This is THE QUESTION these days. Was that it?

That was the stock market correction?

Have we already set the new lows as the stock markets march on with a new bull market? Wow, that was quick. Quick down, quick up?

Yes, it was the most violent correction in stock market history.

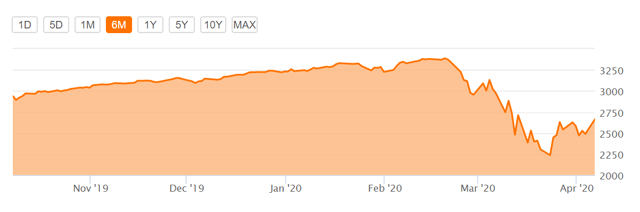

The above is a chart showing the decline of Canadian stocks. It's a very similar chart for US stocks (IVV) (VTI) and stock markets around the Globe.

The above is a chart showing the decline of Canadian stocks. It's a very similar chart for US stocks (IVV) (VTI) and stock markets around the Globe.

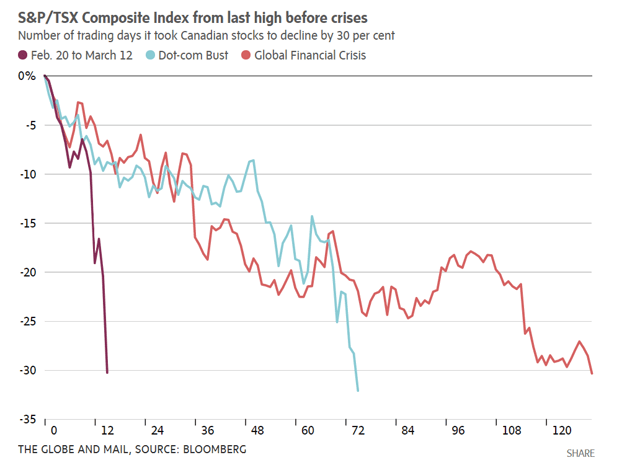

Here's a six month chart for the S&P 500, from Seeking Alpha ...

Again that correction only needed a couple of weeks. The total correction was 36% according to the Seeking Alpha chart. That was followed by a 19% 'recovery'.

Mr. Market Ignores COVID-19 and the Recession?

That's a lot of pending bad news to blow off. Of course the COVID-19 crisis is more than troubling. It is and it will take a tragic toll on human life and suffering. It will affect so many families by the time this is all said and done.

This is how many politicians and healthcare workers frame the battle. We have a common enemy. Every country in the world is fighting against that common enemy.

I knew this threat early. I was one of the first to suggest why and how investors might prepare their portfolio for the coronavirus outbreak. I penned this on February 1; weeks before the markets began the correction. It is a small group that took this seriously, early in the outbreak.

How to prepare your portfolio for the coronavirus outbreak.

In that article you'll see the suggestion of some assets that have performed quite well.

We'll get back to the COVID-19 effects and when it might peak (in cases and deaths) and when we