Introduction

The Weekly Breakout Forecast continues my doctoral research analysis on MDA breakout selections over more than 5 years. This subset of the different portfolios I regularly analyze has now reached 164 weeks of public selections as part of this ongoing live forward-testing research.

In 2017, the sample size began with 12 stocks, then 8 stocks in 2018, and at members' request into 2020, I now generate 4 selections each week, 2 Dow 30 picks, and a separate article for monthly Growth & Dividend MDA breakout stocks. I now provide 6 different ways to beat the S&P 500 since my trading studies were made public.

Remarkably, the frequency streak of 10% gainers within a 4- or 5-day trading week remains at highly statistically significant levels above 80% not counting frequent multiple 10% gainers in a single week. More than 200 stocks have gained over 10% in a 5-day trading week since this MDA testing began in 2017.

How The Momentum Gauge® trading model works

I am revealing additional insights into the gauges to help readers better understand how I use this model to consistently beat the S&P 500 and protect investments. Members of my service receive much more information and background on this system including my doctoral research and presentation materials. The links in the introduction section above will also help you greatly.

The Momentum Gauges® work as a broad measure of all the stocks on the major US exchanges that are either in the outlier conditions of high positive breakout or high negative breakdown conditions. By comparing these two segments from my research, I can model where the strongest market directional forces are acting as a leading indicator. This can also be applied at the sector level when the market is not acting in a broad rally and some sectors are still in strong breakout conditions.

- The Momentum Gauges® turned Positive again on June 30th after a short negative signal. The current bull signal qualifies as a Segment 5 Positive Control signal from Tuesday of week 27.

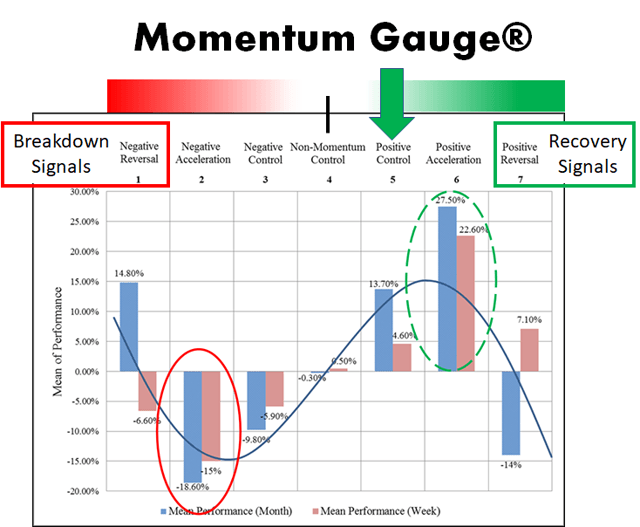

The Seven Segments Of The Momentum Cycle

Each of these segments is identified by comparing the positive and negative scores from my research model that is run many times a day. Those scores are shown on the Momentum Gauge charts later in the article.

- Segment 1 - Negative Reversal includes the Breakdown Signal that occurred on Feb. 24th that shows a sudden early change in market direction. This is detailed most recently here:

Revisiting The Signals That Forecasted Every Recent Decline, In Search Of Early Recovery Indicators

- Segment 2 - Negative Acceleration was the overall market condition from the negative signal on Feb. 24th to the lows in March before the Federal Reserve intervened with the large stimulus packages in US history.

- Segment 3 - Negative Control is a phase with negative market conditions and declines that are small and steady involving much less accelerating type declines.

- Segment 4 - Non-Momentum phase is when the overall market may be in the process of changing direction or is stalled out with very little cause to either rise or fall. In this condition, the positive and negative Momentum Gauge scores would be nearly even and/or both relatively low.

- Segment 5 - Positive Control is the condition of a positive market with slow and steady gains that do not involve many large positive accelerating gains.

- Segment 6 - Positive Acceleration is the strong positive bull market condition where gains are large and accelerating at a record pace with high net inflows into the market. In these conditions, nearly any stock will deliver positive returns as a strong market exuberance or FOMO buying behavior becomes common.

- Segment 7 - Positive Reversal involves a key breakout reading on the Momentum Gauges that confirms a positive reversal market change in direction on the daily and/or weekly charts.

