Note: My analysis incorporates my framework which I call "MAD Investing" or Machine Assisted Dividend Investing. Every day, I calculate approximately 60,000 ratios for all U.S. stocks. I sort all stocks into percentiles for each ratio, from strongest to weakest. This information is used to derive a "stock strength score" and a "dividend strength score," which serve as indicators of a stock's potential for capital appreciation and potential as an income producing investment, respectively. To learn more about how these scores are calculated, please refer to this post. All financial data on mad-dividends.com is sourced straight from the S.E.C., whereas price data comes from IEX.

Written By Robert Kovacs

Introduction

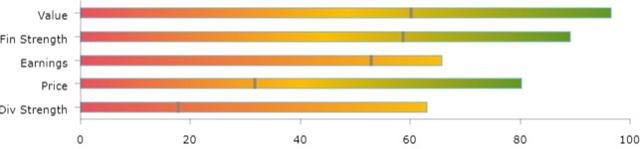

CVR Energy(NYSE:CVI) has a dividend yield of 6.76% and trades around $44.38. My M.A.D Assessment gives CVI a Dividend Strength score of 63 and a Stock Strength score of 99.

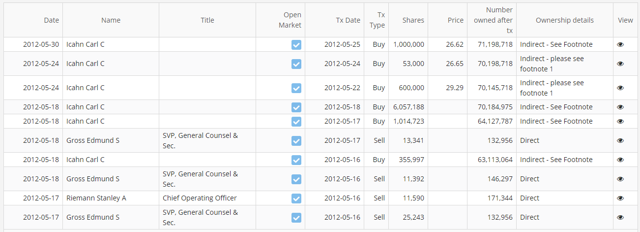

I came across CVR Energy a few days ago, in an article by fellow Seeking Alpha contributor Fredrik Arnold. In his article, he discusses dividend stocks which figured on a list curated by Kiplinger dubbed “Billionaire Buys”. The billionaire of concern here, is none other than Carl Icahn.

I have since placed orders to initiate a starter position in CVI. I believe that dividend investors should invest in CVR Energy at current prices.

Source: mad-dividends.com

CVR Energy is engaged in the petroleum refining and nitrogen fertilizer manufacturing. It operates under two business segments: petroleum refining and nitrogen fertilizer.

The analysis presented in this article is divided into two sections: dividend strength and stock strength.

For me dividend strength and stock strength are two distinct phenomena. Companies with a high dividend strength score are ones that are interesting to dividend investors as they have a strong dividend supported by strong underlying fundamentals and are more likely to continue paying and growing their dividends. Companies which have a high stock strength score are good picks for capital gains investors. As such companies which score well in both categories are more likely to have higher total returns (capital + dividend).

Dividend Strength

When looking at the dividend strength of a company, I am looking for a combination of good yield and dividend growth as well as dividend safety.

So I look at 2 different aspects: how likely the company is to be able to continue paying the dividend (safety) and how likely it is to grow (potential),

Coverage and payout ratios will be analyzed to assess dividend safety. Dividend potential will be assessed by focusing on the company's dividend yield, historical dividend growth as well as evolution of top and bottom line results throughout the past years.

Dividend Safety

CVR Energy pays out 82% of earnings as dividends. This is better than 21% of dividend stocks.

I then look at cashflow payout ratio; which is dividends in relation to operating cashflow. By looking at cashflow payout as well as earnings payout, I get a better grip of the company's ability to pay its dividend. Dividends represent 34% of CVI’s operating cashflow, which puts the company in front of 37% of dividend stocks.

Finally, I look at the company's free cash flow payout. This adjusts operating cashflow for capital expenditures and paints the clearest picture of whether or not the company can afford its dividend. 32% of CVR Energy's free cashflow are paid out as dividends, putting it ahead of 64% of dividend stocks.

