AfteAfter being sent to the penalty box in the last quarter of 2018 due to an exceedingly high valuation (alongside many other high-growth recent IPOs), shares of Pluralsight (PS) have enjoyed a strong rebound so far in 2019, up more than 50% year-to-date. The company, which went public last year at just $20 per share, has continued to throw up impressive numbers on the growth front - and with the stock's lockup expiration now firmly in the rearview mirror, it seems that there are no near-term obstacles in Pluralsight's way. Analysts have also come out in favor of the stock, citing the company's fantastic growth rates and seemingly wide-open competitive landscape.

The question for investors now is: does Pluralsight have further upside left? Since Pluralsight's IPO, I've been alternating between a bullish and bearish stance on the company, largely anchored by the stock's present valuation. I identified the stock as a strong buy late last year when it sunk to the low $20s (near its original IPO price), but in my view, with Pluralsight now zooming back toward its old all-time highs, investors would do well to be cautious.

For one, I'm not overly sold on Pluralsight's story. The company focuses on training and employee development specifically for technical personnel - and while this is a great niche, I have trouble believing Pluralsight's TAM is truly $34 billion as it claims (see the slide below from its latest investor update).

Figure 1. Pluralsight TAM Source: Pluralsight 1Q19 earnings deck

Source: Pluralsight 1Q19 earnings deck

Pluralsight claims that the technology skills gap is growing, necessitating the proper tools and processes in place to bring these workers up to scratch. This much is true. But in my view, Pluralsight's reputation as a niche provider of technical training programs offers it little edge. Other companies, like Cornerstone OnDemand (CSOD), can eventually add the same content to their material libraries. Pluralsight's market opportunity could also very well be encroached upon by large entrenched HCM platforms like Workday (WDAY), which are hunting for new sources of growth as core HCM (payroll, people management, directory) products reach a saturation point.

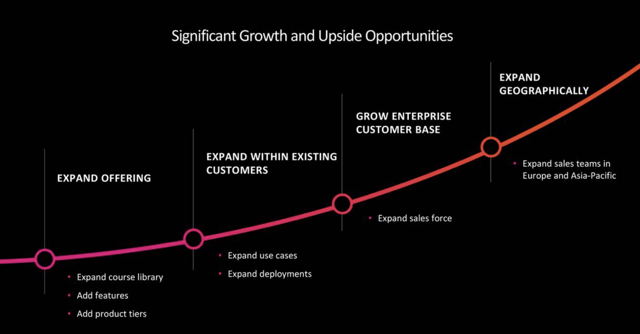

At present, Pluralsight's growth rates are enormous - and its billings growth suggests that there's plenty of revenue in the pipeline as well. But at some point, these growth rates will taper down. Pluralsight's current plan for growth consists of nothing truly original - it simply wants to extend its product offering, geographic reach, and cross-sell into existing customers, much like every other SaaS company in existence. There's no telling how increased competition might cut into the company's growth.

Figure 2. Pluralsight growth strategies Source: Pluralsight 1Q19 earnings deck

Source: Pluralsight 1Q19 earnings deck

Valuation the limiting factor

My intention is not to communicate that the future is dour for Pluralsight. Based on recent trends, Pluralsight's fundamentals have been off the charts. My assertion rather is that there are risk factors on the horizon - that Pluralsight's TAM and future competitive pressures might weigh on near-term growth - and that Pluralsight's currently full valuation may not take these risks into account.

A niche software vendor like Pluralsight often achieves the greatest shareholder returns through M&A. I'd use a company like Apptio (APTI) as a reasonable compare - the company offered spend management tools for IT departments specifically; very much in the same fashion that Pluralsight focuses its training tools on IT workers. Apptio ended up getting bought out by famed growth tech investors Vista Equity Partners last November at a ~50% premium and a total buyout price of $2 billion.

In my view, Pluralsight's current overextended valuation makes a buyout a more remote possibility. At the company's preset share price in the mid-$34 range, Pluralsight carries a market cap of $4.76 billion. After netting out $736.6 million of cash and $481.2 million of recently-issued convertible debt on the company's balance sheet, we are left with an enterprise value of $4.50 billion.

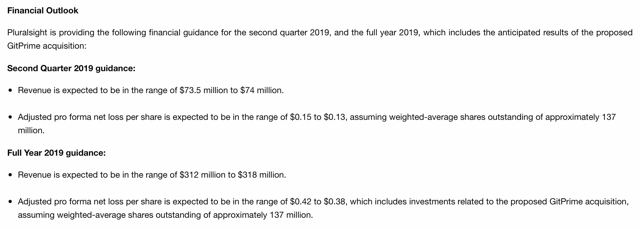

Let's gauge that against Pluralsight's latest outlook for 2019:

