Editor's note: Seeking Alpha is proud to welcome MillennialMKTS as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Company is richly valued at these levels

With Palantir Technologies (NYSE:PLTR) trading at $25.67 as of 12/1 close, despite the recent weakness, it is trading incredibly rich. This isn't too much of a surprise given the online retail community's interest in the name. However, when we look at different scenarios and subsequent valuations of these scenarios, the drivers of the company's growth become clear.

The future of Palantir depends on its ability to convert more commercial entities into clients. The more net adds they are able to add to the platform per quarter, the more the bull case makes sense. However, customer count decreased from 133 at the end of 2019 to 131 at the end of Q3 (Q3 earnings presentation). PLTR has seen incredible growth over the past year with 52% revenue growth y/y and an inflection into positive margins in their Q3 earnings.

However, is this growth sustainable? There are additional signs of lower confidence in growth – weak headcount increase of +2-3% y/y in FY21, and operating expense decreasing 28% y/y which is a huge number and unusual for a company in high growth mode (per company S-1). When taking a sober view of the company, the current price is very high. Our Bull Case can justify a $44 price target, but the risk-reward is not attractive here with our Base Case of a $20 price target. If you are a current holder, then perhaps enjoy the ride, but if you are looking to dip your toes in, the risk reward-ratio is not in your favor at these trading levels.

Company Background and Summary

Palantir's data analytics platform is distinct because of its “full stack” approach, meaning PLTR provides a product or service that addresses the complete client experience, from front-end to back-end, both client and server, database and OS. Palantir technologies is a one-stop-shop, for now, but they have shown signs of flexibility which will be key in its growth as a company.

PLTR’s two core platforms include Gotham and Foundry.

Gotham: Palantir’s first platform, Gotham was built for government operatives in defense and intelligence. Gotham enables the end user to identify patterns within large datasets and enables the users to create and execute responses.

Foundry: This platform enables organizations to create a central OS for their data. Users can integrate with other core systems and analyze large datasets in a singular, consolidated platform. Foundry is primarily targeted to commercial customers.

