I've written about retail industry stocks that have valuations depressed from the ongoing coronavirus pandemic. Investing in these stocks means having to analyze these companies on both a short-term financial and liquidity basis as well as a long-term basis. People still need clothes but not all apparel companies will survive. I am sharing the results of my due diligence on Kontoor Brands (NYSE:KTB).

Just a brief introduction to the company. Kontoor Brands was born out of a spin-off from V.F. Corporation (VFC) and is an apparel company carrying two iconic US brands (Wrangler and Lee). All three of the company's clothing brands are focused on jeans (the third brand being jeans brand Rock & Republic). Wrangler and Lee are very old jean brands, 70 years and 130 years old respectively, with a rich heritage. The Lee brand generates 45% of its revenues from outside the US, a large portion of which from China where it has a leading position.

A key concept I would like to re-iterate is being able to separate the temporary short-term headwinds faced by a company due to the coronavirus and the long-term challenges of the industry. A short-term headwind is something a good company can weather and if the long-term picture still looks rosy would present an investment opportunity.

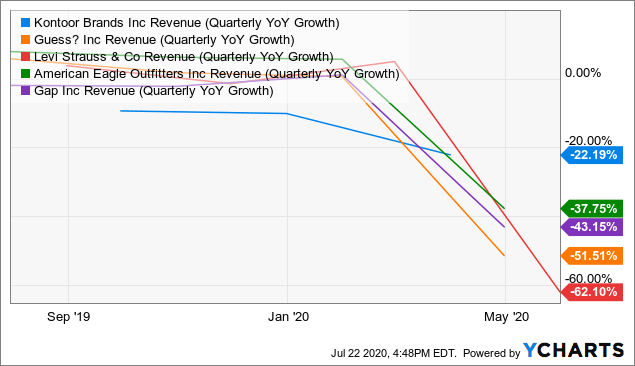

In terms of Q1 results, Kontoor Brands had an ugly quarter. The company reported a significant business impact due to the coronavirus pandemic which hit both revenues and profits. Q1 2020 revenues were down to $504 million which is a 22% decline year over year after adjusting for currency effect. US revenue was down 16% and International revenues were down 37%. Operating income was a $22 million loss for the quarter. Compared to its peers though Kontoor Brands did not suffer as sharp a drop. I think this is due to the company having a portion of its revenue, roughly 25% in 2019, coming from international. By all indications, China and other developed countries in Asia were able to properly contain the spread of the coronavirus by late March.

Data by YCharts

Data by YCharts

Despite having results better than its peers, the company was in a precarious financial position at the end of Q1 2020 due to having a large amount of debt. The company had $479 million in cash against $1.4 billion in debt. The majority of this debt was incurred during the separation with V.F. Corporation. Against assets of $1.9 billion, the company had a debt to asset ratio of 0.73 and negative equity of -$18.4 million. The company had a negative cash burn of $45 million from operations in Q1 2020. Using 2019 figures, the company currently has a net leverage ratio of 4.3x using trailing 12-month EBITDA of $213.6 million.

Given that the company was at risk of exceeding its allowed net leverage ratio to its debtors, the company had to apply for covenant relief with regard to net leverage ratios (5.5x in Q2 and Q3, 4.0x in Q4) with minimum liquidity of $200 million. Note: Net leverage ratio is defined as Net debt less cash divided by EBITDA. The company has also suspended dividends in order to preserve liquidity. While the company is in a slightly better spot than its peers due to its strong international business, its balance sheet is a concern for me.

