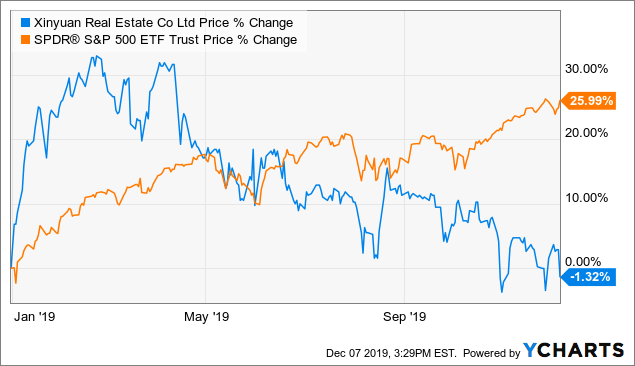

Xinyuan Real Estate's (NYSE:XIN) stock has significantly underperformed the broader market over the last few years, and 2019 has been more of the same.

Data by YCharts

Data by YCharts

Saying that 2019 has been a challenging year for Xinyuan would be a major understatement, as this Chinese company has had to deal with a number of significant headwinds (see "XIN: A Lot Of Risk To The Story" for more detail on the risk factors that have impacted the stock). And it was the same old story for Xinyuan's most recent quarter.

The Latest, A Tough Q3 2019

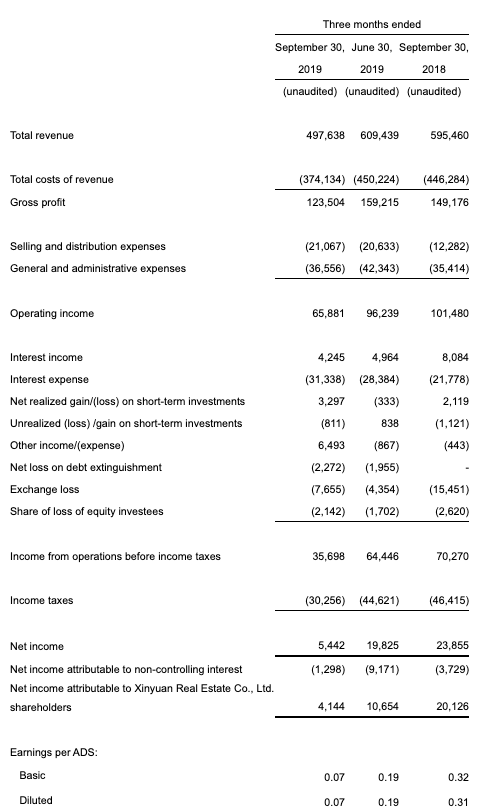

On December 6, 2019, Xinyuan reported adjusted Q3 2019 EPS of US$0.07 on revenue of US$497.6M, which does not compare favorably to the year-ago quarter.

Source: Q3 2019 Earnings Press Release

Highlights for the quarter:

- Total revenue decreased by ~16% YoY to US$497.6M

- Contract sales decreased ~12% YoY to US$504.8M, and the average selling price per square meter sold in China declined from US$2,059 in Q3 2018 to US$1,975 in the current period.

- Gross profit decreased by ~17% YoY with net income coming in at US$5.4M (down significantly from both of the prior periods)

Make no mistake about it, Q3 2019 was a tough quarter for Xinyuan and the numbers prove it. Revenue was down. Contract sales were down. Earnings were down. And most importantly, management is now guiding for the company's full-year 2019 net income and contract sales to be flat when compared to the prior year. This change in expectations comes shortly after management guided for contract sales (10%) and net income (15%-20%) to both be higher than the previous year. So what really changed since the previous guidance was provided in August 2019? Nothing material, in my opinion, and I will cover this below.

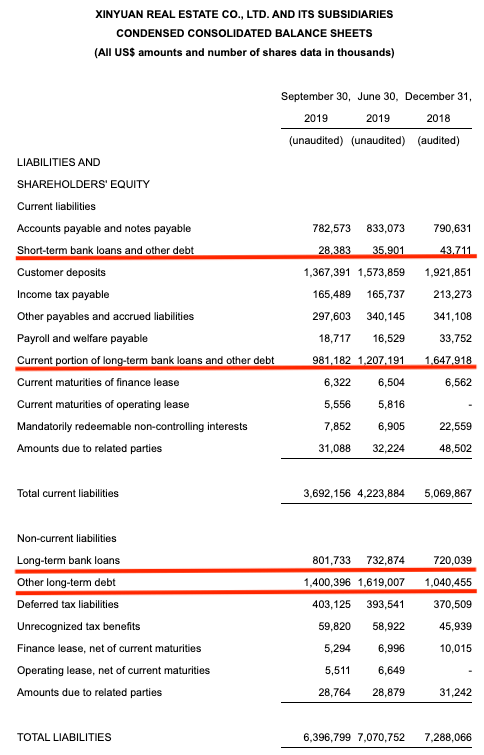

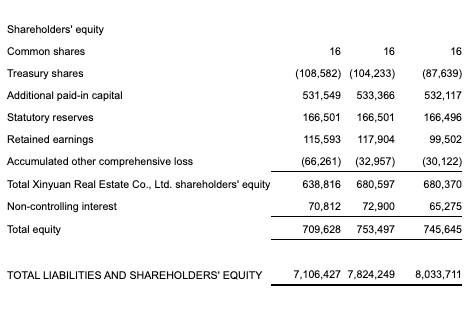

On the other hand, one of the few bright spots for the company was the fact that the debt balance was down significantly when compared to the year-ago quarter.

