We have previously highlighted the poor fundamentals of this company and made a recommendation to short this company. The market has reacted negatively since the company reported its result on 20th August 2019 with the stockdeclining by about 10% in the past 10 days. We have factored in the company’s 2Q19 performance into our model and maintain our view that the company is still overvalued despite being conservative in our analysis.

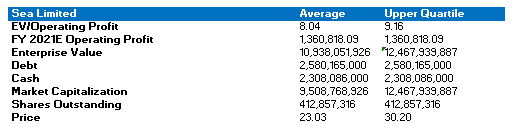

We have revised our models to reflect Sea Limited 2Q19 performance and our valuation model suggests that the company should be trading between USD 23.03 - USD 30.20. Even if we continue to apply a reasonable premium to Sea Limited, the potential downside remains significant, and we see little upside potential.

Data by YCharts

Data by YChartsInvestment Thesis

Sea Limited's consistent weak operating fundamentals and lack of profitability persists despite beating our expectations on most of the topline metrics (e.g. revenues, quarterly active users, gross orders, etc). Despite an improvement in operating fundamentals, we feel that the improvement was not large enough. As of now, we still do not have enough colour on how the company intends to turn into profitability. Operating fundamentals continue to be poor and there is currently not enough information to know how the company can turn this around in the near future. In the next segment, we will explore the company's operating fundamentals.

Investors appear to be valuing Sea Limited primarily on the basis of revenues. Although the share price of the company has recently fallen more than 10%, we still maintain our view that the company is overvalued. Currently, the company is trading at more than 10x price-to-sales (TTM). However, mobile gaming and e-commerce peers are only trading at average P/S multiples of 2.45x and 1.89x respectively.

Despite achieving better than expected revenue, we still do not see any compelling reason to justify the company's current price due to its persistent operating fundamentals. The latest market correction is an indication that investors are starting to pay attention to Sea Limited's operating fundamentals. We will explore more on the valuation of the company in detail at the end of the article.

Digital Entertainment (Garena)

Free Fire continued to grow and was the third most downloaded mobile game globally according to App Annie. It was also the Latin America’s top-ranking game in 2Q19 by monthly active users and consumer spending. The company also spearheaded numerous events in an effort to solidify its reputation as one of the leading e-gaming companies. For example, Arena of Valour World Cup in July with Tencent had attracted more than 74M views online. The Free Fire event hosted in Brazil had also attracted over 12M view online.

Source: Created by the author using company filings

Source: Created by the author using company filings

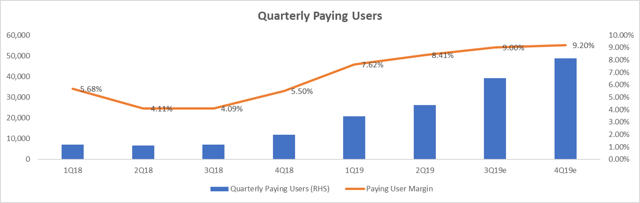

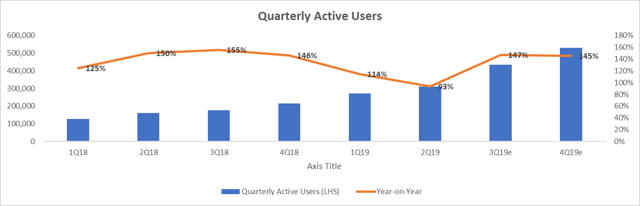

Quarterly active users increased 93% year-on-year to 310,500 which missed our expectations of 329,181. However, overall paying users increased 295.4% to 26,100 and beat our expectations of attaining only 25,089 quarterly active users. The percentage of paying users also increased from 7.62% to 8.41% in 2Q19.

Source: Created by the author using company filings

We revised up our assumptions for 2H19 and maintain our optimistic view for digital entertainment segment. Revenue growth has been revised to 1.24B for 2019E from 1.06B, primarily driven by an increasing quarterly paying user base and quarterly active user base. We are optimistic that the Call of Duty Mobile launch and Speed Drifters in Latin America will be strong drivers for the company in FY19. Based on our revision, we expect revenues for the Digital Entertainment segment to hit US $1.23B driven by an increasing quarterly paying user base and quarterly active user base.

