(Editor's Note: Corrections have been made to this article post-publication. Originally, it was stated that Uranium Energy's production was at 4 million pounds per year. However, that is in fact the potential production level, as most of Uranium Energy's assets are not producing uranium.)

It has been a rough year for energy commodities. The crude oil price fell to a new all-time low on the NYMEX WTI May contract when it traded below zero and became a bearish hot potato on April 20. At the same time, Brent futures fell to their lowest price of this century at $16 per barrel. Natural gas dropped to a low of $1.432 per MMBtu in late June, the lowest price in a quarter of a century. Coal for delivery in Rotterdam fell below $40 per ton in April and May.

Meanwhile, the price of uranium traded on either side of $25 per pound from the beginning of 2020 through late March. When crude oil was tanking, and natural gas fell to a twenty-five-year low, uranium took off on the upside in April and remained significantly higher than the $25 level at the end of last week. Uranium is an energy commodity with the bulk of global production coming from Kazakhstan and Canada. The United States is the ninth leading producer with under 5% of Kazakhstan’s output and just over 7% of Canadian production.

Uranium Energy Corporation (NYSE:UEC) is a US company that explores for uranium in the Americas.

The price of uranium makes a comeback

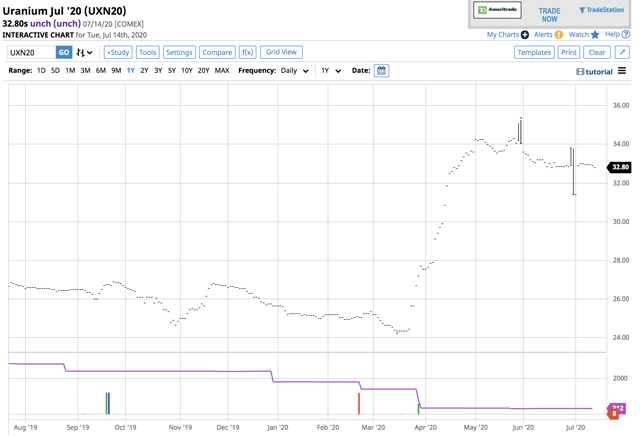

The benchmark price of NYMEX uranium closed 2019 at $25.65 per pound.

After trading in a range between $24.35 and $25.35 until March 23, the price broke out to the upside. Uranium rallied to a high of $35.25 per pound on May 29 and was heading higher as crude oil and natural gas prices were tanking. The price was at the $32.80 level on July 15, closer to the high than the low for 2020.

Kazakhstan suspended production for three months

Kazakhstan is by far the world’s leading producer of uranium. According to the World Nuclear Association, 43% of the world’s uranium supply came from mines in Kazakhstan in 2019. The country produced approximately 22,808 metric tons. Canada and Australia, the second and third leading producing countries, together produced 13,551 tons.

The outbreak and spread of coronavirus worldwide caused Kazakhstan to shut down production for three months earlier this year. At the 2019 rate of output, the closure would account for 5,702 fewer tons of production compared to the previous year. The rise in the price of the commodity was a function of the production decline. Moreover, output in other producing nations likely declined because of the pandemic, further supporting uranium’s price.

UEC is a producer in the Americas

Uranium Energy Corporation (UEC) explores for, extracts, and processes uranium and titanium concentrates in the United States, Canada, and Paraguay. The company owns interests in the Palangana mine, Burke Hollow, Goliad, Longhorn, and Salvo projects in Texas. It also has interests in Anderson. Workman Creek, and Los Cuatros projects in Arizona, the Slick Rock project in Colorado, Diabase in Canada, and the Yuty, Oviedo, and Alto Paranai titanium projects in Paraguay. UEC was incorporated in 2003. The company’s headquarters are in Corpus Christi, Texas.

