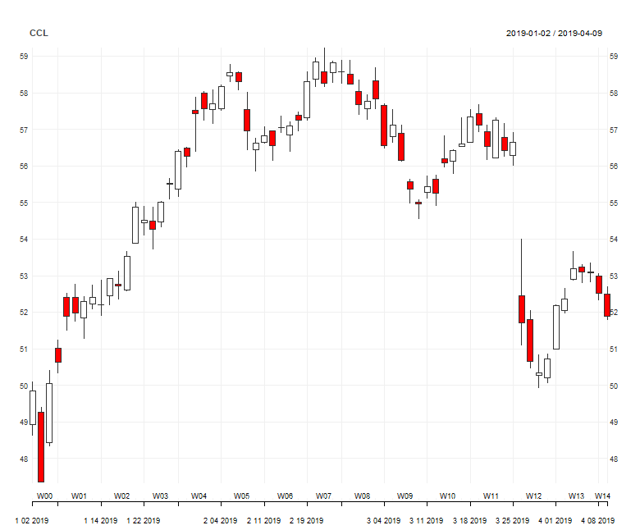

Carnival (NYSE:CCL) reported its Q1 2019 earnings late last month. In response, the stock showed a large gap that appeared to be a breakaway gap, based on distance and volume:

(Source: Damon Verial; data from Yahoo Finance)

The selloff seemed to be more of a guidance-based selloff than an earnings-based one. This is common over earnings, as my subscribers know well: Guidance has roughly 50% more influence over stock price than earnings. The question remains as to whether this selloff was justified or an overreaction; the former implies the retracement is a good point to sell/short, while the latter implies that the breakaway gap is in fact an area gap and that we should buy.

Today, we are going to look into CCL’s earnings call to find whether management sentiment dropped significantly. Financial lexical analysis shows us that changes in optimism/pessimism can provide useful data orthogonal to fundamentals/technicals/price action. Significant changes in sentiment have predictive utility for a stock in the following quarter.

Sentiment Analysis

I ran my sentiment analysis algorithm on CCL to find surprising results. The recent earnings call was 27% more optimistic than average and 117% more optimistic year-over-year (I had to take an average here because Seeking Alpha is missing some of the previous earnings call transcripts).

In other words, the earnings call was net positive and – all things being equal – predict the gap to close over the coming quarter. The price action seems to mesh with this idea; the original reaction was an overreaction – perhaps a misunderstanding. The stock rallied back to its post-earnings price, but the rally might have been overbought, hence the pullback.

Let’s take a look at some of the statements flagged by my algorithm to gather some clues as to why this earnings call was actually optimistic.

Flagged Statements

“And as far as the UK is concerned, we had said, as Arnold said, there is uncertainty relating to Brexit. The UK is doing okay. But clearly had it not been for the uncertainty, we probably would have done perhaps a little bit better in the UK. It's really hard to – you will never know for sure.”

-One of the volatility concerns was the UK side of the business. The management admits macro fears and uncertainty, and this sort admission is typically good for the stock (as opposed to dismissing concerns). However, management fails to present a plan on how to deal with the UK issue with or without Brexit. Overall, uncertainty is present, which implies risk, which in turn implies a risk premium for the stock and excess returns, on average.

“Our guidance reflects continued improvement in operating performance. And we are maintaining the operational guidance we gave for the year with an update for changes in fuel prices and currency. Included in the midpoint of our guidance is $0.25 per share earnings growth from operations over the prior year, which is a reflection of our 120,000 plus employees who go above and beyond every day, as well as hundreds of thousands of travel professionals who support our world leading cruise brands.”

-Guidance shows continued earnings growth. Changes in guidance (forex and fuel costs) were macro-based and thus outside of the company’s control. In addition, statements that attribute positive results to team efforts show a statistically significant relation to excess returns in financial lexical analysis, so we have two positive statements here.

“Going forward, our earnings growth will include a higher contribution from capacity growth. That increase in capacity will lend itself to more predictable revenue growth and enable us to better contain costs, in essence, enhancing the reliability of future earnings growth.”

-A statement that volatility will decrease going forward, which implies the current risk premium is one given for taking on short-term risk. Moving forward, economies of scale will assist in earnings growth, meaning investors will see even less risk as CCL simply builds upon its current business rather than experimenting.

“And we actually don't need things to be very different in order to deliver sustained double digit earnings growth. Even with minimal yield increases, the capacity we have coming online and the inherent efficiencies and scale advantages we gained from that capacity will help to contain costs and enable us to achieve double digit earnings growth and elevated return on invested capital.”

-Earnings growth should continue despite the company’s share repurchase program and dividend increases. Investors focused on earnings growth have little about which to worry, according to management.

“First of all, as you know, we've got double digit capacity increase in Europe in kind of uneven economic environment. But the reality is, the bookings are strong and we're doing some proactive management.”

-Similar to the above statement, management is confident that the business will continue growing amid macro uncertainties. Many investors are concerned about European exposure, but it seems management is not so worried.

Overall, the earnings call was much more optimistic than pessimistic. The stock might continue falling a bit because of the overemphasis on risks and the European market (which, by the way, is not a large market for CCL). I think these fears are mostly misplaced.

