A few days ago, I promised you more on Sprint (S) and T-Mobile (TMUS). Here are 3 reasons why I think the odds of the deal closing may be slightly better than widely anticipated. It is far from a lock but here goes:

John Legere

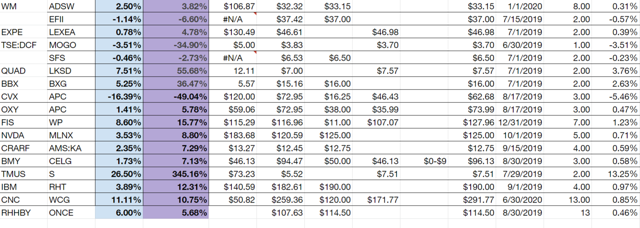

T-Mobile's John Legere is a fun guy who doesn't necessarily tap dance to work but especially loves tap dancing all over Verizon (VZ) and AT&T (NYSE:T). Ever since he got the top job he has been bringing a ferocious attitude to the competitive arena and having it out for the big two. Now he is bringing that narrative to this deal. For a long time, I haven't been too interested in this deal because going from 4 to 3 telcos seemed like such a basic non-starter. I only started digging in after the spread widened out even further very late in the story. It is currently the largest annualized return in the Special Situations M&A Dashboard:

Arguably, this is due to the high risk of the deal getting shut down.

As I'm digging in and learning more about Legere and other players, I'm starting to think differently about certain things.

Yes, the baseline is for the FCC or DOJ to shut this down. I've seen analyst estimates of 33% and 50% that it closes. I'm sure most will have it pretty low.

But Legere could be a game changer here as he's been for T-Mobile's marketing. While most CEOs would not have credibility if they argued they wouldn't raise prices, Legere could get the benefit of the doubt. You can legitimately see him go after AT&T and Verizon even harder after a merger gets him the scale and network to truly meet them head-on.

Source: John Legere's twitter

If you've never heard of him, here's a

Check out the Special Situation Investing report if you are interested in M&A events like the T-mobile/Sprint merger. We look at all kinds of special situations like buybacks, asset sales, spin-offs, and liquidations. Ideas like this are especially interesting in the current late stages of the economic cycle.