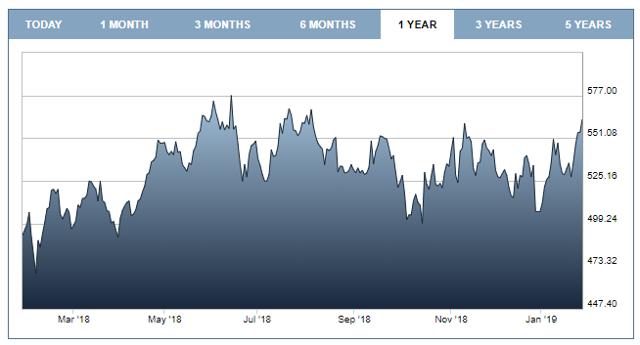

In Europe, some of the REITs (or the local equivalent status) got hammered in the past six to 12 months as investors were getting scared of the impact of higher interest rates and a lower economic growth rate. Especially the companies focusing on commercial real estate were crushed, but others, like Safestore Holdings (OTCPK:SFSHF) were able to avoid any real selling pressure thanks to an excellent performance and continued growth perspectives.

Source: London Stock Exchange

Safestore is a British REIT and unlike other companies in the UK, there is a 20% dividend withholding tax on the dividends payable by a REIT (and Safestore is a mixed story as its dividend is usually partly subject to the dividend tax, and another part isn't). As the average volumes in the UK are substantially higher than in the U.S., I would strongly recommend you to trade in Safestore's shares through the facilities of the London Stock Exchange. The ticker symbol in London is SAFE, and the average daily volume is approximately 350,000 shares.

The first results are in, and it's looking very good

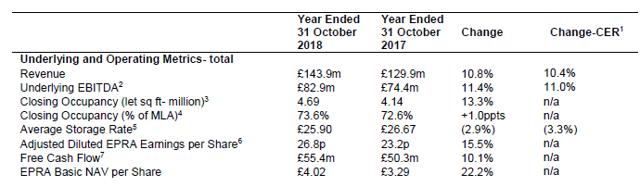

As I explained in a previous article, Safestore has been trading at relatively high valuations, but that's not entirely undeserved as the company's growth trajectory is outpacing a lot of its REIT peers (focusing on other segments of the real estate world). This wasn't any different in FY 2018, which ended in October. Safestore reported a 10.8% increase in its revenue to almost 144M GBP, while its EBITDA result increased by 11.4% thanks to a 1% higher occupancy rate and despite a 2.9% decrease in the average revenue per square foot of storage that was let.

The strong revenue growth was also fueled by several purchases during the year which further expanded the company's asset portfolio, but even on a like-for-like basis, the growth numbers are pretty impressive. In fact, I'd say they are even more impressive as the 5.6% revenue increase and 6.9% EBITDA increase was generated through a 2.7% increase in the occupancy rate and a 0.6% increase in the average revenue per square foot.

Source: press release

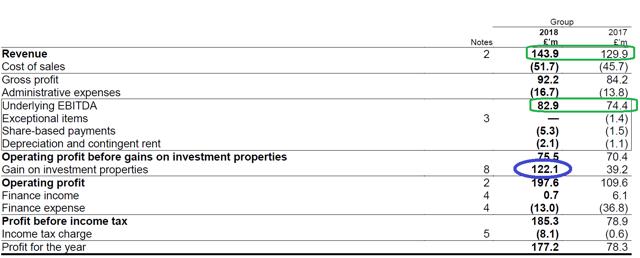

Despite higher expenses due to share-based payments (a non-cash item), the operating profit still increased by approximately 7% to 75.5M GBP. The pre-tax income however more than doubled to 185M GBP due to a 122M GBP increase in the valuation of its assets. Safestore claims this is mainly due to the Alligator acquisition. That being said, I'm not entirely convinced this is fair. Although the Alligator division has contributed 4.5M GBP in net income to Safestore in its first year (confirming the price tag of 56M GBP was quite cheap for a REIT), I'm not entirely sure this already warrants a serious mark-up of the book value of the properties after just one year. It looks like the Alligator properties are now valued at a rental income yield of 5% and that's perhaps a bit low. If we would use an effective rental yield of 6% (excluding any adjustments for occupancy rates), I would agree with an upwards adjustment to the tune of 75 GBP, so perhaps the remaining 26M GBP in valuation increases is based on other assets in the portfolio.

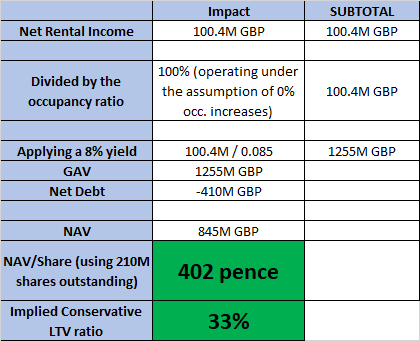

My own NAV calculations: quick and dirty

To run my numbers, I have used the reported revenue of 143.9M GBP and a 73.6% occupancy, but I have applied a 1.5% inflation-linked rent hike to the FY 2018 results to derive a result for 2019. Keep in mind I am keeping the occupancy stable and am not taking any positive developments into account. I am deducting a 45M GBP cost related to the leasehold property expenses into account (assuming the vast majority of "cost of goods sold" of the REIT are related to this), which results in a normalized net rental income of 143.9M - 45M = 98.9M GBP for the 73.6% occupancy, which, after taking the 1.5% inflation-linked rent increase into account, results in a 100.4M GBP net rental income for FY 2019.