These numbers lead me to believe that CVR Energy has a decent payout ratio. While the dividend has always been covered by operating cashflow in the past 5 years, during its worst years free cash flow alone wasn’t enough to cover the dividend. At current oil prices, however, CVI generates plenty enough cash to pay its dividend.

Source: mad-dividends.com

I also want to make sure that the company is earning enough to cover its interest payments, and more broadly to service its debt.

CVI makes enough to cover its interest payments 4 times, putting it ahead of 45% of stocks. I find this level of coverage to be sufficient, although not great.

Based on the company’s coverage and payout ratios, I believe CVI’s dividend to be relatively safe.

Dividend Potential

Now that we have assessed the company’s dividend safety, we turn to its dividend potential.

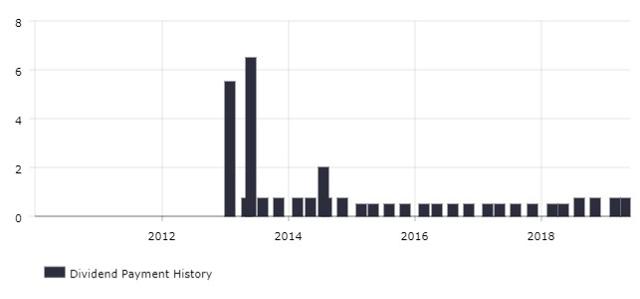

CVR Energy’s dividend yield sits at 6.76% which is higher than 92% of dividend paying stocks. Last year, the dividend grew 50%, back to the rate it was before the company cut its dividend in 2015.

Source: mad-dividends.com

As you can see looking at the chart above, CVI started paying a dividend soon after Carl Icahn initiated a position in the stock.

Source: mad-dividends.com (sourced from SEC filings, here)

Source: mad-dividends.com (sourced from SEC filings, here)

A few special dividends were paid, on top of regular dividends.

While this sort of sporadic dividend history makes me somewhat uneasy, given the company’s large amounts of cashflow, I believe they will continue paying the dividend at a stable rate. I don’t expect any increases though.

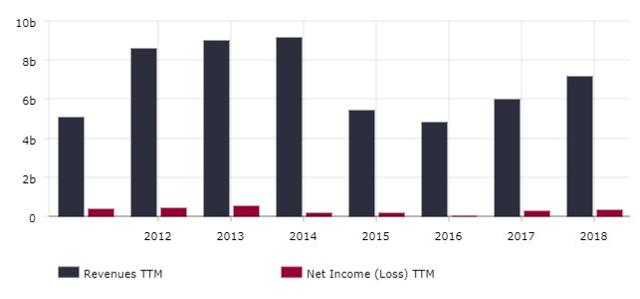

These past 3 years, revenues have grown at a 13% CAGR while net income has grown at a 49% CAGR. The company has snapped back well from its 2016 lows.

Source: mad-dividends.com

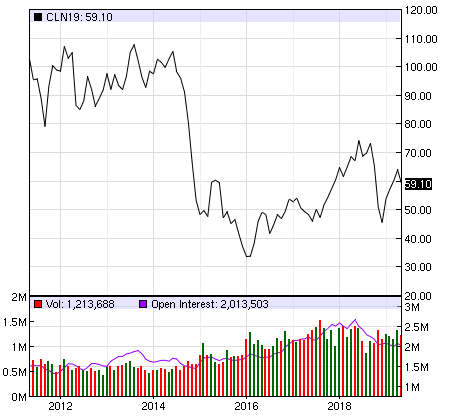

As you can see in the chart below, which shows the evolution of the price of WTI crude oil, CVI's revenues move in tandem with the price of oil.

Source: NASDAQ WTI price

So the question investors should ask themselves is: where is oil headed for the rest of 2019. Multiple factors need to be considered.

The trade war is the biggest source of angst among investors right now. In simple terms, if the trade war results in a severe economic slowdown in China - a key consumer of global oil- it could result in lower demand for oil, pushing prices lower. On the other hand, if the trade tensions alleviate, Oil would go up.

Then there is the question of supply. Last week the U.S government reported a surprise surge in crude oil reserves, reaching the highest level since July 2017. This has made investors wary of another supply glut. Price movements will be heavily impacted by whether OPEC members decide to maintain production cuts throughout 2019, when they meet in June. Given that the price of WTI has dropped 8% in the past 7 days, I wouldn't be surprised to see production cuts be maintained.

In the short term, expect a lot of volatility around the prices of oil. For an interesting read on the outcome of the trade war, you can read this article by China Briefing.

Nonetheless, even at 2017 oil prices, CVI can cover its dividend, which should reduce investor concerns about the stock.

I don’t believe investors should invest in CVI for potential dividend growth, but only for the huge yield the company offers. Note that it would take years of double digit dividend growth for a stock yielding half of CVI’s yield for it to match its yield on cost.

Dividend Summary

CVI’s dividend strength score is 63 / 100.

While not a dividend growth stock, CVI qualifies as an income stock. Investors should keep in mind that the short history of dividends and the company’s decision to cut the dividend make it less safe than energy companies which have been paying dividend for decades.

However, the high dividend payment is totally manageable by the company, and should continue to be paid for the foreseeable future.

Stock Strength

Whilst dividend safety and growth are important for the dividend investor they are only half the story. While companies which pay stable and growing dividends usually fare quite well, one would be foolish to not look closely at the fundamentals.

Historical data of nearly a century of stock market performance identifies four factors which dictate stock performance: value, momentum, financial strength and earnings quality.

I look at these factors one by one to assess the quality of the company which I’m considering investing in.

Value

This won’t come as a surprise to most, undervalued stocks outperform in the long run. To assess value, I look at P/E, P/S, P/CFO and Shareholder Yield. I combine them to give the stock a value score out of 100.

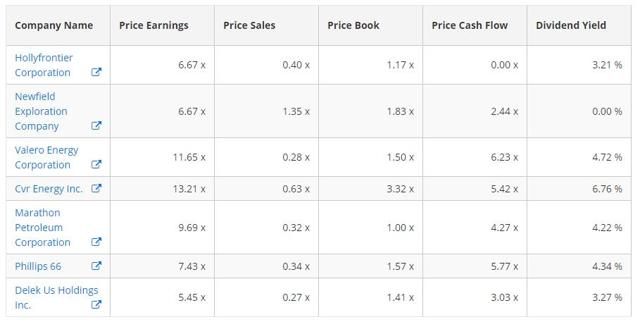

- CVI has a P/E of 13.21x

- P/S of 0.63x

- P/CFO of 5.42x

- Dividend yield of 6.76%

- Buyback yield of 0.00%

- Shareholder yield of 6.76%.

Based on these ratios, CVI is more undervalued than 97% of stocks, which I find very satisfying. Like many energy stocks, CVI is extremely undervalued, trading at only 5 times cash and at a low multiple of earnings.

Value Score: 97 / 100

Furthermore, I like to draw PE Lines over the stock chart, like Peter Lynch used to do back in his day. Doing so gives investors an idea of the stock's valuation range as a multiple of earnings.

Source: mad-dividends.com

As you can see, CVI is currently trading below its historical average PE. As you can see, the price has previously traded at much higher multiples of earnings, providing interesting amounts of upside throughout this market.

As you can see, while CVI is trading at a premium to its peers based on earnings, it trades in line with them compared to cashflow and book value, all while boasting a much higher dividend yield. Like all refiners, they are currently priced at a discount.

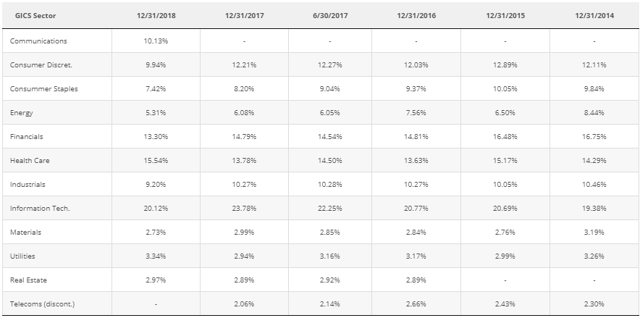

The energy sector is at its lowest weighting in the S&P 500 for the past 5 years.