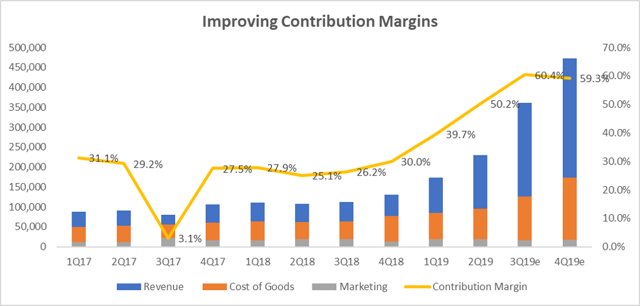

SEA Limited’s Digital Segment has been improving its efficiency and acquisition, even alongside outstanding revenue growth of 93% in 2Q19. Overall contribution margin (revenue minus cost of revenue minus customer acquisition costs) has improved significantly from 25.12% in 2Q18 to 50.25% in 2Q19.

Source: Created by the author using company filings

Source: Created by the author using company filings

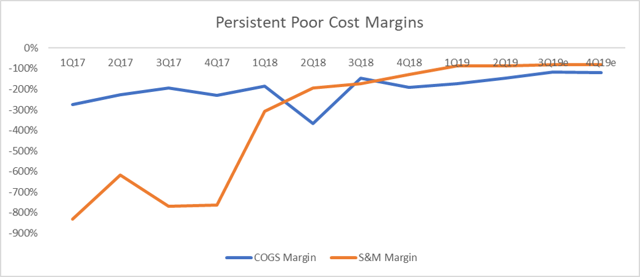

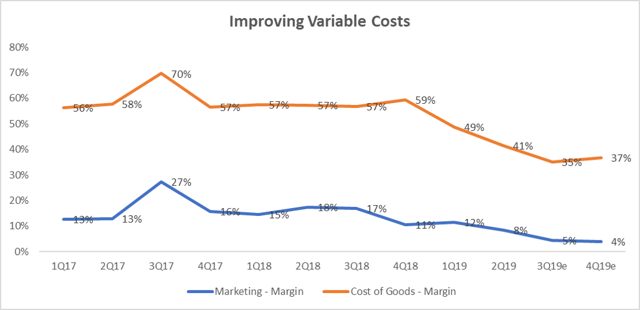

The contribution margin improvement was primarily driven by a significant reduction in variable costs such as cost of goods sold and marketing expenses. Sales and marketing expenses margin was only 8% as compared to 18% in 2Q18 and 12% in 1Q19. Cost of goods sold has fallen to only 41% of sales in 2Q19, better than 49% in 1Q19 and 57% in 2Q18.

Source: Created by the author using company filings

Source: Created by the author using company filings

We believe that the company’s digital segment is growing at a reasonable pace without burning cash unnecessarily. The growth of the company in the digital entertainment segment has been reasonably sustainable. This is not surprising given that Garena’s quality of games and expansion strategy has consistently proven to yield exceptional results. We expect the company’s segment to continue to surpass our expectations, supported by a healthy pipeline and sound customer acquisition and marketing strategies such as the employment of gaming events in their operating regions

E-Commerce & Other Related Services:

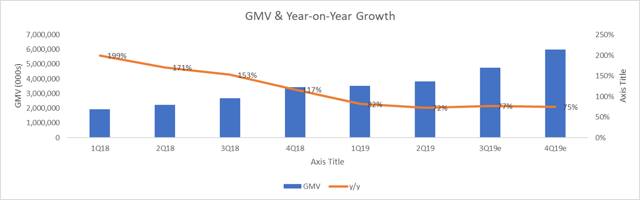

Segment performance in 2Q19 has beat our expectations in their GMV, gross orders, and revenue. The company’s GMV was 3.8B in 2Q19 as compared to only 2.2B in 2Q18. However, deteriorating GMV growth is starting to show. In 2Q18 GMV growth stands at 171%, however, GMV growth was only at 72% in 2Q19. While we revised up our GMV growth forecast slightly, we expect to see continued deteriorating growth in the subsequent quarters.

Source: Created by the author using company filings

Source: Created by the author using company filings

Unfortunately, we are seeing declining revenue growth despite aggressive expansion. Sea Limited has achieved a revenue of 206,673 and has beat our expectations by 8.4%. Despite beating our expectations revenue growth in this segment has unfortunately been waning. We understand that e-commerce expansion is not easy. However, year-on-year growth has declined from 651% in 2Q18 to 173% in 2Q19. The significant decline in growth is simply too large to ignore. Sea’s performance in 2Q19 has confirmed our initial concerns from our previous article.

