A few days ago, a reader asked me what I thought about dividend growth investing vs. ETF (index) investing. He referred to an article from the Globe & Mail written by Benjamin Felix. He claimed that dividend investing is nothing but a fairy tale. He described how focusing on dividend stocks would prevent from getting an optimal return and that index ETF investing is a lot better.

"In my opinion, investing for dividend income is one of the most romanticized ideas in personal finance."

- Ben Felix

That's it! This guy is looking for a fight!

I'm sure he expected a response from dividend investors, and this is what I'll be providing today. But before I start debunking his arguments one by one, I'd like to mention that I have nothing against ETF or Index investing. In fact, I truly believe there are multiple ways for an individual investor to be successful on the market. Some do it with technical analysis, others with options. Dividend growth investing and index investing are just two more ways to make money. The problem I have with Ben's article is how he despises dividend investing with a questionable rationale.

He also published a video earlier this year on his YouTube channel restating pretty much what I found in the article:

"Dividends do not matter"

- Ben's YouTube introduction

In his video, he asks investors to prove him wrong. I will use both the article and the YouTube video and answer his points one by one. I'm using Ben's article subtitles to answer them.

But first, I'm tired of people citing Buffett

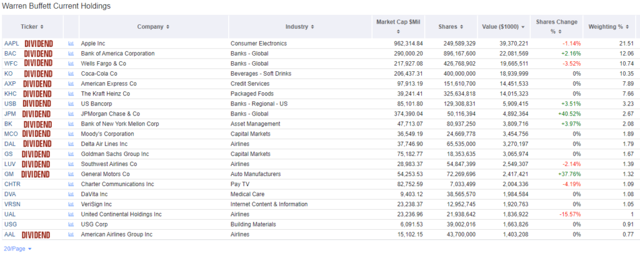

Ben is no fool, he is a portfolio manager with PWL Capital in Ottawa. But I really wonder why he cites the greatest investor of all time, Warren Buffett, to prove his point. Besides looking cool, citing successful people doesn't mean much. As an example, Buffett explains why his company doesn't pay dividends (Berkshire Hathaway (BRK.A, BRK.B) 2012 letter to investors as cited by Ben). His rationale totally makes sense (he prefers to keep the money to find better alternatives like investing than giving money back to shareholders.) Now, let's look at Buffett's top holdings today:

(Source: GuruFocus)

15 of his top 20 holdings pay dividends. Interesting enough, in the same 2012 letter to investors, Buffett also mentions:

"We applaud their actions and hope they continue on their present paths. We like increased dividends, and we love repurchases at appropriate prices."

My point on Buffett? He's richer than all of us combined together. But that doesn't mean he is not human and does not make mistakes. Everything he says is not directly coming from God and should not necessarily followed to the point (after all, my returns would have been pretty bad if I had invested in Kraft Heinz (KHC) and IBM in the past few years!)

Dividend investing leads to poor diversification

Ben's first point is that focusing on dividend investing leads to poor diversification. He argues that 35-40% (video) of stocks don't pay dividends. By ignoring such large amount of stocks, your portfolio will suffer from poor diversification.

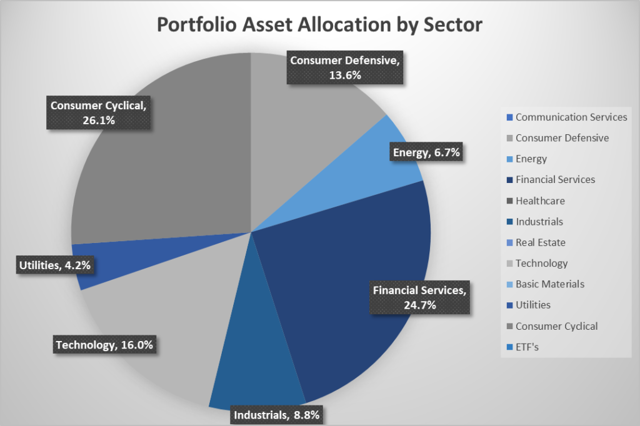

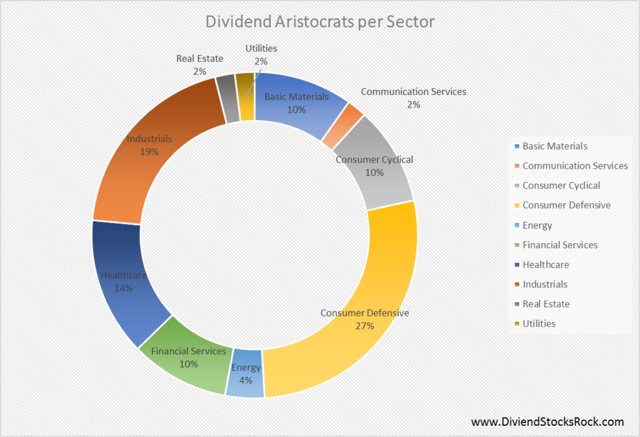

This sounds like a very poor argument. In fact, I'm pretty convinced that among the thousand stocks paying dividends, you can build a solid portfolio covering different sectors. Oh wait, let's take a look at my portfolio, shouldn't we?

