Prepared by Tara, Senior Analyst at BAD BEAT Investing

O'Reilly (NASDAQ:NASDAQ:ORLY) is a name that had long been a winner for us, but has recently experienced a sharp and sudden decline in the last two months following the COVID-19 crisis. Interestingly, in the last few weeks, a lot of the losses have been recovered. While some of our members at BAD BEAT Investing took advantage of this decline, we wanted to check in and discuss the just reported earnings.

At present, we are neutral on the name, despite loving the company. While the lasting impact of economic damage could persist well after the more restricted stay-at-home measures are lifted, we see the company as well positioned to rebound quickly and return to solid growth, even if the broader economy is still under pressure. This is probably why the market quickly repriced shares in the last few weeks. A significant majority of the demand in the automotive aftermarket is nondiscretionary in nature as the parts that the company supplies to customers are necessary for the operation of their vehicles. Much of this was a broader market weakness and a sector contraction.

We think that on another major pullback, you can buy. But for those that have ridden the trade higher from the lows, probably time to take some profit. For now, we are neutral, given the price action. opportunity and believe that great profits can be made here on this pullback. The company continued a solid buyback, but that is now suspended, comparable sales are under pressure, margins contracted, and given the market has repriced shares to near pre-COVID-19 levels, we think its best for new money to wait. Let us discuss the key metrics you should be aware of.

Q1 performance

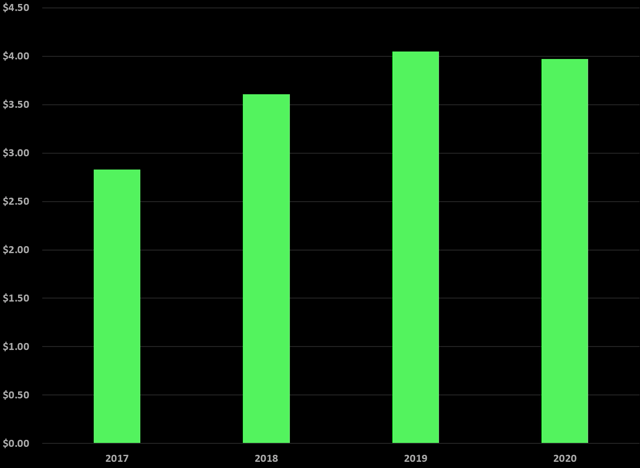

We looked at the name for a few hours before deciding it was a name we think traders should book profit in who bought the dip, and decided new money should wait. In this market, a pullback is very likely to create an opportunity. We looked to see if the O'Reilly story changed. Long-term, not it has not, but in the next quarter or two, pain will continue. In our opinion, the quarter was a bit below expectations. Let us be clear, it was not awful but the quarter was slightly below expectations in many aspects. The company has crushed sales expectations over the years and even exceeded with authority its own same-store sales expectations over the long term. This is why we wanted you in the name. But now, we need to wait. In Q1, O'Reilly registered sales of $2.48 billion, which was a 2.9% year-over-year increase, and was a slight beat versus consensus analyst estimates by $20 million. But a slight beat is unlike the past big beats we have seen. Still, sales continue to reliably grow each year:

Source: SEC filings, graphics by BAD BEAT Investing

Source: SEC filings, graphics by BAD BEAT Investing

While sales continue to grow, they would have been much better but the last few weeks of the quarter were a disaster. Since the month of April has seen stay at home orders, rest assured Q2 will face a lot of pressure. All that said, we need to, of course, have a handle on what is driving these sales. As such, we turn to comparable sales which have been improving each year since 2017. This is a critical metric, and we were bullish on comps coming into the quarter, but obviously lost faith when COVID-19 started. But even with COVID-19, we expected flat comps, which would have been bad any other quarter. O'Reilly got nailed here.

The negative impact caused by COVID-19 beginning in the middle of March and extending through the first two weeks of April resulted in a decrease in comparable store sales of 13% for the four-week March time period. The lack of beneficial harsh weather and the significant impact of COVID-19 in the last two weeks of March drove comparable store sales decline of 1.9% in the first quarter, reversing many quarters of positive comps. Rest assured, April here in Q2, has been similar. In the press release management stated "through the first two weeks of April, our comparable store sales decreased 13%." Ouch. The revenue increase thus was driven by more stores being open.

