I recently named Simon Property Group (NYSE:SPG) my top pick for the rest of 2019, and it has proceeded to immediately disappoint. Poor retail earnings reports have sent the stock down to rare levels not seen since the 2008 financial crisis. In this article, I explain how SPG has prepared for even the worst doomsday imaginable, and thus why this is a great opportunity to buy shares of this best of breed operator at a 5% dividend yield.

The 5% Gift: Let Them Fall

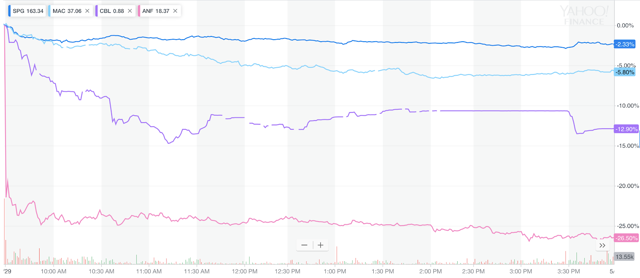

Retail REITs fell hard after Abercrombie & Fitch (ANF) reported disappointing earnings:

This is a case of buying when there is blood in the streets. In their earnings release, ANF noted that they would be closing their flagship stores, specifically:

Pedder Street, Hong Kong A&F flagship store closure to be completed in the first quarter of fiscal 2017.

Copenhagen, Denmark A&F flagship store closure to be completed in the first quarter of fiscal 2019.

SoHo Hollister flagship store in New York City to be closed in the second quarter of fiscal 2019.

Milan, Italy A&F flagship store is expected to close by the end of fiscal 2019.

Fukuoka, Japan A&F flagship store is expected to close in the back half of fiscal 2020.

While this is indeed rather damning news for the retail sector, none of these stores belong to SPG and many of the stores have been well known to be underperforming for many years. The bigger question is: who’s next?

While I concede that many of the lower quality mall and retail properties are likely to go belly-up in the next decade, I believe that higher quality retail real estate, like that owned by SPG, will continue to thrive. SPG now trades at a 5% dividend yield, which it has not done since the 2008 financial crisis (and