2020 YTD Breakout Portfolio Returns

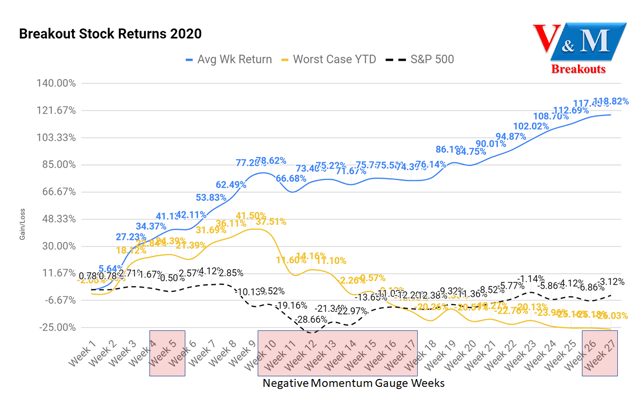

The Breakout Picks are high volatility selections for short-term gains, but with no selections below $2/share, under 100k avg daily volume, or less than $100 million market cap. The returns were at +41.50% in the first 9 weeks of 2020, consistent with exiting the portfolio following the negative Momentum Gauge® signal of Feb. 24th (red weeks below).

The cumulative average returns YTD are +118.8% compared to the S&P 500 -3.12% over the same period. The very best case timed returns at +263.7% and in the worst case, fixed buy/hold, do nothing, equal weighted returns through Week 27 the returns are -26.0%.

So far YTD, 39 stock selections in the past 27 weeks have gained over 10% in less than 5 days with 15 of those short-term picks gaining over 19% and as high as +77%. I have removed the best-case returns from the chart below as it begins to distort the chart between the very worst possible returns and the actual S&P 500 returns shown below.

(Source: Value & Momentum Breakouts)

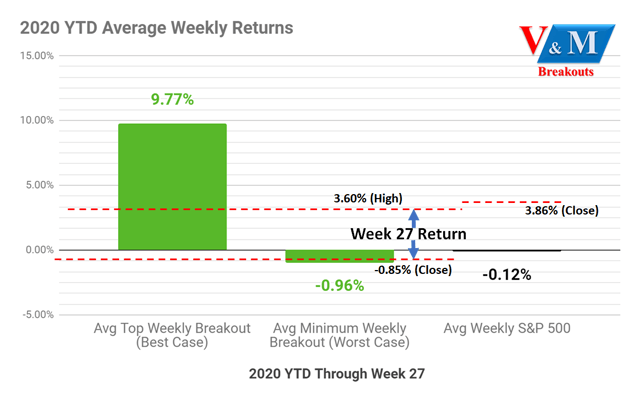

The best-case average weekly returns are +9.77% and worst-case average -0.96% YTD as shown below. These returns include trading against all the Negative Momentum Gauge signal warnings which increases your risk of declines, but are conducted without interruption for testing and measurement purposes.

(Source: Value & Momentum Breakouts)