Figure 3. Pluralsight guidance update Source: Pluralsight 1Q19 earnings release

Source: Pluralsight 1Q19 earnings release

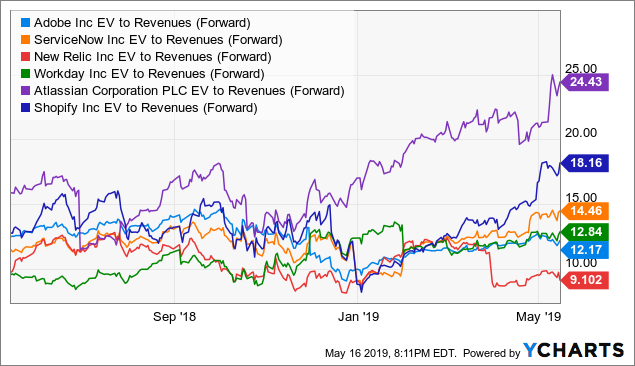

Based on the $415 million midpoint of Pluralsight's FY19 guidance ranges, Pluralsight is currently trading at a whopping 14.3x EV/FY19 revenues. That puts Pluralsight right up with some of the most expensive names in the software sector:

It's difficult to fathom that Pluralsight's valuation can extend meaningfully beyond the ~15x forward multiple it's currently at. There's no doubt that Pluralsight's fundamental progress is fantastic - to put its guidance into context, the first time Pluralsight unveiled FY19 guidance at its Q3 earnings announcement, the company's high end topped out at $310 million. Now the low end of its guidance range, at $312 million, has already exceeded that prior forecast.

Pluralsight is certainly no stranger to expectations management - a classic tactic employed by most of its peers in the SaaS industry. I wouldn't be surprised if, by the end of the second or third quarter, Pluralsight's guidance once again tops the high end of its current range. Nevertheless, I'd argue that with a strong double-digit revenue multiple, this conservatism has already been baked in. For investors evaluating a position in Pluralsight now, there's more downside than upside risk. I'd value Pluralsight at no more than 12x EV/FY19 revenues, implying a price target of $29 and 16% downside from current levels.

Q1 highlights

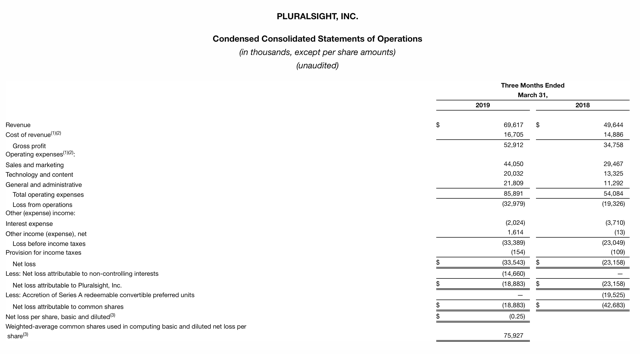

That being said, it's important to recognize the strengths that Pluralsight displayed in its most recent quarterly earnings release. The earnings summary is shown below:

Figure 4. Pluralsight 1Q19 results Source: Pluralsight 1Q19 earnings release

Source: Pluralsight 1Q19 earnings release

Revenues grew 40% y/y to $69.6 million, surpassing Wall Street's estimates of $68.3 million (+38% y/y) by a respectable two-point margin. The company also showed barely any deceleration relative to the 42% y/y growth rate that it notched in Q4.

More importantly still, Pluralsight's Billings of $77.9 million notched a 41% y/y growth rate. Because billings represents a twelve-month view of the existing revenue pipeline, a billings growth rate that exceeds revenue growth is typically a signal for potential acceleration.

Figure 5. Pluralsight 1Q19 billings Source: Pluralsight 1Q19 earnings release

Source: Pluralsight 1Q19 earnings release

It's important to note that Pluralsight's recently announced acquisition of GitPrime has no bearing on its current growth rates, nor is it expected to make a material contribution to FY19 growth rates (put another way, Pluralsight's FY19 guidance is an organic forecast). Management expects GitPrime to contribute 5 percentage points to Pluralsight's billings growth rate only by 2020.

Perhaps even more impressively still, however, is the fact that Pluralsight managed to tip its FCF results positive this quarter. While its ~$2 million of free cash flow this quarter is still a pittance compared to more mature software startups like Dropbox (DBX), it's a far cry from the -$13 million FCF that Pluralsight endured in the year-ago quarter:

Figure 6. Pluralsight 1Q19 FCF Source: Pluralsight 1Q19 earnings release

Source: Pluralsight 1Q19 earnings release

The company's pro forma EPS of -$0.07 also beat Wall Street's consensus estimates of -$0.09 by two cents, driven largely by a gross margin bump as well as improved leverage on sales and marketing expenses.

Final thoughts

While it's clear that Pluralsight has a lot of near-term momentum, I'd argue that the stock's current ~14x forward revenue multiple already captures a lot of its opportunity. With the stock teetering toward multiples that are historically high for virtually every SaaS stock, I'd start focusing more on the possible risks than on the recent strength.

Stay cautious on this stock - lock in gains and wait for a better price to avail itself.