Over the last two months, we have seen one of the most interesting markets on record as we continue to see daily swings of -5%/+5% on a regular basis. Prior to all this craziness, we had avoided the preferred space because many of the shares in John and Jane's accounts were fully valued above the coupon redemption price.

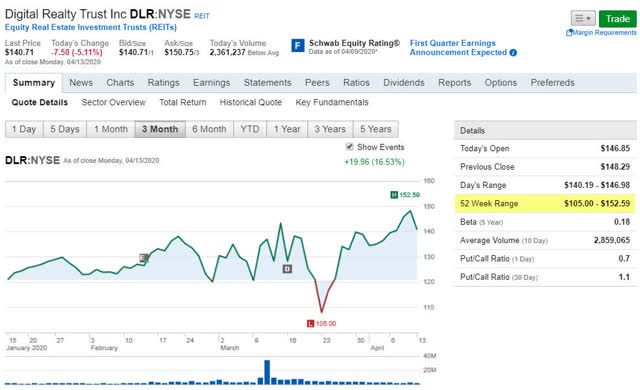

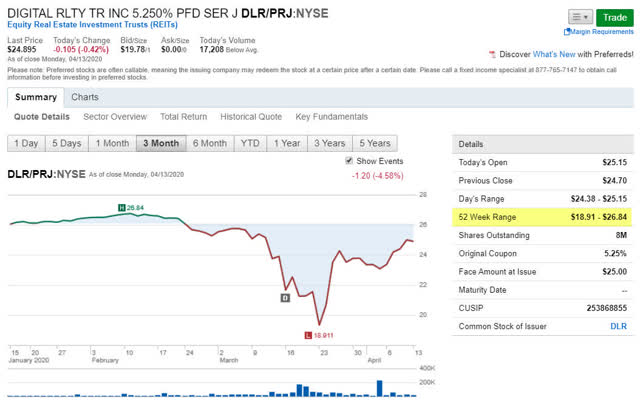

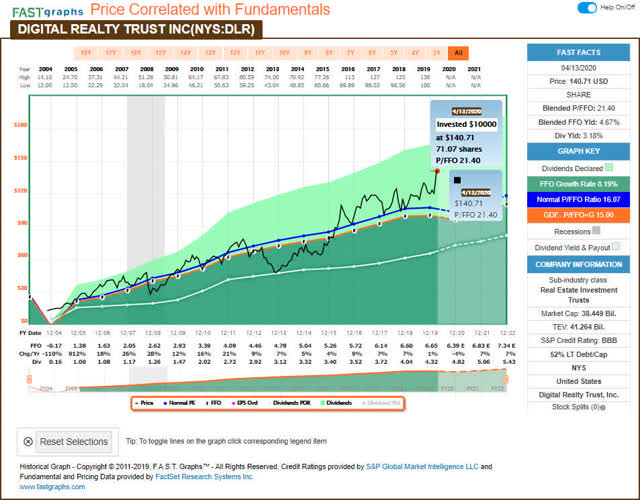

I personally find it interesting that many preferred issuances were clobbered just as hard (if not harder) than the stocks, shares themselves. In fact, preferred issuances such as those provided by Digital Realty (DLR) reacted oddly even as the common stock reached new highs. The preferred issuance that John owns in his retirement portfolio is (DLR.PJ). Although the drop in this preferred issuance his bottom on the 23rd, it has not recovered to previous levels even though the common shares rallied to a 52-week high of $152.59/share.

What I find most interesting with preferred shares, in general, is that you would think their popularity would grow as the prime rate gets flashed in CDs which were yielding upwards of 2% are now offering half of that (or less depending on the term). Overall, preferred shares look like a great space to park additional money if you can get in that the right price.

Almost all preferreds were added to the account in April. Preferred shares added in Jane's account include:

LXP.PC and EPR.PE are both interesting plays because these are the perpetual preferreds and they have no stated call date on either of these issuances. EPR.PE was previously "broken" as a result of investors having the option to convert shares into common stock at an exchange rate of .4721 shares of EPR for every 1.00 EPR.PE share owned. When EPR's stock price was at a 52-week-high of $80.75/share this caused shares of EPR.PE to trade above $39/share. This meant investors could hypothetically purchase two shares of EPR.PE for $78 and have them converted into .9442 of the common share which was worth $76.24/share at the 52-week-high. Today, the exchange rate is broken because it would be unfathomable that an investor would exchange two preferred shares (costing nearly $50 to purchase) for .9442 of the common share which would be worth approximately $21.09/share.

