In the last two years, I have repeatedly advised income-oriented investors to purchase Omega Healthcare Investors (NYSE:OHI) for its exceptional dividend yield. I first recommended purchasing the stock when its yield was 8.1%. As the stock has rallied approximately 30% since my recommendation, it is now offering a 6.4% dividend yield. Nevertheless, the rally of the stock should not deter investors from locking in this exceptional yield, which is particularly attractive given the low prevailing interest rates. While such abnormally high yields usually signal the risk of an imminent dividend cut, the dividend of Omega can be considered safe for the foreseeable future.

Business overview

Omega boasts of having grown its adjusted funds from operations at a 21% average annual rate since 2005. However, this growth rate is misleading, as the greatest portion of growth materialized in the first years thanks to the low initial base. In addition, Omega has failed to grow its funds from operations per share in the last three years, primarily due to the bankruptcy of some of its tenants, particularly Orianna, which used to generate 5% of the total revenue of Omega.

However, it is critical for investors to realize that most of the damage has already been done. The future is much brighter for Omega, which is poised to return to growth mode from next year thanks to the transition of its vacant properties to new tenants. Analysts expect Omega to grow its funds from operations per share at a 4.9% average annual rate over the next three years, from $3.03 in 2019 to an all-time high of $3.50 in 2022.

Moreover, Omega will benefit from some favorable secular trends in its business in the long run. For more than a decade, the skilled nursing facility business was adversely affected by the aging of the “baby bust” generation. However, the “baby boom” generation began turning 75 years old in 2016. As Medicare utilization more than doubles between the 65-75 age group and the 75-85 age group, the aging of the baby boomers bodes well for the future prospects of Omega. Notably Omega believes that its business is in the early phases of a 20+ year secular tailwind thanks to the aging of baby boomers.

Dividend

As mentioned above, Omega is offering a markedly attractive 6.4% dividend yield. The REIT is also characterized by an exceptional dividend growth record. It has raised its dividend for 17 consecutive years. Moreover, it raised its dividend for 22 consecutive quarters, until early 2018. It then froze its dividend for six consecutive quarters due to the aforementioned headwinds in its business and resumed raising its dividend in the fourth quarter of 2019. The latest dividend hike is a strong signal that the dividend is safe, as managements do not raise the dividend unless they have strong conviction for its safety.

Due to the stagnant funds from operations per share in the last three years, the adjusted payout ratio has climbed to 88%. This is a high payout ratio but not extreme in the REIT universe. Moreover, as Omega is expected to grow its funds from operations per share by 16% over the next three years, the payout ratio will greatly improve, to 77% in 2022 if the dividend remains flat.

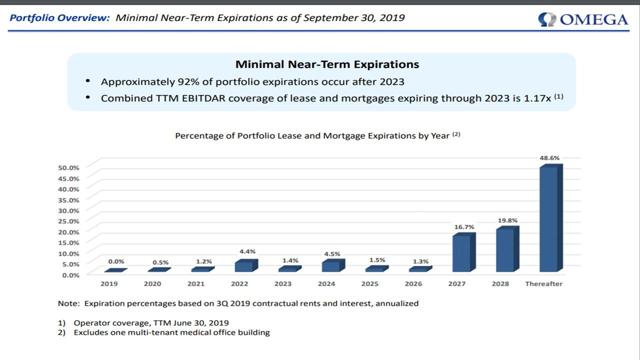

It is also worth noting that Omega has no material lease expirations and no material lease renewal risk, as 92% of its lease expirations occur after 2023 and only 15% of its leases expire over the next seven years. This lease profile renders the cash flows of the REIT reliable for the next seven years.

Source: Investor Presentation

Income-oriented investors should also note the resilience of Omega during recessions. Most dividend cuts occur during recessions, which put most companies under great stress. However, this is not the case for Omega, as the healthcare sector is much less cyclical and more resilient to recessions than most other sectors. In the Great Recession, when most companies saw their earnings collapse, Omega saw its funds from operations per share fall only 3% and thus continued raising its dividend. In other words, the investors who remained focused on the results of Omega and ignored the emotionally driven sell-off of its stock did not feel the impact of the Great Recession. Whenever the next recession shows up, Omega is likely to prove resilient once again thanks to the defensive nature of the healthcare sector.

Debt

Omega has a leverage ratio (debt to adjusted EBITDA) of 5.07, which is somewhat high both from an absolute and an historical point of view. However, the REIT has net debt (as per Buffett, net debt = total liabilities – cash – receivables) of $4.5 billion, which is not negligible but is less than 7 times the annual free cash flows of the REIT. Therefore, the debt of Omega is certainly manageable. This is also reflected in the investment-grade credit rating (BBB-) of the REIT. It is also remarkable that the REIT does not have any debt maturities until 2023. Overall, Omega carries a significant amount of debt, but this debt is manageable and unlikely to force the REIT to cut its dividend for the foreseeable future.

Final thoughts

Omega has failed to grow its funds from operations per share in the last three years due to the bankruptcy of some of its tenants. However, most of the damage has already been done and the REIT is poised to return to growth mode from this year. As a result, the payout ratio is likely to significantly improve from its current level of 88% and hence the margin of safety of the dividend will widen in the upcoming years. Therefore, in the current environment of low interest rates, income-oriented investors should lock in the current 6.4% dividend yield of Omega before they see the stock rally further.