Investment Thesis

NorthWestern Corporation (NASDAQ:NWE) delivered better than expected Q2 2020 despite the lockdown caused by the pandemic. Management expects the impact of COVID-19 to gradually recede towards the end of 2020. NorthWestern plans to invest $1.8 billion of capital in the next 5 years to grow its EPS and dividend through 2024. The company currently pays a growing 4.2%-yielding dividend. The stock is also trading at a discount to its historical average and to its peers. Therefore, we believe this is a stock suitable for investors with a long-term investment horizon seeking both capital appreciation and dividend growth.

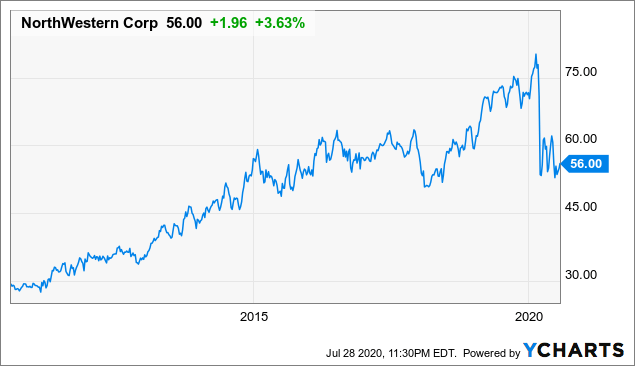

Data by YCharts

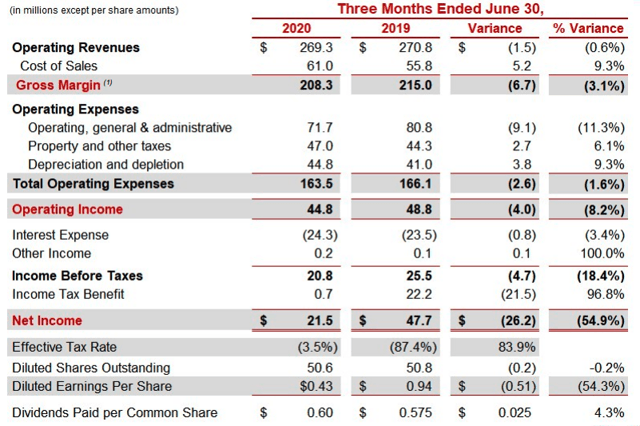

Recent Developments: Q2 2020 Highlights

NorthWestern delivered a better than expected Q2 2020 as the company saw its gross margin decline by 3.1% year over year. This was primarily due to the impact of COVID-19 but offset by favorable weather condition. For more information about COVID-19 on its Q2 2020 and future outlook, please read our next section. Despite a better than expected gross margin, its net income declined by 54.9% year over year to $21.5 million. This was primarily due to much lower income tax benefit in Q2 2020 from last year’s $22.2 million.

Source: Q2 2020 Investor Presentation

Earnings and Growth Analysis

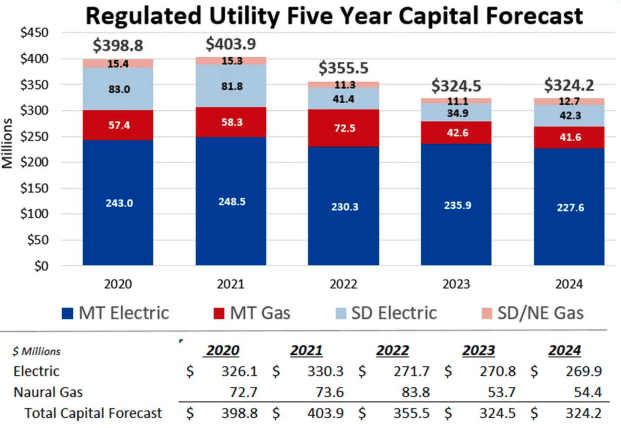

NorthWestern’s $1.8 billion of capital investments through 2024 will support its EPS and dividend growth

NorthWestern has a 5-year capital program to grow its business between 2020 and 2024. The company expects to invest in total of $1.8 billion in its electric and natural gas utilities in Montana, South Dakota and Nebraska. Management hopes that these investments will help drive 6%-9% of total returns in the long term.

