Article Thesis

UnitedHealth Group (NYSE:UNH) is a quality pick in the healthcare insurance industry. The company has delivered strong total returns for a long time, has a more than solid growth track record, and continues to reward shareholders through growing dividends and share repurchases. On the other hand, its valuation is not as low as it used to be, and political headwinds are larger than they were in the past. Uncertainties around the next presidency and its healthcare insurance policies make us shift to a more neutral position on UnitedHealth.

Source: Stock Rover

Source: Stock Rover

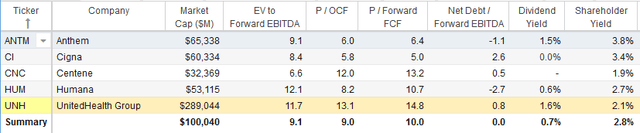

UnitedHealth is the biggest player in its industry by far, but shares are not as inexpensive as they were a year ago. In fact, shares are more expensive than the peer group average right now, in terms of enterprise value to EBITDA, but also by price to cash flow. Its shareholder yield is now also lower than that of its peer group, as UnitedHealth's market capitalization has risen quite a lot over the last year, while the company slowed down its buyback pace at the same time.

UnitedHealth Remains A Quality Company

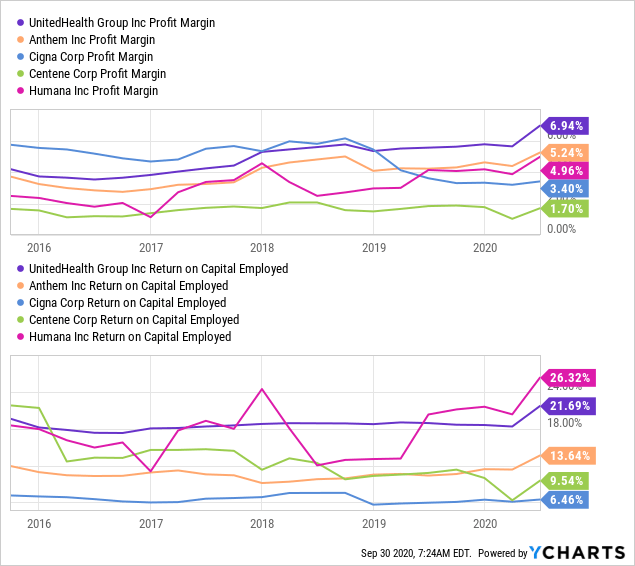

UnitedHealth is not only the biggest player in its industry, but it also is a company with strong fundamentals. Compared to its peers, UnitedHealth is able to generate above-average margins and returns on capital:

Data by YCharts

Data by YCharts

UnitedHealth's net profit margin is significantly higher than the margins that its peers are able to generate, at roughly one-third more than its closest competitor Anthem (ANTM). Looking at returns on capital employed, we see that UnitedHealth is the second-strongest name in the group, with an attractive ROCE of 22%. Only its peer Humana (HUM) is able to generate higher returns with the capital that it puts to work. Looking at the above five-year chart, it seems like UnitedHealth was able to strengthen its position versus competitors over the last couple of years, as its ROCE and net profit margin both went up - on an absolute basis and relative to the peer group average. UnitedHealth can thus fittingly be described as a quality player in the health insurance industry for sure. This also holds true when we look at the company's growth track record or its excellent dividend history: Over the last five years, UnitedHealth has raised its dividend by a very sizeable 24% a year, which has resulted in a quite nice yield on cost for those that bought early on. 10 years ago, shares were trading at $35, which means that those that bought back then have now a yield on cost of more than 14%, not yet including the positive compounding effect of reinvested dividends. It is not at all a bad idea to choose quality companies when making investment decisions, but other factors should be factored in as well, including valuation, which brings us to the next point.

The Easy Gains Have Been Made

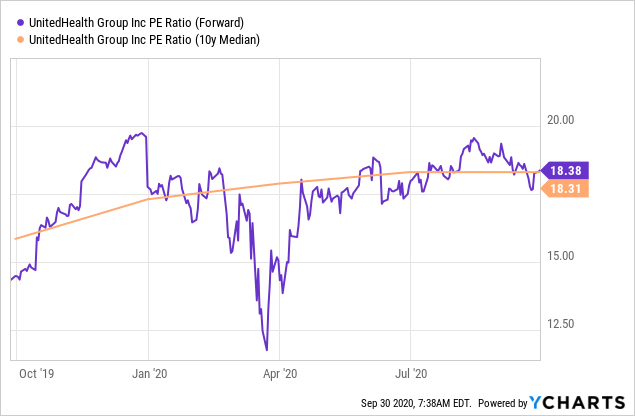

Roughly one year ago, on October 2, 2019, I published my first article on UnitedHealth, calling it a quality growth stock with significant upside potential. At the time, its valuation was well below the long-term average, which is why I assumed that UnitedHealth would be able to deliver sizeable share price gains over the coming years. As it turns out, shares hit the ~$300 price target that I had conservatively set for 2024 way earlier, and shares delivered a return of more than 40% from the time the article was published.

Total returns for shareholders can be viewed as a combination of three independent factors: The EPS/cash flow per share/FFO per share growth the company generates, changes in its valuation (i.e. does the P/E ratio/cash flow multiple/FFO multiple increase or decrease), and dividend payments. In a best-case scenario, all three factors are working in an investor's favor, i.e. the company continues to grow following the investment, while its valuation expands, and the investor receives dividend payments along the way.

