Thesis Summary

Trulieve Cannabis Corp. (OTCQX:TCNNF) is a medical cannabis company with most of its operations based in Florida. This company is a rare find in the cannabis space, due to its high growth, sound finances, and good profitability. Despite a +100% appreciation of the stock in the last year, I think Trulieve is still undervalued given the growth potential, and I believe the stock price could double once again in 2021.

Source: Trulieve.com

Company Overview

Trulieve operates as a producer and distributor of legal use marihuana, with most of its operations based in Florida. The company has seen revenue growth of 120% and is expanding its operations both regionally and in terms of product offerings. Trulieve Cannabis shares have been skyrocketing in the last year on the most recent results:

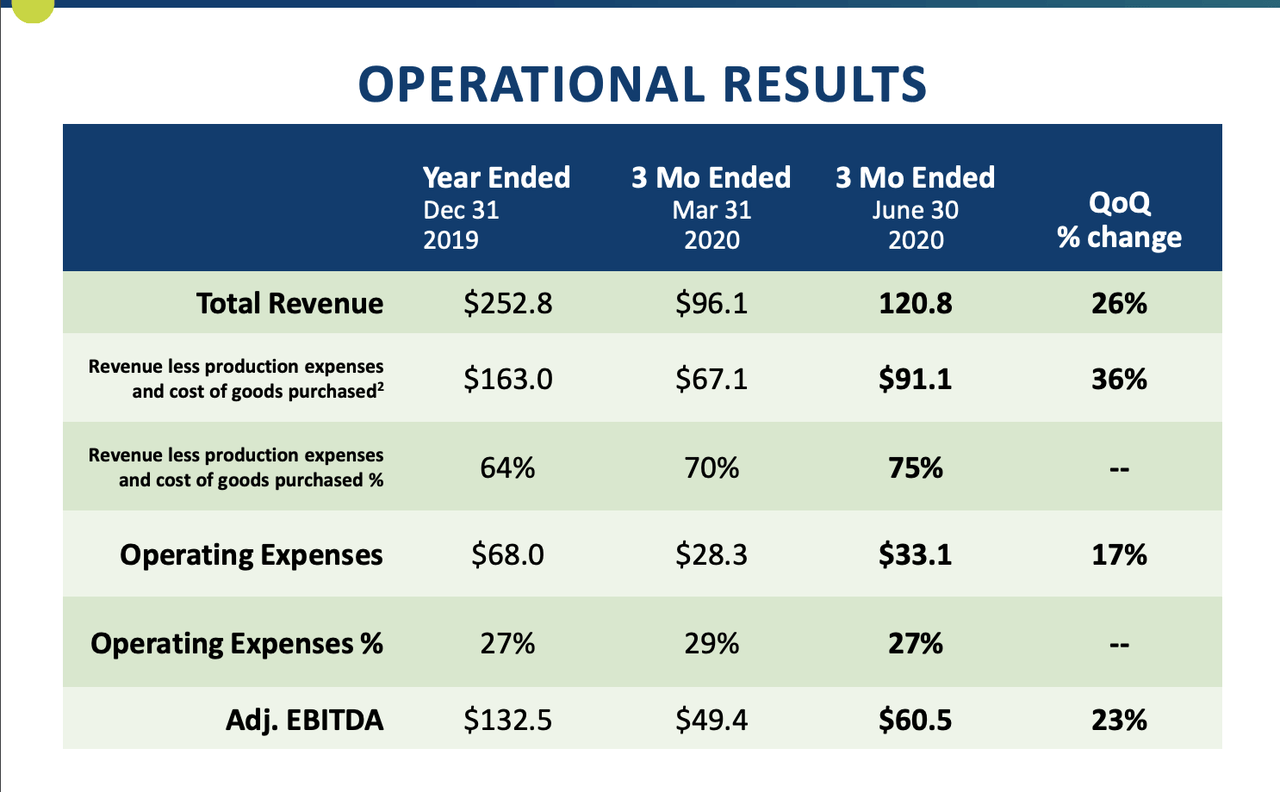

Source: Investor Presentation

Trulieve has been able to achieve triple-digit growth in the last year, while also keeping a lid on expenses, showing impressive customer retention rates and organic growth. Furthermore, the company has been able to achieve this without further expanding its indebtedness. Trulieve carries around $130 million in long-term debt, which is about the same as a year ago. However, this now represents only 18% of assets and interest expenses, at 6.5% of revenue, seem manageable.