The company also continues to strategically open new shops to fuel future growth. The company had opened 200 shops in 2019 and came into the quarter operating 5,460 stores in 47 states and Mexico. Through the first quarter, ORLY opened 73 net new stores, and as such is well on its way to the 2020 target of 180 net new stores opened. But be aware that as the measures to combat the spread of COVID-19 have been implemented, including restrictions on travel and various other services, the company will see meaningful delays in the new store property openings, so this target may not be hit, or may be hit later. When things get back to normal, or close to it, comp sales should return. How about profit?

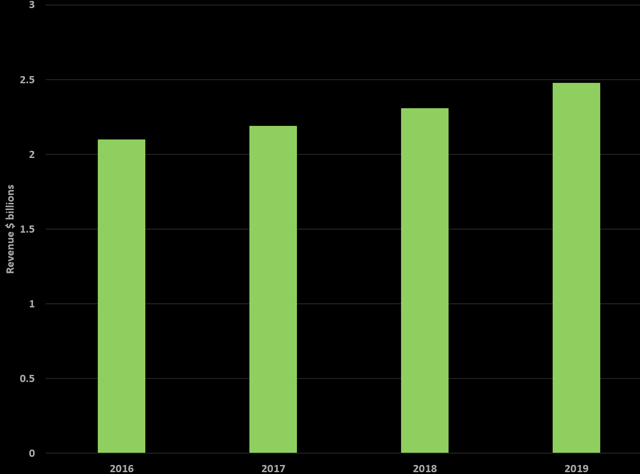

Generally margins have been solid. Gross margins were down from a year ago though. We saw gross margins remaining strong due to better merchandise margins as a result of the sales mix in the quarter. While O'Reilly's gross margins are pretty stable, it has worked hard to cut costs. Gross margins have generally improved of late, but got hit here in Q1. For the quarter, the gross margin of 52.3% was below our expectations. The company saw deleverage of fixed distribution cost and a negative mix impact from the sluggish sales of higher-margin cold weather items. Outside of mix differences, product margins continue to be as expected and the pricing environment was adequate and on par with past years. We expect a bit more pain in Q2. So with the revenue hit from lower comparable sales, and margin contraction, EPS was a bit short of expectations, and fell from last year:

Source: SEC filings, graphics by BAD BEAT Investing

We saw EPS rise to $3.97 per share, and perhaps, unnerving investors was that this missed consensus by $0.03. We expect Q2 will see pressure as well on the earnings front, and the uncertainty caused management, like so many others, to pull guidance.

Looking ahead EPS pressure expected, and buybacks on hold

O'Reilly, for many quarters, invested a good chunk of excess cash into the buyback program, which we believe is one of the best approaches to building shareholder wealth. In 2020, we expected O'Reilly will continue its buying streak. In Q1, O'Reilly invested another $574 million into new purchases at an average price of $386.71 per share. This helped drive EPS in past quarters, and helped Q1. However, the share repurchase program has been suspended until business conditions improve.

It is now extremely tough to handicap where earnings will end up in 2020. Obviously they will be far below past expectations. We thought EPS could hit as high as $20 per share. Given the uncertainty, the weak March-April period, and uncertainty on the timeline for economies reopening in the U.S., we think EPS is more likely to approximate $15-$16 on the year. However, we will know more as time moves on.

Take home

This is a quality company, but shares have recovered a lot of their losses. We think if you played the dip, you can take profits. If you are on the sidelines, this market will you another chance to buy shares lower. We believe the story is intact here, but on hold.

If you like the work, scroll to the top of the article and click the orange "Follow" button.

Join A Community Of Traders Seeking Rapid-Returns

If you enjoyed reading this column and our thought process you may wish to consider joining the community of traders at BAD BEAT Investing.

We are available all day during market hours to answer questions, and help you learn and grow. Learn how to best position yourself to catch rapid-return trades.

- We're a top performing marketplace service.

- You get access to a dedicated team, available all day during market hours.

- Rapid-return trade ideas each week

- Target entries, profit taking, and stops rooted in technical and fundamental analysis

- Start winning today