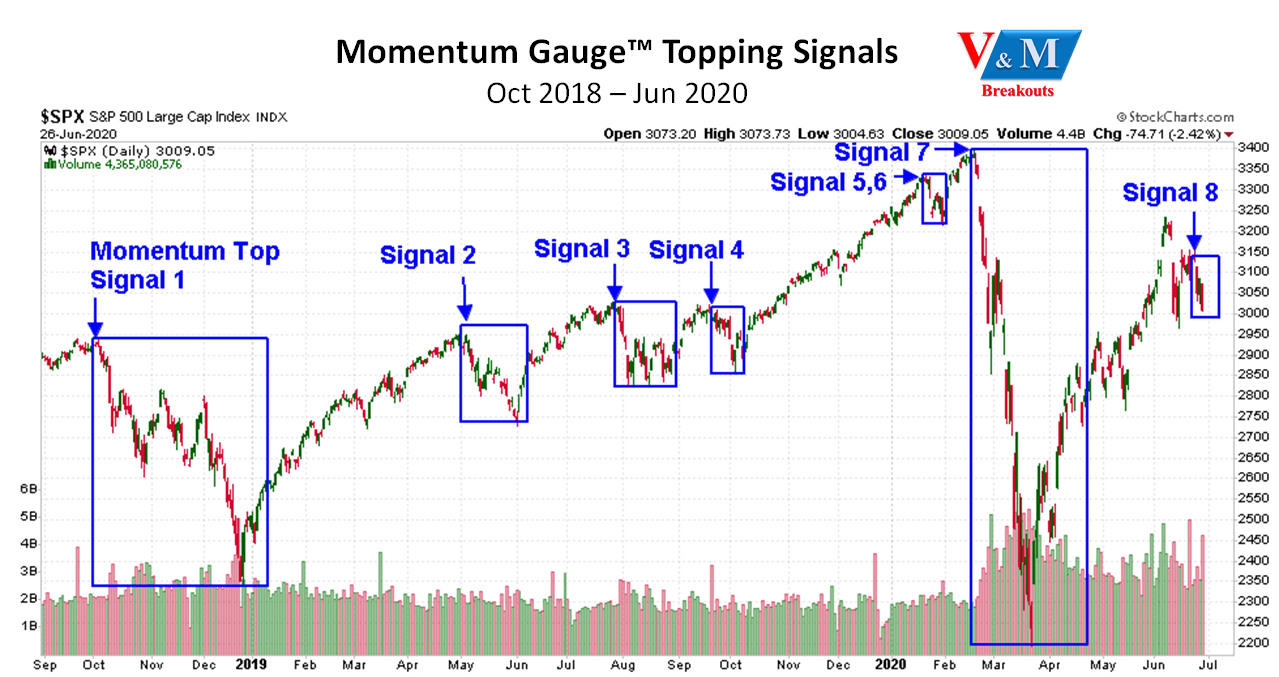

You can see how each of the 8 prior events numbered above relate to the Momentum Gauge topping signals shown below. These forecasted market tops are detailed in my recent article: Evaluating The 8th Market Correction Signal On June 24th That Has Preceded Every Recent Decline.

Over the years, the evidence is clear that timing your investments during the most positive momentum periods greatly enhances your weekly returns. We have recently experienced a new Negative Momentum Gauge™ signal on June 24th that may mark a longer-term downturn.

(Value & Momentum Breakouts)

Market Conditions Into Week 28

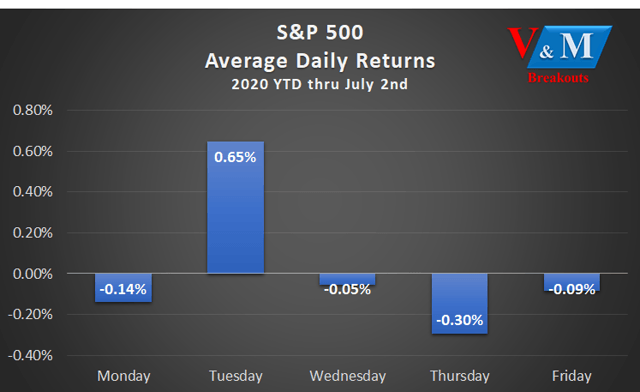

Tuesday continues with historical patterns well documented in published research as the best day of the week, especially in weeks with FOMC meetings and the current POMO schedule. Research studies discussed in the Members' Library show that this is a pricing behavior patterned on the Fed's strong intervention activity called pre-FOMC drift. Last year with less Fed intervention, Fridays were by far the best day of the week.

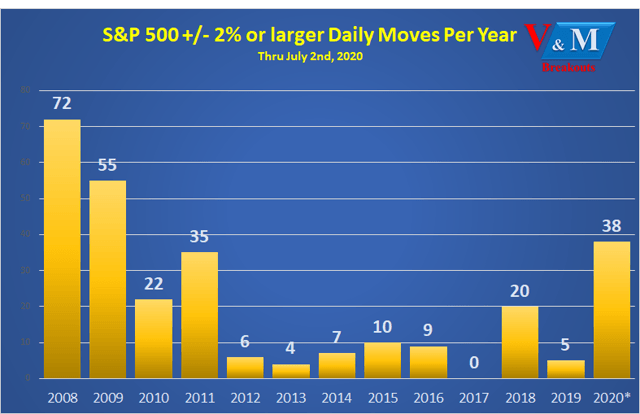

Last Friday, the S&P 500 index delivered the 38th high volatility move this year with 38 daily moves greater than +/- 2% on the S&P 500 in just the past 6 months. These are more daily +/- 2% moves than the years 2012, 2013, 2014, 2016, 2017, and 2019 COMBINED. If the second half of 2020 continues like the first half we will have more record volatility days than 2008 during the financial crisis.

