Introduction

Some companies are something special. You know it when you first hear about them, when you use their product, when you first buy their stock. Those stocks should be held close to the vest. Alibaba (NYSE:BABA) is such a company in my opinion.

I have written two articles about Alibaba before. I first wrote about it in August 2018, when I wrote a series of six articles under the title 'Chinese Stocks To Buy Now.' Alibaba was in the first installment. The stock had gone down a lot because of the starting trade tensions, but those tensions have not gone away yet, which means that Alibaba is still around the same price level as then. The good thing is that its fundamentals have kept improving, which makes its valuation all the more attractive. But that is for later in this article.

Then I wrote the second article in August of this year. In that article, I tried to explain that lower margins were no problem, since they only signaled a period of investment for the company. I also tried to convince the reader that the upcoming dilution (at the time) of the Hong Kong listing was not a problem. The stock is up about 11% since that article.

The listing that was a part of the subject of the article was postponed because of the political unrest in Hong Kong. 'People familiar with the matter' have now revealed that the Chinese giant wants to proceed to list at the end of November or the beginning of December And that might bring a catalyst to Alibaba's price that you don't want to miss if you want to be an Alibaba investor.

But before we go into that, we will have an overview of the Q3 2019 results.

The Q3 2019 Results Are Outstanding

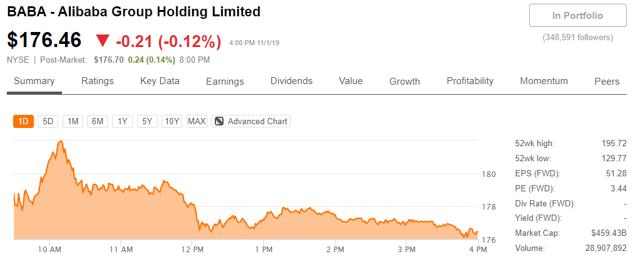

Alibaba reported its Q3 2019 results last week, on November 1, before the market opened. The reaction of the market was anemic:

(Source: Seeking Alpha)

After an initial spike to $181.98, the stock fell again, even going down a bit. Sometimes the market does irrational moves and this is one, in my opinion. Because the Q3 results were outstanding.

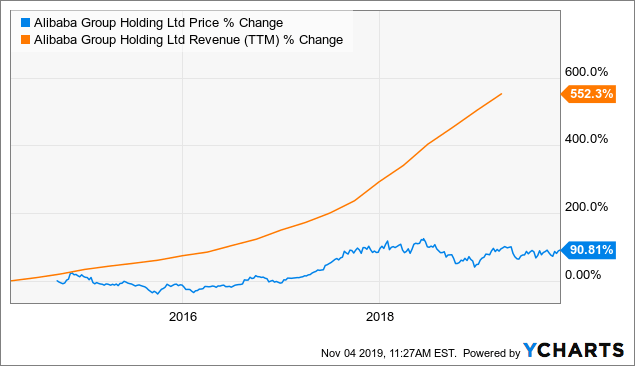

Revenue was up 40% YoY, which is mindblowing for such a huge company. Since the IPO, just five years ago, in September 2014, Alibaba's revenue has grown by 552%:

Data by YCharts

Data by YCharts

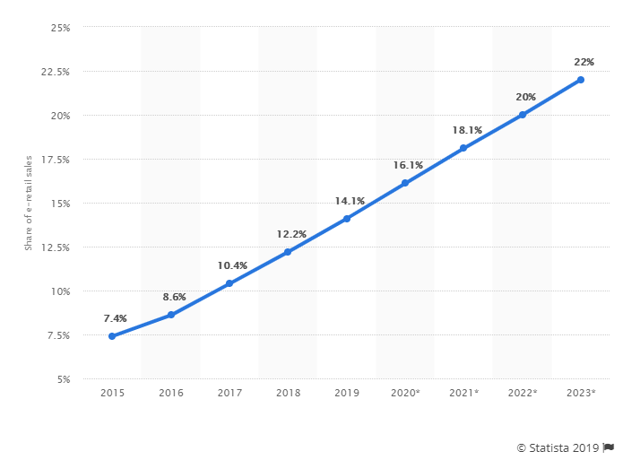

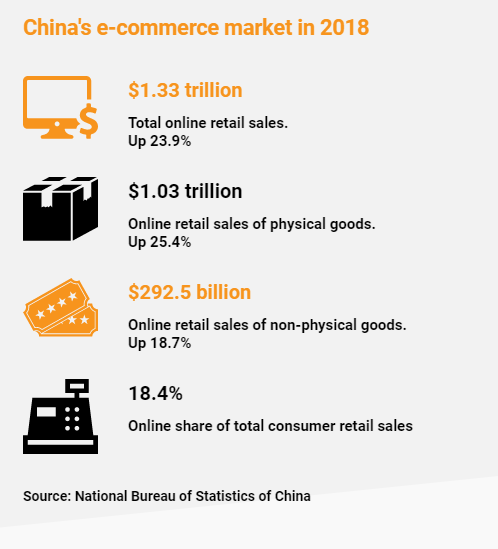

If you look at the separate parts of the revenue stream, it was a surprise to see that even the core commerce revenue (basically the online retail part of Alibaba) grew 40% YoY. This shows that Alibaba is not at its limits yet, even though the percentage share of online retail is already higher in China than anywhere in the world.