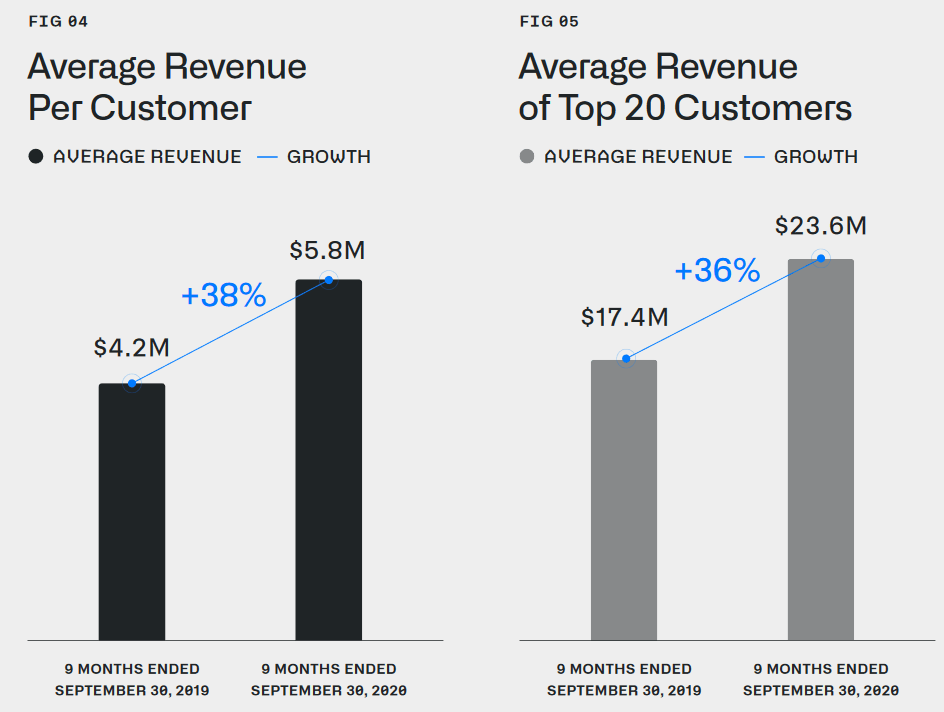

Despite having a low number of customers, once PLTR successfully gains a customer and becomes a core data platform, thanks to this full-stack approach they are able to expand rapidly. Average revenue per customer (ARPC) has been growing at a 30% CAGR since 2009, reaching $5.8mm as of 2019 (per the company S-1). The top 20 customers have an even greater spend at $23.6mm nine months ended 2020. This sort of revenue per customer growth is indicative of PLTR’s ability to prove and expand into new use cases once a customer is onboard. The PLTR platform addresses a variety of workflows including data management, integration, app development, security, analytics, supply chain, enterprise resource planning (ERP) and the mythical AI among others.

Source:

Source: Source:

Source:The revenue growth is impressive, with full year 2020 revenue expected to be 44% year-over-year according to guidance given in the Q3 presentation.

Palantir’s Business Model

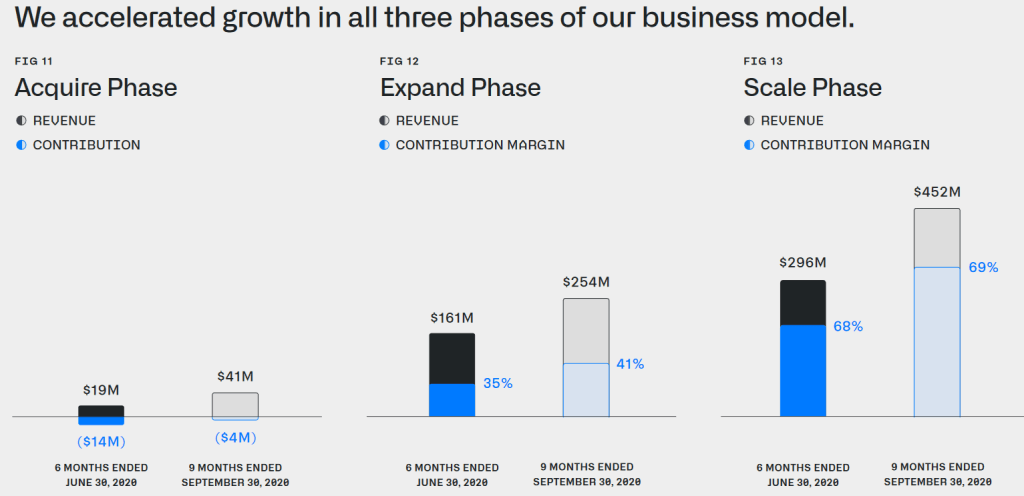

PLTR goes to market with a direct sales force, with heavy involvement from senior management in the early stages. Sales cycles can be long, with heavy implementation services required to get customers running. Sales engineering and pricing vary on the scope and scale of the project. PLTR’s business model has three phases: Acquire, Expand, and Scale.

Acquire – PLTR offers short-term pilot deployments of their software at little to no cost to attract new customers and further monetize existing ones. These pilots lead to initial losses. Customers in the Acquire phase are defined as customers who contribute less than $100k in revenue in a calendar year.

Expand – This is the phase where PLTR would begin to see margin inflection and revenue growth per the company S-1. Customers in the expand phase are defined as those generating more than $100k in revenue in a calendar year, while having negative contribution margin throughout the same period.

Scale – With 95% of revenue coming from existing customers per the company S-1, the company’s ability to scale within its existing customer base is crucial to its growth strategy. Palantir’s system is very sticky, once the software is installed and configured, the customer can develop further apps and software to use on top of the platform, contributing to further usage.

Total Addressable Market (TAM) opportunity

Palantir estimates their TAM to be $120bn in their S-1 based on their bottom-up analysis of customer spending levels across the commercial and government sectors.