All in all, Trulieve looks reasonably financially secure, has outstanding growth, good profitability, and is by many metrics cheaply valued. But what can investors expect for this company during the next year?

Market and Competition

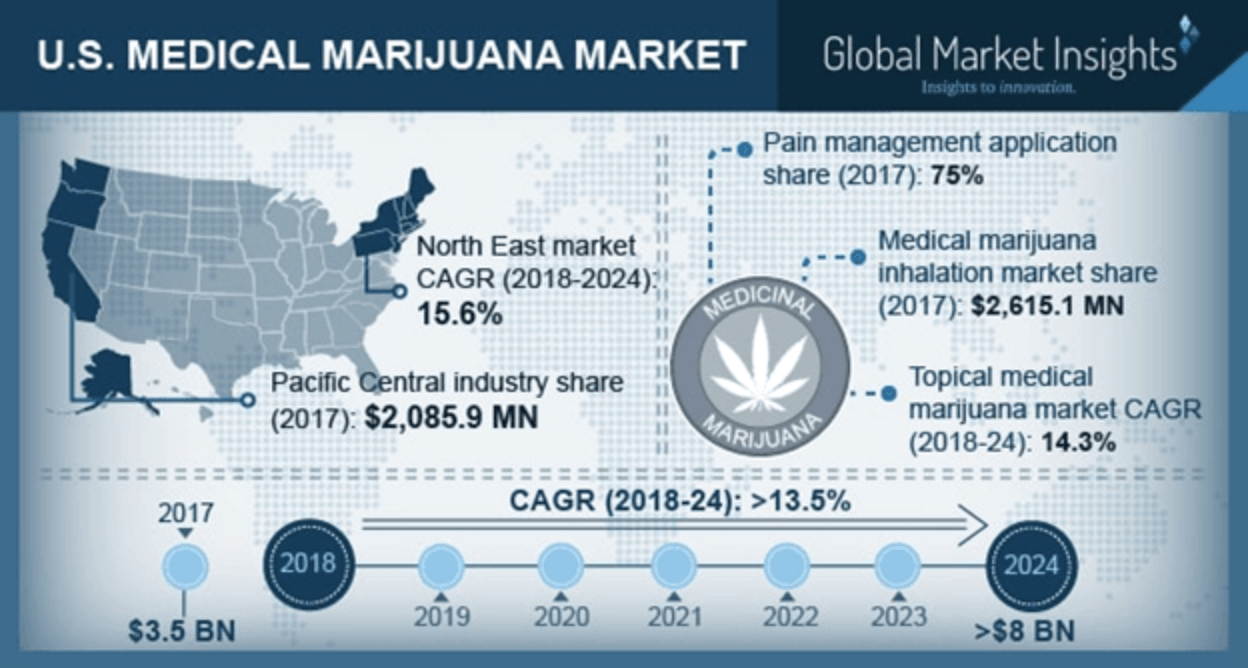

The cannabis market has been a hot topic of discussion for the past few years. It is undeniable that there is an ever-increasing demand for both recreational and medical uses. In this regard, it seems that the market still has significant growth ahead of it.

Source: Gminsights.com

According to Global Market Insights, the U.S. cannabis market could grow

Macro Trading Factory is a new service focused on macro views, market outlook, and asset-allocation.

We demonstrate portfolio and risk management, in a simple and relaxed manner.

Our model-portfolio is:

well-diversified, containing up to 25 leading ETFs and CEFs.

managed by a team of professionals, led by TMT.

aiming to outperform the SPY on a risk-adjusted basis.

allowing you to keep-up with your daily-routine.

MTF is your perfect solution if you're looking for an ongoing, professional, trusted, affordable guidance, especially with little time on their hands.