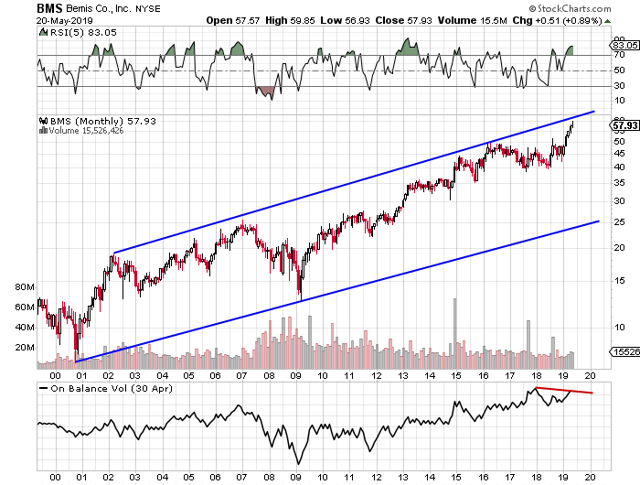

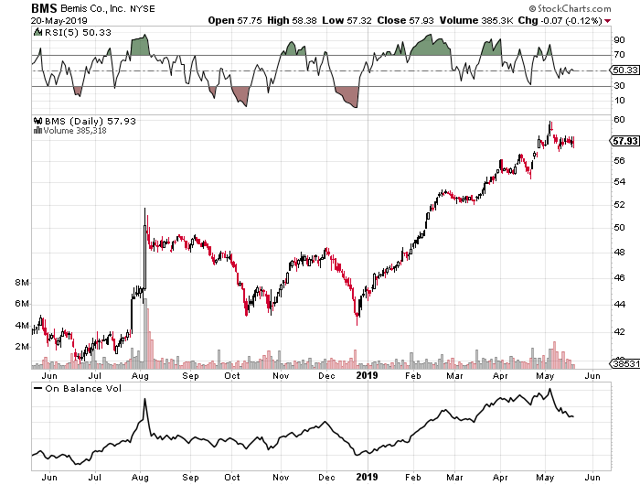

If we look at a long-term chart of Bemis Company, Inc. (BMS), we can see that shares look to be coming up against long-term resistance. We would not expect the share price to get through this resistance level on their first try though. Slight divergences in volume would confirm our point of view.

Currently, Bemis trades with a forward earnings multiple of 19. Although this number is ahead of the industry average of 16, Bemis' five-year average is close to 24.

This stock is closely followed for its dividend and for good reason. Bemis has now increased its dividend for 35 years straight with the payout over the past four quarters currently coming in at $1.25 per share. Apart from the firm's valuation and technicals, many investors also look to the viability and strength of the dividend before making a decision. A long-term investment in Bemis, for example, over the past few decades has enabled investors compound their returns due to how the dividend has grown over the years.

Therefore, from this standpoint, let's research the dividend to see if it can continue to be covered by the firm's profits and also whether the firm's key financials lend themselves to a growing stable dividend going forward.

Because Bemis is up well over $11 a share already this year, the stock's dividend yield is close to its 10-year low. The company's current yield is 2.23%.

For a proven dividend growth stock such as Bemis, the actual growth percentages of the dividend comes next in line of importance. Robust dividend growth rates are important because:

- It allows a fundamentally sound company with growing earnings share its profits with its shareholders through its dividend

- A growing dividend helps protect against loss of purchasing power

- It is a sign of confidence in the company which attracts fresh investment in the company over time

Although growth in Bemis' dividend has been declining slightly in recent years, the growth rate is still above 3% (which is the number over the past 12 months). Although this percentage may dissuade some investors, Bemis shareholders know that this company focuses heavily on the long term. Over the past decade, for example, operating profit is up about 4% on average per year with net profit up 3%. This means dividend growth has not outpaced earnings growth. We believe this is important for longevity reasons as the dividend payout ratio is able to stay in check.

What we have discussed though looks at what has happened up until now. To get a read on how the dividend will fare going forward, we like to look at the interest coverage ratio, the debt to equity ratio, and also earnings expectations going forward. How these numbers are trending though is probably more important than the figures themselves.

With respect to the interest coverage ratio, Bemis' number comes in at just over 5 at present. This ratio is an important ratio because sustained dividend growth becomes very difficult if a large portion of the firm's operating profit has to be spent on ongoing debt interest payments. There is no adverse trend here though. In fact, the ratio has been on the rise over the past 6 quarters or so.

At present, Bemis' debt to equity ratio comes in at 1.12. Again, no major adverse trend to worry about here although this ratio has increased from 0.68 since 2009. This is a metric which should be closely watched by income orientated investors. Why? Because when an aristocrat such as Bemis is able to reduce its float over time, this very act helps in keeping the payout ratio in check. However, if debt is rising, this trend can mask the fact that more of the firm's profit needs to go to paying off company debt.

However, up to now, any potential adverse trends remain pretty mild. Furthermore, strong earnings growth can easily rectify adverse trending financials pretty quickly. Analysts who are following this stock expect Bemis to increase its bottom line by 7.5% this year and an average of 7% over the next 5 years. These numbers are well above what the dividend has been growing at in recent years.

Therefore, to sum up, Bemis' dividend looks in good stead for the time being. Although liabilities have been rising at a faster clip than assets in recent times, future earnings projections at present are above average. Suffice it to say, if the firm can hit its numbers over the next few quarters, 3%+ growth rates and more should continue over the long term.

----------------------

Elevation Code's blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not stop until it reaches $1 million.

-----------------------