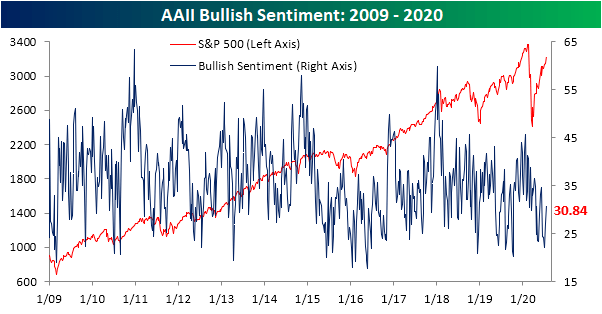

Sentiment changes were relatively uneventful this week. Bullish sentiment rose 3.68 percentage points to 30.84%. That is a second straight weekly increase for bullish sentiment and the first time that it has risen above 30% since June 11th. That is still below the historical average of ~38%, but for the first time in four weeks, bullish sentiment came within one standard deviation of its long-term average.

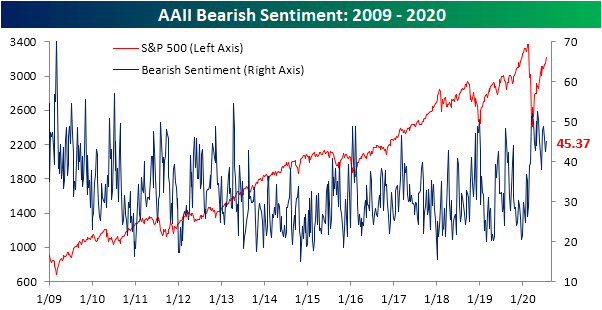

The gains in bullish sentiment were met with a smaller gain in bearish sentiment which rose from 42.67% to 45.37%. Although higher, that is right in the middle of the past month's range and not any sort of significant uptick week over week. But unlike bullish sentiment which is finally back within a standard deviation of its historical average, bearish sentiment remains elevated above its historical average of 30.5% by one standard deviation for a fifth consecutive week. That has now been the case for 17 of the past 20 weeks.

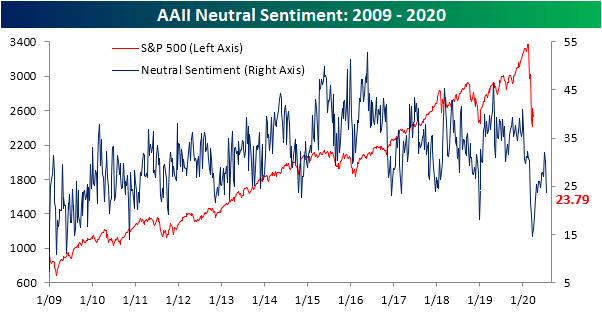

The gains to bulls and bears borrowed from those formerly reporting as neutral. Neutral sentiment fell 6.38 percentage points this week. That was the largest week-over-week decline since the first week of March. Now at 23.79%, neutral sentiment has reversed all of its gains of the past month and a half as it sits at its lowest level since May 7th.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.