Selling Volatility More Profitable Post Financial Crisis

The purpose of this article is to reiterate that selling volatility remains profitable post financial crisis (but should not be implemented through the Iron Condor strategy).

In a recent paper titled Is Selling Options Still Worth the Risk? the authors question whether selling volatility is still wise post financial crisis. This article triggered some commentator to conclude that selling volatility may no longer be worthwhile. See for example the Bloomberg article The Short-Volatility Trade Is Now So Big It's Starting to Break.

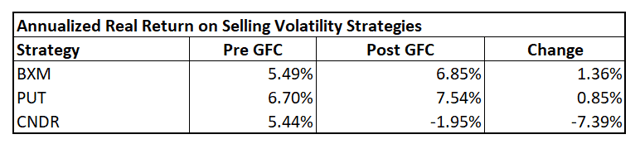

I have computed the real (i.e., inflation adjusted) return for three leading strategies selling volatility (BuyWrite BXM, PutWrite PUT and Iron Condor CNDR). The annual return for BXM and PUT has increased since the financial crisis (GFC), but CNDR has decreased.

I show my workings here (opens new window).

Readers are invited to review, comment and suggest corrections or improvements.

The increased performance of BXM and PUT should be encouraging for traders selling volatility, but the reader may be worried that in the years to come, it may be BXM and PUT that perform poorly, and CNDR may outperform. How can we determine which is likely to outperform going forward?

This article explains when CNDR is expected to outperform, and when it is best avoided. This is done by reference to skew. When the SKEW index is relatively low CNDR provides the best risk adjusted returns, but when SKEW is high CNDR is best avoided.

BuyWrite PutWrite and Iron Condor Explained

The BuyWrite and PutWrite strategies are fairly simple. In the BuyWrite strategy, the investor invests his funds in the SPX index, and writes at-the-money call options against it. In the PutWrite strategy, the investor keeps his funds in cash, and writes at-the-money puts (on the SPX) against the cash as collateral.