As a Hong Kong-based airline, Cathay Pacific (OTCPK:CPCAY) is currently in a tough situation. In addition to the civil unrest, which sparked in Hong Kong a year ago and led to the reduction of air travel activity in the region, the ongoing pandemic fully disrupted the airline’s operations. In Q2 alone, the company’s revenues declined by 99% Y/Y, and it will take years for Cathay Pacific to return to normalcy. While the government of Hong Kong helped the airline to stay afloat, the high debt load, along with a weak recovery, is making the airline uninvestable. For that reason, we hold no position in the company.

Painful Road Ahead

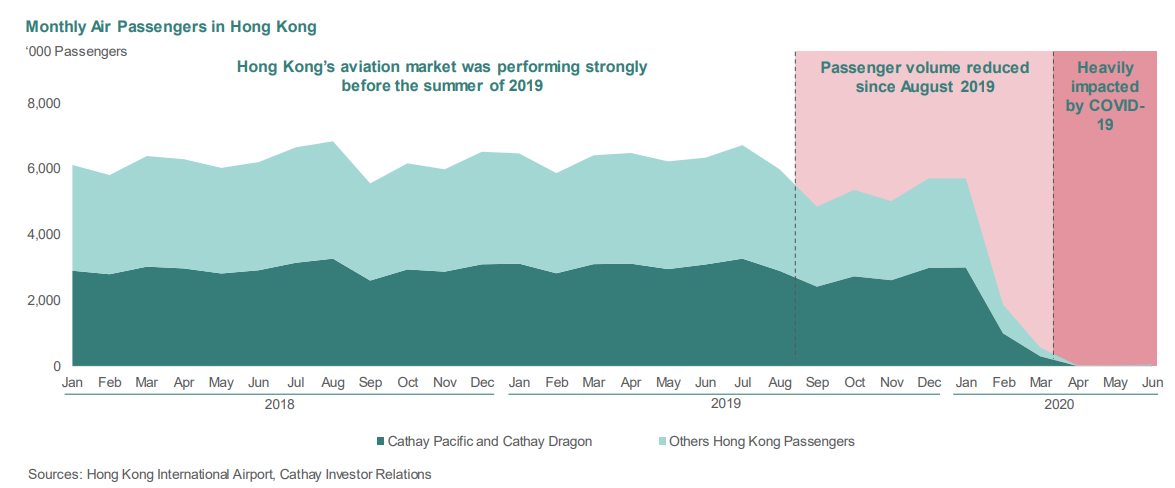

Cathay Pacific has systemic importance to the government of Hong Kong, as it accounts for the majority of the passenger traffic in the country’s main airport. In addition, the aviation and tourism industries employ over 300,000 people and account for 10.2% of Hong Kong’s economy. After the civil unrest in Hong Kong started a year ago, the airline experienced a decline in passenger traffic, as governments around the world told their citizens not to travel to the region. While the protests prevented the airline from growing its top line in 2020, COVID-19 acted as an even greater disruptor, since the airline was forced to ground the majority of its fleets.

Source: Hong Kong International Airport, Cathay IR

While the airline ramped up its cargo operations in recent months, it was still not enough to offset the losses from the commercial business. As of today, most Cathay Pacific planes are parked in storage facilities in Hong Kong and Australia, and it’s unlikely that they’ll become operational once again anytime soon since the majority of international borders are still closed to this day.

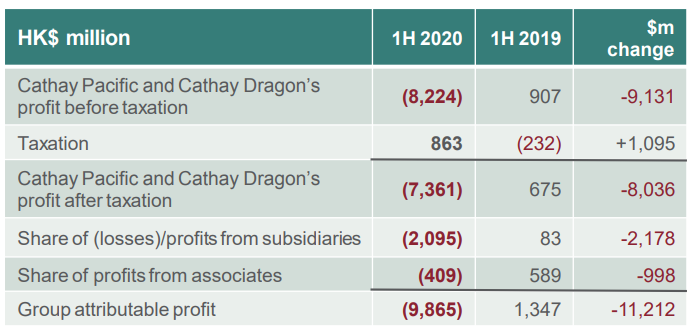

Due to the groundings, Cathay Pacific’s revenues in the first half of the year declined by 48.3% Y/Y to HK$27.67 billion. In addition, Cathay Pacific suffered a HK$9.87 billion loss in the first six months of 2020, and the number of passengers that it transferred was down 76% Y/Y to only 4.39 million.