Source: Q3 2019 Earnings Press Release

However, it should be noted that Xinyuan used its cash to reduce debt so, at the end of the day, the company's leverage did not improve as much as you would think.

| (US$ in thousands) | 9/30/19 | 12/31/18 | $ Chg | % Chg |

| Cash and cash equivalents | $327,488 | $674,142 | ($346,654) | -51% |

| Restricted cash | 220,487 | 511,875 | (291,388) | -57% |

| TOTAL | 547,975 | 1,186,017 | (638,042) | -54% |

| S/T debt | $28,383 | $43,711 | ($15,328) | -35% |

| Current portion of L/T debt | 981,181 | 1,647,918 | (666,737) | -40% |

| L/T bank loans | 801,733 | 720,039 | 81,694 | 11% |

| Other L/T debt | 1,400,396 | 1,040,455 | 359,941 | 35% |

| TOTAL | 3,211,693 | 3,452,123 | (240,430) | -7% |

Source: Data from Q3 2019 Balance Sheet; table created by author

Two things to note: (1) the company still has a healthy current ratio (~1.5) and (2) Xinyuan already has a large portfolio of real estate under development that should help the company preserve cash in 2020.

The real takeaway, Xinyuan's balance sheet is stretched and that is putting it nicely. The lower current debt balance helps but, in my opinion, it is not enough.

To me, the biggest takeaway from the Q3 2019 results and commentary was the fact that management finally seems to be seeing (and sharing) reality. Meaning that during the conference call, management talked down the company's near-term prospects and let the investor base know that everything is not perfect. A few examples from the conference call:

Brian Chen, CFO in response to a question about the company's cash balance - For the quarter we didn't acquire a lot of land. To some extent is our cash management, but next year with also have some land acquisition plan in place. Also you look at our overall land bank, asset at this point, we have about 668 billion Chinese Yuan was for the land bank which is sufficient for our development and growth for the next two to three year.

Yong Zhang, CEO in response to a question about positive changes to policies in China - At this point we causes automates that somewhere middle next year. There might be some loss of the restriction but not really in recent weeks and the next quarter. We are more focused on our own operation and efficiency than betting and gambling, on the lose of these governmental policies.

This is the first time, maybe ever, that I felt like Xinyuan's management was keeping it real. Yes, management tried to turn the focus to the results of the first nine months of the year (YoY comparisons were reasonable for this period of time in 2019 when compared to 2018) but it was impossible not to see that the last three months was a tough period of time for Xinyuan.

I believe that management keeping it real is an extremely positive development because let us remember that the previous management team (for full disclosure, there has been a lot of turnover in the C-suite and in the board over the last 2 years) kept trying to sell a dream when the share price clearly showed that the headwinds were strong. Talking reality will not make everything right but, in my opinion, speaking truths to an investor base that already does not have much trust in management (and its Investor Relations department) is a step in the right direction. Now we just need to see better results.

Valuation

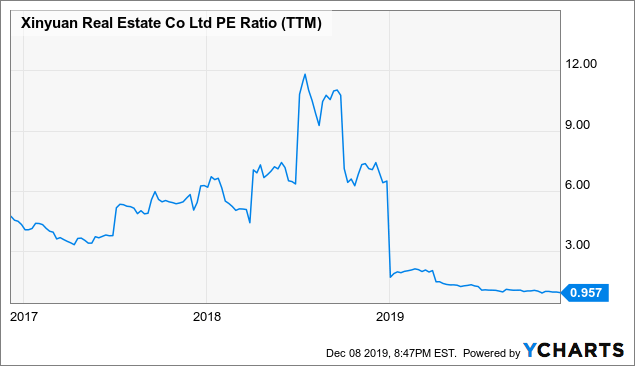

Xinyuan's stock has been trading at rock bottom prices for awhile now.

Data by YCharts

Data by YCharts

The stock is trading at attractive levels. And management continues to be a buyer, as they repurchased ~1M American Depository Share, or ADS, in Q3 2019. Management also touted the fact that they have repurchased ~13% of the total shares outstanding. It helps that the company has been a buyer, especially when shares are trading at attractive levels, but the stock likely will not move higher until the company's operating results and financial position improves.

Risks

There are risks that come along with investing in a small-cap Chinese real estate company like Xinyuan, so it would be wise for investors to first familiarize yourself with the company (and its history) before deciding to purchase shares. To learn more about the company, a good starting point would be to review Xinyuan's website.

Bottom Line

Q3 2019 was another tough quarter for Xinyuan, which had a negative impact on an already beaten down stock. Management has a lot to prove in 2020 but at least they are finally seeing and telling the real story. I believe that it will be the other bets - i.e., UK, US and other foreign properties - that will turn out to be the real catalysts for the stock but investors will likely have to play the waiting game with an investment in Xinyuan. The risk, in my opinion, is currently to the downside so investors could potentially get an opportunity to purchase shares in the mid-$3 range in the near future.

Author's Note: I hold a Xinyuan Real Estate position in the R.I.P. Portfolio, and I have no plans to reduce my stake in the near future.

Disclaimer: This article is not a recommendation to buy or sell any stock mentioned. These are only my personal opinions. Every investor must do his/her own due diligence before making any investment decision.

If you enjoyed our stock coverage, please consider joining the Going Long With W.G. marketplace service. We cover at least one new small-cap company each month and we regularly update our thoughts on past recommendations. Additionally, subscribers have access to a Live Chat feature that allows for one-on-one and/or group conversations. *Start your free trial today*