(Source: My pension plan dividend income March 2019 update)

You can also download my Q1 2019 full report here.

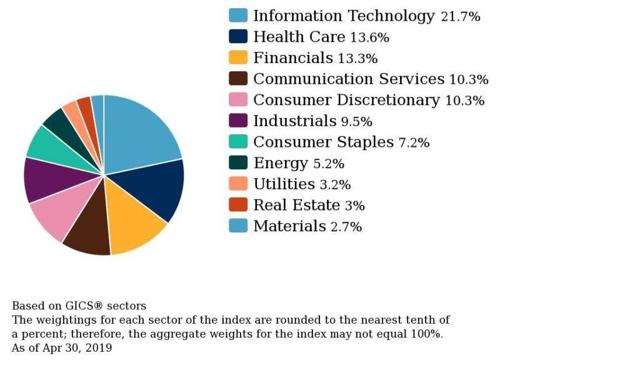

Let's take a look at the S&P 500 sector allocation:

(Source)

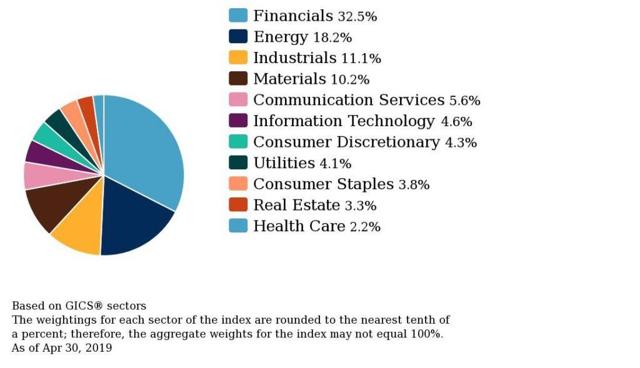

Or the TSX:

(Source)

When I compare the three charts, I see that there are some pros and cons for each of them, but they all include several sectors. I don't think my sector allocation is flawed by my concentration (100%) in dividend stocks.

You might as well look at the Dividend Achievers' (10yr+ with a dividend increase) sector allocation:

Then again, you get a good sector diversification. You can see the full Dividend Achievers list here.

Picking dividend stocks is unlikely to lead to investing success

I guess it's hard for someone who can't beat the market to admit that some investors can. It's not a personal attack to Ben, but if you invest in index ETFs, all you do is the market returns minus small fees for your ETFs... and maybe fees charged by your advisor to setup a "coach potato" portfolio (should you really pay for that?). Therefore, it's impossible to beat your benchmark with index investing - you will eternally run behind it by a small margin.

Ben pulls out lots of research to prove his claims. While I like reading research myself, they are only part of the answer. Academic researches don't put anything in your pocket. Academic researches look back at stats and tell you a story. It tells you what already happened.

When I look at my investment statement, academic research returns don't show, and they don't pay me either. This is why I like real-life cases so much. I'm talking about real money invested in the real market producing real returns.

During the latest bull market, I've proven my strategy to be successful by beating both markets and dividend ETFs benchmarks. The article showed my 5 years' returns in 2017 (from 2012 where I started dividend investing to 2017). You can read the article here. Then, you may want to come with the famous saying:

"Mike, bull markets make tons of geniuses."

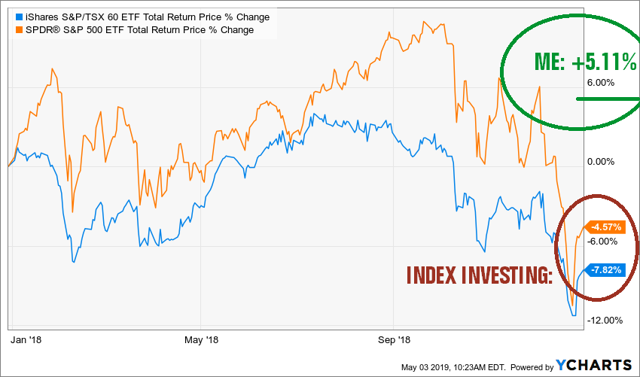

All right, fair point, let's assume investing in a bull market is easy and you should beat the market with your eyes closed (not true, by the way). Then let's take a look at my investing performances in 2018, where both the Canadian and the US market dropped, shall we?

