Introduction

In prior pieces, I have been bullish on Xinyuan's (NYSE:XIN) prospects. Unfortunately, this last quarter was a step backwards. One only hopes XIN will continue to pay a 10¢ quarterly dividend.

The Numbers

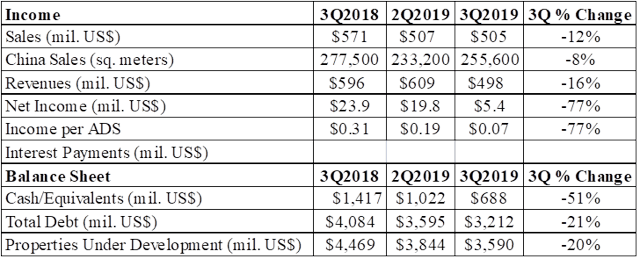

Table 1 provides a summary of the latest numbers. The only positive news here is the debt reduction. However, even that is offset by the reduction in properties under development.

Table 1. - XIN's Financials

Source: XIN's Financial Reports

Xinyuan Service

Many of us thought that having XIN get into the property management business was a good move. And indeed, XIN had contracted to manage properties in over 35 cities in China, including Zhengzhou, Jinan, Xi'an, Chengdu, Suzhou, Beijing, and Shanghai.

However, this last quarter, we learned that beginning in October, the property management arm would be split off and issued on the Hong Kong Stock Exchange with 25% of the outstanding shares going to new investors. After the listing, Xinyuan Real Estate remains the largest shareholder with 60% of total shares held. This is not good news for existing XIN shareholders. Before this listing, Xinyuan Service was totally owned by XIN. Now, XIN only owns 60%. The stock has effectively been "watered down."

Overseas Properties

The property development industry is primarily a local industry. That is, developers must deal with local politicians as well as the economics of every opportunity. I have always been concerned about XIN developing properties outside of China. XIN has investments in the US, England, and Malaysia, and they are very hard to track. One property we can track is the Oosten property in Brooklyn. It sold 4 units in the third quarter leaving it with 39 units to sell.

TPG Holdings

In prior postings, I have tracked the ongoing liquidation of TPG Holdings and Table 2 indicates they continued in the