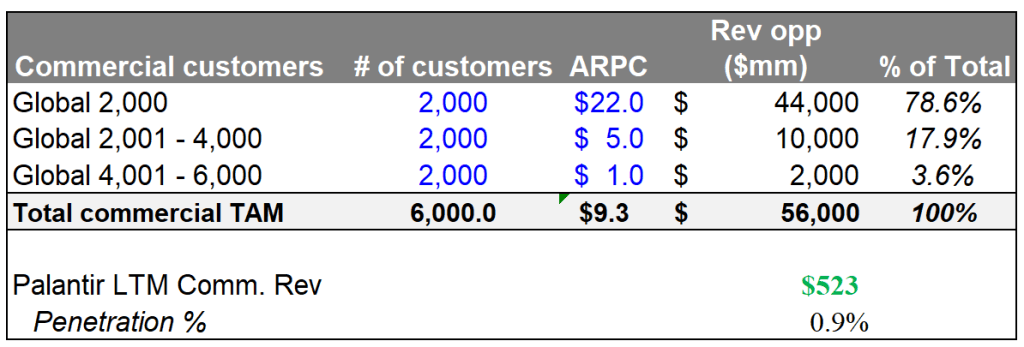

Company management believes the core product is applicable to commercial customers with more than $500mm in revenue, roughly 6,000 commercial companies. Management estimated commercial TAM of $56bn, implying $9mm per commercial customer. This sort of TAM calculation signifies PLTR's market opportunity, with less than 1% of their potential commercial market currently on board.

Source: our estimates,

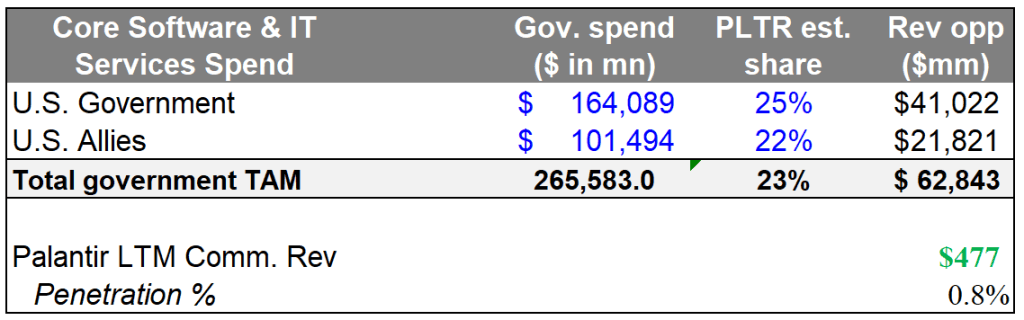

Source: our estimates,For government customers, management estimated a $63bn TAM in their S-1 based on their assumptions around software and consulting services penetration of US and US-allied governments. We estimate spend based on Gartner FY24 IT spend estimates (link – subscription required). This sort of government TAM calculation once again signifies that PLTR has penetrated less than 1% of this potential market opportunity.

Source: our estimates, company S-1

Source: our estimates, company S-1Sell-side estimates vary from $55bn at Citi (source: subscription required), who utilized a top-down methodology, and $105bn at Goldman (source: subscription required) based on similar methodology to Palantir’s estimates. Regardless of methodology, these sort of TAM levels imply PLTR has penetrated less than 0.8%-1.8% of their total market opportunity. Clearly, there is room to run if management is able to execute effectively and grab more market share.

