Investment Thesis

Garrett Motion (NASDAQ:GTX) gained a lot of attention since the spin-off from Honeywell (HON). Stock is down 70+% since its IPO in 2018. Investors don't seem to like the challenges Garret is currently facing with the liability payments to Honeywell, spin-off related tax obligations, high leverage, change in revenue mix and margin pressures (diesel to gasoline turbochargers). However, Garret's revenue consistently outperformed the overall auto sector, and the turbocharger market's long-term outlook remains solid. Comps (below) show the company is trading at a premium based on 2021 EV/EBITDA basis (adding back Honeywell liabilities) and base-case multiple implies a short. However, a short is a risky move at the current price levels ($4-$5), considering Garret has moderate pricing power, high revenue visibility, sticky business model and an expected rebound in light/commercial vehicle unit production in 2021.

DCF model (below) indicates a 100+% upside, but I don't see an upside catalyst in the near term that closes this valuation gap. For extremely cautious investors who are reluctant to buy at the current levels, I'd recommend waiting on the side-lines for any new developments. Garret's close competitor Borgwarner (BWA) looks like a better alternative for investors looking to gain exposure to the growing turbocharger industry.

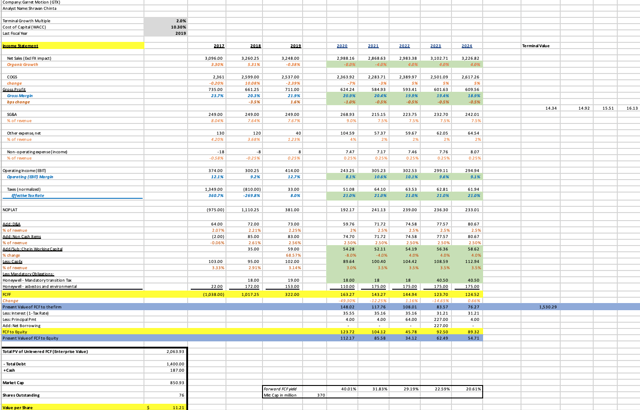

Free Cash Flow Valuation Model

(Source: Company Reports, Management Guidance and Author's Estimates)

(Source: Company Reports, Management Guidance and Author's Estimates)

Revenue Drivers Model

(Source: company reports and authors estimates)

(Source: company reports and authors estimates)

Revenue Assumptions

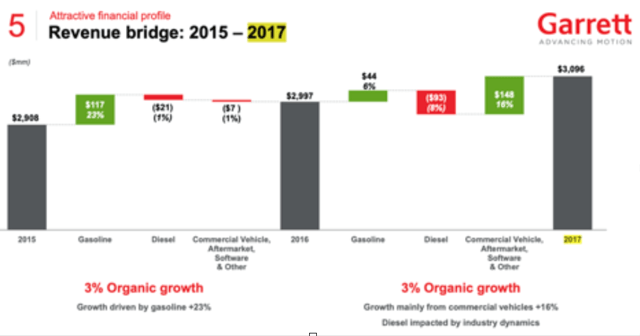

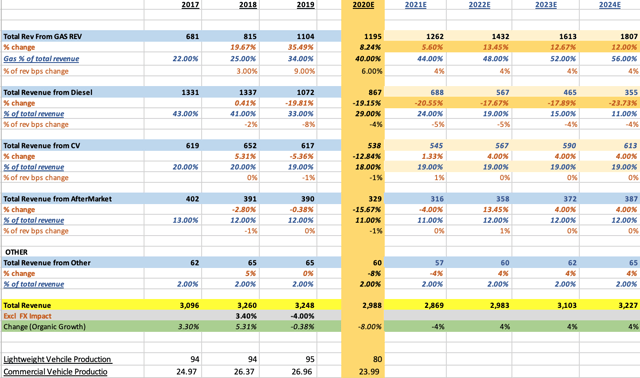

Excluding FX impact, organic revenue grew at 3% in 2016, 3% in 2017, 5.31% in 2018, -0.38% in 2019 (or flat).