Client Background

I want to emphasize that this is an actual portfolio with actual shares being traded. This article focuses on Jane, who is now approximately one year away from retirement and has requested my help in managing her own portfolio instead of paying a financial advisor. It is important to understand that I am not a financial advisor and merely provide guidance for her account based on a friendship that goes back several years. In this article, I will refer to Jane as "my client" and I do this for simplicity's sake, but I do not charge her for what I do. The only thing Jane offers in return is allowing me to write anonymously about her financial journey with the hope that I can potentially help others who are wanting to achieve the same thing.

Jane is still working and has aspirations of retiring in the next year which is part of the reason why I write this series separately from her husband John (who is currently retired). Because Jane is not currently retired, I have focused her portfolio on slightly more aggressive investments than her husband and plan to transition to a slightly more conservative mix over the next year. From a day-to-day finance perspective, readers should be aware that Jane and her husband currently have no debt or mandatory monthly obligations other than what is expected (such as property taxes, water, etc.)

Jane and her husband have adopted my philosophy of focusing on cash flow from investments instead of drawing out large sums of money by selling shares of currently held investments. To briefly summarize this, Jane and her husband are on board with the idea of building a portfolio of stocks that will provide a steady stream of growing dividend income that will supplement their income during retirement.

Because of Jane's age, we are not overly concerned with the impact of required minimum distributions (RMD) from her Traditional IRA. RMDs are important for retirees to pay attention to since the penalties for not withdrawing the mandatory amount is 50% tax on the difference between the RMD and what was actually withdrawn.

The goal for Jane's retirement accounts is that she will be able to rely on dividends for the majority of her near-term Traditional IRA distributions and all of her Roth IRA distributions. By doing this, we are making sure that Jane won't need to sell shares from her Traditional IRA until it is absolutely necessary to meet the RMD (and will only need to sell from her Roth IRA if she should choose to want to do this). Living on dividends vs. selling shares is the key difference between living on the cash flow generated by her investments and needing to sell shares as a means of "funding her retirement."

Here are some important characteristics to keep in mind about the Retirement Portfolio:

- Capital appreciation is the least important characteristic of this portfolio. This doesn't mean we don't care about it (because all investors do to some degree), but it does mean that we are less concerned about the day-to-day fluctuations of stock prices. Since the goal is to never sell (although I make occasional changes by eliminating or adding positions), a focus on capital appreciation doesn't mean a lot when it comes to the game plan.

- I am not concerned with owning stocks that have a qualified/non-qualified dividend because both of these accounts are tax-sheltered (Traditional IRA and Roth IRA).

- I do trade stocks in the retirement portfolio on a more regular basis because the gains are sheltered from taxes. The number of trades that take place on any given month depends on market volatility and whether or not a stock has reached the price target that I have set for it. I adjust these targets regularly and will be incorporating more information as to how I set these price targets over the next few months.

For those who are looking to understand John and Jane's portfolio I have included the link for the March Taxable account below:

The Retirees' Dividend Portfolio: John And Jane's March Taxable Account Update

Dividend And Distribution Increases

The following companies from the Traditional IRA and Roth IRA paid an increased dividend during the month of March. This includes:

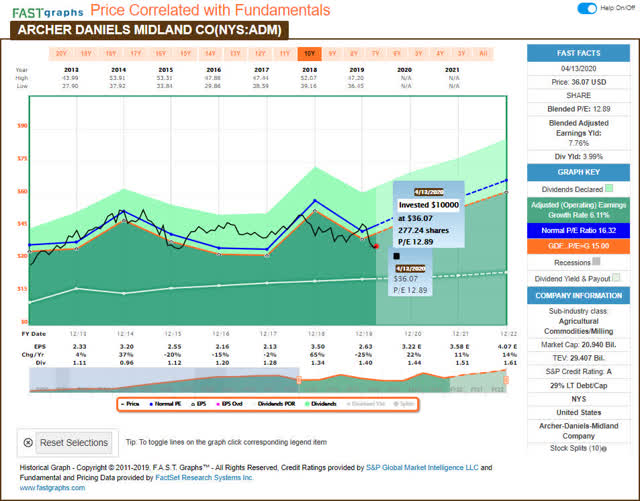

- Archer-Daniels-Midland (ADM)

- BP (BP)

- Digital Realty (DLR)

- Enbridge (ENB)

- Eaton (ETN)

- Gilead Sciences (GILD)

- The Williams Companies (WMB)

We already covered BP in March Taxable Account Update but will include a summary of the dividend increase.