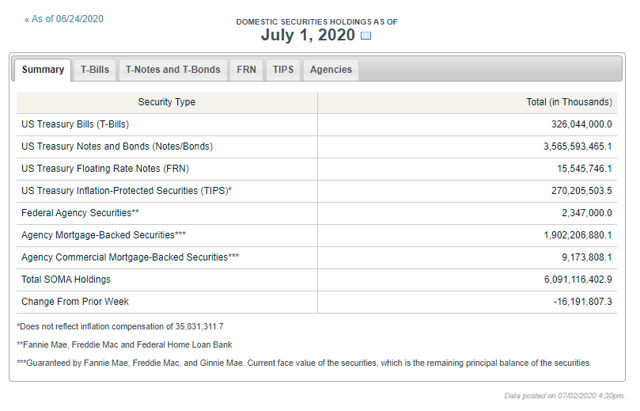

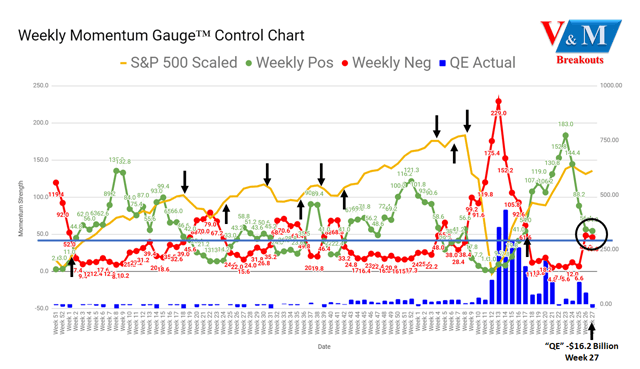

We can confirm the Fed reduced -$16.2 billion this week down substantially from $53.2 billion in easing last week and the first weekly net reduction in domestic securities since Week 22. This brings the total easing to around $2.45 trillion in liquidity just the past 6 months. The Federal Reserve's balance sheet is at the highest level in US history to over $7.1 trillion.

System Open Market Account Holdings - Federal Reserve Bank of New York

The Weekly Momentum Gauge® chart shows continued weekly declines in the positive momentum values since the peak at 183 in Week 23. The weekly gauge has not confirmed a negative signal but is moving very close toward a potential crossover. The Weekly Momentum Gauge® chart below also shows the Fed's easing activity in dark blue with a decline of -$16.2 billion most recently.

(Value & Momentum Breakouts)

Two conditional signals that are very important to watch:

- Avoid/Minimize trading when the Negative score is higher than the Positive momentum score.

- Avoid/Minimize trading when the Negative score is above 70 on the gauge.

The MDA momentum gauges have correctly called every major market direction change since they began. The more detailed daily Momentum Gauges are reserved for members of my subscription service. These movements and signals were updated in more detail through the Daily Update articles this past week:

- Markets Closed Friday, July 3rd for US Independence Day Holiday

- V&M Breakout Morning Update - July 2: Markets Higher Ahead Of June Job Numbers And Week 28 MDA Breakout Picks Today

- V&M Breakout Morning Update - July 1: 3rd Quarter Begins With Markets Lower After Strong Tuesday Rally And Momentum Gauges™ Positive Again

- V&M Breakout Morning Update - June 30: Markets Higher And Tuesday Anomaly In Play With Fed Testimony To Congress On $660 Billion PPP Program Today

- V&M Breakout Morning Update - June 29: Markets Mixed With S&P 500 Rebounding And Nasdaq Lower With Momentum Gauge™ Signal Negative From June 24th

The Week 28 - 2020 Breakout Stocks For Next Week Are:

The selections consist of two Technology, one Consumer Cyclical and one Consumer Defensive sector stock. These stocks are released to members in advance every Friday morning and already reached gains of over 11% led by SOLO gaining +21.3% today and still more room to run.