On top of deducting just the net debt (359M GBP), I also deducted the financial lease obligations (56M) from the equation as Safestore operates some of its storage units using the leasehold structure (versus the freehold structure), so it's only fair to take these obligations into account as well. I am using a required rental income yield of 8% which is relatively high but I feel this is appropriate given the traditional relatively low occupancy ratio of self-storage units. I am also adding the 5M GBP in "assets under construction" back to the NAV calculation.

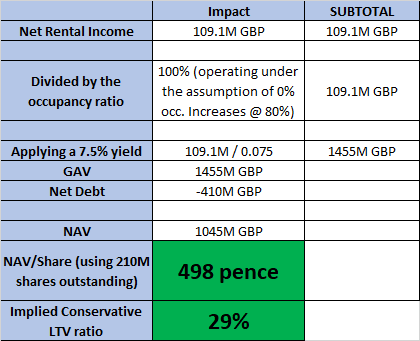

As you correctly notice, a lot depends on the occupancy ratio. The required 8% rental income yield is based on the revenue generated with a 73.6% occupancy rate, and should Safestore be able to hike the occupancy rate from here, the fair value will go up. This is what happens if the storage facilities reach an occupancy rate of 80% and applying a 7.5% rental income yield.

This scenario is perhaps a bit more optimistic, but not unlikely as Safestore is targeting a long-term occupancy ratio of in excess of 80%. And indeed, the 498 pence as conservative fair value is below the current share price but A) Safestore's balance sheet is safe with a LTV of less than 30% and B) this calculation does not include any of the 4 advanced stage planned new storage facilities which will undoubtedly add more value as well. Applying a 70% occupancy and an annual rent of 26 GBP per square foot, these four new buildings will contribute up to 4M GBP in additional rental income. Applying the same 7.5% required rental yield, the NAV/share would be boosted by 25 pence to 523 pence.

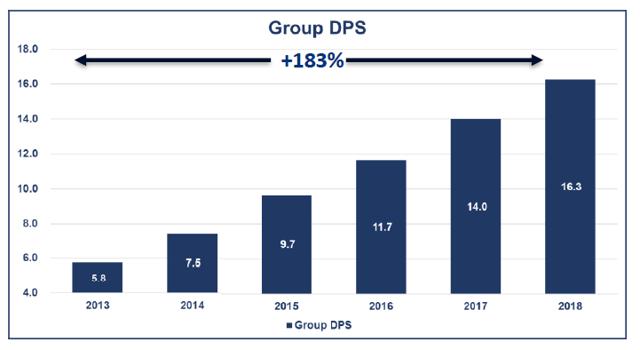

The dividend was - unsurprisingly - hiked again

Thanks to the strong performance in FY 2018, Safestore's board of directors has increased the final dividend by 13.8% to 11.15 pence per share, which results in a full-year dividend of 16.25 pence per share for a dividend yield of 2.84% based on the REIT's most recent closing price. The REIT will go ex-dividend on March 8th, and the dividend will be payable on April 10th.

Source: company presentation

This means the dividend of Safestore has now almost tripled in the past five years, and this is very likely also one of the reasons why the self-storage REIT remains a market darling. And Safestore has no plans to slow down its growth rate. Thanks to its low LTV ratio (30% based on the company's own NAV calculations, 33% based on mine), Safestore could continue to expand in the London and Paris area.

For 2019, Safestore expects to spend 37.5M GBP which includes 3.5M GBP to be spent on store build-outs, 5M GBP on maintenance capex and 29M GBP on expansion programs. Safestore expects to open 95,000 sq ft. of space in London this year and 65,000 sq ft. in Paris, while the Paris Magenta project is expected to be completed in 2020, offering an additional lettable area of 50,000 square foot. The new properties will obviously need some time to reach their run rate and desired occupancy ratio's but slow and steady wins the race.

Investment thesis

I was secretly hoping for Safestore Holdings to move in line with other REIT's in Europe, but unfortunately the share price remained quite strong, despite the looming Brexit. Safestore is generating an operating cash flow of 67M GBP per year and after deducting the maintenance capex, its free cash flow (excluding any build-outs or new projects) is almost 30 pence per share for a free cash flow yield (as far as that's applicable) for a REIT is just slightly below 6%. This means that even after covering the maintenance capex and the dividend, Safestore is able to spend 20-25M per year on expanding its portfolio so while its dividend yield of 2.84% isn't high for a real estate, the company is a strong grower.

I still think this REIT deserves a spot in a diversified portfolio but despite (or perhaps because) the strong performance of the share price, I'd like to see Safestore going a bit lower before picking it up. The company has been doing the right things, but I'd like to get the stock at a bargain price.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

New at ESCI: A dedicated European REIT Portfolio!

Take advantage of the two-week free trial period and kick the tires!