(Source: Investor Presentation)

This year, management expects a 4%-1% decline in revenue but withdrew guidance in the wake of COVID uncertainty. For the DCF estimates, I've accounted for 8% decline instead (double the management's lower end guidance) and another 4% decline for 2021, assuming a "U"shaped recovery across the automotive sector, which seems likely at this point and leaves enough room for error. IHS estimates show 2-2.5% light vehicle (LV) unit growth and 5.5% CAGR commercial vehicle unit growth from 2021 to 2025, with the majority of the growth coming from China and India. Based on this, I've extrapolated 2022 to 2024 revenue using a 4% revenue growth rate which I believe is a conservative estimate for a firm that outperformed the auto sector every year.

Going forward, declines in diesel turbocharger sales offset by an increase in demand from gasoline turbos due to rise in four-cylinder gasoline engines. IHS expects gasoline turbochargers to outpace diesel by 2023 (this trend is reflected in Garret's revenue mix) but diesel turbos aren't expected to go away completely. Diesel turbocharger demand for small/medium vehicles has been fading away over the past several years but for heavy passenger vehicles like SUV and pick-up trucks, demand has been stable due to SUV's and pick truck rising share of overall passenger vehicle production. The SUV/pick-up truck sales are expected to grow to nearly 50% of the entire automotive market, by the end of 2025. In addition to that, diesel engines produce 10%-15% less Co2 than gasoline and it's relatively easier for OEM's to meet regulatory standards. Furthermore, any softness across NA and Europe segments will be counteracted with the tremendous growth from Asia Oceania regions (accounts for 61% of the global passenger car production) with China sharing half (33%) of that. More importantly, the threat of electric vehicles (EV) is low (at least over the next five years) and Garret is already preparing for EV evolution with their new products like e-turbos, fuel cells and other software tools. I think the demand for EVs will be low, at least in the short to medium term due to lack of government support, high production cost and slow consumer adoption.

Commercial vehicle (CV) segment comprises 20% of revenue and mostly equipped with diesel turbochargers. This market approximately accounts for 10% of the entire turbocharger market. CV market tends to be more cyclical than light vehicles and management's expects 7-10% revenue declines. Declines in the CV revenues will spillover to the aftermarket segment (12% of revenue) since the majority of the aftermarket vehicles that are commercial vehicles that have higher replacement rates. Based on this, I expect CV revenue to decline by 12% (in line with 08' - 09' downturn) and aftermarket sales to decline by 15% in 2020 (again, in line with 08'-09'). These estimates are conservative and are below management's low-end guidance.

For gas/diesel as a percentage of revenue, I've used the figures indicated by the management. Gasoline: "We believe it would go up in a range of between 40% to 42% for 2020. Diesel sales were 33% for the full year of 2019. We believe the 33% will drop between 28%, 29% for 2020"(source: Q4 2019 earnings call). Based on this, I've extrapolated gas/diesel revenue mix numbers using management's guidance and assuming gas outpaces diesel as a percentage of revenue by 4% YoY, until the next five years. Management also said -"the impact of the mix shift from diesel to gas will become smaller and smaller"(Q4 earnings call). I agree with this statement because diesel is still popular amongst heavy passenger and commercial vehicles. Thus, I expect the decline to be gradual and not sudden.