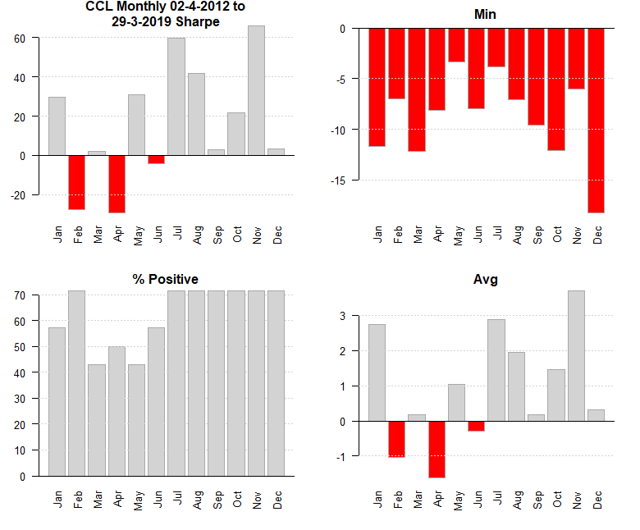

Still, April tends to be CCL’s worst month. And thus a drawdown is seasonally aligned with CCL’s pattern. However, CCL’s bullishness tends to pick up in fiscal quarter 2:

(Source: Damon Verial; data from Yahoo Finance)

Taking seasonal data into account, you might want to wait April out. The ex-dividend date lies in May, however, and so you might want to enter late April or early May. The dividend, by the way, is currently producing a 4% yield, which puts CCL in the top 25% of dividend-paying stocks.

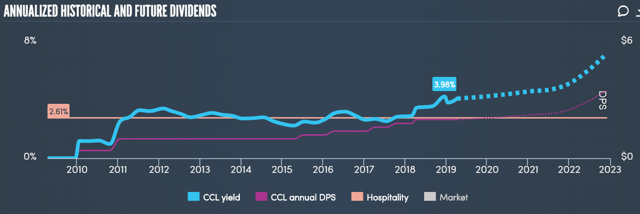

The Dividend

Dividend payments have been increasing over the past nine years. Nevertheless, increases have been volatile. Still, CCL’s dividend yield is one of the best in the hospitality sector:

(Source: Simply Wall St)

Interestingly, dividends and stock price have moved mostly in tandem for CCL. Hence, a focus on the dividend is important for both dividend investors and value/growth investors. Here is the yearly dividend plotted against the price:

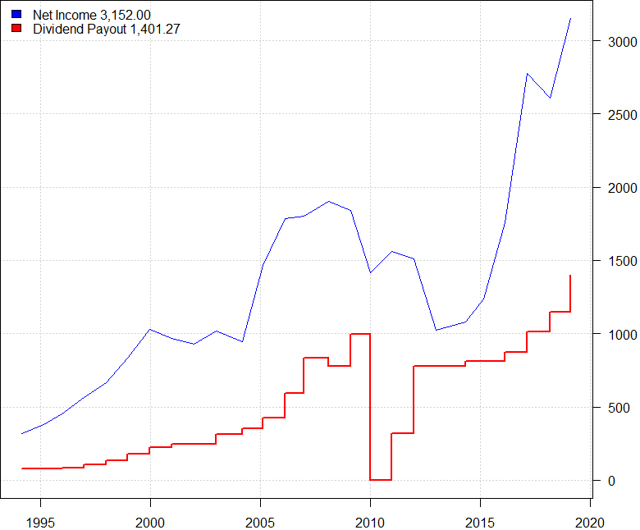

(Source: Damon Verial; data from ADVFN)

And here is the quarterly dividend:

(Source: Damon Verial; data from Yahoo Finance)

Dividends are well-covered by income at 2.2x:

(Source: Damon Verial; data from ADVFN)

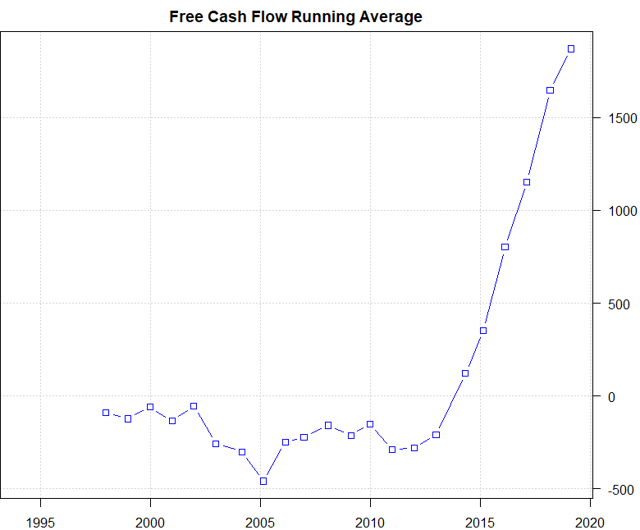

As per CCL’s earnings growth, the dividend is in no danger and can easily be hiked yearly. Moreover, the company’s cash flows (running average) support the continuation of dividend payments and growth:

(Source: Damon Verial; data from ADVFN)

Trade Recommendation

The negative earnings reaction is likely an overreaction. Still, seasonality shows the propensity for a weak April. The best trade at this point is a high-gamma play that aims to fill the gap and convert to stock before the ex-dividend date in May.

Here is my recommendation:

- Sell Apr18 $52 call

- Buy Jul19 $52.50 call

This is a sort of time spread that will allow profit from the difference in the time decay, while leaving you long CCL with a high-gamma play after the short leg’s expiration. This play makes sense if you agree that CCL will remain below the gap until April 18 and will rise afterward. The play costs a total of roughly $150, essentially giving you exposure to 100 shares of CCL for that price, should the short leg expire worthless.

If CCL remains stagnant, you can roll the short leg forward with May options. If CCL begins to rally before expected, you can buy back the short leg. In any case, ensure you execute the long leg of the play before the ex-dividend date so as to collect the dividend.

Happy trading!

Exposing Earnings is an earnings trade newsletter (with live chat) that is based on statistics, probability, and backtests. My models are unavailable anywhere else online, as I designed them myself, keeping the code private for Exposing Earnings subscribers and myself. If you want a definitive answer on which way a stock will go on earnings, the probability of the prediction paying off, the risk/reward of the play, and my specific options strategy for the play, click here.