Quick Take

GFL Environmental (NYSE:GFL) has filed to raise gross proceeds of $100 million from a U.S. IPO, according to an F-1/A registration statement, although the final amount may be as high as $1.5 billion.

The firm provides a variety of environmental and waste treatment services in the North America region.

GFL has grown primarily through acquisition and the IPO is really a bet on management’s ability to continue growth through consolidation.

I’ll provide an update when we learn more valuation assumptions from management.

Company & Technology

Vaughan, Ontario-based GFL [Green For Life] was founded in 2007 to provide a range of waste management, remediation, and recycling services in Canada and 23 US states.

Management is headed by Founder, President, CEO and Chairman Patrick Dovigi, who previously worked at Lower East Capital Partners and has managed Waste Excellence.

Below is a brief overview video of the company’s solid waste solutions:

Source: GFL

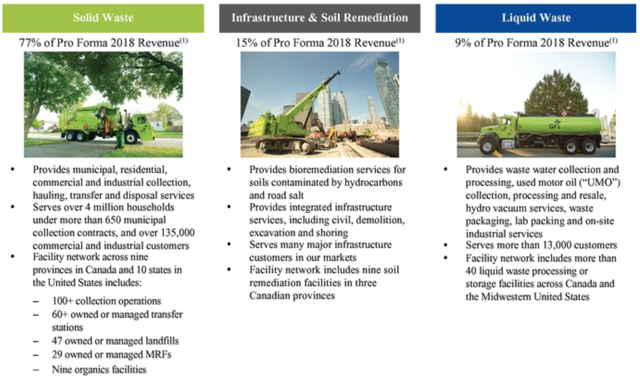

The firm’s services and solutions include non-hazardous solid waste management, infrastructure and soil remediation, as well as liquid waste management services, as shown in the table below:

Source: Company registration statement

GFL’s solid waste management operations comprise the collection, transportation, transfer, recycling and disposal of non-hazardous solid waste for municipal, residential, and commercial and industrial customers.

As of the end of 2018, the company had over 100 collection operations, more than 60 transfer stations, 47 landfills, as well as 29 material recovery and nine organics facilities.

Infrastructure and soil remediation includes remediation of contaminated soils and related services, such as civil, demolition, excavation and shoring.

By the end of 2018, the firm had nine soil remediation facilities.

The company’s liquid waste management business includes the collection, transportation, processing, recycling and/or disposal of liquid waste from commercial and industrial customers, with over 40 liquid waste processing or storage facilities as of the end of 2018.

Management said that “GFL is the fourth largest diversified environmental services company in North America,” as measured by revenue and operating footprint in the region.

Investors in GFL included Ontario Teachers’ Pension Plan and BC Partners. Source: Crunchbase

Sales and marketing expenses as a percentage of revenue have fluctuated in recent periods, per the table below:

Selling G&A | Expenses vs. Revenue |

Period | Percentage |

To June 30, 2019 | 9.4% |

2018 | 17.0% |

2017 | 10.9% |

Source: Company registration statement

Market

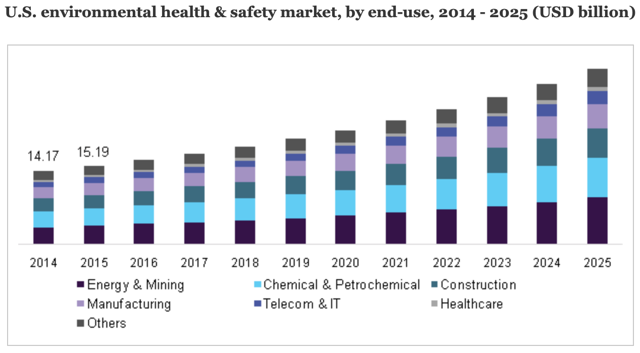

According to a 2016 market research report by Grand View Research, the global environmental health and safety market was valued at $49.8 billion in 2015 and is projected to reach $96.2 billion by 2025, nearly double that of 2015.

The main factors driving forecasted market growth are the rising number of regulations imposed by environmental protection and governmental agencies globally.

Increasing risk of environmental damage due to poor compliance by players has led to more stringent regulations across industries.

As of 2015, the US was the largest market for environmental health and safety services and is anticipated to grow at a CAGR of over 8.5% between 2016 and 2025.

Source: Grand View Research

Financial Performance

GFL’s recent financial results can be summarized as follows:

Growing topline revenue through acquisitions

Increased gross profit but reduced gross margin

Reduced before-tax loss

Variable cash flow from operations

Below are relevant financial metrics derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

To June 30, 2019 | $1,164,236,250 | 98.0% |

2018 | $1,389,443,250 | 39.0% |

2017 | $999,800,250 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

To June 30, 2019 | $379,206,000 | 118.6% |

2018 | $416,625,750 | -0.8% |

2017 | $420,179,000 | |

Gross Margin | ||

Period | Gross Margin | |

To June 30, 2019 | 32.57% | |

2018 | 29.99% | |

2017 | 42.03% | |

Before-Tax Profit (Loss) | ||

Period | Before-Tax Profit (Loss) | Operating Margin |

To June 30, 2019 | $(159,717,000) | -13.7% |

2018 | $(468,189,000) | -33.7% |

2017 | $(104,967,750) | -10.5% |

Comprehensive Income (Loss) | ||

Period | Comprehensive Income (Loss) | |

To June 30, 2019 | $(156,693,750) | |

2018 | $(320,551,500) | |

2017 | $(80,938,500) | |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

To June 30, 2019 | $27,220,500 | |

2018 | $14,538,000 | |

2017 | $94,775,250 |

Source: Company registration statement

As of June 30, 2019, the company had $157 million in cash and $8.4 billion in total liabilities. (Unaudited, interim)

Free cash flow during the twelve months ended June 30, 2019, was a negative ($121.8 million).

IPO Details

GFL intends to raise $100 million in gross proceeds from an IPO of its ‘subordinate voting shares,’ although the final amount may be significantly higher, possibly as high as $1.5 billion.

The subordinate voting shares will have one vote per share and the ‘multiple voting shares’ will have ten votes per share.

Multiple share classes are a way for management or existing investors to retain voting control of the company even after losing an economic majority. The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

Management intends to list the subordinate shares on the NYSE and the Toronto Stock Exchange. Per the firm’s latest filing, it plans to use the net proceeds from the IPO as follows:

"We intend to use the net proceeds received by us from this offering to repay certain indebtedness."

Management’s presentation of the company roadshow is not currently available.

Listed underwriters of the IPO are BMO Nesbitt Burns, Goldman Sachs, J.P. Morgan Securities, RBC Dominion Securities, and Scotia Capital.

Commentary

GFL wants to raise money from the public to pay down debts incurred in its long history of acquisitions.

With $6.6 billion in long-term debt, I’m not surprised that it seeks public capital to reduce debt since debt service is the firm’s second largest expense category.

The firm’s financials are difficult to analyze from an organic growth viewpoint since management has been in a nearly continuous acquisition mode, with the most recent major acquisition occurring in 2018.

The market opportunity for environmental services is large and expected to grow substantially in the years ahead, so GFL appears well-positioned to take advantage of a very favorable market backdrop for growth.

The GFL IPO will essentially be a bet on management’s roll-up acquisition strategy and that it won’t overpay for assets as it seeks to grow primarily through acquisition.

When we learn more details about valuation assumptions, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!