Government services

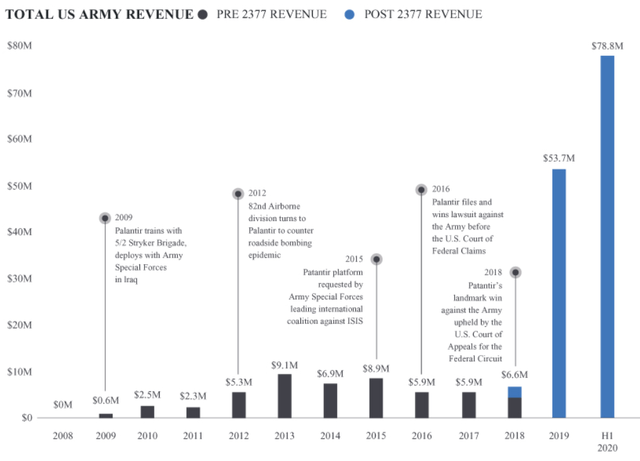

Recent strength in the government segment was primarily due to the results of a lawsuit – specifically a lawsuit in 2016 against the US Army that allowed the army to consider commercially available products instead of strictly using custom-built software solutions. In 1H20, the US Army represented 31% of total government revenue vs. 16% in FY 2019. Palantir says in their S-1 "Our victory in federal court has already had a significant impact on our business. We generated a total of $51.9 million in revenue from our U.S. Army accounts from 2008 through September 2018, when the federal court ruled in our favor. After the ruling, in less than two years, between October 2018 and June 2020, we generated $134.5 million in revenue from those accounts."

Source: Company S-1

While PLTR has worked with other government agencies such as the Dept. of Defense, US FDA, CDC, and NIH, there is still a large customer concentration within the US Army. PLTR has signaled its attempts to broaden into other western-allied governments, but it is unclear how much traction, if any, the company has outside the US government. Some government customers like the UN have begun to expand into commercially-focused product such as Foundry, which is a positive theme for future cross-selling opportunities.

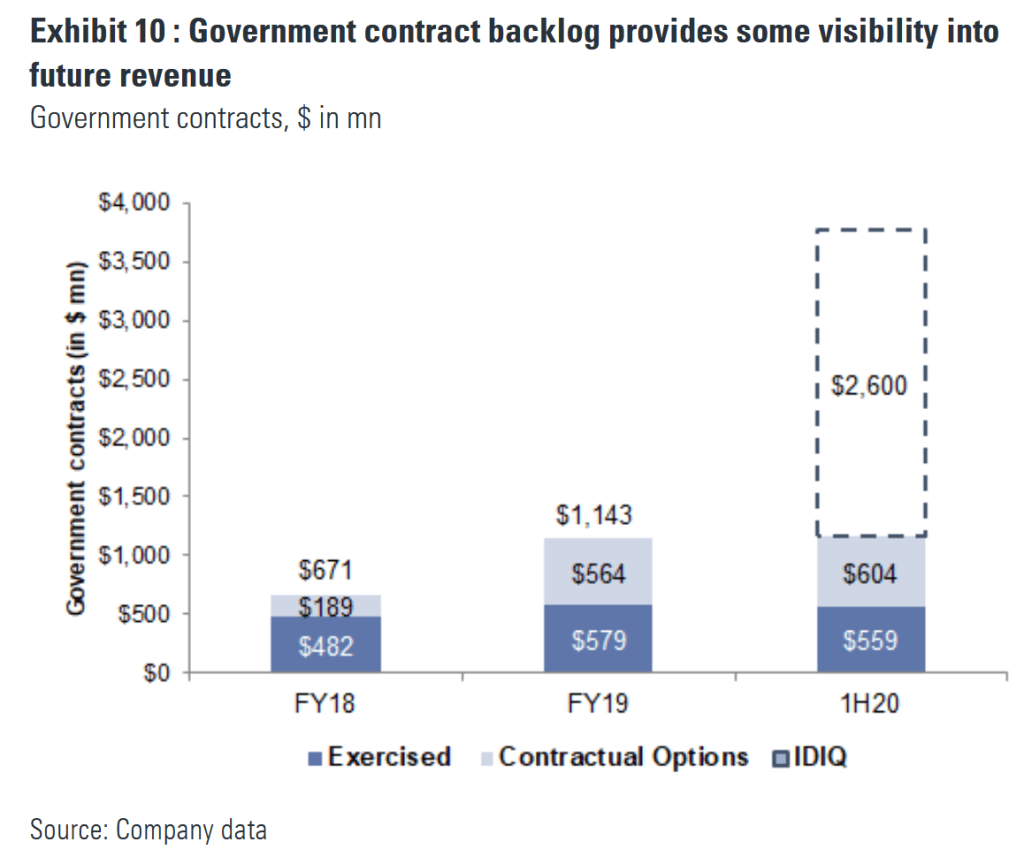

Government contract backlog provides some visibility into future revenue, at least more visibility when compared to the commercial segment. PLTR has indefinite delivery, indefinite quantity (IDIQ) government contracts totaling $2.6bn as of 2Q 2020 per the S-1. These are awarded contracts, but the funding has yet to be determined and is not guaranteed. With little certainty surrounding funding and timing, these contracts represent potential upside to our estimates.