You can read the details here.

I would like to take a moment here to emphasis the fact that I'm not an incredible investor, I'm not a financial guru and I have not found a magical recipe. I simply follow a meticulous investing process and stick to it. In fact, I didn't do anything in 2018 besides watching my stocks doing well and paying me a nice dividend. You can spend lots of time pulling out research telling you index investing is better than dividend growth investing or the opposite, but what you should really do is to build your own investing process. Find out what really works for you. But I'm telling you, both index investing and dividend growth investing work.

Dividends are an identifier for strong, stable companies

In this point, Ben argues that companies should be better off using their cash to invest in profitable projects (R&D, mergers & acquisitions, marketing, etc.) than giving it back to shareholders through dividends or share repurchase.

According to the financial theory (once again theory, not real life), companies only distribute money they "don't know what to do with" to shareholders. When all other options have been looked at and management hasn't found a way to make it more profitable, they write a check.

In real life, many companies decide to split their cash flow among various opportunities, including paying dividend. At one point, it gets difficult to continuously finding attractive projects, and you might as well reward shareholders. Companies like Microsoft (MSFT) and Apple (AAPL) are perfect examples. They both use their cash in smart ways and also add value in shareholders' pockets with share repurchases and dividend increases.

A dividend paid isn't a guarantee you found a solid and stable company. However, if you find a company growing its dividends year after year for several years in a row, you have a good lead. Then again, further research will be necessary (I use 7 investing principles to do so), but dividend growers is always a great start.

Dividends are a guaranteed source of returns

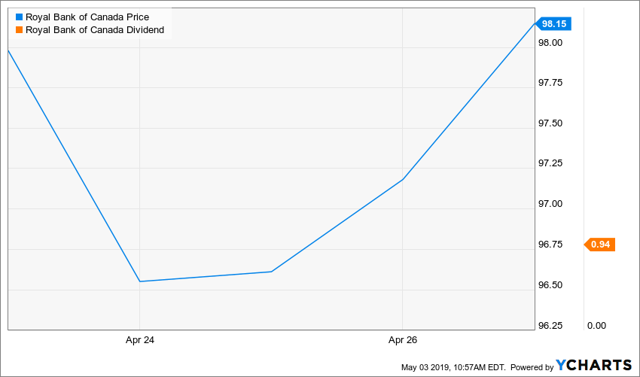

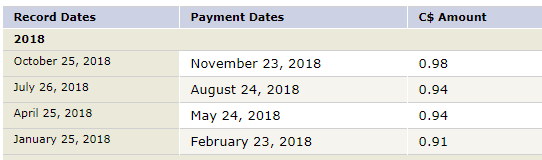

Then again, Ben uses financial theory to proves his point. When a $2 dividend is paid, the company loses this money (it goes out of its bank account) and therefore lose this value. In theory, and in reality, this is totally true. Once the dividend is paid, the money is no longer in the hands of the company and can't grow or do anything, as it is now sitting in your account. But when you look at what really happens on the market, you will rarely see the full dividend payment impact on the stock price. I've decided to look at how Royal Bank (RY, RY.TO) shares reacted to the April 2018 dividend payment:

(Source: RBC website)

(Source: YCharts)

Here's the price variation from one day to another:

| Closing Price | Variation | |

| April 23rd | $ 97.98 | $0.00 |

| April 24th | $ 96.55 | -$1.43 |

| April 25th | $ 96.61 | $0.06 |

| April 26th | $ 97.18 | $0.57 |

| April 27th | $ 98.15 | $0.97 |

For an investor who wanted to get the dividend, he could pay $97.98 for shares of RY on the 23rd, get the dividend of $0.94 and still not lose anything at the end of the week ($98.15, +$0.17 variation). It is true there is a drop in value on April 24th, but are you telling me RY took only 3 days to recuperate its entire dividend?

This happens because there are tons of other factors influencing share prices each day. The benefit of receiving dividend is to get real hard cash in your pocket while the market goes crazy (either too high or too low). A company like RY offering a robust dividend probably gives additional value to the eye of many investors. I know it's not "real value per se", but when it comes down to valuation, I can't stop laughing about how dozens of CFAs put in a room together will come out with a dozen of fair market values for the exact same company. Not too long ago, I came across a piece about Air Transat (TRZ.TO) where 3 CFAs give a value between $5 and $16... kind of narrow, right?

