An authoritative figure pulls a chicken egg from a carton. He holds the egg up for the television viewer to see.

“This is your brain,” he announces. Then he points to a frying pan and says, “This is drugs.”

The man cracks open the egg on the side of the pan. He then spills the viscous contents into the skillet and allows the slop to sizzle. “This is your brain on drugs.”

He waits for a second or two to let the imagery sink in. Then he stares into the camera knowingly and remarks, “Any questions?”

Young people in the 1980s, myself included, lampooned the iconic public service announcement. And why not? Most of us enthusiastically experimented with marijuana and alcohol. Others used pills, cocaine and heroin.

It wasn’t that we had dismissed the notion that drugs damage brain functioning. We were living for the moment rather than thinking about our futures. What’s more, we made a collective stink over the difference between use and abuse.

Are today’s investors able to make the distinction between the use of economic stimulus and its perversion? I doubt it.

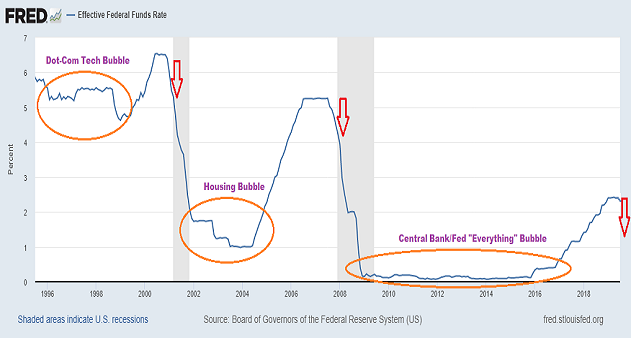

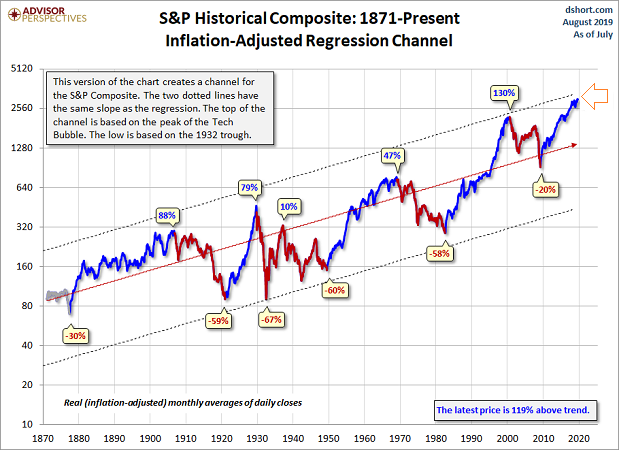

Monetary policy stimulus (e.g., rate cuts, quantitative easing, etc.) as well as fiscal stimulus (e.g., infrastructure spending, tax cuts, etc.) helped the U.S. get out from underneath 2008’s Great Recession. Yet easy access to ultra-low borrowing costs for an extended period in the 2000s fostered the housing bubble. The same misapplication of monetary policy in the 1990s nurtured the technology balloon.

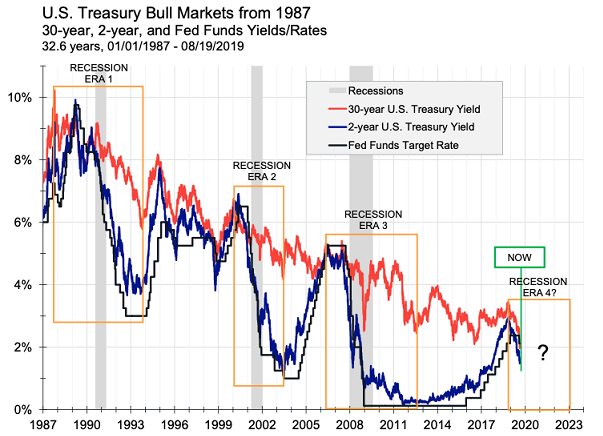

Eric Hickman at Adviser Perspectives recently demonstrated stimulus use, overuse and eventual recession going back to the late 1980s. The Fed makes an effort to wean the economy off of lower-than-normal rate policy by raising its overnight lending rate. The activity causes shorter maturity Treasury bond yields like the two-year to rise faster than longer-term yields like the 30-year. The yield curve flattens. It eventually inverts, prompting the Fed to start cutting rates. A recession begins shortly after the easing begins in earnest.

Are we stuck in a similar quagmire today? I believe that we are. Throughout the 2010s, policymakers chose to manipulate rates so low for so long, the investment community became hopelessly addicted. It’s likely to cost us dearly.

Some believe that the Federal Reserve can prevent a recession by sending us back toward zero percent rate policy. However, in addition to printing electronic money credits (a.k.a. “quantitative easing”), central banks around the world have been slashing rates to zero or below for years. The activity has not kept Europe or Asia from recessionary pressure.