Source: Created by the author using company filings

Source: Created by the author using company filings

We revised up our assumptions for 2H19 slightly due to a better than expected performance in 2Q19. However, we maintain that the growth in this segment is unsustainable and we expect the deterioration to persist in the foreseeable future.

Margins for the E-Commerce & Other Services segment has improved slightly in 2Q19. Sales and marketing expenses improved to 86.54% as compared to 88.53% in 1Q19 and 306% in 1Q18. Cost of revenue in this segment has improved to 117.94% in 2Q19 as compared to 126.62% in 1Q19 and 186.88% in 1Q18. It is also important to note that Shopee has continued to record a positive quarterly adjusted EBITDA. Shopee was also ranked number one in the Shopping category by average monthly active users and by downloads in both SEA + Taiwan combined in 2Q19.

Source: Created by the author using company filings

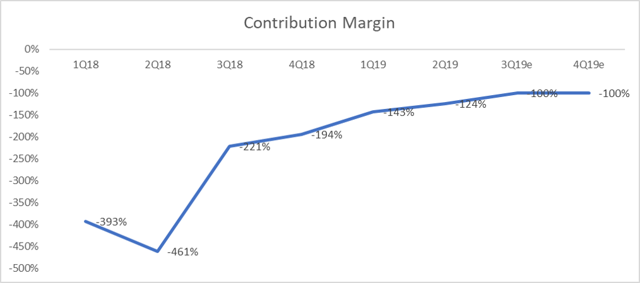

However, we reiterate that improvement must be expedited and is currently not fast enough. The segment’s margins are poor, and the contribution margin of the segment is persistently atrocious. Although the margins of these variable costs have been improving, the contribution margin of the company is still negative. Improvement of these margins is simply too slow at its current traction. As demonstrated in the share price movements since 2Q19 earnings release, investors are starting to lose their patience.

Source: Created by the author using company filings

Overall, we expect the contribution margin of this segment to continue to be poor for the year FY2019 despite a slight improvement in 2Q19. Again, we still do not have enough colour on how the company intends to optimize its expenses. Given the current e-commerce landscape, we are still cautious about Sea Limited’s outlook.

Valuation

We reiterate our firm conviction that Sea Limited is overvalued. The decline in share price since the release of 2Q19 results is also another indicator that the market is starting to lose patience with Sea Limited and wants to see some kind of profitability.

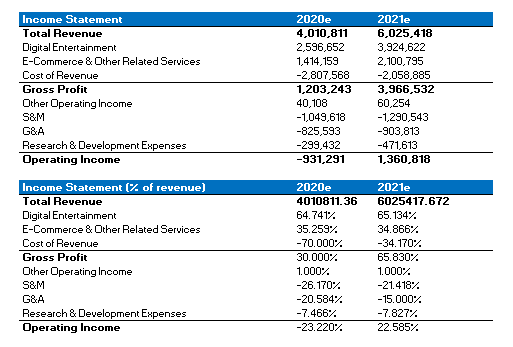

We wanted to move away from valuing Sea Limited using revenue but also at the same time accounting for Sea Limited's exceptional revenue growth. We projected Sea Limited well into FY2021 using our most optimistic scenario and value the company using EV/Operating Profit. The results indicate that we should be very careful with the company's current valuation.

Source: Created by the author using company filings

If Sea Limited were to remain disciplined in managing its operating expenses for the next two years, we should see the company achieving operating income by 2021E. We shortlisted a few companies that have achieved positive operating profit to compare Sea Limited with. In reality, it is highly likely that the company continues to burn cash and takes on more debt. However, to support our "most optimistic scenario", we further assumed that Sea Limited's debt and cash levels stay constant.

Source: Created by the author using company filings

Based on these assumptions, our analysis suggests that Sea Limited should trade between USD 23.03 - USD 30.20 and that the current pice of Sea Limited is overvalued.

Conclusion

Despite an improved 2Q19 performance, we maintain our view that the company is still overvalued. We want to highlight that the company has accumulated over 3B in retained deficit and consistently delivering negative net profit with poor margins since its IPO. Based on our projections, we do not agree with the current valuation of the company.

We don't see upside potential for the stock, based on our analysis. Even if we account for our "most optimistic scenario", shares of Sea Limited still do not look attractive.

Moreover, given the current global market conditions, investors are expected to reduce risks and start off-loading price growth companies. The immediate decline of the company's share price after the earnings release on 20th August was one such indication. Investors are losing patience and are shedding such pricey companies with high risk out of their portfolios. We recommend investors avoid the hype surrounding the company's growth.