Archer-Daniels-Midland - One of the sayings I consistently hear from investors during this period of panic is "people gotta eat". Honestly, I couldn't agree more with the sentiment because it only takes one trip to the grocery store to know that people were not messing around when it came to stocking up on food. We have continued to add small tranches of ADM to both the Taxable and Retirement portfolios because the stock looks reasonably valued and is trading at a P/E ratio that hasn't been available since 2012.

The dividend was increased from $.35/share per quarter to $.36/share per quarter. This represents an increase of 2.9% and a new full-year payout of $1.44/share compared with the previous $1.40/share. This results in a current yield of 3.99% based on a share price of $36.07.

The dividend was increased from $.35/share per quarter to $.36/share per quarter. This represents an increase of 2.9% and a new full-year payout of $1.44/share compared with the previous $1.40/share. This results in a current yield of 3.99% based on a share price of $36.07.

British Petroleum - The dividend was increased from $.615/share per quarter to $.63/share per quarter. This represents an increase of 2.4% and a new full-year payout of $2.52/share compared with the previous $.2.46/share. This results in a current yield of 10.12% based on a share price of $24.91.

Digital Realty - The run-up in DLR has been absurd and what makes it even interesting is how it reached a new 52-week-high during some of the craziest times we've ever seen. At current prices, DLR is extremely overvalued which is why I have used the opportunity to sell the high-cost portions of Jane's holdings to increase the amount of cash she has on hand which has been used to purchase shares of DLR when they are much more attractive. When shares of DLR are trading at a P/FFO ratio of more than 20x I consider the stock to be overvalued but when it is trading at a P/FFO of 18x or less I consider it attractive.

The dividend was increased from $1.08/share per quarter to $1.12/share per quarter. This represents an increase of 3.7% and a new full-year payout of $4.48/share compared with the previous $4.32/share. This results in a current yield of 3.18% based on a share price of $140.71.

The dividend was increased from $1.08/share per quarter to $1.12/share per quarter. This represents an increase of 3.7% and a new full-year payout of $4.48/share compared with the previous $4.32/share. This results in a current yield of 3.18% based on a share price of $140.71.

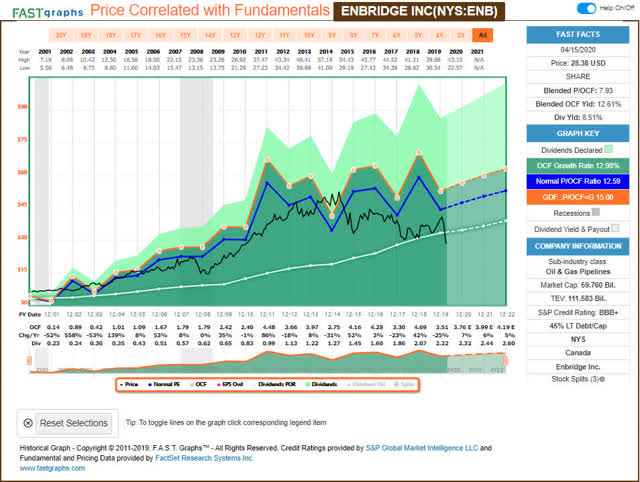

Enbridge - The oil and gas sector has been devastated by a lack of demand which was induced by coronavirus-related mandates to stay at home. Although ENB is more immune to these effects because it operates an energy infrastructure company there are still risks associated with bankruptcy filings for the companies sending their products through its pipelines. ENB is a behemoth that I expect will ride out the storm and it can do this while providing an annual dividend payment of $3.24/share (Canadian) which works out to be roughly $2.27/share USD.

The dividend was increased from $.738/share (All figures in Canadian unless noted) per quarter to $.81/share per quarter. This represents an increase of 9.8% and a new full-year payout of $3.24/share compared with the previous $2.952/share. This results in a current yield of 8.00% based on a share price of $28.38 USD.

The dividend was increased from $.738/share (All figures in Canadian unless noted) per quarter to $.81/share per quarter. This represents an increase of 9.8% and a new full-year payout of $3.24/share compared with the previous $2.952/share. This results in a current yield of 8.00% based on a share price of $28.38 USD.