Commercial services

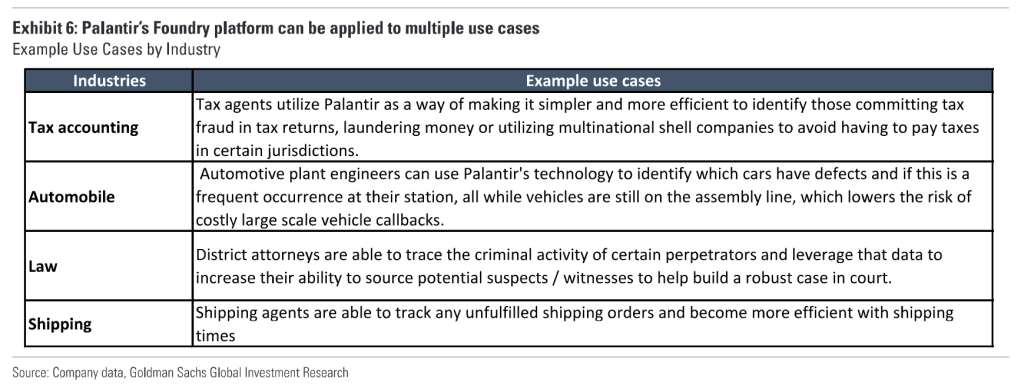

In 2016, Palantir launched its Foundry platform – a centralized data OS for customers in the commercial space. Customers can use the platform to manage, filter, and visualize large datasets. Sustainable growth in the commercial segment will hinge on efforts to broaden use cases and leveraging sales reps to drive top line growth.