Is the company ready for Omni-channel

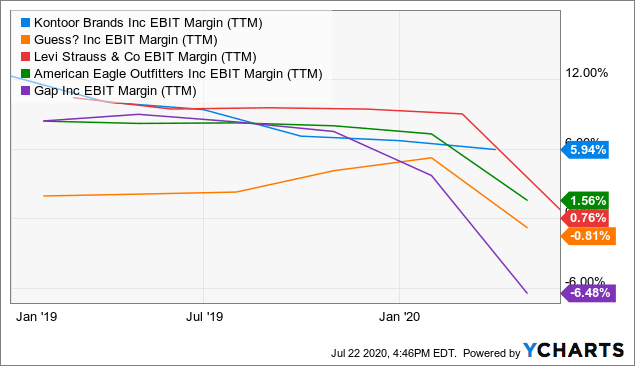

Apart from the headwinds caused by the coronavirus pandemic, apparel companies also need to be concerned about the long-term challenges faced by the industry. A lot of prominent clothing brands such as Forever 21 have filed for bankruptcy in recent years. However, what makes Kontoor Brands slightly different is that it is not a retailer but rather a wholesaler of its products. The company has wholesale arrangements with retail distributors, department stores, and others rather than run its own stores. The company generates 85% of its revenue through its wholesale channel. This is why the company has above average EBIT margins relative to its peers.

Data by YCharts

Data by YCharts

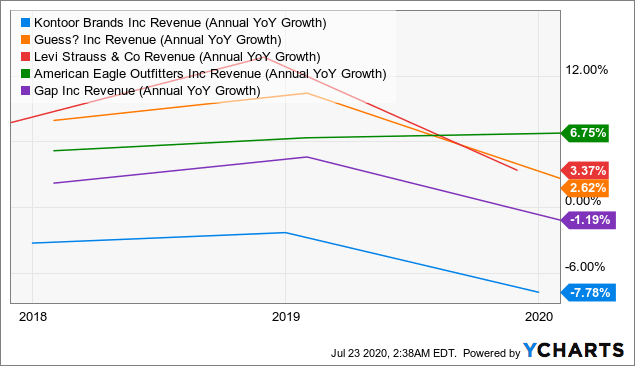

While in the short term being a wholesaler means higher margins, in the long term I believe this puts Kontoor at a disadvantage to its peers. As I've mentioned in a previous article, there has been a shift in how consumers interact with brands on the experiential front. While Wrangler and Lee are classic brands, that hasn't stopped other brands from experiencing a decline. We can see a bit of downtrend with the company's revenue as well. The company suffered negative YoY growth these past 2-3 years.

Data by YCharts

Data by YCharts

The other shift that has happened in recent years is the trend of the Omni-channel approach when it comes to the retail experience. By being a pure wholesaler, the Kontoor Brands would have difficulty "owning" the customer relationship and creating the retail experience. The company relies on its partner retailers and distributors who may also carry other brands and have their own way of doing things. How will Kontoor Brands for example implement a single store inventory system that makes ordering online and pick in-store possible if it has to deal with multiple distributors? If this type of shopping experience becomes expected then the company would be at a disadvantage relative to its peers.

At its core, Omni-channel is defined as a multi-channel sales approach that provides the customer with an integrated customer experience. The customer can be shopping online from a desktop or mobile device, or by telephone, or in a bricks and mortar store and the experience would be seamless.

15 Examples of Brands With Brilliant Omni-Channel Experiences

Valuation

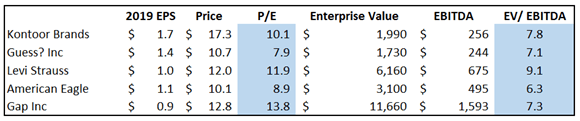

With regard to valuation, Kontoor Brands had a 2019 EPS of $1.71. This implies a 2019 P/E ratio of 10.1x and a forward P/E ratio of 12.28x. Relative to its peers, the company isn't really that cheap from a P/E and EV/EBITDA perspective. As mentioned above, I am also concerned about the large debt position of the company especially now given the ongoing coronavirus pandemic. Kontoor Brands has an interest coverage ratio of 7.2x (given EBITDA of $256.2 and interest expense of $35.8 million). The company has a Moody's credit rating of Ba2 which is a few notches below investment grade.

Author calculations using data from Seeking Alpha

Given the fact that Kontoor Brands is not necessarily cheap relative to its jean making peers as well as its high-debt level, makes the company a hard "avoid" for me. While there are things to like such as the company's exposure to China which is recovering sooner from the pandemic than the US, these aren't enough to offset the negatives.