Gross Margin Assumptions

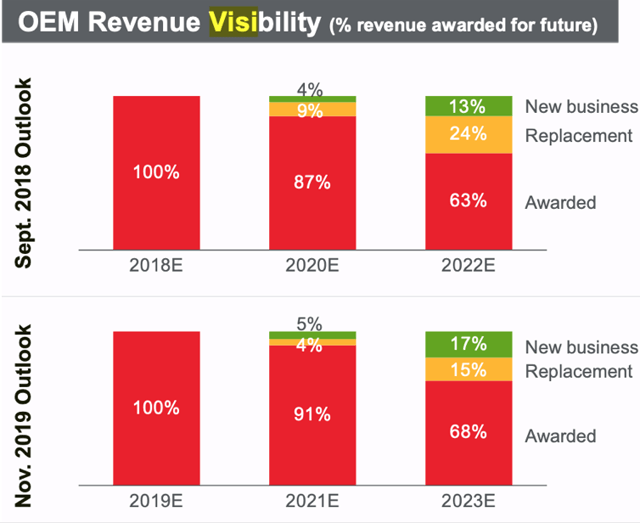

A 100 bps decline in 2020 and 50 bps decline thereafter reflects for change in revenue mix - high margin (diesel) to low margin (gasoline). Also, accounts for any raw material price fluctuations. I strongly think that 50bps decline over the next five years is a realistic estimate and reflects Garret's industry position within the turbocharger market. Garret as an auto parts supplier has lot of strength operating in a duopoly market. The company provides a differentiated product and has the technological expertise to meet customer (OEM) demand. Garret has long term supplier agreements with OEM's for a complete set of gasoline and diesel engine turbocharger components. Vehicles development stage could be as long as 36 months, and with stringent emissions requirements, Garret's engineers participate very early in the development phase of a vehicle. In addition, a vehicle usually has 5 to 10-year lifecycle, assuring Garret long-term contractual streams of revenue, although subject to changes in unit volumes and customer demand. Evident in Garret's revenue visibility:

(Investor presentation)

Obviously, Garret supplies turbochargers to hundreds of vehicle programs from different manufacturers. This also aids the company to be the incumbent supplier for new and redesigned vehicles, potentially creating a 5 to 12-year tie-up with each OEM customer. Thus, Garret has a 'sticky' business model with well-established long term contracts, creating a barrier to entry.

It's less likely that an OEM would switch to another supplier since it can come with significant lead times and investment to validate and develop new components. There is a risk that the customer might experience production disruptions and delays. The whole process of changing a key supplier like Garret could cost millions of dollars for the OEM customer. Companies like Garret and Borgwarner have a majority of the OEMs as their customers because they have a global manufacturing presence which helps them to supply the same underlying turbos or structure of a particular vehicle across multiple countries. This type of global manufacturing presence requires high capital investment, which further strengthens barrier to entry.

The above-mentioned factors give some moderate pricing power for Garret, where it could pass on the additional cost of goods sold incurred from gasoline turbos to customers. I think OEM customers wouldn't be reluctant to pay the extra price since Garret is up to date with technology (including EV and hybrid vehicles). And Garret's turbocharges also help OEM's to meet Co2 standards, emission requirements and fuel efficiency requirements effortlessly. For instance, the gas and diesel turbochargers can improve fuel economy by 10-20% and increase power by 15+%. Thus, Garret remains a key supplier to OEMs and the company will eventually pass on some extra costs to the OEMs, protecting the company from any significant declines in gross margins.

EBIT Margin Assumptions

Although 80% of costs are variable, the company still has to pay employees in China. Management said - "there is not such a thing as furlough, and therefore you need to keep on paying your employees, so the decremental margin into the current crisis is obviously much higher than what it should be for a company like us". (Q1 2020 earnings call). For that reason, I've used 9% SG&A as a percentage of revenue for 2020 estimates, which is above usual 7-8% range, and normalized at 7.5% going forward. For other expenses (indemnity obligation and related ligation fees), I believe 2% of revenue going forward is a conservative estimate, assuming the lawsuit against Honeywell continues going forward. Incorporating these estimates, Garret's EBIT margin could decline by up to 406 bps in 2020 and normalizes at 9-10% going forward (which is the low end of the historical range 9-12%).

Unlevered FCF Assumptions

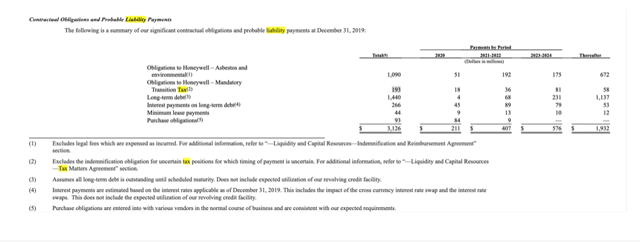

After deducting tax (21% normalized) and adjust for depreciation, non-cash items, CAPEX, change in NWC and mandatory payments to Honeywell (incl tax obligations), leaves $150 million of unlevered FCF in 2020. Accounting for interest and principal payments (debt payments) leaves equity holders with $123 or $112 million (after discounting) in free cash flow to equity, which is in par with Management's guidance range - $85 to $110 million. I expect cash flows to decline YoY over the next five years due to obligations to Honeywell, leaving literally nothing for shareholders since the management will be paying down debt.

Note (change in NWC): Change in NWC was negative (inflow) for 2018 and 2019 so I grew it at the revenue growth rate. NWC can have wild fluctuations for a cyclical business like this, thus, I believe my estimates are conservative.