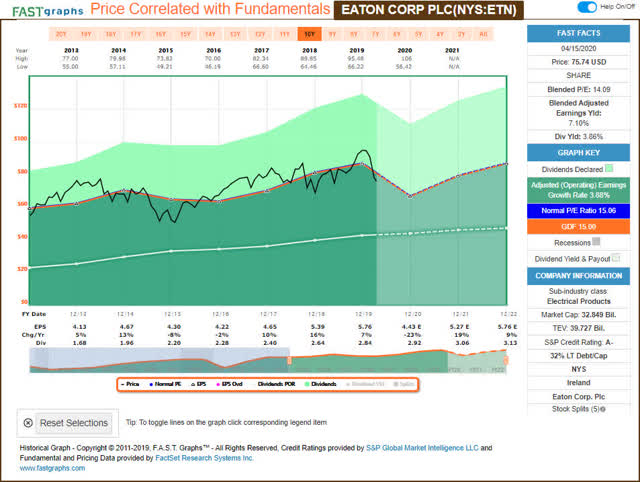

Eaton - ETN's stock has been flying high for the better part of the last six months but the stock price has continued to take a beating as JP Morgan's (JPM) analyst Ann Duignan estimates EPS of $3.24/share for 2020 which is significantly lower than original estimates of $5.79/share. I really like the changes that ETN has undergone in order to make itself more competitive as it continues to push for the production of goods with higher-margins. I believe that ETN represents a compelling value when shares can be picked up at a P/E ratio of 13x or lower.

The dividend was increased from $.71/share per quarter to $.73/share per quarter. This represents an increase of 2.8% and a new full-year payout of $2.92/share compared with the previous $2.84/share. This results in a current yield of 3.72% based on a share price of $75.74.

The dividend was increased from $.71/share per quarter to $.73/share per quarter. This represents an increase of 2.8% and a new full-year payout of $2.92/share compared with the previous $2.84/share. This results in a current yield of 3.72% based on a share price of $75.74.

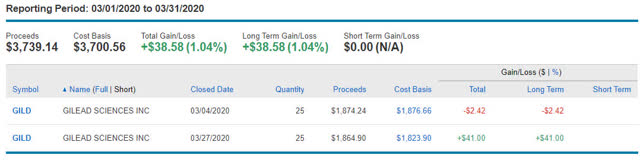

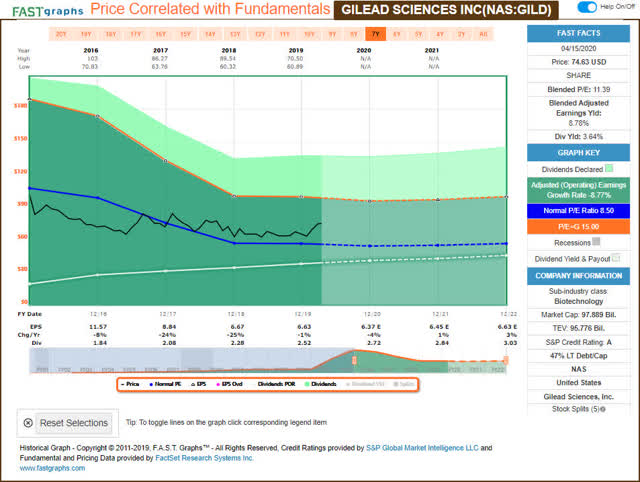

Gilead Sciences - In some ways I am sad to say that GILD is no longer a holding in the portfolio but I think there is too much hope from investors riding on the success of Remdesivir trials for COVID-19. Additionally, GILD has forward estimates that anticipate minimal to no growth over the next two years. Finally, healthcare and especially pharmaceutical companies are not my areas of expertise and so we will be looking at adding the closed-end fund (CEF) BlackRock Health Sciences Trust (BME) to Jane's portfolio at some point in the future to gain more exposure to the healthcare field. The only direct pharmaceutical stock Jane and John will continue to hold going forward is AbbVie (ABBV).

The dividend was increased from $.63/share per quarter to $.68/share per quarter. This represents an increase of 7.9% and a new full-year payout of $2.72/share compared with the previous $2.52/share. This results in a current yield of 3.61% based on a share price of $74.63.

The dividend was increased from $.63/share per quarter to $.68/share per quarter. This represents an increase of 7.9% and a new full-year payout of $2.72/share compared with the previous $2.52/share. This results in a current yield of 3.61% based on a share price of $74.63.

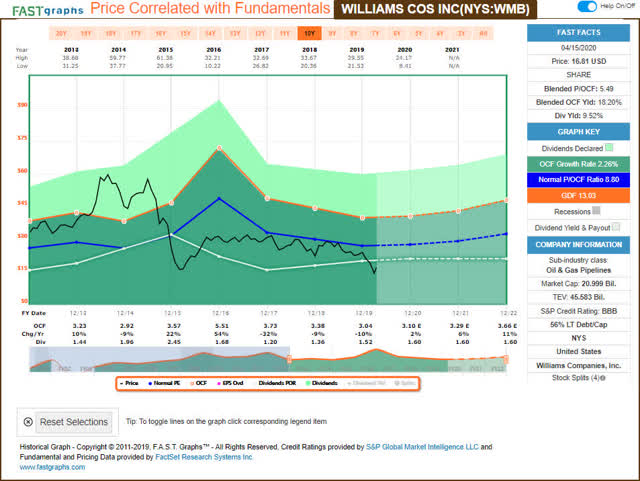

The Williams Companies - WMB hasn't been exempt from the pain of seeing its stock price be heavily impacted but the company's operations do offer protections that potential investors should be made aware of. WMB's operations focus on natural gas distribution and its current infrastructure handles 30% of the natural gas demand in the United States. The majority of its customers are utilities and power production companies that need natural gas to provide power to consumers. Although natural gas is experiencing a glut right now, it is important to consider that this cheap plentiful energy source continues to be a preference for consumers. One major concern for WMB has to do with the take-or-pay contracts it has with Chesapeake Energy (CHK) and whether or not it will survive the current round of low commodity prices.

The dividend was increased from $.38/share per quarter to $.40/share per quarter. This represents an increase of 5.3% and a new full-year payout of $1.60/share compared with the previous $1.52/share. This results in a current yield of 9.36% based on a share price of $16.81.

The dividend was increased from $.38/share per quarter to $.40/share per quarter. This represents an increase of 5.3% and a new full-year payout of $1.60/share compared with the previous $1.52/share. This results in a current yield of 9.36% based on a share price of $16.81.

Retirement Account Positions

There are currently 21 different positions in Jane's Roth IRA and 31 different positions in Jane's Traditional IRA. While this may seem like a lot, it is important to remember that some of these stocks cross over in both accounts and are also held in the Taxable portfolio.

Traditional IRA - The following stocks were added to the Traditional IRA during the month of March.

- Cummins (CMI) - 10 Shares @ $157.28/share.

- EastWest Bancorp (EWBC) - 25 Shares @ $39.42/share.

- Laurentian Bank of Canada (OTCPK:LRCDF) - 25 Shares @ $28.96/share.

- Royal Bank of Canada (RY) - 10 Shares @ $69.01/share.

- Main Street Capital (MAIN) - 50 Shares @ $26.26/share.

- RY - 5 Shares @ $58/share.

- Honeywell (HON) - 10 Shares @ $137.41/share.

- Eaton Corporation (ETN) - 20 Shares @ $80.50/share.

- Boeing (BA) - 25 Shares @ $165.52/share.

- BA - 5 Shares @ $118.78/share.

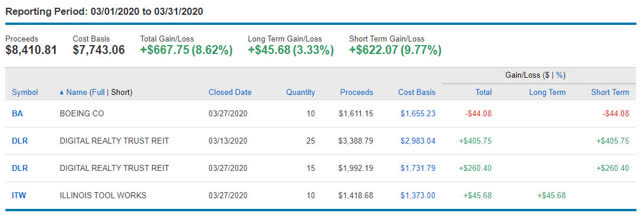

The following shares in the Traditional IRA were sold during the month of March.

- DLR - 25 Shares @ $135.55/share.

- BA - 10 Shares @ $161.12/share.

- DLR - 15 Shares @ $132.82/share.

- ITW - 10 Shares @ $141.87/share.

Source: Charles Schwab

We ultimately sold a portion of the Boeing position because I expect we can add more at a better entry point. Now that Boeing is not paying a dividend, this stock is no longer a priority in the portfolio although I expect that it will offer substantial capital returns a few years down the road. We have continued to regularly trade DLR shares through the highs and lows while maintaining the core position. Lastly, we reduced the ITW position to build additional cash reserves.

Roth IRA - The following stocks were added to the Roth IRA during the month of March.

- Bank of America (BAC) - 40 Shares @ $28.40/share.

- Vermilion Energy (VET) - 100 Shares @ $10.72/share.

- BAC - 25 Shares @ $27.23/share.

- BAC - 25 Shares @ $23.15/share.

- BAC - 25 Shares @ $22.78/share.

- Bank of Nova Scotia (BNS) - 25 Shares @ $38.62/share.

