Adesto Technologies Corporation (IOTS) signed a merger agreement with Dialog Semiconductors (DLGNF). In my view, both companies will generate much more sales together than separately. The merger would also include cost synergies and will be EPS accretive. Besides, the conditions, the termination fees and Adesto's Board of Directors make me believe that the closure of the merger is likely. I may not buy shares of IOTS at the current share price, but will follow the company closely.

The Target: Adesto

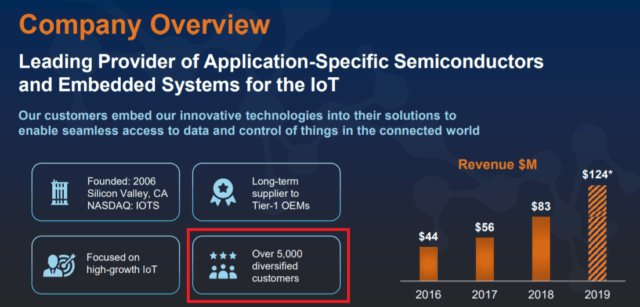

Adesto Technologies Corporation offers semiconductors and embedded systems that are essential building blocks of Internet of Things edge devices. It was founded in 2006, and is headquartered in Santa Clara, California.

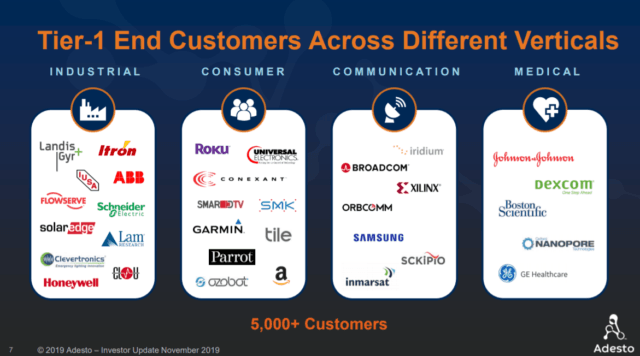

There are two features that make this company a hidden gem. They include revenue growth and the large number of customers from different industries. In my view, the company is a perfect target for corporation willing to diversity its revenue sources:

Source: IR Presentation

Source: IR Presentation

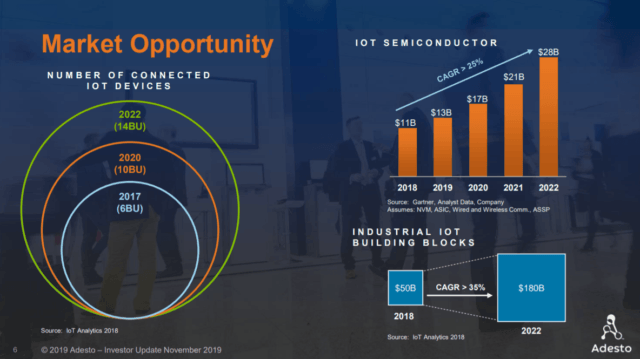

Besides, from 2018 to 2022, the company's market opportunity is expected to increase at a CAGR of 25%. Again, Adesto is, due to this reason, an interesting target for large corporations willing to profit from the growing IoT market:

Source: IR Presentation

Balance Sheet And Expected 2020 Sales

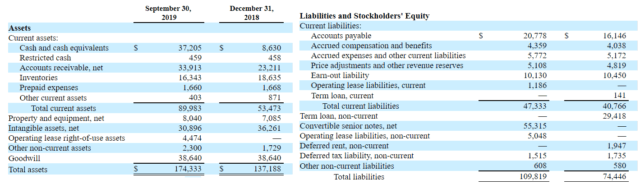

Adesto's balance sheet is very stable. As of September 30, 2019, cash in hand was equal to $37 million, accounts receivable was $33 million, and goodwill was equal to $38 million. In my view, both the goodwill and the accounts receivable are interesting for the buyer as they mean potential FCF. On the liability side, the company reports $20 million in accounts payable, and $55 million in convertible debt, which don't seem large amounts. Taking into account Adesto's cash in hand and accounts receivables, the amount of liabilities don't seem that large:

Source: Quarterly