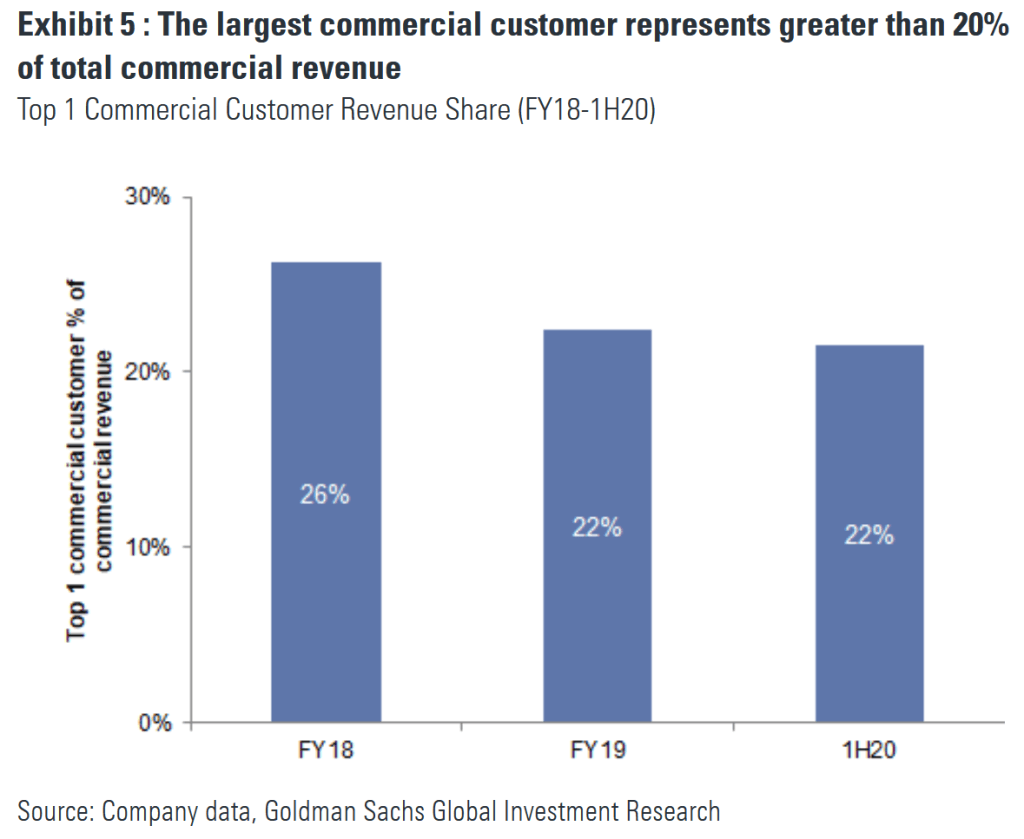

With ARPC at $5.8mn as of the last 9 months of 2020, PLTR has a meaningful opportunity to expand via new use workflows and growth in users. Sales cycles and implementation times can be long given PLTR’s complexity per the S-1, but once commercial organizations see and realize the value, spending growth can grow at a rapid rate. It is critical that PLTR reduce sales times and becomes more efficient in implementation in order to diversify its customer base as its largest commercial customer represents greater than 20% of total commercial revenue.

While the company has expanded into various industries and use cases over the last several years, its customer count remains among the lowest in growth software – Morgan Stanley estimate 131 (including government entities). Today, product market fit remains narrow and tailored to specific scenarios or one-off situations (table below). The use cases also tend to be concentrated around a few industries such as energy, transportation, financial services, law, and healthcare. Near-term visibility in the commercial segment remains low and depends entirely on the execution and size of a few contracts per quarter and year.

Quarterly Earnings recap

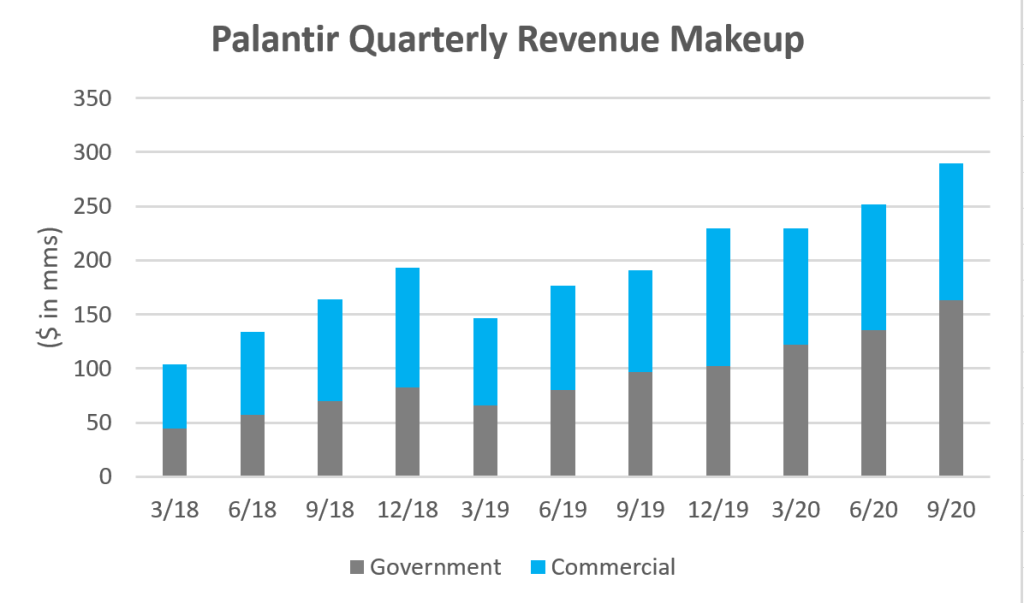

Palantir put up a strong 3rd quarter in its first quarter as a public company. There was ongoing momentum for the government business, as revenue growth accelerated from 56% in Q2 to 68% in Q3. Most impressive, the commercial business grew 35% y/y, up from 17% in 2019. Total revenue growth accelerated to 52% y/y, up from 43% last quarter.

The company also announced efforts to modularize (flexibility around the full-stack solution) its Foundry product and to accelerate the pace of app development according to their Q3 earnings call. These efforts will help drive broader product market fit in the commercial segment and drive more sales. We like these solutions as it shows Palantir is adapting to the needs of its customers in order to gain more future customers. The full-stack or perhaps a not-so-full-but-fuller-stack solution capability can be expanded once a customer is up and running on Foundry. These sorts of efforts will be crucial in diversifying the customer base.

