Investment Thesis

The Vanguard Total Stock Market ETF (VTI) and the SPDR S&P 500 ETF (SPY) are two of the three biggest ETFs in the industry and command the greatest percentage of passive asset inflows. For many, they are the default investment options both in their personal portfolios and 401(k)s. In this article, I want to discuss why I think the Fidelity ZERO Total Market Index Fund (MUTF:FZROX) and its 0% expense ratio could be a better choice.

Background

It's been a year and a half since Fidelity debuted the Fidelity ZERO Total Market Index Fund and launched the industry into the next phase of the fee wars. Since then, the fund has amassed $5.2 billion in assets and still exists as something of a unicorn in the investment fund space. Like VTI, FZROX is a total market fund investing in stocks of all sizes within the United States.

Although FZROX doesn't have nearly the asset base of its biggest competitors, it can make a claim that no other can - no minimum to invest, no transaction fees and a 0% expense ratio. It's completely free and now has three sister funds just like it - the Fidelity ZERO Extended Market Index Fund (FZIPX), the Fidelity ZERO International Index Fund (FZILX) and the Fidelity ZERO Large Cap Index Fund (FNILX).

VTI and SPY are two of the biggest ETFs in the industry and serve as the cornerstone in countless portfolios, including 401(k)s and other retirement plans. While a lot is often made of the expense ratio in the fund industry, it's never quite as simple as just going with the cheapest fund. There are issues of liquidity, trading costs and availability that need to get factored into the decision.

In this article, I want to break down FZROX, VTI and SPY and explain why I think FZROX could be a better choice for investors.

Benchmarks

SPY is the biggest ETF in the world and draws the most investor interest worldwide, so I want to include it in this article even though it's not an apples-to-apples comparison with the other two funds.

SPY is benchmarked to the S&P 500, the commonly quoted index that is typically used as a proxy for the U.S. large-cap stock universe.

VTI is benchmarked to the CRSP U.S. Total Market Cap Index. It includes nearly 4,000 constituents across mega-, large-, small- and micro- caps, representing nearly 100 percent of the U.S. investable equity market. The index is market-cap weighted.

FZROX is benchmarked to the Fidelity U.S. Total Investable Market Universe Index. It selects the largest 3,000 U.S. companies based on market cap and certain liquidity and investability requirements.

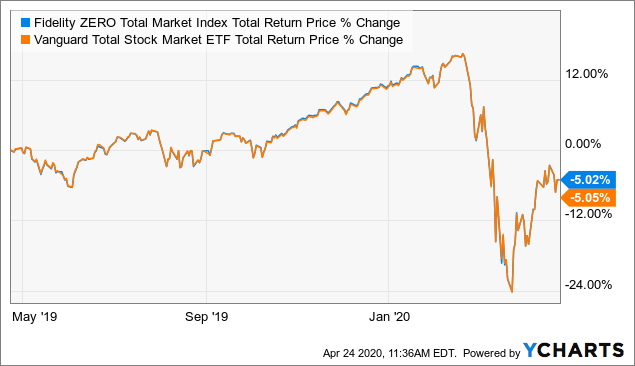

In essence, the only real difference between VTI and FZROX is that VTI casts a slightly wider net and includes more of the micro-cap universe. From a standpoint of how they perform, they're virtually identical.

Data by YCharts

Data by YCharts

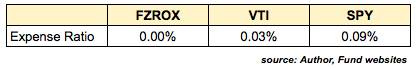

Expense Ratios

These are the headline numbers that everybody cares about.

FZROX steals the spotlight with its 0% expense ratio, but, in reality, both VTI and SPY aren't far behind. One thing to keep in mind is that SPY isn't quite like VTI and FZROX and I'm not just talking about the difference in target indices. SPY is designed to be more of a trading vehicle than a long-term buy-and-hold investment, although it certainly can and does often get used as that. FZROX and VTI are the more traditional long-term investments.

FZROX steals the spotlight with its 0% expense ratio, but, in reality, both VTI and SPY aren't far behind. One thing to keep in mind is that SPY isn't quite like VTI and FZROX and I'm not just talking about the difference in target indices. SPY is designed to be more of a trading vehicle than a long-term buy-and-hold investment, although it certainly can and does often get used as that. FZROX and VTI are the more traditional long-term investments.

SPY is frequently used by big institutions for daily trading, so liquidity and tradability are its most important factors.

Trading Costs

When it comes to liquidity, SPY simply has no comparison. It typically trades around 100 million shares daily, but traded north of 300 million during the recent bear market. Its trading spread is around 0.004%, so it costs next to nothing to trade. VTI has only a slightly higher average spread of 0.01%. Any way you slice it, these are two of the most liquid, tradable vehicles you'll find anywhere in the marketplace.

FZROX, however, being a mutual fund has a 0% spread. The tradeoff, of course, is that it only gets priced once at the end of the day, but investors buy and sell at the NAV whenever they trade.