Payment Obligations:

(Source: Company Report)

Note: Payments to Honeywell could be lower than $175 million (capped) but I've incorporated the capped figure as a conservative estimate.

The impact of 50bps YoY decline in gross margin due to change in revenue mix (from diesel to gasoline) doesn't have a huge impact on FCF, as it only represents around $14 to $16 million of gross profit, but payment obligations to Honeywell have a massive impact on free cash flow.

For the cost of capital calculation, I have used 10.30% rate (5.125% fixed annual interest on debt x 2) to discount the cash flows, assuming the bond markets priced in default and loss severity risks. I believe 10.30% is a conservative estimate and takes into account the mandatory liability payment burden on cash flows and the cyclicality of the business. Adding back cash and subtracting debt (excl Honeywell payments) leaves us with $850 million market cap or $11 per share (or 100+% upside). The reason why I left out indemnity payments because it's not a 'real' debt and the value on the balance sheet can change every year since they are estimated liability pay-outs.

Other than a rebound in the automotive sector, I don't see near term catalyst that would close the valuation gap and bet on a positive legal outcome (Honeywell lawsuit) is way too uncertain and it's beyond a retail investor's expertise. Assuming a recovery in 2021 and better than expected FCF could lead to balance sheet deleveraging, which can attract institutional investors (due to reduced risk and improved equity book value)- resulting in multiple expansion and a decline in cost of equity, potentially pushing shares to $8 to $12 range (60% to 150% upside). But this ultimately depends on how quickly the management can pay down debt and reduce margin pressures from gasoline sales by passing on costs to OEM customers. A successful outcome on Honeywell lawsuit would be an added bonus.

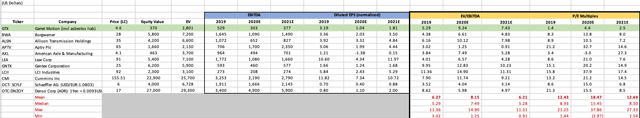

Trading Comparables

(Source: Company reports, Koyfin, Management Guidance, Author's Projections)

Note: Peer group companies include Borgwarner (BWA), Allision Transmission Holdings (ALSN), Aptiv Plc (APTV), American Axle & Manufacturing (AXL), Lear Corp (LEA), Gentex Corp (GNTX), LCI Industries (LCII), Cummins (CMI), Shaeffler AG (OTCPK:SCFLF), Denso Corp (OTCPK:DNZOY)

After adding back Honeywell payment obligations you can see that the firm is trading at a premium relative to peer average on 2021 EV/EBITDA basis, but the market is undervaluing Garret on a 2021 P/E basis. This tells me that the market isn't expecting a strong EPS recovery in 2021 since management can't buyback shares, revenue mix change impact on margins and a 'U' shaped recovery. With management withdrawing guidance due to extreme uncertainty, buying Garret at 2.5x 2021 P/E seems like a reasonable price to initiate a position.

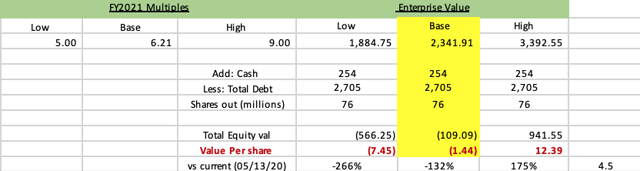

Risk - Reward Analysis (2021 multiples)

(From Authors DCF projections, Comps table, Company reports)

I know, the range looks embarrassingly wide and the base case shows -132% decline even after using 6.21x avg peer 2021 EV/EBITDA multiple, which is higher than Garret's usual range 4x to 5x. However, the company went public in 2018 so I wouldn't put a lot of weight on past EV/EBITDA multiples. For high/Bull estimate, 9x EV/EBITDA (22% lower than max peer group multiple) shows 150+% upside potential. The base-case scenario suggests Garret is a short. However, it's worth keeping in mind that Garret operates in an industry that grows twice as much as the overall auto sector and competes in a duopoly market with Borgwarner and Garret sharing 60% market, besides having strong barriers to entry, low threat of substitutes and moderate buyer power. Also, Garret has some element of pricing power, high revenue visibility and flexible cost structure. Buying at $4-$5 range seems like a reasonable price considering risks above-mentioned. Thus, I'd be highly vigilant shorting Garret at $4 to $5 range. For cautiously pessimistic investors, I'd suggest a wait and see approach and look out for any new developments, and initiate a long or short position accordingly. I'm not surprised by the base-case negative $1.44 per share since Garret has $2.2 billion equity deficit on its balance sheet and am being very conservative with the EV/EBITDA multiples due to lack of historical data, no management guidance and high cyclicality of the business. However, shares going to zero or essentially Garret going out of business (as suggested by the base-case) is a draconian scenario and I don't expect that to occur for a company that has a dominant market share and industry position.