Income-seeking investors (and dividend funds portfolio managers) will likely be interested in buying more Royal Bank and leave Dundee Corp. (OTCPK:DDEJF, DC.A.TO) to speculators. The demand for RY will be stronger, and then, price will likely be higher because of the demand. Once again, this has nothing to do with the "real theorical value" of the stock, it has to do with the demand for the stock. If the market crashes tomorrow, chances are there will be more demand for Royal Bank than for Dundee. Just my thoughts - maybe I'm wrong and Dundee would skyrocket during a market crash.

Dividends protect you in down markets

According to Ben, "There is no difference between selling some shares to create a dividend, and receiving a cash dividend. I get that there is a psychological aspect here, but even if dividends make market volatility feel better, the reality is that in 2009, 14 per cent of firms worldwide cancelled their dividend, and 43 per cent reduced their dividend."

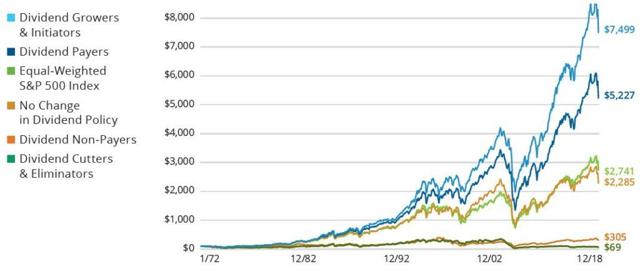

Obviously, if you do a poor job at selecting companies that will eventually cut their distributions, you will not be covered during down markets. However, if you hold on to dividend growers during down markets, your portfolio will do just well. A company that is able to generate sufficient cash flow to increase its payout during crisis is obviously a solid company. The key is to avoid red flags that announce a potential dividend cut.

When I look at my 2018 returns, my portfolio generated about 3% in dividends, while my total return was +5.11%. You can see that most of my profit was made through dividend. The point here is while the market is going nuts and value drops like nonsense, your holdings continue to pay their due on time.

This is what happens in all down markets: shares of great companies are likely to get hit as hard as the bad ones because people sell in bulk. If you invest in index ETFs, you take the full hit. If you invest in solid businesses, you get your dividend paid in the meantime and shares are quickly recuperating afterwards. But you don't have to believe me, you can only believe Ned Davis Research instead:

(Source)

Companies that grow their dividends should beat the market

Ben says it's not true. I say "just look at the above-mentioned graph."

Ben refers to the Efficient Market Hypothesis... yeah well, that's a hypothesis, and it clearly doesn't work in the real world. According to this hypothesis, "According to the EMH, stocks always trade at their fair value on stock exchanges, making it impossible for investors to either purchase undervalued stocks or sell stocks for inflated prices." Right... so back in 2008, all Canadian banks lost 50% of their fair value within 6 months because they were really worth 50% less. Then, they did an incredible job at changing their whole business model (and generated tons of profit, I guess), since their share price went back up in 2019.

(Source: YCharts)

Isn't the EMH beautiful? Or maybe it just doesn't work at all, right? The biggest problem with this hypothesis is that everybody does have access to pretty much the same information. However, the way you read it and the way I read could be completely different. The market price each company according to the information available and the assumptions of what is going to happen next. It's basically wild guesses all the time. Can you beat wild guesses? Why not? I've already proved that dividend growth investors could outperform ETF investing here.

Final thoughts

I think that Ben did lots of research to prove his point, but I don't buy it. If you watch the video (which is more complete), he refers that dividend growers are exposed to factors such as showing a strong business model, revenue growth and earnings growth (read the dividend triangle for more). He argues that those factors are more important than the dividend growth. I guess it's like talking about the hen and the egg, right? Going after dividend growers help me narrow my stock basket where it includes most companies showing "favorable factors." Why would I bother investing in index ETFs that take all the great businesses and all the crappy ones at the same time?

As I've demonstrated in this article, dividend growth investing works. We can pull out tons of academic researches and, as you saw, one research will crush the other (and so on). Therefore, it's fun reading about research and financial theories, but this is not what gives you money in your pocket. Real-life investing does.

Dividend Growth investing is not perfect, it's not easy and it requires lots of commitment. But if one follows a solid investing process and pick dividend growers across various sectors, chances are he/she will outperform the market. But remember, there are many paths that will allow you to achieve your investing goals.

Does ETF investing work? Yes

Does Index investing work? Yes.

Does Dividend Growth Investing work? Definitely yes.

Researches are cool, making real money in the real world is even better.

Disclaimer: I hold shares of MSFT, AAPL and RY.TO.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.