In my view, there’s still a good case for including gold and gold stocks in a portfolio, despite their recent period of outperformance.

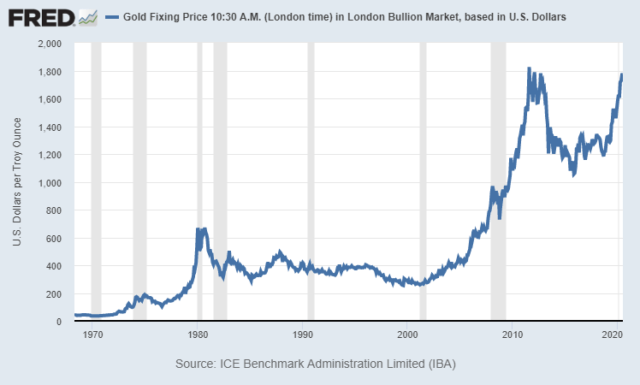

In other words, I still think we’re in the first half of this gold bull move from 2015/2016 lows, rather than the tail end, and that gold is eventually due for a breakout to new nominal highs in dollar terms.

Chart Source: St. Louis Fed

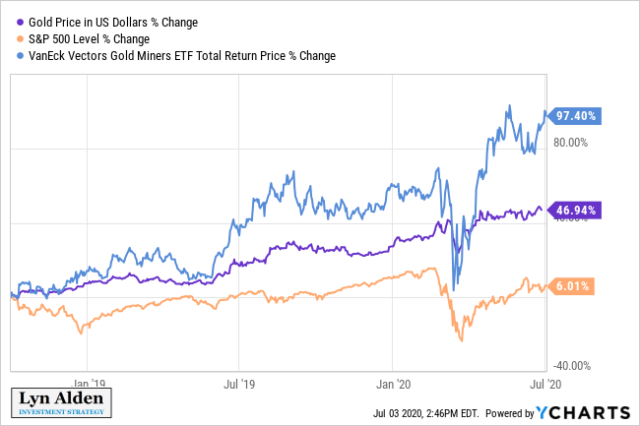

I added gold and gold stocks to my model newsletter portfolio in October 2018, and have dollar-cost averaged in from then until the present day. In the year and a half or more since then, gold and gold stocks have outperformed.

Should contrarian investors get concerned? Should we pivot away from gold now?

In my opinion, no. I still think this rally has legs, and remains an attractive risk/reward addition to a diversified portfolio. It’ll rise and fall of course, but my base case continues to view gold as being in a healthy upward trend. I’m still happy to buy gold at current prices, even though they’re not as good as prices that I bought at back in 2018 and 2019.

Here are four reasons why I remain bullish on gold in the intermediate and long term, without much care for week-to-week fluctuations.

1) Money Supply is Expanding Quickly

As long-term readers know, one of my favorite charts for gold is to compare the price of gold to the growth of broad money supply per capita. This works for any major currency, and I happen to track it in U.S. dollars, which is perhaps the best comparison because both gold and the dollar are traded worldwide.

The idea behind this ratio is that, over time, currencies inflate and devalue vs gold at various rates, while gold holds its purchasing power over the long term. And the

I share model portfolios and exclusive analysis on Stock Waves. Members receive unique ideas, technical charts, and commentary from three analysts. The goal is to find opportunities where the fundamentals are solid and the technicals suggest a timing signal. We're looking for the best of both worlds, high-probability investing where fundamentals and technicals align. Gold has been a successful component of the model portfolios.

Start a free trial here.