Source: Siblis Research

Momentum

Stocks that go up will go up some more. This investment belief is mistakenly viewed as one that only growth investors should hold.

Believing so is a grave mistake. Data suggests that on average stocks which have been going up will continue to do so while losers are likely to remain losers: buying on the way down would therefore be exposing you to more downside risk than you believe.

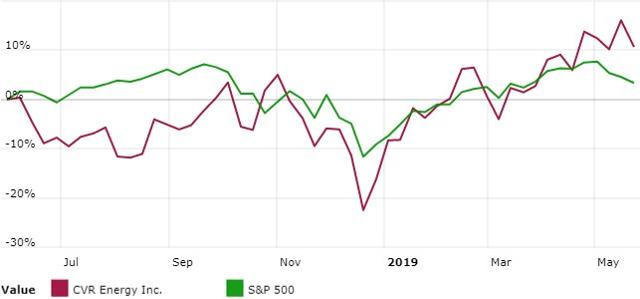

CVR Energy trades at $44.38 and is up 7.17% these last 3 months, 17.13% these last 6 months and 1.77% these last 12 months.

Source: mad-dividends.com

It has better momentum than 80% of stocks, which is very satisfying. Stocks with great short term momentum tend to outperform the market in the following twelve months.

For more details on this, you can read our recent blog post: “Why we stopped buying stocks on the way down.”

However, as you can tell by looking at the chart, CVI is more volatile than the index, and suffered a severe plunge in the last quarter of 2019.

Momentum score: 80 / 100

Financial Strength

Financially strong companies produce high amounts of cashflow in relation to their liabilities and don’t need to take on huge amounts of debt.

Historically, financially sound companies outperform the financially weak. Investors should be wary of companies who suddenly increase their debt dramatically.

CVI has a Debt/Equity ratio of 1.9, putting it ahead of 41% of stocks. Liabilities have decreased by -12% during the last 12 months. Operating cashflow is equal to about 32.5% of its liabilities.

Based on the above, CVI is more financially strong than 89% of U.S. listed stocks. Cashflow can cover a large part of the companies liabilities, and the overall gearing has decreased, although it remains slightly higher than the median US stock.

Financial Strength Score: 89/100

Earnings Quality

Usually, companies with high quality earnings will show low levels of accruals, they will also depreciate assets quickly, and their asset turnover is usually quite high.

CVI’s Total Accruals to Assets ratio of -16.1% is better than 72% of companies. Each year depreciation is worth about 9.2% of Capital Expenditure, putting it ahead of 3% of stocks. Finally, the company’s asset turnover of 1.8x is higher than 93% of stocks. This makes CVI’s earnings quality better than 66% of stocks.

The low levels of depreciation will be a hindrance on long term earnings. This will somewhat be compensated by the high level of negative accruals. The refining business generates high levels of revenue in comparison to the asset base, further solidifying the stock’s earnings quality.

Earnings Quality Score: 66 / 100

Stock Strength Summary

When combining the different factors of the stocks profile, we get a stock strength score of 99 / 100 which is very satisfying. The stock has above average fundamentals, is greatly undervalued and on the rise. It has the potential to continue its trend and beat the market over the next 12 months.

Conclusion

With a dividend strength score of 63 and a stock strength of 99, CVR Energy is a good choice for dividend investors. However, I’m unsure how long I’ll be able to collect this juicy dividend. Just last week, the company announced it retained Merill Lynch as a financial advisor and could consider finding a buyer.

If that is the case, it would likely have to be at a premium to the current price, which I’m OK with.

Appreciated this article? Click the orange follow button at the top of the article and drop a comment below.