Meanwhile, investors may be losing faith in central banking outside of the United States. An international stock bear is closing in on 19 months.

Troubles abroad — Brexit, recession, trade war, negative interest rate debt — might not adversely impact domestic stocks. However, the evidence seems to be pointing to the contrary.

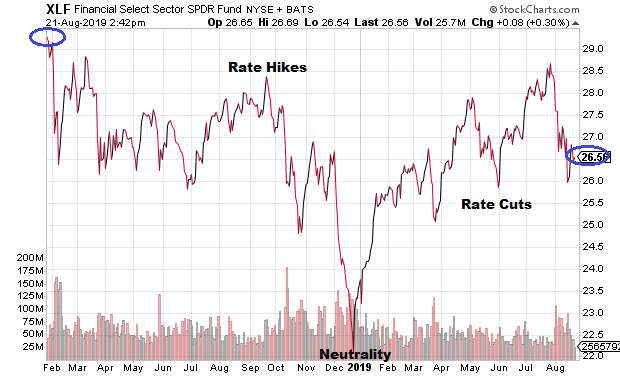

The Financial Select Sector SPDR (XLF) peaked in January of 2018 and remains roughly 10% below a January 2018 “high.” Moreover, its price movement is very similar to Vanguard FTSE All-World ex-US Index Fund (VFWIX).

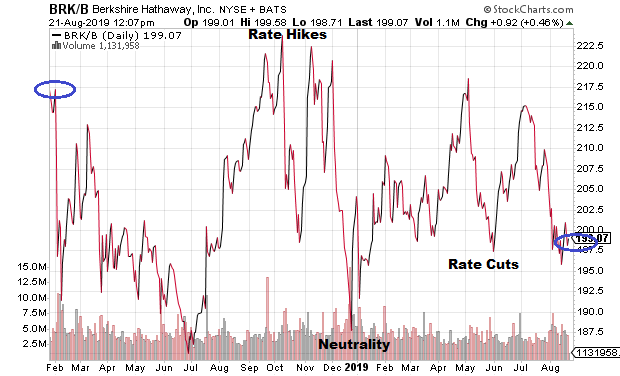

What about influential oracles like Warren Buffett? Though Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) hit new highs in October of 2018, the pattern is eerily similar.

Granted, Buffett’s Berkshire Hathaway is highly correlated with the financial sector. Nevertheless, the explanation does not account for under-performing stocks in the Russell 2000. The iShares Russell 2000 ETF (IWM) has failed to make progress since January of 2018.

There are those who would rather highlight the resiliency of the Dow Industrials, S&P 500 and Nasdaq. They’re ignoring historical precedent. They’re also ignoring the extent of stimulus addiction.

In late December, the Fed turned 180 degrees from tightening to neutrality. By May, the Fed began signaling an intent to manipulate borrowing costs lower, and that wasn’t enough. Here in August, investors, the media and the White House are all clamoring for more.

More rate cuts. More QE. More tax breaks. More, more, more, more, more!

The Fed will eventually acquiesce to the rebel yell to support stocks. That’s all that central bankers know how to do.

On the other hand, more of the same low-rate support has not been as big of a boon to small company stocks, mid-sized company stocks, energy stocks, materials stocks, industrial stocks or financial stocks. More of the same intoxicant seem to be floating fewer and fewer boats.

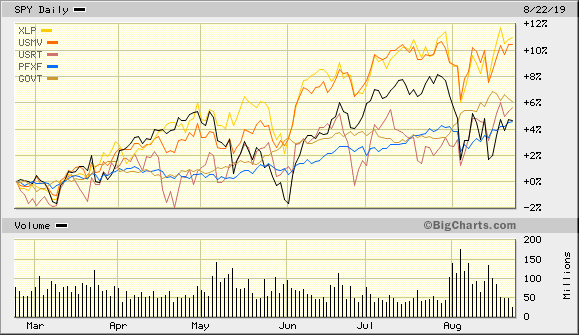

Large-cap S&P 500 stock investors ought to take note of the shift toward less risky assets over the last six months. ETFs that I have favored in that time include the Consumer Staples Select Sector SPDR (NYSEARCA:XLP), iShares Edge MSCI Minimum Volatility USA (BATS:USMV), iShares Core U.S. REIT (NYSEARCA:USRT), VanEck Vectors Preferred Securities ex Financials (NYSEARCA:PFXF) as well as iShares Core U.S. Treasury (BATS:GOVT).

The U.S. economy may continue to defy the odds. Similarly, mega-capitalization stocks like Apple (AAPL), Google/Alphabet (GOOG) (GOOGL) and Facebook (FB) may continue to elevate the large-cap indexes.

Yet, if the Fed’s monetary policy prescriptions falter the way that foreign central bank prescriptions have, then you might want to keep a bit more cash on hand than usual. You cannot buy the big bad dippers without the “dry powder” to do so.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.