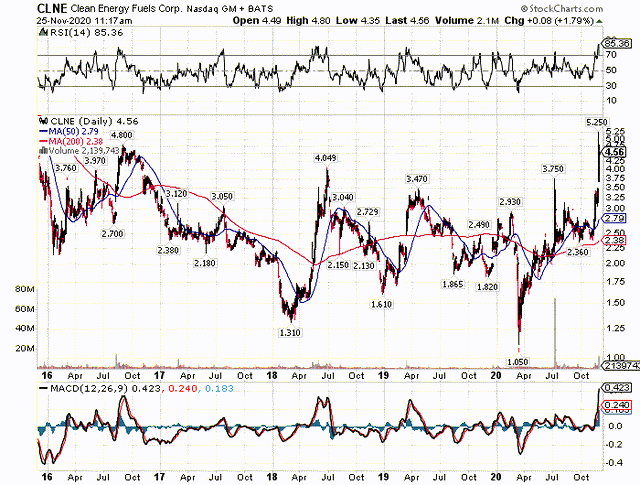

Just about every year, Clean Energy Fuels Corp. (NASDAQ:CLNE) jumps to the $4 to $5 range on renewable fuel hype. The last few days continue this trend, though oddly this time, the stock is rallying along with the electric vehicle space which competes with renewable natural gas vehicles. My investment thesis remains negative on the stock on all of these rallies when the business doesn't match the stock jump.

Image Source: Clean Energy website

Flawed Business Model

The major problem with Clean Energy is that the company doesn't benefit from the cost savings of switching to renewable natural gas fuels such as CNG and LNG. The company just benefits on volumes, and the industry has never taken off due to the lack of fueling stations, while the sector is now quickly moving toward EVs.

A lot of my warnings were ignored over the years as investors bought into the new age concept of CNG and LNG, but Clean Energy was always just a fueling station, making a small margin on each gallon sold. The company wasn't going to generate massive profits from reducing carbon emissions and saving the planet.

A prime reason being the company selling fuel at $0.59 per gallon in Q3, down from $0.65 last year. Clean Energy Fuels only makes a $0.21 effective margin on those gallons sold.

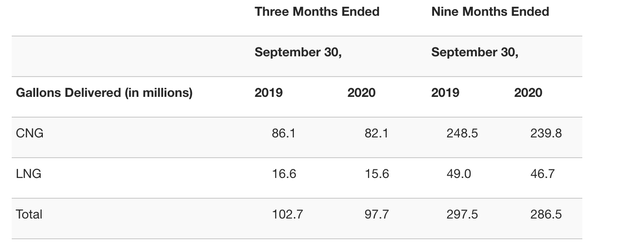

Total gallons of fuel delivered were down 5.0 million in the quarter to only 97.7 million. Yes, the tough business environment and less airport traffic contributed to headwinds in fleet volumes, but Clean Energy Fuels only needed moderate growth trends in converting fleets to CNG or LNG for growth to have continued unabated.

Source: Clean Energy Q3'20 earnings release

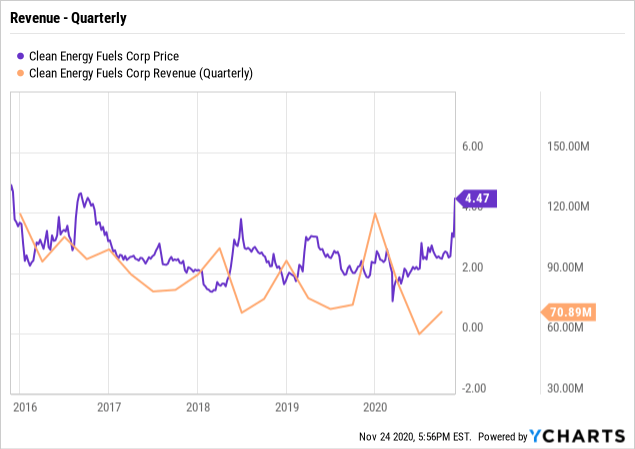

Though the Q3 results were impacted by COVID-19, the below chart highlights the history of struggles at Clean Energy Fuels. Sales have trended down for years, and the Q3 revenues fell another 4.8%.

Data by YCharts

Data by YCharts

Even worse, the financials are always difficult to decipher. The company regularly obtains excise tax credits ("AFTC") for alternative fuels recorded in the wrong periods. These wild excise tax credit swings consistently impact results.

A prime example is Q3 where revenues of $5.0 million were included for AFTC this year, while the company didn't obtain any credits last year. Once excluding these numbers and other one-time charges, revenues actually fell 9.9% in the quarter to only $66.0 million. A renewable energy growth company like Clean Energy Fuels should easily overcome the hurdles of a virus and still generate solid growth.

The company has made some minor improvements in the business over the year. The quarterly SG&A level at $17.0 million in Q3 was much more in line with revenues than in the past. Clean Energy Fuels finally quit paying outrageous operating expenses and cut costs more in line with selling a commodity business with low margins than an alternative fuel with high margins.

Clean Energy Fuels now generates positive EBITDA, though the target is only $45 million for 2020.

Annual False Rallies

The biggest issue for Clean Energy Fuels is that companies like Tesla (TSLA) and Nikola (NKLA) are racing each other to deliver heavy-duty EVs. These companies have all the momentum and will reduce the shift to natural gas fuels.

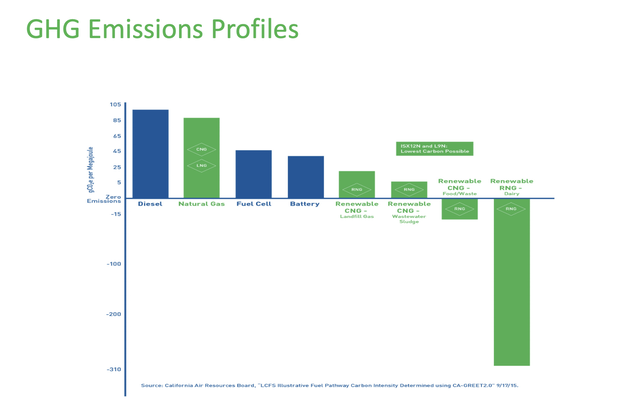

Some hype will occur from the California Air Resources Board rating RNG made from methane with a negative carbon rating while electric batteries have carbon intensity ratings around 46. These ratings are far better than gasoline and diesel around 100 and above, but the market just isn't moving towards renewable fuels very fast.

Source: Clean Energy Sept. 2020 presentation

Source: Clean Energy Sept. 2020 presentation

The hype causes the stock to make these annual rallies that never stick. Nothing about the business model has suddenly changed to warrant this rally just like the prior four years.

Takeaway

The key investor takeaway is that Clean Energy Fuels remains a low-margin fuel business with limited growth potential. While the company will promote the growth in renewable fuels, the company doesn't see meaningful increases in fuel volumes or revenue. Sell the stock on this annual spike in the stock price on hype.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to double and triple in the next few years.