Introduction

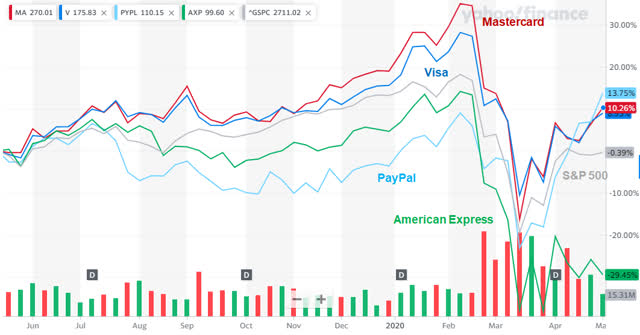

We initiated our Buy rating on Mastercard (NYSE:MA) last March, followed by a similar Buy rating on Visa (NYSE:V) in June, preferring them over American Express (AXP) in the card networks space. Since then Mastercard and Visa have returned 19.0% and 12.8% respectively (including dividends).

In this article we re-evaluate the two companies' investment cases by reviewing their recent volume performance, CY20Q1 results, near-term outlook, post-COVID earnings and valuation.

Recent Volume Performance

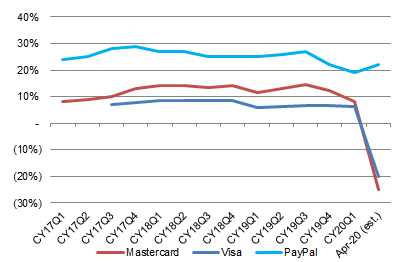

Both Mastercard and Visa showed double-digit year-on-year volume declines in late April, but these were largely attributable to verticals that were particularly impacted by COVID-19 (such as Travel and Entertainment). Excluding these, Card Not Present volumes have in fact been boosted by COVID-19 and are growing at 20%+, similar to PayPal's (PYPL) volume growth.

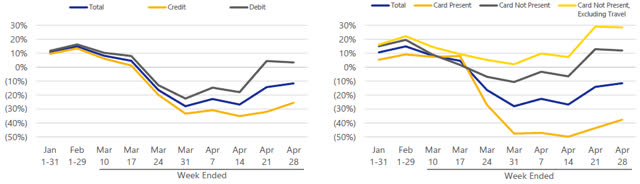

Visa's U.S. volumes were running at -10% year-on-year as of the fourth week of April, with debit card volumes actually being slightly higher than 2019 (as shown below). Given 25% of Visa's volume is from Travel, Fuel, Restaurants and Entertainment, and these were down by more than 50% in April (including Travel down 80%), this is a respectable performance. In fact, excluding Travel, Visa's U.S. Card Not Present volumes were up 30% year-on-year in late April, benefiting from the acceleration of digital payments growth under COVID-19:

| Visa Volume Growth Y/Y (Jan-Apr 2020) Source: Visa results presentation (FY20Q2). |

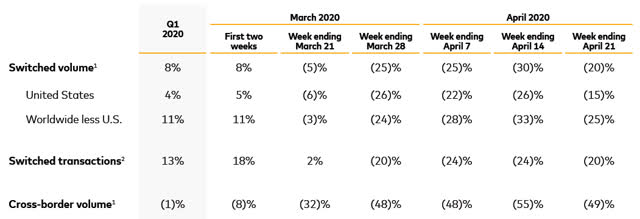

Mastercard's global volumes were running at -20% year-on-year as of the third week of April, with U.S. volumes slightly better at -15% (as shown below). Management believes the late April period represents the early part of a “stabilization” phase, including some benefit from government stimulus payments:

| Mastercard Volume Growth Y/Y (20Q1-Apr) Source: MA results presentation (20Q1). |

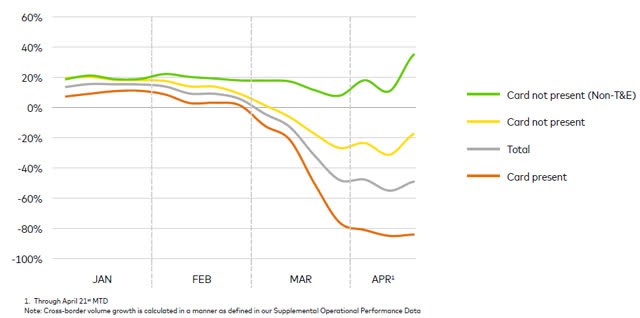

For Mastercard, even in cross-border payment volumes, once we exclude Travel & Entertainment ("T&E"), Card Not Present volume was actually up approx. 20% in April, including up nearly 40% by the last week of the month:

| Mastercard Cross-Border Volume Growth Y/Y (Jan-Apr 2020) Source: MA results presentation (20Q1). |

