Is now the time to buy?

- For the last year or so we have attempted to invest conservatively, focusing on U.S. Treasury and Agency securities, as well as very high credit quality securities in corporate bonds and asset-backed securities. We tried to stay on the sidelines of risk as much as possible.

- But that’s changing for us.

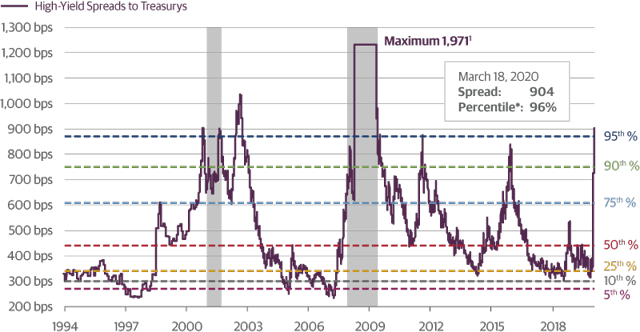

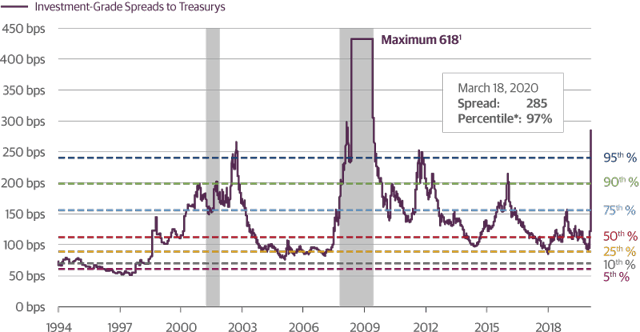

- Measured by the interest rate spread between corporate debt and U.S. Treasurys, investment-grade and high-yield bonds have traded cheaper than where they are right now less than 10 percent of the time.

- Clearly we are in the value zone, therefore we are starting to selectively look at picking up some value securities. But as I have said before, valuation is a poor timing tool. Markets often overshoot, and just because things are cheap doesn’t mean they can’t get cheaper.

High-Yield Corporate Bond Spreads Widen

Source: Guggenheim Investments, Bloomberg. Data as of 3.18.2020. *Percentiles calculated since inception (Jan. 1994). Shaded areas represent periods of recession. 1. Values between June 2008 and July 2009 are averaged.

Investment-Grade Corporate Bond Spreads Widen

Source: Guggenheim Investments, Bloomberg. Data as of 3.18.2020. *Percentiles calculated since inception (June 1989). Shaded areas represent periods of recession. 1. Values between June 2008 and July 2009 are averaged.

What is a value security these days?

- Right now, I think it’s more in the bond market than in stocks. We probably have another 10 to 20 percent of downside from here on stocks. The economic data are just starting to show the effects of this virus-driven shutdown—look at skyrocketing initial jobless claims—and the earnings data are going to look really bad for most industries.

- Because of the forced liquidations we’re getting now out of mutual funds and hedge funds, I am starting to be more positive on bonds. One of the things I like to see is capitulation. Capitulation means just “find me a bid at any price.” We are starting to get that sense of panic in selected parts of the fixed-income market. I haven’t seen that level of panic in stocks.

- The places in the fixed-income market where we are finding real value, where you are being paid more for the risk than the actual risk you’re taking on, is in sectors that are seeing forced liquidation coming out of mutual funds and hedge funds. Sectors like municipal bonds and selected asset-backed securities.

Is there more downside in equities?

- Absolutely. Let’s assume this isn’t as bad as the financial crisis—and that’s a big assumption—when the drawdown in the S&P 500 from peak to trough was 57 percent. The drawdown in the 2001-2002 recession was 49 percent and back in 1974 it was 48 percent. Right now, we’re only down a little over 30 percent.

- We don’t even have to get to financial crisis levels for stocks to fall another 10 to 20 percent, but there’s good reason to believe that this is potentially worse than the financial crisis.

How should bailouts or aid to individual companies be structured?

- The bailing out of the financial services industry and other companies like General Motors in the wake of the financial crisis was political poison for a lot of people in Washington. However, it is probably an essential evil in order to maintain our economic system as it exists today.

- I would take a different approach. Let’s say a company like Boeing needs $10 billion worth of guarantees for their debt. If Boeing went to a bank and said, “I want a guarantee for my debt,” it would be charged an annual fee of maybe 50 basis points or one percent. And I think that’s what we should be doing.

- I think that the U.S. Treasury should also be very careful to craft the program so it does not reward the people who were paid to take on the risk, and then expected the taxpayer to bail them out. And that’s why I think we should be saying to a large company, “Yes, the U.S. taxpayers will help you, but you will have to give them 20 or 30 percent of your company in exchange for that.”

- I would prefer to do it in a low risk fashion with warrants rather than writing checks into the equity part of the capital structure. Meaning, they’re essentially options, so if the stock goes up the taxpayer makes money. Because if we can get senior debt, or claims on senior debt, the downside in a worst-case scenario is not as bad as having the equity wiped out.

- This is one way to justify that what we’re doing is in the best interest of taxpayers.

- And I’ll say it again: TARP was a money-making exercise for the U.S. Treasury, and the U.S. Treasury should look at this as an opportunity the same way Warren Buffett or Steve Schwarzman would. In other words, let’s find a way to make money for the taxpayers.

Does the best stimulus package involve sending direct checks to families?

- I think it’s better than a payroll tax cut, because if you don’t have a job there is no tax to cut.

- But the money should be directed to the people who need it.

- It would be more powerful to increase unemployment benefits and extend them for people that are unemployed. For people who are employed, to be getting an extra check in the mail every month seems to be an inefficient mechanism for allocating taxpayer money.

- This brings me to my biggest complaint about how the financial crisis was handled: It didn’t address the issues of the average person or business on Main Street. We need to make sure this time that our policy solutions address the issues of people who need help and not reward bad actors, and not create a program that worsens income and wealth inequality, which is ultimately politically destabilizing.

Important Notices and Disclosures

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the author, but not necessarily those of Guggenheim Partners, LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Investing involves risk, including the possible loss of principal. Investments in fixed-income instruments are subject to the possibility that interest rates could rise, causing their values to decline. High yield and unrated debt securities are at a greater risk of default than investment grade bonds and may be less liquid, which may increase volatility.

Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Partners Europe Limited, GS GAMMA Advisors, LLC, and Guggenheim Partners India Management.

©2020, Guggenheim Partners, LLC. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC.