Corporate governance is particularly hard to analyze because paper and practice often do not coincide. Companies with good corporate governance on paper can still execute egregious acts and those with poor structural governance will sometimes still be good fiduciaries. The only real way to tell the difference is observation.

When acts of misalignment are observed, they should be noted and investors should adjust fair values accordingly. This article will discuss one of the most serious violations which is the transfer of value between entities. This has a massive impact on fair value, because when management gets comfortable transferring value, whatever value may be embedded in the company's assets may not make it to shareholders. In fact, the companies we are discussing today each trade at massive discounts to Net Asset Value or NAV but still may be bad investments as that value can be erased or transferred away at the whims of management.

The guilty parties

- Ashford Management transferred wealth from Ashford Inc. (AINC) to Ashford Trust (NYSE:AHT)

- RMR, the external manager of a handful of REITs, transferred wealth from Senior Housing Properties Trust (SNH) to Five Star Senior Living (FVE).

Ashford Value Transfer

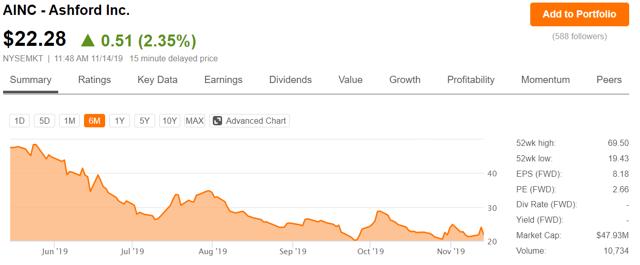

In an Ashford Inc. 8K, filed on October 10th, the company announced that it bought back its own AINC shares from Ashford Hospitality Trust. Specifically, it bought 412,974 shares for $30 per share which equates to about $12.4mm.

Share buybacks happen frequently and are often good for shareholders, what makes this a value transfer?

Well, the price was artificially inflated. AINC shares had not traded anywhere near $30 at the time of transaction.

AINC could have repurchased the same number of shares in the open market for somewhere in the $22 to $23 range. This would have saved them about $3mm dollars (midpoint of $22.50 means 7.50 of savings per share times 412,974 shares).

While it is the case that block purchases are often at a higher price than open market trading, there was simply no reason to do a block purchase. The potential benefit of a share buyback is long term value accretion which can be better done with a continuous buyback. There is no urgency that makes it worth paying more than 25% more for the shares.

This may sound like chump change, but recall that AINC has a market cap of $47mm so this repurchase represents about 25% of market cap. The $3mm of overpaying represents a loss to shareholders of over 6% of market cap. The $3mm was essentially transferred to the related entity AHT.

Why was this done?

I cannot read the minds Ashford management, but I can look at the incentives. If AINC buys its shares back from AHT rather than the open market, the capital stays in the Ashford family of companies and they get to keep collecting fees. I suspect this made the more expensive repurchase from AHT worth it when compared to the more shareholder-friendly open market repurchase.

Ashford Trust profited $3mm from the value transfer, but I view it as just as negative for them because they are controlled by the same external manager. This value transfer was legal as far as I can tell from my layman's knowledge of the law, but it was a terrible transaction for shareholders.

We attempted to contact AINC management for a rebuttal but received no response within 48 hours.

SNH Value Transfer

Senior Housing Properties Trust is fully entwined with Five Star Senior Living with FVE being the major tenant of its senior housing portfolio. Both entities are externally managed by RMR.

In 2019, SNH entered into a series of deals and transactions which to me seem to all benefit FVE at the cost of SNH shareholders.

An April 2nd press release discusses some of these deals.

"Commencing February 1, 2019, Five Star's aggregate monthly rent payable to SNH under the five master leases with Five Star was reduced from approximately $17.4 million to $11.0 million, and Five Star has paid its February rent payment, which was previously deferred to March 31, 2019, at this reduced amount."

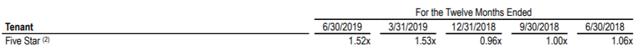

That is a massive rent cut. Such cuts are not unheard of as other senior housing landlords have given rent cuts to their tenants. However, there is a clear difference between the arm's length cuts provided by Ventas et al. and those provided by SNH. Generally, a rent cut would be given by a landlord to help the tenant stay afloat. As such, the rent would be cut just enough that the tenant could afford rent. Thus, the cut would be to an EBITDAR coverage of about 1.0X to 1.1X.

SNH cut rent so significantly that FVE's coverage shot up to 1.53X.

Source: 3Q19 supplemental

FVE, thanks to its egregiously low rent under the new agreement, has a significantly better coverage than the vast majority of senior housing tenants which average around 1.3X.

SNH also provided cash to SNH through purchase of FF&E.

SNH has purchased from Five Star approximately $50.0 million of fixed assets and improvements related to the leased senior living communities"

These so-called assets will generate $0 incremental revenue for SNH. SNH also gave FVE a loan.

SNH has provided a $25 million short term revolving credit facility to Five Star that is secured by six of Five Star's wholly-owned senior living communities. The interest rate under this credit facility is 6.0% per year on any drawn amounts and matures on January 1, 2020. There is currently no amount outstanding under this credit facility."

6% is a very low rate for a company in FVE's financial condition. SNH gave FVE even more cash through overpaying for issued shares.

Simultaneous with SNH and SNH shareholders receiving Five Star common shares, Five Star will reduce Five Star's indebtedness under the SNH credit facility and SNH will assume certain of Five Star's liabilities and/or make a cash payment to Five Star equal to $75 million in aggregate."