While Visa's and Mastercard's overall year-on-year volume growth rates in April were not as impressive as PayPal's 22%, this could be explained by the different mixes of their businesses. PayPal is historically less exposed to Card Present volumes, and it also gained disproportionately from previously-underserved SMEs and consumers moving away from cash due to COVID-19. It is also worth noting PayPal’s volume remains relatively small, at $191bn in CY20Q1, compared to Mastercard’s $1,565bn and Visa’s $2,786bn.

| Total Volume Growth Y/Y (Constant Currency) - Mastercard, Visa and PayPal

NB. Visa and Mastercard Apr-20 growth rates are partly based on management comments. Visa growth rates not meaningful in CY17H1 due to the acquisition of Visa Europe in 2016. Source: Company filings. |

CY20Q1 Results

COVID-19 had only a small impact on Visa and Mastercard during CY20Q1; operational trends, including in value-add services, remained strong.

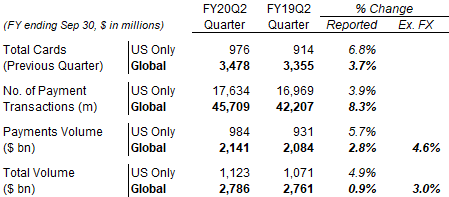

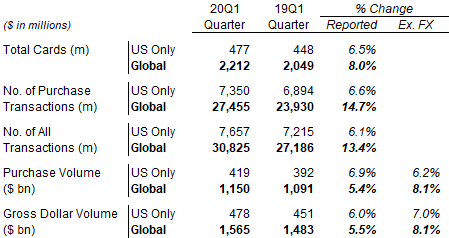

For Visa, Payments Volume grew 4.6% year-on-year (ex. currency) in the quarter (Visa's FY20Q2), decelerating from the 8.1% growth in the prior quarter (FY20Q1) as the impact of COVID-19 started to materialise in March. Excluding the loss of low-margin China volumes, Visa's Payments Volume grew 7% in FY20Q2, compared to 10% in FY20Q1 (ex. currency):

| Visa Operational Statistics (FY20Q2)

NB. FY20Q2 ends 31-Mar. Source: V results supplement (FY20Q2). |

Visa's P&L, excluding currency, showed Net Revenues grew 7% for the quarter, Operating Expenses grew 3% (with management starting to cut costs as COVID-19's impact became apparent), and EPS grew 9% (helped by the share count having been reduced 2.2% by buybacks):

| Visa Key P&L Items (FY20Q2)

NB. Figures are non-GAAP unless otherwise stated. Differences between GAAP and non-GAAP figures include litigation, charitable donation & tax matters. Source: Visa results press release (FY20Q2). |

Note that Visa's Service Revenues are based on the prior quarter’s volume, so they are still 8.5% higher year-on-year this quarter. The growth in value-add services helped both Data Processing Revenues and Other Revenues; acquisitions also helped processing revenues.

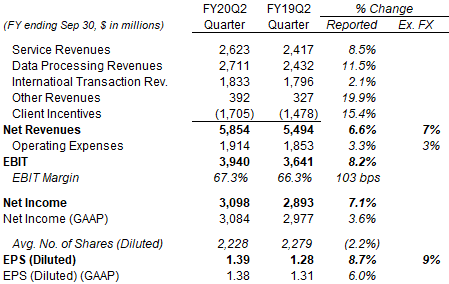

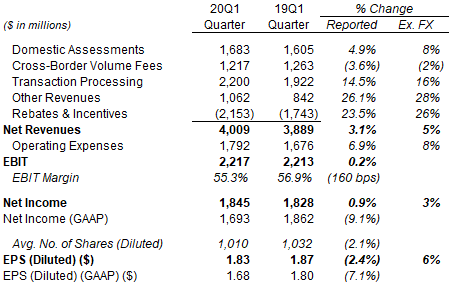

For Mastercard, Gross Dollar Volume was up 8.1% year-on-year (ex. currency) in 20Q1, decelerating from the 12.3% growth seen in 19Q4:

| Mastercard Operational Performance (20Q1)