- BAC - 50 Shares @ $20.51/share.

- Broadcom (AVGO) - 10 Shares @ $195.27/share.

- Synnex (SNX) - 25 Shares @ $65.01/share.

- Store Capital (STOR) - 50 Shares @ $18.49/share.

- Main Street Capital (MAIN) - 100 Shares @ $16.86/share.

- Sysco (SYY) - 50 Shares @ $44.12/share.

- AVGO - 5 Shares @ $238.19/share.

The following shares in the Roth IRA were sold during the month of March.

- Gilead Sciences (GILD) - 25 Shares @ $74.97/share.

- GILD - 25 Shares @ $74.60/share.

My rationale for selling off the GILD position is explained in the dividend increase section but can be summarized by my lack of direct knowledge for the pharmaceutical industry and also because I see too much hype in the stock price around Remdesivir.

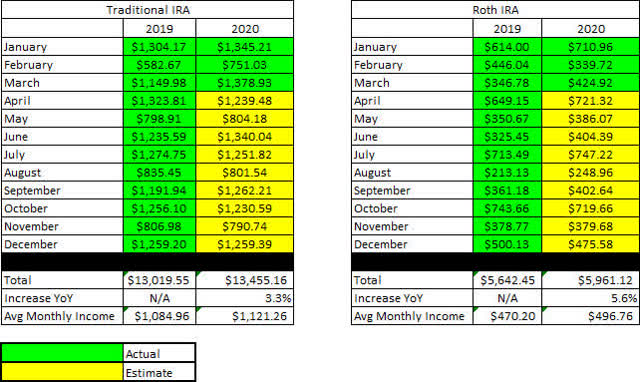

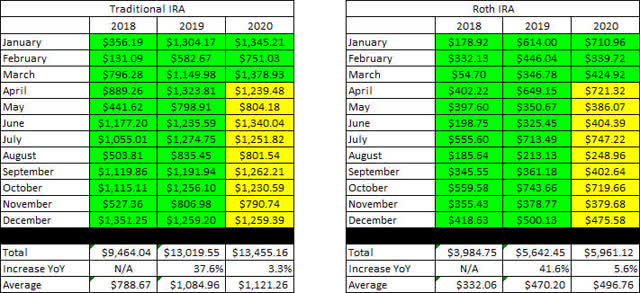

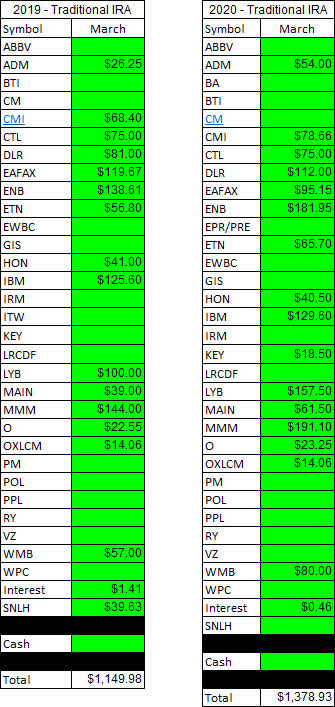

March Income Tracker - 2019 Vs. 2020

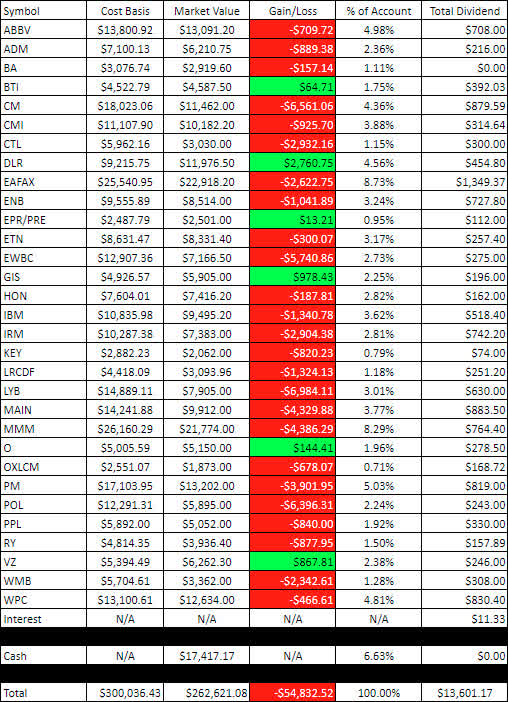

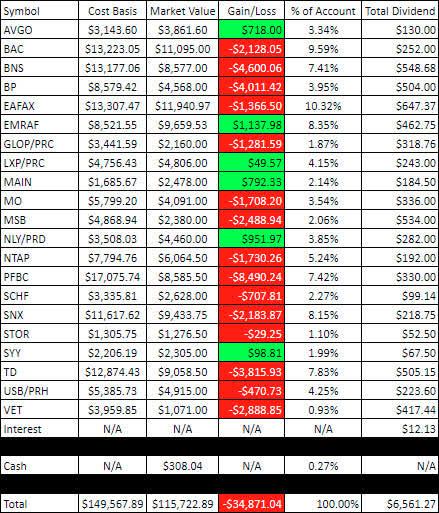

The following images are intended to provide readers with a better understanding of what Jane's Traditional and Roth IRA accounts look like. Jane's Gain/Loss numbers are based on prices from April 15th at market close.

SNLH = Stocks No Longer Held - Dividends in this row represent dividends collected on stocks that are no longer held in that portfolio. We still count the dividend income even though it is non-recurring.

On the lists provided below, it is important to know that not all stocks on that list were owned at that point in time (2019 tables represent what holdings were still held at the end of 2019). All of the stocks you see were acquired over the course of a year.