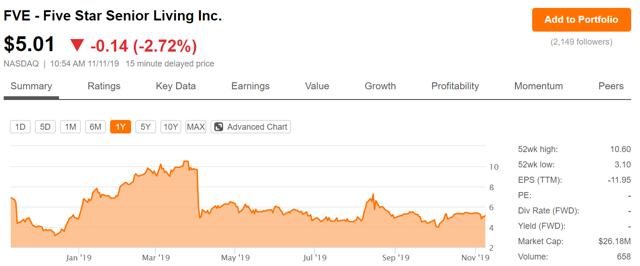

SNH got about 76.7% ownership of FVE in exchange for $75mm. A quick look at the chart shows SNH overpaid. With the 8.3% ownership that SNH already had, this takes ownership to 85%.

Source: SA

As of 11/11/19, FVE's total market cap was only $26mm so 76.7% of the company is clearly not worth $75mm. Even if we value FVE at the highest price of the past 52 weeks, the market cap is only about $55mm.

As RMR already controlled FVE, there should be no controlling share premium here. I see no value gained for SNH shareholders in SNH owning most of FVE and see no reason for SNH to have bought the shares in the open market or through an overpriced block trade like this one. This looks very similar to the AINC purchase of AINC shares at $30 against a $22 market price.

When there is a constant and highly liquid barometer of share value, it is inexcusable, in my opinion, to pay substantially more than market price. Just as the AINC purchase transferred value from AINC to AHT, the SNH purchase of FVE shares transferred value from SNH to FVE.

In summary, FVE received rent reduction, a low rate loan, cash and was able to issue equity vastly above market.

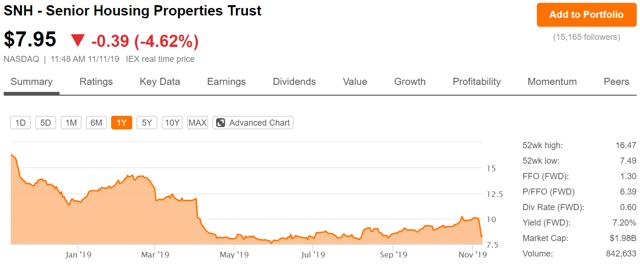

SNH shareholders received a kick in the teeth with the share price dropping from about $12 to about $8 as the deal was announced in April.

Source: SA

SNH's dividend was also cut as the new lower rent meant SNH could not afford its dividend.

Due to the lower cash flow SNH will receive from its senior living communities operated by Five Star, SNH anticipates that it will need to lower its common share distribution rate in the future. SNH currently expects to pay an annual distribution of $0.55 to $0.65 per common share going forward, which is based on a target distribution payout ratio of approximately 80% of projected cash available for distribution in the future. This new distribution rate is expected to begin with SNH's next regularly scheduled quarterly distribution announcement later this month"

Note: We reached out to management of SNH with a request for comment on the matters discussed in this article. SNH was able to confirm the accuracy of their April 2nd press release but as I did not provide SNH with a copy of the article they could not confirm all the facts. My commentary and analysis of the information in their press release is mine alone and has not been endorsed by SNH or FVE.

When companies begin to dabble in transferring value between related entities, it is bad news for investors. Interestingly, the value transfer does not even seem to help the entity to which the value was transferred. AHT and FVE were the recipients of the value transfer and yet their stocks are both down substantially.

The massive red flag of the clearly misaligned management behavior outweighs the small benefit of the value transfer. Thus, these actions are bad for the recipient of the value and very bad for the entity from which the value was extracted.

How to invest in such an environment

With terrible alignment issues being prevalent in this environment, how does one invest? Should we avoid all companies with external management or related party transactions?

I would advocate for a more granular approach. There are plenty of externally managed companies with great management and some related party transactions are beneficial for shareholders.

Granular approach

We prefer to observe the actions of each management team individually and make a judgement call on specific management teams. Following are some great opportunities that would have been missed using a blanket rule of not investing with external management or related party transactions.

W. P. Carey (WPC) built a large portion of its asset base through related party transactions in which the public REIT entity acquired its non-traded relatives. These acquisitions were at fair cap rates and have generally been accretive, leading to a long track record of outperformance.

Source: SNL Financial

NexPoint Residential (NXRT) is and has been externally managed for its entire tenure as a public REIT. Long term shareholders have done phenomenally well, multiplying their investment and importantly management has created value for shareholders through perspicacious capital deployment in refurbishment with an ROIC in the mid-20s.

Source: SNL Financial

It is more work to take a granular approach, but often the companies that check the red flag boxes of the blanket statements are the most undervalued.

NXRT was only ever a $12 stock because so many people feared its external management. Had they looked closer the value proposition would have been obvious.

Disclosure: 2nd Market Capital and its affiliated accounts are long NXRT. This article is provided for informational purposes only. It is not a recommendation to buy or sell any security and is strictly the opinion of the writer. Information contained in this article is impersonal and not tailored to the investment needs of any particular person. It does not constitute a recommendation that any particular security or strategy is suitable for a specific person. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. The reader must determine whether any investment is suitable and accepts responsibility for their investment decisions. Dane Bowler is an investment advisor representative of 2MCAC, a Wisconsin registered investment advisor. Commentary may contain forward-looking statements that are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article. Positive comments made by others should not be construed as an endorsement of the writer's abilities as an investment advisor representative.

Conflicts of Interest. We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to clients on an ongoing basis. As fiduciaries, we prioritize our clients' interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.