producing tires in Georgia last year. Hankook has a new Tennessee factory and headquarters as does Giti in South Carolina. Toyo has expanded production in Georgia. The global tire market is forecast to grow at a 5% clip over the next three years.

Car sales may be impacted by the current trade war but it won't affect Orion. 70% of tire sales are for replacement tires and any slowdown in new car sales add mileage to used vehicle tires.

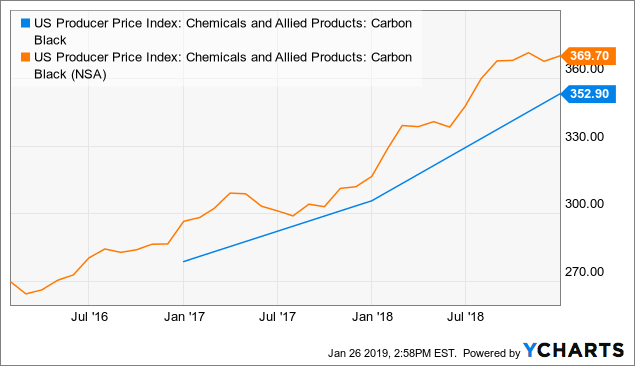

The overall demand picture for carbon black is positive. Management has reacted with a price increase and sees the potential for further increases over at least the next two years sustainable, as long as the market price for carbon black continues to rise.

Data by YCharts

Data by YCharts

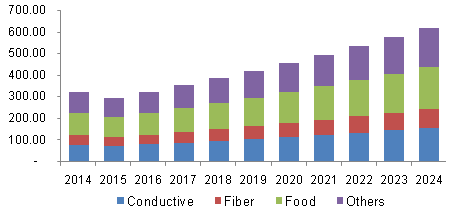

Demand for carbon black, besides for tires, continues to come from its use in plastic products. Another market segment for carbon black has been paint and coatings. This segment is expected to grow at an annual CAGR of 5.5% over the next few years. Carbon black is also used in printing and packaging, industries that are forecast to grow at an annual CAGR of 4% over the near future.

I covered just some of the traditional uses for carbon black. There are numerous applications including many high tech solutions such as conductive polymers and synthetic textile fabrics. Here's a look at how overall sales have grown and are forecast to continue growing.

(Illustration source is Grandview Research)

Technical Picture

The technical picture needs to work itself out. The stock sold off after hitting a 52-week high in September and is now trading below its 200-day MA. It appears that a solid support has been established with a triple bottom as well as the 50-day MA. With this safety net, I am considering starting a position and adding to it once the stock price clears the 200-day MA. I believe this is a good long-term play and not a quick trade opportunity, so entry price is not that important.

Data by YCharts

Data by YCharts

Fundamentals

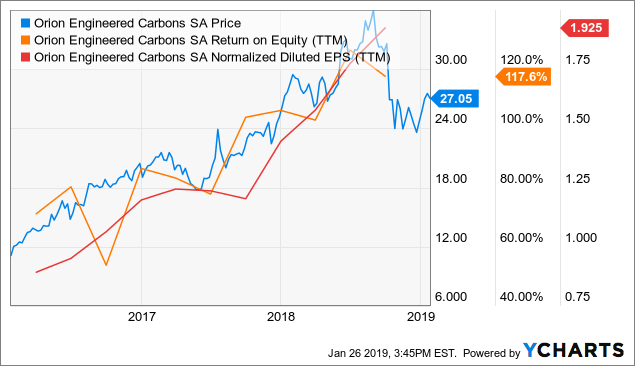

Earnings have grown at a 78% rate over the last 12 months and at over 100% over the last 3 years with an impressive return on equity of 113%. The chart below illustrates how well the stock price has correlated with EPS and ROE over the last three years. This picture says that the stock is oversold.

Data by YCharts

Data by YCharts

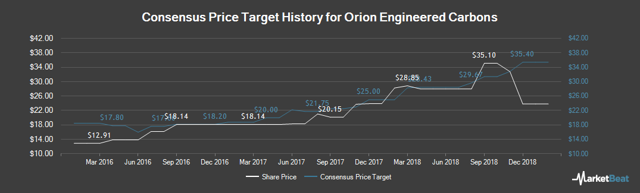

Interestingly, the same correlation exists with analysts' forecasts and Orion's stock price... also leading to the same conclusion; the stock is oversold.

Conclusion

The company has a presence in almost every continent and is well positioned to capture the growing demand for carbon black. Management is satisfied that the company will meet requirements to become a domestic reporter sometime this year, meaning that several U.S. index funds will be eligible and prospective buyers.

Since the company is still a foreign issuer, it files the perhaps unfamiliar 6-K Form for insider trades. Investors may have missed this one:

On November 5th, 2018, Mr. Corning F. Painter, Chief Executive Officer of Orion Engineered Carbons S.A. (the "Company"), purchased a total of 36,950 common shares of the Company. The shares were purchased at an average price of $ 27.30 per share. Mr. Painter took this opportunity to buy the Company's stock upon the opening of the first window period following his appointment as CEO and director of the Company and in compliance with the Company's policies.

Mr. Painter also explained how he is pleased with the company's share buyback program at the recent earnings call:

There is a time and a place for buybacks when utilized effectively. I am very pleased that we have been able to take advantage of the recent volatility to buy back shares at what is clearly a bargain price not reflective of Orion's value. I have fully supported this and I am pleased that we have doubled our capacity of buybacks to $40 million.

I could not find information on how many shares the company has already bought and at what price.

The company strategy of reducing its exposure to up and down cycles has been ongoing for years. While this is not new, their EPS growth is proof that their strategy is working, at least through an upcycle in supply/demand for carbon black. The current cycle is forecast to continue growing over the next five years as illustrated above.

There is a dividend of 3%, to boot. The dividend has been raised in each of the past two years.

Estimating EPS for fiscal 2019 at 2.65 per share and applying a PE of 12 results in a price target of $36.00 or 33% higher than the current price. This is a good stock to buy and hold.

Orion is one of the four largest carbon black companies in the world. It has about a 25% market share and competes is a fragmented industry with numerous small companies having the bulk of market share. The other large players are Aditya Birla, Phillips Carbon Black, and Cabot (CBT).

Oil is a major ingredient in producing carbon black. Production costs are affected by the price of oil. There is a safety net in that Orion's sales are indexed. Customers agree by contract to consume higher oil prices, but with a few weeks delay.

I am seeing little risk compared to the upside.