On Tuesday, May 21, 2019, ship leasing company Ship Finance International (NYSE:SFL) announced its first quarter 2019 earnings results. At first glance, these results were reasonable as the company's revenues were in-line with the expectations of analysts but its earnings beat what they expected. A closer look at the company's results also shows mixed overall performance as the firm did manage to perform a lot better than it did a year ago, but its performance was a little more lackluster compared to the fourth quarter of the year. It was certainly nice to see that Ship Finance managed to maintain its dividend, which is likely the reason why people buy this stock in the first place.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company's earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Ship Finance International's first quarter earnings results:

- Ship Finance International brought in total operating revenues of $116.543 million in the first quarter of 2019. This works out to a 1.71% decline over the $118.571 million that the company brought in during the fourth quarter of 2018.

- The company reported an operating income of $51.287 million in the most recent quarter. This represents a massive 133.35% increase compared to the $21.978 million that the company had in the previous quarter.

- Ship Finance International managed to extend ten of its long-term charters out to at least 2021, adding more than $170 million to its charter backlog.

- The company reported an adjusted EBITDA of $124.4 million in the quarter. This represents a slight decline over the $125.9 million that the company had in the previous quarter.

- Ship Finance International reported a net income of $33.592 million in the first quarter of 2019. This compares very favorably to the $3.470 million that the company had in the fourth quarter of 2018.

It seems likely that the first thing that anyone reviewing these highlights is likely to notice is that Ship Finance saw its revenues decline slightly during the quarter. The main reason for this is that a few of the company's ships came off of their long-term charters during the quarter. This is the way that the company makes a good deal of its money - leasing ships out to other shipping companies like Frontline (FRO) or Golden Ocean Group (GOGL). This business model generally allows Ship Finance to be much less susceptible to the usual volatility in the shipping market. This is admittedly one of the things that most of the company's investors, myself included, like most about the firm. However, we do occasionally see its revenue decline in a given quarter when the company sees a few ships come off of their long-term charters until they find new ones. That is what happened here.

As some may recall, Ship Finance acquired two 19,000 TEU containerships at the end of December. I discussed this in my last article on the company. These vessels were already employed under long-term charters when they were acquired, a fact that helped offset some of the revenue decline from the expiration of the long-term charters that was just discussed. This is due to the fact that Ship Finance receives its charter fee from these two ships for the entire first quarter instead of just a few days out of it. As these vessels are still employed under these long-term charters, they will continue to generate revenues at the first quarter level going forward.

Another thing that someone reviewing the highlights above will note is that Ship Finance saw its operating income increase substantially quarter over quarter. However, the two quarters are not entirely comparable. This is because, in the fourth quarter of last year, Ship Finance took an impairment charge of $35.748 million on five of its offshore support vessels chartered to Solstad Offshore (OTCPK:SLOFF). The company previously had these vessels listed at a value that was higher than charter-free broker estimates so the impairment charge was meant to bring the value of these vessels as listed in-line with these estimates. This was mostly due to concerns that Solstad would be forced to cancel these charters. However, thus far, it has not done this and these ships were still employed as of the end of the first quarter.

The company had no such charge during the first quarter. For a more accurate comparison of the company's actual operating performance, we may want to back that charge out. If we do that, we see that the company's operating profit declined from $57.726 million in the fourth quarter 2018 to $51.287 million in the first quarter of this year. This was mostly due to the lower revenues, although Ship Finance also saw its administrative expenses increase, which was disappointing.

Perhaps the nicest thing in these results was the fact that Ship Finance managed to extend several of its long-term charters and in so doing managed to bring its contract backlog up by $170 million. As contract backlog is about as close as one can get to guaranteed revenue in this business, this is nice to see as it adds to the sustainability of the company's revenues. This is because this backlog represents revenue that the company is contractually obligated to receive.

During the quarter, four 8,700 TEU containerships had their charters extended to 2024, two 5,800 TEU containerships had their charters extended until 2024, and four 4,100 TEU containerships had their charters extended until 2021. We should note that Ship Finance devoted a lot of effect last year to expanding its containership fleet due to this being a relatively strong segment of the shipping industry and these charter extensions show that this is proving to be correct.

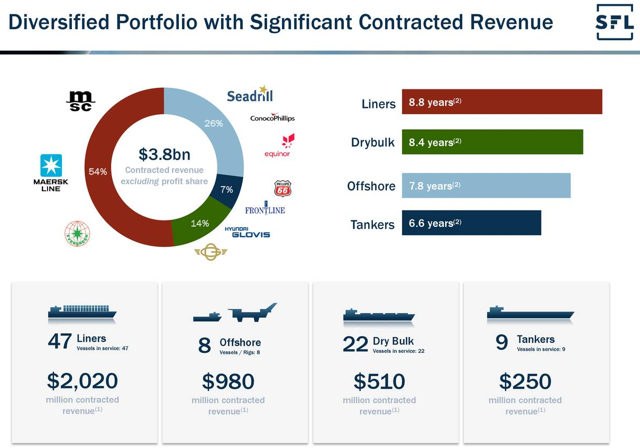

While we are on the topic of backlog, this is an area of strength for Ship Finance right now. As of the end of the first quarter, Ship Finance had $3.8 billion worth of backlog, most of which is concentrated in containerships and dry bulk vessels.

Source: Ship Finance International

Source: Ship Finance International

We can clearly see too that the average remaining charter length of the company's liners (containerships) and dry bulk vessels is also much longer than for its offshore vessels and tankers. These two segments of the market are also stronger than the rest so this is not really a surprise. It is worth noting though that these are also the two segments of the shipping industry that will be hit the hardest by the growing trade tensions between the United States and China, although the fact that Ship Finance's vessels are mostly under long-term contracts should help insulate it somewhat. At the company's current level of revenues, this backlog is enough to allow it to operate for 32 quarters. This should give us some confidence that it will be able to maintain its dividend.

In conclusion, this was a reasonably solid quarter for Ship Finance, albeit not as good as the fourth quarter. We do still see a number of developments here that give us confidence that the company will be able to perform solidly and that its general business model remains quite stable. The company did spend a significant amount of money and effort last year focusing its fleet on areas of the market that were deemed safer and this does appear to have been a good move.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. We are currently offering a two-week free trial for the service, so check us out!