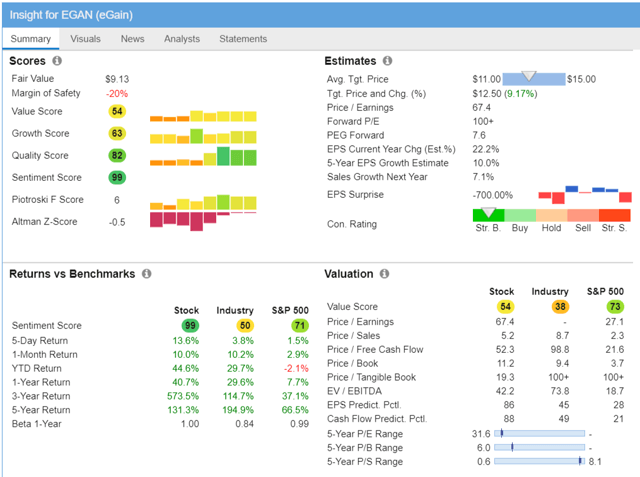

- eGain Corporation (EGAN) - Technology/Software - Application

- Electrameccanica Vehicles Corp. (SOLO) - Consumer Cyclical/Auto Manufacturers

eGain Corporation - Technology / Software - Application

| Jun-25-20 04:49PM | Did Hedge Funds Drop The Ball On eGain Corporation ((EGAN))? Insider Monkey |

| Jun-24-20 11:30AM | Has eGain ((EGAN)) Outpaced Other Computer and Technology Stocks This Year? Zacks |

| Jun-22-20 06:30AM | eGain to Participate at the ROTH Virtual London Conference GlobeNewswire |

| Jun-18-20 06:30AM | Leading US health insurance company selects eGain to modernize member service GlobeNewswire |

(Source: FinViz)

eGain Corporation operates as a software-as-a service provider of customer engagement solutions in the United States, the United Kingdom, India, and internationally. It provides eGain solution, a unified cloud software solution to automate, augment, and orchestrate customer engagement, including digital-first, Omni channel desktop, artificial intelligence and knowledge, and analytics and machine learning applications, as well as platform APIs and pre-built third-party connectors. The company's suite includes various applications for digital interaction, knowledge management, and AI-based process guidance.

(Source: StockRover)

Electrameccanica Vehicles Corp. - Consumer Cyclical / Auto Manufacturers

| Jun-23-20 08:31AM | ElectraMeccanica Partners with Gateway to Lead Expanded Investor Relations Program GlobeNewswire |

| Jun-16-20 08:31AM | ElectraMeccanica Responds to Economic Re-Opening with Planned Retail Expansion of its Flagship SOLO EV into Arizona and Oregon GlobeNewswire |

| Jun-12-20 04:05PM | ElectraMeccanica Announces Closing of $20 Million At Market Financing GlobeNewswire |

| Jun-10-20 09:05AM | ElectraMeccanica Announces Up To US$20 Million At Market Financing GlobeNewswire |

(Source: FinViz)

Electrameccanica Vehicles Corp., a development-stage company, plans, develops, manufactures, and sells electric vehicles under the SOLO name. The company operates in two segments, Electric Vehicles and Custom Build Vehicles. It also has two other electric vehicle candidates under the design development stage, including Super SOLO and Tofino. It also develops and manufactures custom-built vehicles.

(Source: StockRover)

Top Dow 30 Stocks To Watch For Week 28

Applying the same MDA breakout model parameters without regard to market cap or the below-average volatility of mega-cap stocks may produce strong breakout results relative to other Dow 30 stocks.

