Thesis

Ulta Beauty (NASDAQ:ULTA) got hammered recently due to subdued guidance and bearish sentiment about the growth of the cosmetics market for the remainder of year. The company reduced same-store sales growth and overall sales growth guidance for 2019.

I am not a woman and I do not wear makeup. This industry is not one I have followed until recently reading about Ulta. If there is some profound shift occurring in the makeup industry--i.e. women wearing less makeup in favor of skin care products--then Ulta Beauty may face headwinds beyond this year.

If any retailer understands the cosmetics industry, it's Ulta. Half of company revenue comes from cosmetics and the company is a re-seller of 500 different beauty brands in addition to being a retailer of its own products, cosmetics and otherwise.

Given the recent selloff, those who believe in the long-term future of the company are being given an attractive entry point with the stock nearly 40% off its 52-week high and trading at a reasonable valuation.

The Recent Problems

As cosmetics go, so goes Ulta Beauty. The company is the leading beauty retailer in the country, but it is mostly heavily focused on cosmetics, which comprises half of sales.

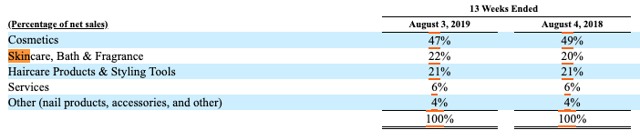

Source: Ulta's Recent 10-Q filing.

Source: Ulta's Recent 10-Q filing.

This quarter, there was a slight shift in sales mix. Cosmetics as a percentage of sales dipped slightly and skin care saw a boost.

In the case of skin care category and brand innovation is driving new rituals and incremental purchases, thus driving strong comp. And we're continuing to drive market share gains in the category, but of course skin care is a smaller part of the business. - CEO Mary Dillon, Q2-19 call.

The company believes lack of recent innovation in the cosmetics industry has resulted in a lack of strong consumer interest. Innovation is a constant driver of newness and newness results in sales growth.

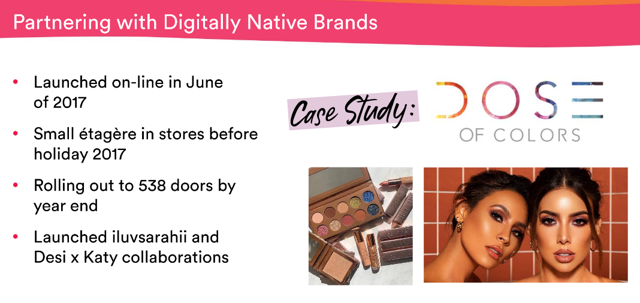

The company is reliant on innovation not only with its own products, but from third-party labels as well. The company actively recruits new brands to its stores, many of these new brands digital-only in nature.

Source: 2018 Investor Day presentation.

Source: 2018 Investor Day presentation.

Maintaining the customer's attention and interest with newness is key--95% of sales are from repeat customers and the company has more than 33 million loyalty program members. Loyalty program membership interest remains strong and grew 13% compared to a year ago.

In addition, the company is ramping up new products and market campaigns to drive interest. This quarter, the brand will launch a new product line from Kim Kardashian. The company is betting that Kardashian's fame and influence - 146 million Twitter followers - will help drive sales growth.

The company is also launching a product brand by one of the stars of Stranger Things, which is probably one of the most talked about shows on television these days.

Competition

Ulta has competitors, but no single competitor comes close to the reach and scale of Ulta. Some women may prefer Sephora, but Sephora, a subsidiary of Louis Vuitton (OTCPK:LVMHF), has less than 100 locations domestically to Ulta's 1,200 locations (1,500 is the goal). And other competitors like Sally Beauty Holdings (SBH) are primarily focused on hair care products.

Part of me wondered how much of an impact Amazon was having on Ulta's business, but in reviewing a few products for price comparison, I couldn't even find many of the Ulta website products on Amazon. Ulta's emphasis on product newness and constant rewards and refill reminders to members appears to be a distinct advantage that sets it apart from the competition.

Valuation

The severe selloff has made Ulta a reasonably valued growth stock. Its forward and trailing P/E ratios trade at a slight premium to competitors, but even at a reduced growth rate of low double-digits--it had grown revenue at a 20% compounded annual growth rate between 2008 and 2018--the company still looks reasonably priced. Growth has decelerated, but the company continues to open stores and the long-term expectation is that same-store sales will grow 5-7% per year.

The question becomes how long makeup struggles will last. If the reduced interest in makeup continues beyond 2019, Ulta will struggle given its dependence on the segment.

Conclusion

The recent selloff is an opportunity to buy a market-leading growth company at a reasonable price.