Source: Q2 2020 Investor Presentation

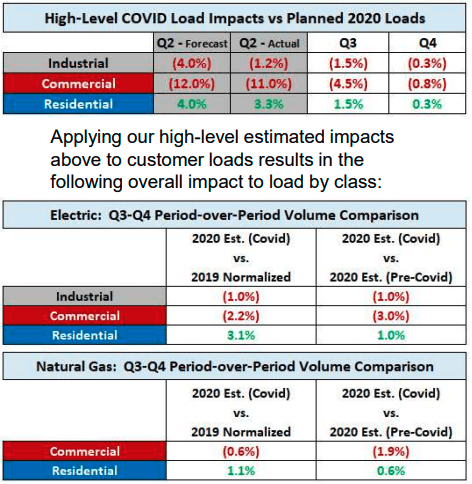

2020 Earnings slightly impacted by the outbreak of COVID-19

The lockdown that happened in Q2 has resulted in lower loads in NorthWestern’s services territories. As can be seen from the table below, its commercial and industrial loads declined by 11% and 1.2%, respectively, in Q2 2020. On the other hand, its residential loads improved by 3.3% year over year as more people are forced to stay at home. Looking forward to the second half of 2020, management expects COVID-19 usage trends to continue with a slow reversion to pre-crisis level by the end of 2020. Based on this assumption, management expects its H2 2020 electricity and natural gas volumes to decline slightly for its industrial and commercial customers. Much of this will be offset by the growth in volume in its residential customers. Based on this forecast, NorthWestern has maintained its revised earnings guidance range of $3.30 to $3.45 per share in 2020. For reader’s information, management lowered the guidance at the end of Q1 2020 by about $0.15 per share. Management also noted that they expect bad debt expenses to rise, but believe that much of this can be recovered through a regulatory mechanism. In order to mitigate the impact of a reduction in sales volume, NorthWestern has also introduced a cost reduction initiative and expects to reduce travel expenses, unnecessary contract services, etc.

Source: Q2 2020 Investor Presentation

NorthWestern should be able to fund its growth projects

NorthWestern has ample liquidity with a total net liquidity of $368.5 million as of June 30, 2020. The company expects to fund its capital projects through a combination of cash flow from operations, mortgage bonds, and equity issuances. Management indicated in its latest conference call that they will likely issue equity in late 2020 or early 2021. NorthWestern’s liquidity and funding plan should allow it to pursue its capital projects in 2020 and 2021 without any problem.

Valuation Analysis

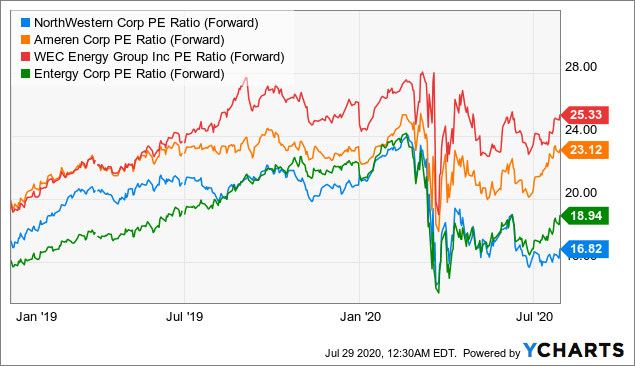

NorthWestern is currently trading at a forward P/E ratio of 16.82x. This is below its 5-year average of 18.01x. Its forward P/E ratio of 16.82x is also below WEC Energy’s (WEC) 25.33x, Ameren’s (AEE) 23.12x and Entergy’s (ETR) 18.94x. Therefore, it appears that NorthWestern is trading at a discount to its historical average and to its peers.

Data by YCharts

Data by YCharts

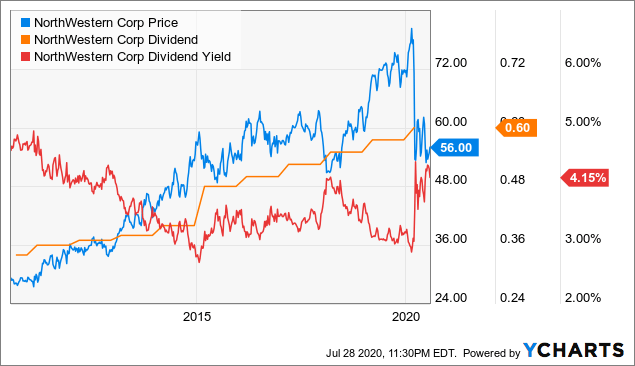

A growing 4.2%-yielding dividend

NorthWestern has recently increased its quarterly dividend to $0.60 per share from $0.575 per share. This represents a dividend yield of about 4.2%. As can be seen from the chart below, the company has consistently increased its dividend in the past and expects to continue to grow its dividend in the future thanks to its investments. NorthWestern’s dividend is sustainable with a payout ratio of 71% based on the midpoint of its 2020 EPS guidance of $3.375 per share.

Data by YCharts

Risks and Challenges

NorthWestern faces several risks:

- Unfavorable regulatory environment could result in lower allowed return on equity.

- Adverse weather condition will impact the demand of natural gas and electricity.

- Multiple waves of pandemic may result in lower than expected energy consumption especially if another lockdown is introduced in its services territories.

Investor Takeaway

NorthWestern’s capital investments in the next 5 years should help deliver long-term EPS and dividend growth. The company currently pays a growing 4.2%-yielding dividend. Its shares are also trading at a discount. Therefore, we believe this is a stock suitable for dividend growth and capital appreciation.