While I don't expect Dow stocks to outperform typical breakout stocks over the measured five-day breakout period, it may provide some strong additional basis for investors to judge future momentum performance for mega-cap stocks in the short to medium term. The most recent picks of weekly Dow selections:

| Symbol | Company | Current % return from selection |

| (PG) | Procter & Gamble | +4.90% |

| (UNH) | UnitedHealth Group | +3.97% |

| (HD) | Home Depot | +0.75% |

| (IBM) | Intl Business Machines | -2.26% |

| (CSCO) | Cisco Systems | +1.24% |

| (TRV) | The Travelers Companies | -0.77% |

| (RTX) | Raytheon Technologies | -14.26% |

| (CVX) | Chevron Corp. | -12.40% |

If you are looking for a broader selection of mega-cap breakout stocks with detailed analysis and strong returns, I would recommend the Growth & Dividend MDA Breakout picks released monthly for long term gains:

- The July MDA Breakout Growth & Dividend stocks

- The June MDA breakout Growth & Dividend stocks

The Dow Pick For Next Week Is:

Nike (NKE)

Nike is setting up across the technical indicators for early breakout potential and with high net MFI inflows. Analyst upgrades through June/July to BUY and Outperform place price targets ranging from $110 to $127/share. Conditions are strong for a move above 100/share short term and new all-time high soon.

Background On Momentum Breakout Stocks

As I have documented before from my research over the years, these MDA breakout picks were designed as high frequency gainers.

The point to be made is that the Momentum Breakout model was designed to increase the frequency, i.e. the rate over time, for selecting stocks that make greater than 10% moves. I know that when using the arbitrary period of 1 week (4 or 5 trading days) this model is consistently outperforming the market at more than 4 times the expected market frequency. So what if I take a look at longer momentum survivors? Can we see decay in performance among the top stock selections? ~ Value & Momentum Breakouts 2017

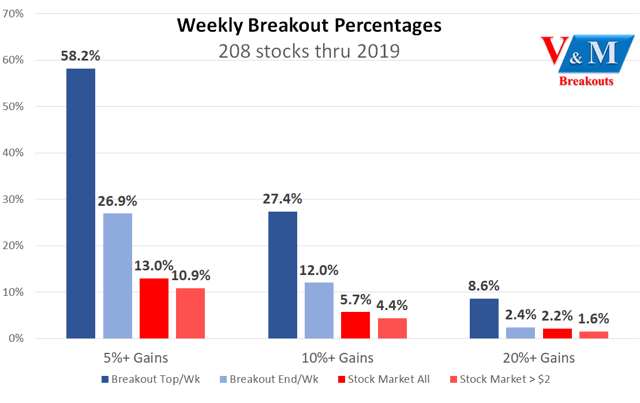

The frequency percentages remain very similar to returns documented here on Seeking Alpha since 2017 and at rates that greatly exceed the gains of market returns by 2x and as much as 5x in the case of 5% gains.

(Value & Momentum Breakouts)

These percentages reflect the results from 208 MDA breakout selections through 2019 across 52 weeks with 4 stocks selected each week. MDA selections are restricted to stocks above $2/share, $100M market cap, and greater than 100k avg daily volume. An additional Stock Market column was added to compare similar groups that exclude high volatility penny stocks below $2/share.

Conclusion

These stocks continue the live forward-testing of the breakout selection algorithms from my doctoral research with continuous enhancements over prior years. These Weekly Breakout picks consist of the shortest duration picks of seven quantitative models I publish from top financial research that include one-year buy/hold value stocks.

My general Market Outlook was released in the SA Roundtable Edition and my views have not changed as the market recovers primarily on record levels of stimulus.

- Market Outlook Edition - My Submission To The SA Roundtable

- The July MDA breakout Growth & Dividend have begun and in two days are led by AMGN +9.49%

- The V&M Premium Portfolio mid-year report card is out and the portfolio is now up +14.96% YTD

All the very best to you, stay safe and healthy and have a great week of trading!

JD Henning, PhD, MBA, CFE, CAMS

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 800+ outstanding members at Value & Momentum Breakouts

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 800+ outstanding members at Value & Momentum Breakouts

- Subscribe now and learn why members are hooked on the Momentum Gauge™ signals!

- Members receive active trading alerts and live stock picks well ahead of published articles.

- Now into our 4th year, this rapidly growing service has consistently outperformed the S&P 500 every single year!

See what members are saying now - Click HERE