(Source)

In the US, this 2018 online share of China is only projected to be reached in 2021:

(Source)

The fact that the YoY growth of the whole online retail industry in China was still 25.4% for 2018 (see the first graph) proves that there is still a huge tailwind there and that Alibaba does even better than the general trend, despite its size or maybe thanks to it.

Another highlight of the earnings was Alibaba's cloud division, which grew by 64% YoY. This is what Alibaba's CFO Maggie Wu had to say about Cloud on the conference call:

Cloud computing revenue increased by 64% year-on-year to RMB 9.3 billion. This was primarily driven by an increase in average revenue per customer. Adjusted EBITA was a loss of RMB 521 million reflecting small widening losses versus the same quarter last year because we continue to invest in talent and technology infrastructure.

(Logo of Alibaba Cloud, source)

As with AWS for Amazon (AMZN), Alibaba's Cloud needs huge investments first to consolidate as the leader. And that strategy clearly works. Alibaba's CEO Daniel Zhang on the conference call (my bold, FGTV)

Based on the most recent available data in August, 59% of China Asia listed companies are customers of Alibaba Cloud.

This is the revenue of Cloud, in RMB MM

(Source: Q3 2019 conference call deck)

(Source: Q3 2019 conference call deck)

In dollars, that is about $1.32B. Just to show the gigantic size of Alibaba, that's just 8% of its revenue in this quarter, as you can see in the third column.

That is impressive and that also means that if (when) Alibaba gets to the 25%+ margins that AWS gets constantly now, this again will be a big contributor to the earnings.

Alibaba's media division also keeps growing, although it is at a lower rate of 23%. There is huge competition there, especially of all Tencent (OTCPK:TCEHY)-owned or Tencent-backed outlets.

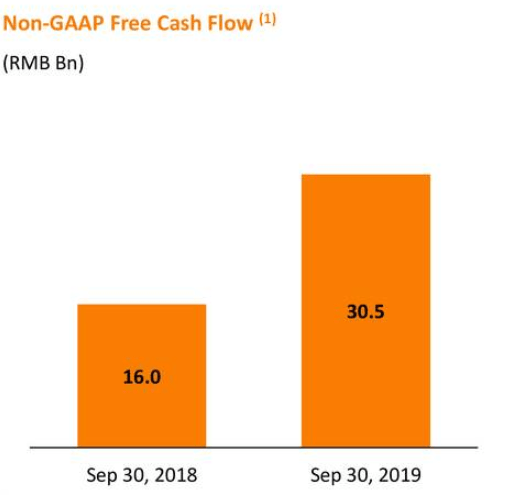

We have only looked at revenue so far, and it's impressive in my book, but let's also not forget profitability. I always like to look at FCF (free cash flow), as it is the lifeblood of any company. And FCF for Alibaba grew by a jaw-dropping 90% to $4.3B:

(Source: Q3 2019 conference call deck)

(Source: Q3 2019 conference call deck)

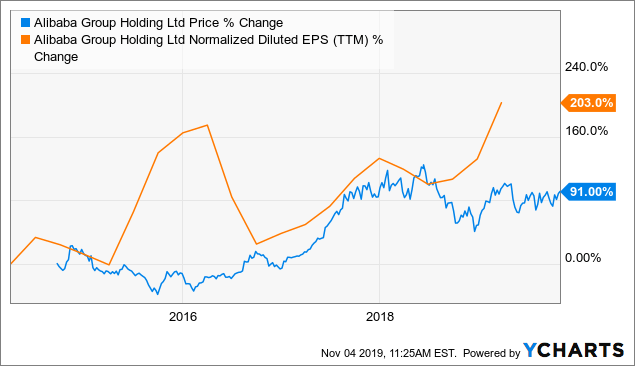

You could also highlight the GAAP EPS of $3.85, although, with so many moving parts, adjustments and consolidations that GAAP EPS doesn't say that much, besides the upward trend. FCF and EBITA are better standards to evaluate Alibaba's performance. But the EPS growth is impressive too:

Data by YCharts

Data by YCharts

Valuation

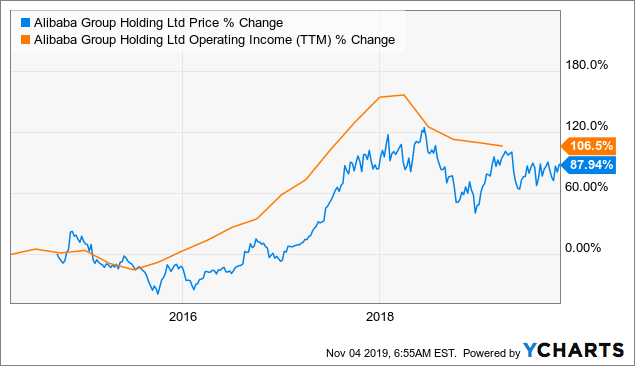

I have already argued before that for growth companies, which, amazingly enough, Alibaba still is at this stage, you should look at operating income for valuation. Just to make sure you know what we are talking about: operating income measures the profit from the operations minus expenses that are needed to operate.

Data by YCharts

Data by YCharts

If you look at operating income, you see two things. First, again, that the stock price has more or less followed operating income, as I have shown before for other growth companies. Secondly, that it has come down. The reason there are the loss-making new initiatives of Alibaba, where it invests heavily: media and cloud. Those will pay off later and will boost the operating income.

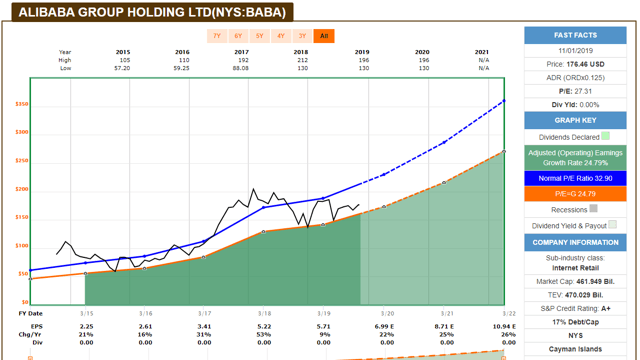

You can also see the same correlation between stock price and operating income in this F.A.S.T. Graph:

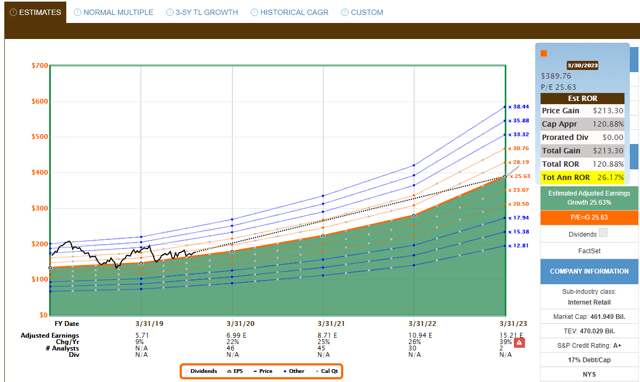

But what is more interesting is the projection into the future, based on all estimates of analysts.

You can see that Alibaba's operating income is projected to keep growing at 25%. That also means that CAGR for the stock price around 25% is very likely. Mind you, except for the last year, there is a great number of analysts projecting these numbers. For 2022, there are still 30. The higher the number of analysts, the higher the probability that they, as a group, are right.

To cut this valuation side very short: Alibaba is undervalued based on its growth projections and it could easily return 26% each year over the next few years.

Why you should buy now

There is one thing that I want to stress before wrapping it up. I think that the undervaluation of Alibaba (relative to its possible returns) could turn around over the next few weeks. As I have already mentioned in the introduction, rumor has it that Alibaba will list on the Hong Kong stock exchange at the end of November or the beginning of December.

That might be a gamechanger for the company. If the valuation on the Hong Kong exchange shoots up, because of Chinese investors who see the true potential of Alibaba to the full, the valuation on the American market will follow, of course. I wouldn't be surprised if I saw Alibaba's price on the rise, both because of the trade talks that seem to work towards a deal and because the big money moves in before the Hong Kong listing.

Conclusion

Alibaba's quarterly results were impressive. The high growth of 40% in the core business, online retail, was impressive. But the real star was maybe Cloud, which grew by 64% YoY. Alibaba has a market share of 59% in all of Asia's public companies. It's investing a lot to keep up the growth and be the market leader, but once it can get to the profit margins of Amazon's AWS, this will be another huge stream of revenue for the company.

There are persistent rumors that the stock will list in Hong Kong at the end of November or the beginning of December. That might be a sign that the relative cheap valuation might come to an end. If enthusiastic Chinese investors are able to buy the shares, this could let the shares pop, especially if this is combined with a trade deal between China and the US.

If you have enjoyed this article and would like to read more articles from a long-term perspective, feel free to hit the "Follow" button next to my name.

In the meantime, keep growing!

P.S. Can I ask you to keep an eye out for my upcoming Marketplace: Potential Multibaggers? It should be launched within a few weeks.