If, however, one of these factors works against the investor, i.e. if growth is negative or if valuations decline, then the total return outlook is less attractive. At the time of my original buy thesis on UnitedHealth, all three factors looked good: The company was growing fast, its valuation was low, and the dividend yield was at an above-average level. One year later, however, things are not looking as great any longer. I think that UnitedHealth will be able to continue to grow its earnings per share in the long run, despite political headwinds, but its valuation has expanded meaningfully, while its dividend yield of just 1.6% is now lower than that of the broad market.

Data by YCharts

Data by YCharts

Shares were valued at less than 15 times net profits one year ago, but they are valued at a little above 18 times this year's net profits right now. This is almost perfectly in line with the 10-year median earnings multiple, thus one could argue that shares are fairly valued right now. Due to increasing political uncertainties, I personally think that its valuation may actually decline a little over the coming years. Apart from that, however, it seems reasonable to assume that shares are not undervalued any longer, unlike they were one year ago.

Political Uncertainties Could Be A Headwind For The Industry

There are powerful long-term trends working in favor of the healthcare industry as a whole, mainly the fact that demographic change results in a population with rising average age. This results in more ailments that require treatment. This is why the healthcare industry as a whole has grown quite a lot over the past decades. Its share of the US gross domestic product has risen from 5% in 1960 to 18% in 2020.

Since the aging of the US population has not stopped or reversed, it seems likely that this trend of above-average growth relative to GDP growth will continue. It should, however, be noted that the growth rate has been noticeably lower over the last decade compared to the 1960-2010 time frame, and the healthcare industry's share of total GDP will surely not triple again. Nevertheless, the healthcare industry should continue to grow at least slightly faster than the economy as a whole.

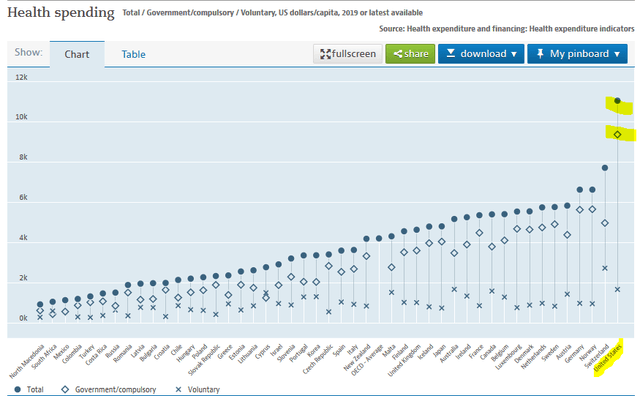

There are, on the other hand, rising political pressures on insurers and other players in this industry. The US healthcare system is famously expensive relative to that of other industrial nations (including Canada, Japan, and Western Europe):

Source: OECD

Source: OECD

Evaluating the merits of different healthcare systems is not in the scope of this article, but the fact that per-capita healthcare costs in the US are much higher than in much of the rest of the world is still of relevance here. Some politicians in the US have indicated that they are interested in reforming the system, not all of them sharing the same goals. No matter what one personally thinks about these reform ideas, it is clear that these political pressures could be a headwind for the healthcare industry overall, and maybe especially for (highly profitable) insurance companies such as UnitedHealth.

To sum this section up, I think that the long-term megatrend of an aging population will remain in place, and I think the growth outlook for UnitedHealth remains positive. But political pressures seemingly are increasing, which is why I think that profit growth going forward will likely come in at a slower pace compared to the very attractive growth UnitedHealth has delivered in the past. Depending on shifts in the political landscape in either November or over the coming years, it is, however, also possible that growth will completely grind to a halt (although I think that is rather unlikely).

Takeaway

UnitedHealth is a quality pick with above-average fundamentals and an excellent track record. The company should also continue to benefit from the fact that an aging population requires, overall, more healthcare spending.

At the same time, however, political risks seem bigger than they were one year ago. Since UnitedHealth is also trading at a much higher valuation than it did one year ago, we are ending our bullish call on UnitedHealth following a 40%+ return over 12 months, and moving to a hold/neutral rating on UnitedHealth.

One Last Word

If you found this article interesting or helpful, it would be greatly appreciated if you "Follow" me by clicking the button at the top, or if you "Like this article" below, as this will help me in building an audience and continuing to write on SA. If you want to share your opinion or perspective, you are also very welcome to comment below. Happy investing!

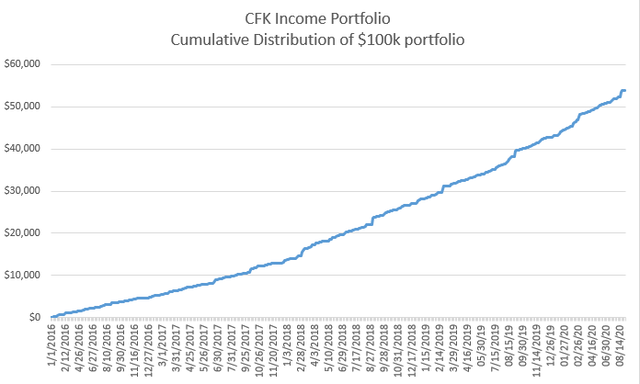

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, the income stream not so much. Start your free two-week trial today!