Source: Consistent Dividend Investor, LLC

Source: Consistent Dividend Investor, LLC

Source: Consistent Dividend Investor, LLC

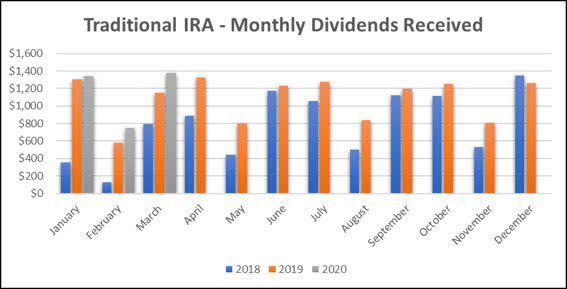

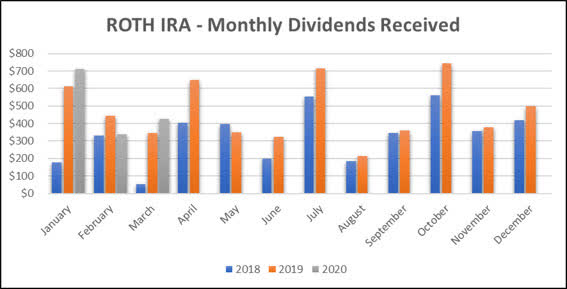

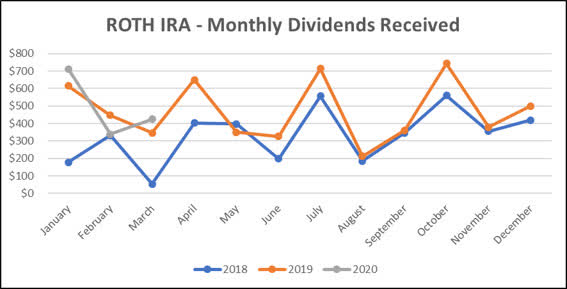

Here is a graphical illustration of the dividends received on a monthly basis for the Traditional and Roth IRAs.

Source: Consistent Dividend Investor, LLC

Source: Consistent Dividend Investor, LLC

Source: Consistent Dividend Investor, LLC

Source: Consistent Dividend Investor, LLC

Based on the current knowledge I have regarding dividend payments and share count, the following tables are a basic prediction of the income we expect the Traditional IRA and Roth IRA to generate in FY-2020 compared with the actual results from 2019.

Source: Consistent Dividend Investor, LLC

Below is an expanded table that shows the full dividend history since inception for both the Traditional IRA and Roth IRA.

Source: Consistent Dividend Investor, LLC

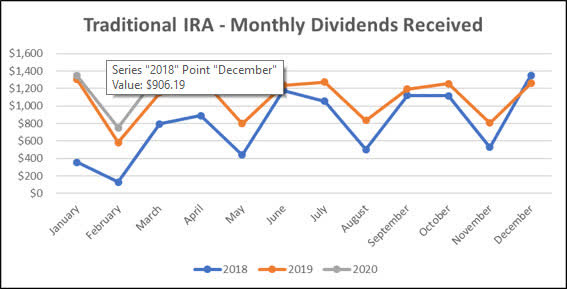

As another bonus, I have included line graphs that better represent the trends associated with Jane's monthly dividend income generated by her retirement accounts. As year three begins, we should continue to see a more stable pattern that comes from the deposit of regular dividend income. The images below represent the Traditional IRA and Roth IRA, respectively.