Source: Cathay Pacific

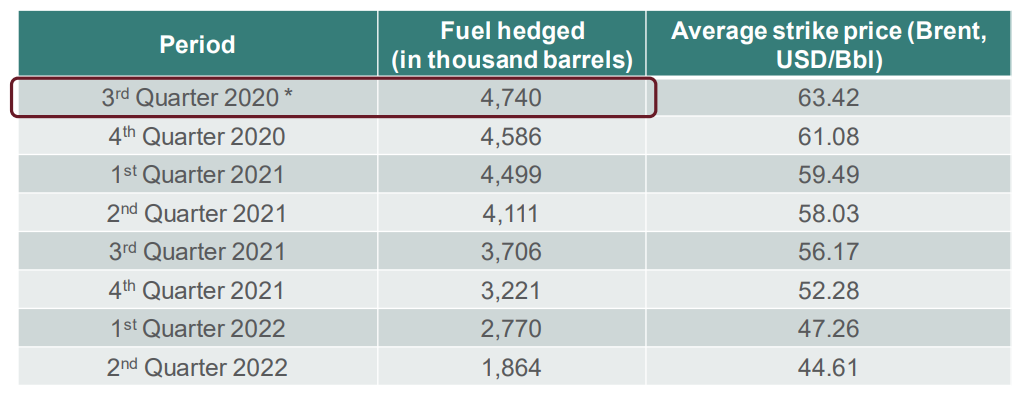

Despite such an underperformance, Cathay Pacific will survive the current crisis, as it was able to raise liquidity by issuing bonds, executing private placement of its notes, engaging in a sale and leaseback of its planes, and receiving state aid. Only a few months ago, Cathay Pacific agreed with Hong Kong on a HK$39 billion bailout plan, which will help the airline to stay afloat for the time being. However, despite such a boost of liquidity, it’s unlikely that the airline will be able to create shareholder value in the foreseeable future. The problem is that, with the net debt position of HK$62.51 billion, the airline has an overleveraged balance sheet. In addition, as EIA expects the Brent oil price to be $44/b and $49/b in Q4 and FY21, respectively, Cathay Pacific will continue to lose money on the ineffective fuel hedges.

Source: Cathay Pacific

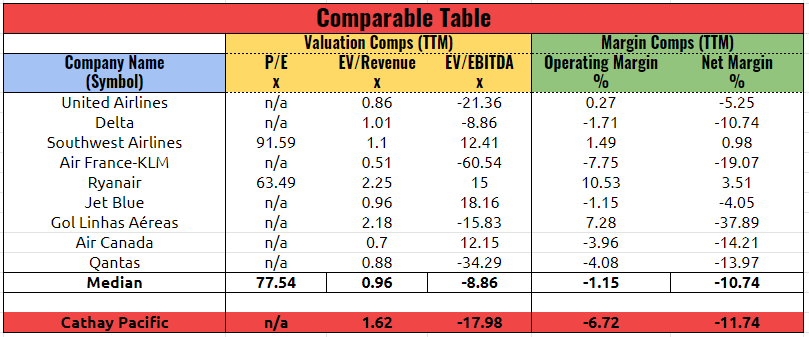

While in order to preserve cash and improve its financial situation, Cathay Pacific cut its workforce and deferred the delivery of A350 and A321neo planes, it’s still not going to help the airline to reach the breakeven point in the foreseeable future. Going forward, Cathay Pacific expects its monthly cash burn rate to be HK$1.5 billion – HK$2 billion, which means that it’s likely that it’ll be required to raise even more liquidity along the way due to the long recovery of air travel. In addition, with negative margins and no profitability in sight, it’s hard to justify a long position in Cathay Pacific and nearly every other airline that operates in the same environment.

Source: Capital IQ

Another problem of Cathay Pacific is the fact that the airline is exposed to geopolitical risks. In recent months, China has been tightening its grip on Hong Kong and angering part of the population of the city state. The possibility of another civil unrest in the midst of the pandemic is one of the major risks, which will prevent Cathay Pacific from growing. In addition, we should not forget that most international borders are currently closed, and it’s unlikely that we’ll see the reopening anytime soon, as the number of active COVID-19 cases only continues to climb, and it’s unlikely that we’ll see a vaccine in the next few months. However, even if we do see a proper COVID-19 vaccine in the following months, its distribution at scale will take months and will make lots of governments hesitant to open the borders until the virus is fully contained. As IATA expects the air traffic to return to normalcy only in 2024, Cathay Pacific will continue to suffer financial losses in the near term.

With a load factor of less than 25% in July and August, it’s safe to say that the airline will not be able to return to its pre-pandemic profitability levels in the next few quarters. Since the swift recovery is not going to happen anytime soon, we believe that it’s better to avoid Cathay Pacific.