Source: MA results press release (20Q1). |

Mastercard's P&L, excluding currency, showed Net Revenues grew 5% year-on-year, Operating Expenses grew 8%, Net Income grew 3%, and EPS grew 6% (helped by buybacks) (as shown below). The 8% growth in Operating Expenses included a net +3% impact from one-off items (including +5% from acquisitions and -3% from hedging gains/losses):

| Mastercard Key P&L Items (20Q1)

Source: MA results press release (20Q1). |

Mastercard's Domestic Assessments revenues grew 8% year-on-year, in line with its volume growth for the quarter. The 28% growth in Other Revenues included a +6% contribution from acquisitions, but was still comfortably double-digit organically, showing the strength of value-add services.

Near-Term Outlook

Both Mastercard and Visa guided to a low-single-digit organic reduction in Operating Expenses, while also committing to not making any COVID-19-related lay-offs this calendar year.

For Mastercard, this means a low-single-digit growth in Operating Expenses once acquisitions (notably the $3.18bn acquisition of Nets, still expected to close in 20Q3) and currency are included:

| Mastercard Operating Expenses Outlook (20Q2) Source: MA results presentation (20Q1). |

For Visa, this means Operating Expenses will be "flat or down in the second half" of their financial year (ending 30-Sep):

“We have plans in place to hold second-half expenses flat compared to last year and, excluding acquisitions, our expenses will be down in the low single digits year-over-year. We are evaluating additional actions to reduce expenses even further.”

Vasant Prabhu, Visa CFO (FY20Q2 Earnings Call)

Revenue headwinds from lower volumes will be somewhat offset by the continuing growth in value-add services. For example, Mastercard predicted that their service revenues will still grow year-on-year in 20Q2, albeit at a lower rate than in Q1:

“In the second quarter, we expect services growth will continue to outperform our core products. You should, however, expect the growth rates to come down sequentially in the second quarter, but remain positive overall.”

Sachin Mehra, Mastercard CFO (20Q1 Earnings Call)

We believe near-term earnings are essentially impossible to predict. COVID-19 means that there are huge uncertainties around volumes, and revenues do not follow a linear relationship with volumes - different revenue lines carry different revenue margins (for example, intra-regional Travel has lower margins than inter-regional Travel), much of services revenues are not volume-based, and rebates & incentives to card issuers do not have terms disclosed and contain some fixed components.

We also believe that investors will largely regard COVID-19 as an one-off and anchor their valuation on 2019 earnings until the recovery phase.

Post-COVID Earnings

While we expect significant volume and earnings declines in 2020, with a recession likely extending into 2021, we believe that after 2021 both volumes and earnings should be at least on par with 2019 levels.

COVID-19 has clearly accelerated the move to digital payments. This means there will be a larger base of users and applications for digital payments in 2021, in an economy that will likely be of the same size or larger than 2019.

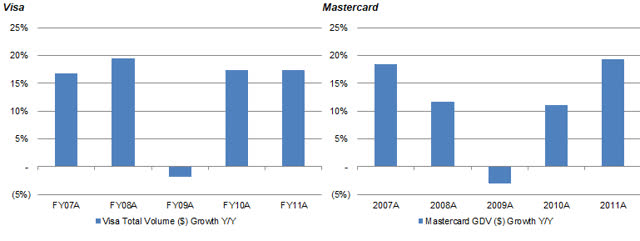

While each crisis is different, we believe the 2008-9 financial crisis provides some encouraging datapoints. While the Great Financial Crisis did not have the travel and “social distancing” restrictions that we face with COVID-19, the headwinds that these represent are somewhat offset by the tailwinds created by the accelerated move to digital payments.

