Investment Thesis

Summit Hotel Properties (NYSE:INN) saw a modest growth in its revenue per available room in Q2 2019. The REIT's recent joint venture announcement with Singapore's sovereign wealth fund will allow it to become opportunistic to acquire good quality properties in the future. It also has several initiatives to grow its revenue. The company offers a 6.7%-yielding dividend with a sustainable payout ratio. However, the U.S. economy appears to be heading for a slowdown. Therefore, it may be challenging to grow its business in this challenging environment. We think investors may want to wait on the sideline.

Data by YCharts

Recent Developments: Q2 2019 Highlights

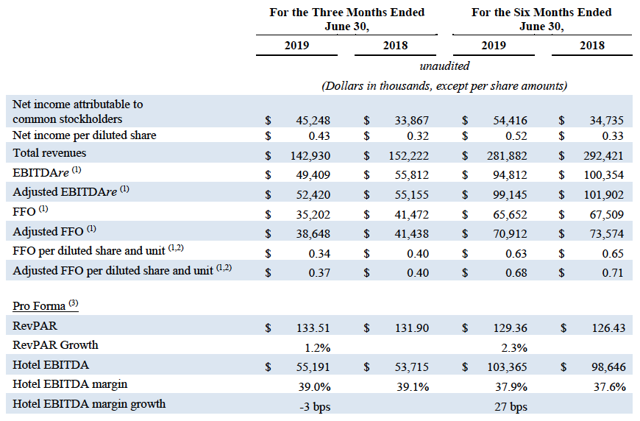

Summit Hotel delivered an inline Q2 2019. Due to its disposition of 8 properties year-to-date, the company saw its total revenue declined to $142.9 million from $152.2 million in Q2 2018. Similarly, its adjusted funds from operations declined to $0.37 per share from $0.40 per share. Fortunately, the company continued to see growth in its RevPAR. As can be seen from the table, its RevPAR increased by 1.2% year over year.

Source: Q2 2019 Press Release

Earnings and Growth Analysis

Joint venture with GIC will allow Summit to grow its portfolio quickly

In Summit Hotel's Q2 2019 earnings release, the company announced that it has entered into the joint venture with GIC, Singapore's sovereign wealth fund, to acquire assets. Summit Hotel will control a 51% interest in the joint venture with GIC contributing to the remaining 49% interest. We like this announcement as it will allow the company to gain a source of long-term capital to acquire quality properties. GIC's deep pocket means that Summit Hotel can be opportunistic to acquire quality properties at good prices. In addition, the company will be able to earn fees for providing services to the JV and incentive fees. The access to long-term capital also will allow Summit Hotel