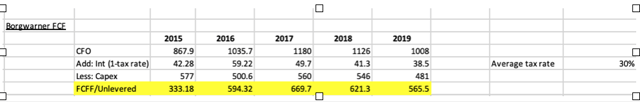

Competitor Borgwarner (BWA) As An Alternative

GTX has a lot of uncertainty ahead and $2.2 billion equity deficit adds more to it, leaving no margin of safety for debt and equity holders. For investors who are hesitant to buy Garret at $4-$5, its closest competitor Borgwarner (BWA) looks like a better opportunity, to gain exposure to the turbocharger industry. BorgWarner's ROIC has been 10+% over the past five years and the EPS is growing consistently. The company's net debt / EBITDA declined from 1.5x (2015) to 0.7x (2019) as the management prioritized paying down debt instead of buying back shares, even in good times- weighted average diluted shares outstanding declined by only 8% since 2015. The company sold off asbestos-related liabilities to a legacy liabilities management company called Enstar Group Limited, which further strengthened BWA's balance sheet. I think the market will definitely reward BWA for the company's disciplined capital allocation strategy and its financial strength.

(Source: Company reports)

BWA generated descent free cash flow and FCF yield was in the 10-15% range over the past five years, using the end of year market cap. On top of that, the company has close to $2.4 billion in liquidity ($900 million in cash and $1.5 million in revolver credit facility). BWA's strong balance sheet and liquidity position should aid the company to ride COVID and emerge stronger from the crisis. If conditions deteriorate across the automotive sector, Garret could face financial difficulties and could be forced into bankruptcy if financial leverage rises to 4x, which isn't far off from current levels. Based on the trading comps above, Borgwarner is trading below the peer average on EV/EBITDA and P/E basis. With the stock down 30% since Jan 2020, it looks like a compelling opportunity for long term investors.

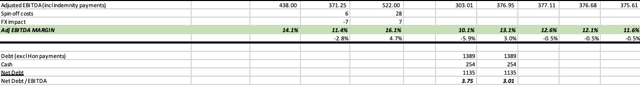

Key Risks To Keep In Mind - Garret Motion

- Potential increase in financial leverage assuming no changes in cash, debt pay repayment or additional borrowing could force the company into bankruptcy. With a Net debt of $1.1 billion (for 2020 and 21), $303 and $377 in estimated Adjusted EBITDA leaves us with 3.75x and 3x financial leverage for 2020 and 2021. 3.75x estimated financial leverage is very close to 4x covenant requirement. If light vehicle production drops further and OEM's struggle, the company could be forced into bankruptcy.

(Company Report and Author's own estimates)

- Profitability declines if the industry aggressively shifts towards gasoline products (low margin) and the company cannot pass on costs to customers.

- Garret's financial difficulties can aid Borgwarner to take Garret's market share.

- Customer concentration could be a concern - "Our top ten customers accounted for approximately 60% of net sales and our largest customer represents approximately 12% of our net sales in 2019"(annual report).

Conclusion

On EV/EBITDA basis (incl indemnity liabilities), the stock looks expensive relative to peer average, with base case showing a negative equity value. The DCF model shows 100+% upside. However, I don't see any near term catalysts that would push the shares up to that level, and betting on a positive outcome against Honeywell lawsuit is way too risky at this point. However, the company has a strong business model, operates in a growing industry, has moderate pricing power and revenue visibility. As a result, I think it's worth taking the risk and I'd definitely be a buyer at $4-$5 range. I don't see shares going down any further, considering the firm already resumed operations in Wuhan, an expected rebound in light/commercial vehicle production in 2021 and the firm's long term OEM contracts, should only push shares higher. If investors are worried about a liquidation event or shares going to zero, I'd highly recommend Borgwarner (BWA) as an alternative to gain exposure to the turbocharger industry.