The following immortal Neil deGrasse Tyson quote just about sums up my view on the high-quality BlackRock Science and Technology Trust (NYSE:BST):

Innovations in science and technology are the engines of the 21st-century economy; if you care about the wealth and health of your nation tomorrow, then you'd better rethink how you allocate taxes to fund science. The federal budget needs to recognize this."

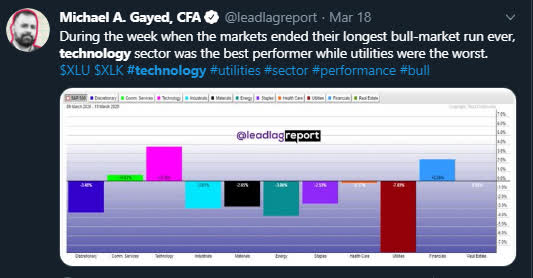

Even before the impact of the pandemic was known, science and technology stocks were outperforming the broader market. Science and technology will also lead us in the post-COVID-19 age. I'm sure many will agree.

Source: Twitter (@LeadLagReport)

The sector was doing very well before the pandemic and is expected to do better in its aftermath. So, yeah, I'm very bullish on BST for the long term, both as a dividend play and growth play. BST invests in current leaders and emerging winners in the field of science and technology, and there's no reason not to feel bullish about it as a long-term play.

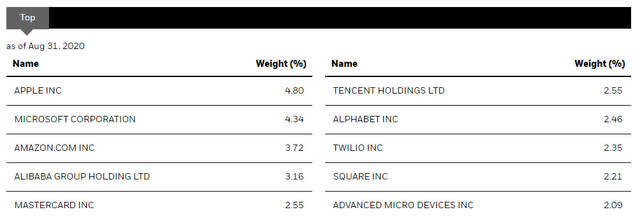

Here are its internals:

BST Portfolio and its Risks

Source: BST Website

Some 70% of BST's funds are invested in domestic stocks, 12.70% in Chinese stocks, and the rest in other global stocks as of August 31, 2020. About 30% of its funds are parked in its top 10 holdings, which include domestic IT giants like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOG) (GOOGL).

In H1 2020, BST's NAV was boosted by its holding in e-commerce and cloud communications companies. Among the star performers were AMZN, Shopify (SHOP), and Twilio (TWLO). In the same period, the fund increased its exposure to software (cloud computing, digital transformation, and gaming) and semiconductor companies, while reducing exposure to internet companies. It also focused on investing more in domestic companies.

As of August 31, 2020, a large part of BST's funds was invested as follows: 47% in software and services companies, 15% in media and entertainment companies, 14% in semiconductor companies, and 11.7% in retailing (e-commerce companies).

Now, let's talk about the risks.

The fund's China-based stocks can witness tremendous volatility if a U.S.-China cold war were to break out. As of September 10, 2020, the chances of such a standoff are increasing. So, I'm a bit apprehensive about BST's 12.7% exposure to Chinese shares. There's also the current volatility and elections to contend with. It also seems like the volatility of the last few days may continue for a while because there's no telling what can happen in a tech-overheated market. These are my two caveats regarding BST's portfolio.

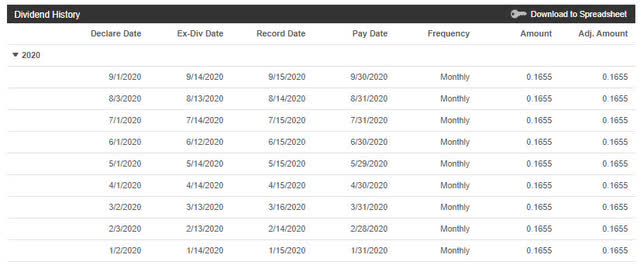

BST's Dividend Record

Image Source: BST's Dividend History on SA

BST is a consistent dividend payer. It has declared $1.49 in dividends (paid monthly) for the first 9 months of 2020. It is on track to pay $1.98 for the whole year, which translates to a yield of 5% based on its market price of $39.70 as of September 10, 2020.

Well, 5% is a terrific yield for investors of a high-quality closed-ended fund that focuses on a growth sector like science and technology.

BST's Performance

Source: SA

From the total return angle, BST has knocked out the S&P 500 (SP500) in the medium to long term. Investors who bought it 5 years ago are making a total return of 241% as compared to an 89% gain delivered by SP500. Those who picked up 6 months ago are making a total return of 30% as compared to a 17% gain delivered by the SP500. BST emerges a winner in every period in between.

However, SP500 has performed better in the period from August 2020 to September 2020, but I estimate that BST will easily overtake it in the medium to long term.

Summing Up

BST looks like a winner both from growth and dividend angles. It has a very bright future because it is professionally managed by a high-quality investment management firm and it focuses on the exciting growth sector of science and technology, which will lead us in the future.

The management fee of 1% is on the higher side, but given that the fund is investing in sectors that will grow exponentially, this high fee isn't a big concern to me.

Like this article? Don't forget to hit the Follow button above.

Subscribers told of melt-up March 31. Now what?

Sometimes, you might not realize your biggest portfolio risks until it's too late.

That's why it's important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.