JPMorgan (NYSE:JPM) is gearing up to report third-quarter results, as financial services companies kick off earnings season in just a couple of weeks. The bank's press release should come out on Tuesday, October 13, and analysts don't seem to be expecting much of it.

Consensus estimates suggest a top line decrease of 6% YOY, coupled with deterioration in EPS of about 27%. The former would represent a revenue decline not seen in the past five years at least. However, I believe the latter is a bit more likely to happen, considering the potential for further increases in credit reserves.

(Image Credit: Investor Place)

What to expect this time

In the most recent quarter, JPMorgan's businesses headed in two different directions: community and consumer banking suffered from lower spending and an unfavorable interest rate environment, while corporate and markets saved the day. I expect the dichotomy to be in place in the third quarter once again, although possibly not to the same extent.

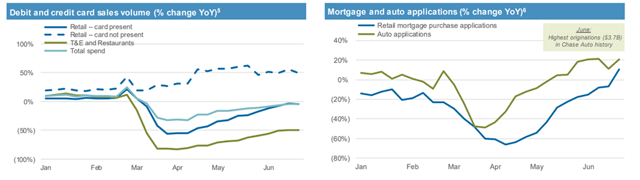

On the consumer side, I noted last quarter that aggregate spending was about to reach pre-pandemic levels (see chart below), after total debit and credit card sales volume dipped by as much as 30% YOY in March. However, it also looks like the recovery hit soft patches along the way in the third quarter, especially once a fiscal stimulus stalemate was reached in September.

Further, I will be interested in a few important topics of conversation. First, I wonder if strength in mortgage and auto applications will carry into the third quarter or die out as demand for big-ticket items (partly a result of low interest rates) eases. Also, I will keep my eyes open for any sign of deterioration in credit quality, which so far has not been much of a concern.

(Source: Q2 FY20 Earnings Slide)

On the corporate and markets side, I think it would be overly optimistic to expect results to be as robust as they were in the second quarter. Still, JPMorgan has proven time after time that it can execute on its deal pipeline better than almost any other bank. Corporate and investment bank revenues, for example, were up a whopping 66% in the second period, beating by a mile and a half the performance of peers Citigroup (C) and Bank of America (BAC) in this business segment.

On the stock

I continue to have opposing views on the financial services space in general and JPMorgan more specifically. Regarding the former, the cocktail of unstable economic fundamentals and unfavorable interest rate landscape is worrisome to me, particularly in the consumer banking segment. For this reason, I remain very cautious about industry-lagging diversified banks, like Wells Fargo (WFC), or pure-play consumer service institutions, like Capital One (COF).

But within the sector, I maintain my positive stance towards what I consider to be best-of-breed players. In my view, JPM seems like one of the top alternatives during times of uncertainty. In my view, the bank is likely to survive the 2020 crisis better than most and thrive in the longer term.

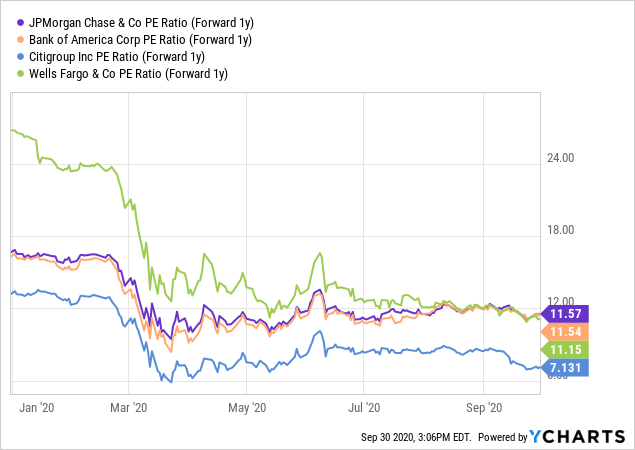

Data by YCharts

Data by YCharts

Yes, JPM is just about the priciest stock among mega US-based banks, as the chart above depicts. It has also corrected the least among the four since the start of the COVID-19 correction. However, when it comes to the financial services sector, I believe that now is not the time to be cheap. If dipping my toes into these turbulent waters, I would consider JPM first within its peer group and American Express (AXP) in the consumer finance space.

Members of my Storm-Resistant Growth community will continue to get updates on AXP (allocation updates, insights, etc.) and the performance of my market-beating "All-Equities SRG" portfolio on a regular basis. To dig deeper into how I have built a risk-diversified strategy designed and back-tested to generate market-like returns with lower risk, join my Storm-Resistant Growth group. Take advantage of the 14-day free trial, read all the content written to date and get immediate access to the community.