In the case of these three funds, trading spreads are a non-issue. With smaller and less-traded ETFs, spreads can become an issue. Not to pick on this fund in particular, but the Amplify Transformational Data Sharing ETF (BLOK), otherwise known as the Blockchain ETF, created some buzz when it launched a little over two years ago. It recently traded at a spread of 0.3% and got up to nearly 1% when the bear market was at its peak. That's a significant cost if you're looking to trade in and out of a position where the number of buyers and sellers is lower and can severely impact total returns.

With VTI and SPY, though, 0.01% isn't anything to worry about.

Disconnections From NAV

We hear a lot about discounts and premiums to NAV as it relates to closed-end funds. Many people assume that these don't exist with ETFs due to the ongoing share creation/destruction mechanism that exists that keeps trading prices tied tightly to underlying NAVs.

While that's usually the case, that's not always the case. Even funds like VTI and SPY can trade at tiny differences from their NAVs from time to time.

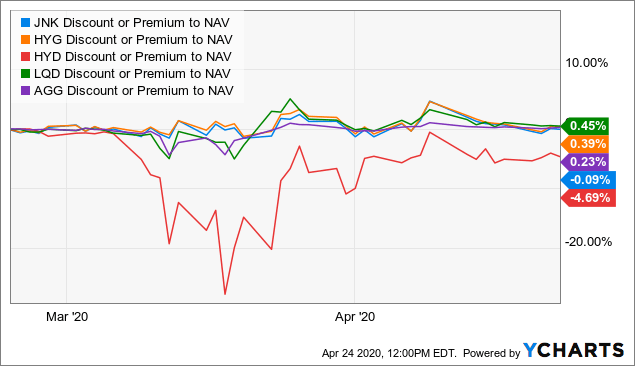

When market volatility spikes, however, is when things get wonky. We saw this recently in junk bond ETFs when prices started melting down. Take, for instance, some of the biggest junk and investment-grade bond ETFs.

Data by YCharts

Data by YCharts

Some of these funds traded as much as 5% away from their underlying NAV. And that's not a mistake you're seeing with the VanEck Vectors High-Yield Municipal Index ETF (HYD). At its lowest, it traded at a nearly 30% discount to its NAV.

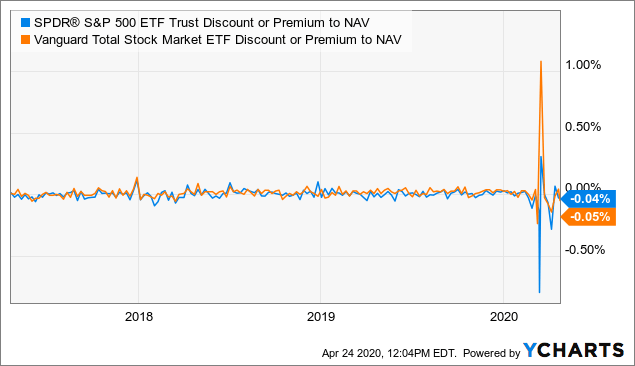

Unfortunately, even the largest ETFs aren't immune.

Data by YCharts

Data by YCharts

Both funds traded about 0.25% away from their NAV at several points in March and April, but at their worst, their discounts/premiums were at or above 1%. That can be a huge trading cost, especially when investors wanted to trade the most.

FZROX, again as a mutual fund, doesn't experience those premiums and discounts to NAV. It simply trades at the NAV once at the end of the trading day. In most cases, those disconnects inherent in ETFs are negligible (as you can see in the chart, they are fairly common although almost always minimal), but they can be problematic in volatile markets. Just like with the trading spread, smaller funds are generally more exposed to the risk of greater discounts and premiums.

FZROX Only Available Through Fidelity

Here's perhaps the biggest catch. If you want to buy FZROX in your portfolio, you're going to have to open a direct account with Fidelity. You won't be able to buy it through Vanguard or TD Ameritrade (AMTD) or anywhere else.

If you already have a Fidelity brokerage account, this is probably no big deal. But if you're like me, you want all of your financial assets in one place. I have everything at Vanguard and opening up a separate account at Fidelity is, at best, an inconvenience and, at worst, a dealbreaker.

Whether or not this is an issue for you depends on your personal preferences. I imagine for many a cost savings of a few hundredths of a basis point in the expense ratio (amounting to $3 annually on every $10,000 invested) simply isn't worth the trouble.

Conclusion

The differences in both trading spreads and expense ratios between FZROX and VTI/SPY are virtually negligible (although become more significant if you're comparing FZROX to a less frequently traded ETF). The requirement to buy FZROX shares only through Fidelity may or may not be an issue for you.

But the potential for wide discounts and premiums during times of significant volatility can be a very real issue. In normal times, any discount or premium within the pair of ETFs is mostly minor and possibly not even worth considering unless you're a real high net worth investor. But if they can spike to 1% or greater in even the largest and most liquid ETFs in times when you might want to trade the most, it's a potential problem.

Granted, the primary drawback with FZROX is the lack of intraday trading. So essentially you're weighing a lack of trading flexibility versus the potential of unexpectedly high trading costs in volatile markets.

Many prefer the trading flexibility of ETFs, but if you're a long-term investor not worried about frequent trading, there's a case to be made that FZROX is the better bet.