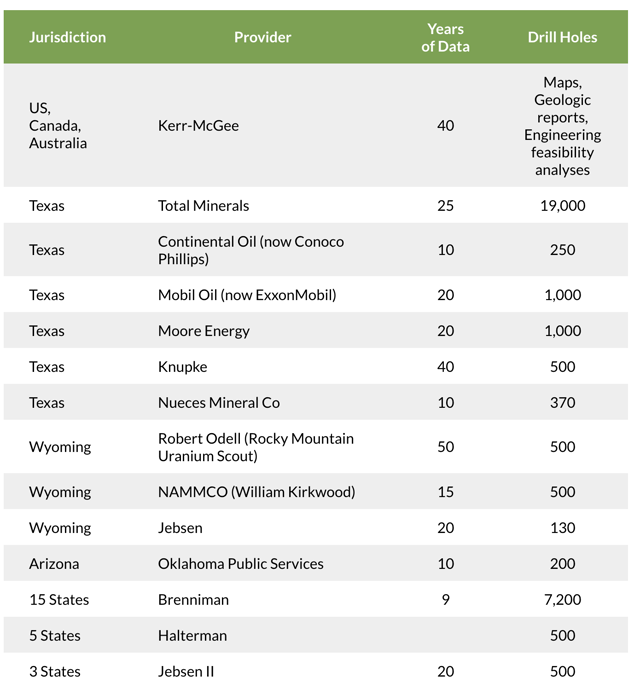

According to the US Department of Energy, there are 516 million feet of uranium exploration and development drilling in the United States. UEC owns rights to significant properties totally more than 4.6 million feet including:

Source: UEC

The company employs an in-situ or ISR mining technology which reverses the natural process that deposits uranium in sandstones. The on-site groundwater if fortified with gaseous oxygen. The process separates the uranium from the sandstone host. The solution is then processed into yellowcake for the market. According to the company's July 2020 presentation, potential production is at four million pounds per year level and UEC has the largest US resource base of fully permitted ISR projects in Texas and Wyoming of any US-based producer.

According to UEC's latest 10Q, the company had just over $9 million in cash and current assets with total assets and liabilities of $93.6 million. UEC has a market cap of $174.444 million and traded over 1.6 million shares each day.

UEC has been lobbying the US government to purchase uranium from US companies. The CEO has worked to convince the government that dependence on uranium from foreign sources is not in the best interest of national security. Given the desire of the current administration to support US businesses, the lobbying efforts could pay off, especially if the current administration wins the November election.

The trend in the stock remains bearish

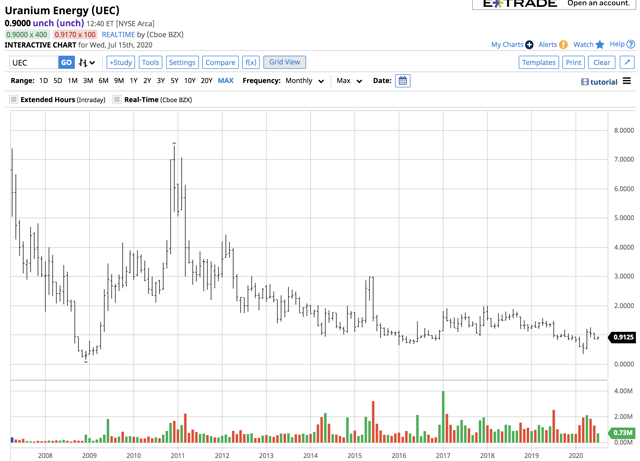

In December 2010, UEC shares traded to an all-time high of $7.48. Since then, it has been all downhill for the stock.

Source: Barchart

As the chart highlights, UEC shares have made lower highs and lower lows over the past decade. In March 2020, as risk-off conditions hit the stock market, the shares traded to a low of 35 cents, which was a record low.

Since then, the shares recovered and traded at a high of $1.2641 on May 11. On July 15, UEC was at the 91.68 cents level, above the midpoint of the trading range for 2020.

Levels to watch in the stock

UEC shares almost tripled in value from the March low to the May high. Short-term technical support is at the 85.60 cents level. Any long positions in UEC should have a stop at 70-72 cents.

Technical resistance is at the May high at $1.2641, with short-term levels at 95 cents, $1.07, and $1.13 per share. UEC is a highly speculative stock. The decline in uranium supplies in 2020 should provide some support for the shares. Moreover, if the US decides to purchase uranium from domestic suppliers and favor US-based mining companies, UEC shares could break higher and move above the May peak.

The risk-reward for UEC at 90 cents per share favors the upside. However, the stock is highly speculative, and a stop to limit risk is the optimal way to approach an investment in this company. Stocks that trade below $1 per share are often lotto tickets. Many investment funds do not invest in companies with such low share prices. Therefore, the risk of an investment in UEC is high. Even if UEC does not have production today, exploration companies often outperform the price of the commodity during bull markets because of their speculative nature. Speculators tend to flock to exploration companies and bid the stock up. If the stars line up for UEC, it could turn out to experience a nuclear explosive move on a percentage basis from its current price level.

When it comes to an investment in uranium, Cameco (CCJ) is a Canadian producer that is far less speculative than UEC when it comes to sensitivity to the price of the commodity.

Andy Hecht is a sought-after commodity and futures trader, an options expert, and analyst. He is a top author on Seeking Alpha in commodities. He is also the author of the weekly Hecht Commodity Report on Marketplace - the most comprehensive, deep-dive commodities report available on Seeking Alpha.