During the 2008-9 crisis, Visa's volume growth fell from 20% in FY08 (ending Sep) to a negative -2% in FY09, but recovered to a positive 17% in FY10 (all growth rates based on dollar volumes). Similarly, Mastercard's volume growth fell from 18% in 2007 to -3% in 2009, but recovered to 19% by 2011:

| Visa & Mastercard Volume Growth Y/Y in the Great Financial Crisis NB. Visa FY ends 30 Sep; figures exclude Visa Europe (acquired FY16). Source: MA and Visa 10-K filings. |

We expect at least the non-T&E part of Visa and Mastercard's volumes to recover relatively quickly after the lockdown and subsequent recession, offsetting any potential weakness in T&E spend, and with overall volumes after 2021 at least back to 2019 levels.

Valuation

We value Mastercard and Visa on their CY19 earnings, given our assumption that earnings after 2021 will be at least on par with their 2019 levels.

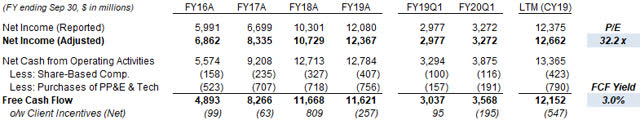

For Visa, at $182.72, share are trading on 32.2x P/E and a 3.0% Free Cash Flow ("FCF") Yield; the Dividend Yield is 0.7% ($1.20 per share). Visa has confirmed that its dividend policy remains unchanged, and it will continue to execute the $9bn buyback program it has for FY20:

| Visa Net Income, Cashflows & Valuation (FY16-CY19A) NB. Visa Europe acquired in Jun-16. Source: V company filings. |

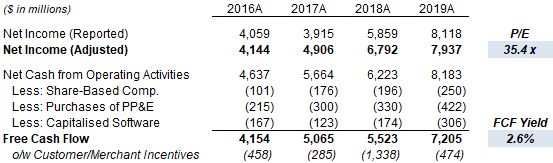

For Mastercard, at $278.47, shares are trading on 35.4x P/E and a 2.6% FCF Yield; the Dividend Yield is 0.6% ($1.60 per share). Mastercard has continued to pay dividends and, while it has suspended buybacks, will “re-evaluate” if visibility on the economy improves and will “opportunistically execute” them:

| Mastercard Net Income, Cashflows & Valuation (2016-19)

Source: MA company filings. |

Both Visa and Mastercard shares have de-rated by 10-15% in the last few months. For example, Mastercard's FCF Yield was 2.2% in our last article on the company in January; while Visa's was 2.7% in our last article in February:

| Mastercard & Visa Share Price vs. Peers & S&P 500 (Since 31-Mar-19) Source: Yahoo Finance (07-May-20). |

Prospective Investor Returns

We believe a plausible scenario for returns over the next 5 years is as follows:

- First, between now and 2021 year-end, as the economy is impacted by COVID-19 and recessions, investors will likely anchor their valuation on 2019 earnings, while valuation multiples recover to pre-COVID levels. In this period, the share prices would rise by 10-15% in total

- Then, after 2021 year-end, earnings growth becomes more in line with historic trends and pre-COVID management outlooks, i.e. high-teens annually for Mastercard and mid-teens for Visa. In this period, the share price will rise in line with EPS, i.e. at mid-to-high teens annually

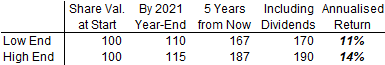

Including a Dividend Yield of 0.6% (growing with earnings in reality), investor returns in the next 5 years will be 70-90% in total, or 11-14% annualised:

| Illustrative Returns in 5 Years

NB. “Low End” = 10% gain by 2021 YE, 15% CAGR thereafter, 0.6% Dividend Yield. “High End” = 15% gain by 2021 YE, 17.5% CAGR thereafter, 0.6% Dividend Yield. Source: Librarian Capital estimates. |

Conclusion

While both Visa and Mastercard had double-digit volume declines in April, their Card Not Present volumes outside specific verticals like Travel are growing at 20%+, a respectable performance even when compared to PayPal.

COVID-19 is accelerating the move to digital payments and, while near-term volumes and earnings will suffer, after 2021 there will be a larger base of users and applications on an economy that is same or larger in size. We expect earnings after 2021 to be at least on par with 2019 levels, and that both Visa and Mastercard will resume their historic (mid-teens and high-teens respectively) EPS growth.

We believe the shares can generate a 11-14% annualised return over the next 5 years, based on some re-rating prior to 2021 year-end and strong earnings growth thereafter.

We re-iterate our Buy ratings on both Visa and Mastercard.

Note: A track record of my past recommendations can be found here.