Source: Consistent Dividend Investor, LLC

Source: Consistent Dividend Investor, LLC

Source: Consistent Dividend Investor, LLC

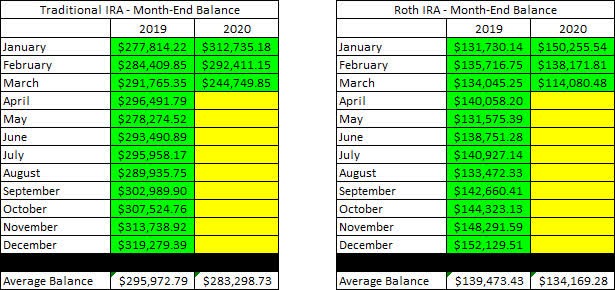

Here is a table to show how the account balances stack up year-over-year (I previously used a graph but believe the table is more informative).

Source: Consistent Dividend Investor, LLC

Lastly, on the topic of transparency, I like to show readers the actual gain/loss associated with each position in the portfolio because it is important to consider that in order to become a proper dividend investor, it is necessary to learn how to live with volatility. The market value and cost basis below is accurate as of the market close on April 15th.

Here is the Unrealized Gain/Loss associated with Jane's Traditional IRA.

Source: Consistent Dividend Investor, LLC

Here is the Unrealized Gain/Loss associated with Jane's Roth IRA.

Source: Consistent Dividend Investor, LLC

Conclusion

We are continuing to focus on preferred shares and will begin looking at a few specific bonds in the current market because these are excellent income-generating assets and many of them are currently being sold at a significant discount. Some of the preferred shares I find most interesting are:

- RPT Realty Preferred Series D (RPT.PD)

- Broadcom Preferred Series A (AVGOP)

- Lexington Realty Trust Preferred Series C (LXP.PC)

- Annaly Capital Preferred Series D (NLY.PD)

We already have the last two on the list in Jane's portfolio but we would definitely consider adding to these positions at these levels. What makes RPT so interesting is that it is prepared to ride out the store and its perpetual preferred is prices for some pretty extreme consequences.

New Article Format: Let me know what you think about the new format (what you like or dislike) by commenting, liking, following, etc. I appreciate all forms of criticism and would love to hear what I can do to make the articles more useful for you!

In Jane's Traditional and Roth IRAs, she is currently long the following mentioned in this article: AbbVie (ABBV), Archer-Daniels-Midland (ADM), Broadcom (AVGO), Boeing (BA), Bank of America (BAC), Bank of Nova Scotia (BNS), BP (BP), British American Tobacco (BTI), Canadian Imperial Bank of Commerce (CM), Cummins (CMI), CenturyLink (CTL), Digital Realty (DLR), Eaton Vance Floating-Rate Advantage Fund A (MUTF:EAFAX), Enbridge (ENB), EPR Properties Preferred Series E (EPR.PE), Eaton Corporation (NYSE:ETN), Emera Inc. (OTCPK:EMRAF), East West Bancorp (EWBC), General Mills (NYSE:GIS), Gilead Sciences (GILD), GasLog Partners Preferred C (GLOP.PC), Honeywell (HON), International Business Machines (IBM), Illinois Tool Works (ITW), Iron Mountain (IRM), KeyCorp (KEY), Laurentian Bank of Canada (OTCPK:LRCDF), Lexington Realty Preferred Series C (LXP.PC), LyondellBasell (LYB), Main Street Capital (MAIN), 3M (MMM), Mesabi Trust (NYSE:MSB), Altria (NYSE:MO), Annaly Capital Preferred Series (NLY.PD), NetApp (NTAP), Realty Income (O), Oxford Lane Capital Corp 6.75% Cum Red Pdf Shs Series 2024 (NASDAQ:OXLCM), Preferred Bank (NASDAQ:PFBC), Philip Morris (NYSE:PM), PolyOne Corp. (NYSE:POL), PPL Corporation (NYSE:PPL), Royal Bank of Canada (NYSE:RY), Schwab International Equity ETF (SCHF), Synnex Corp. (NYSE:SNX), STORE Capital (STOR), Sysco (SYY), Toronto-Dominion Bank (NYSE:TD), US Bank Preferred H-Series (USB.PH), Vermilion Energy (VET), Verizon (VZ), Williams Companies (WMB), W.P. Carey (WPC).