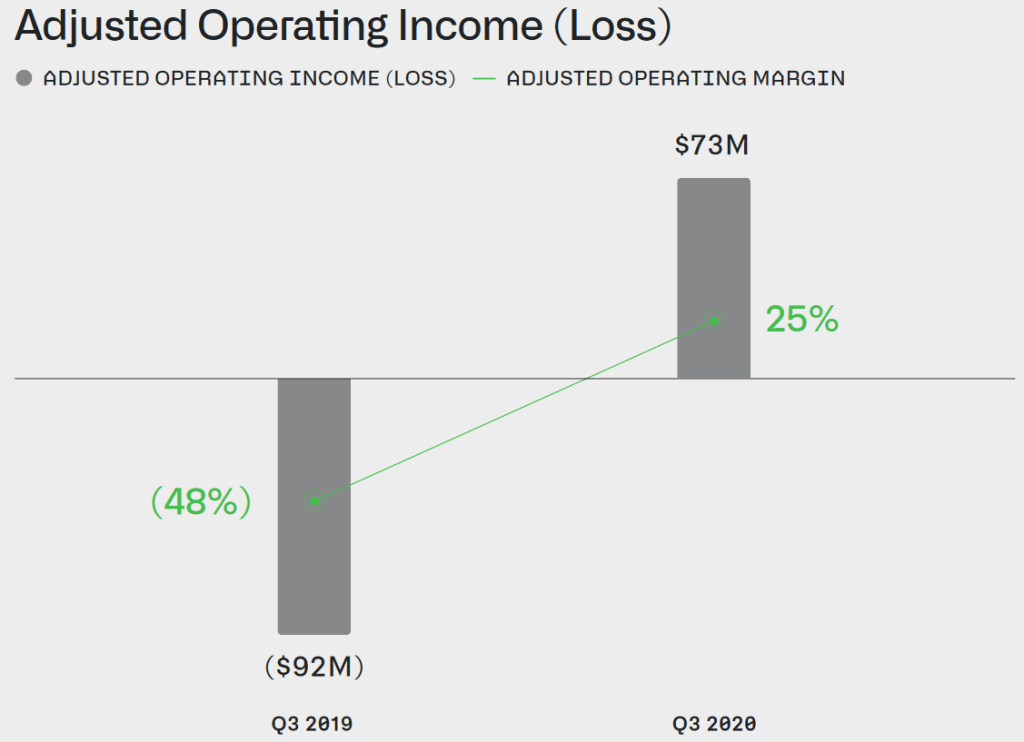

Adjusted operating margins improved and were a positive 25%, up from -48% a year ago in Q3. This healthy margin expansion was primarily due to greater efficiencies in acquiring and scaling customers. We expect PLTR to generate further operating leverage with a more experienced sales force and account management teams.

Source: Company Q3 presentation

Source: Company Q3 presentationPLTR Comparables Trading Multiples

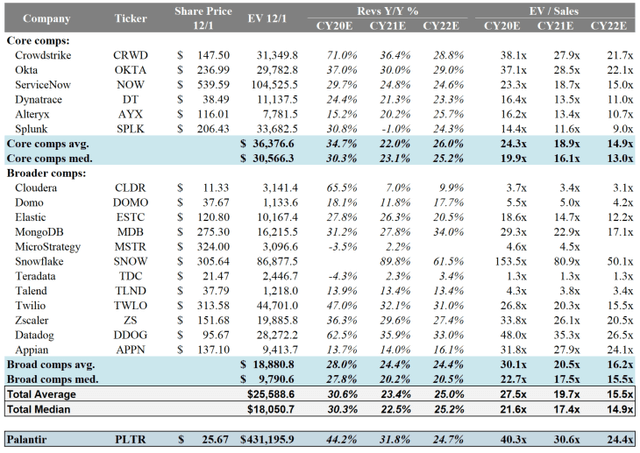

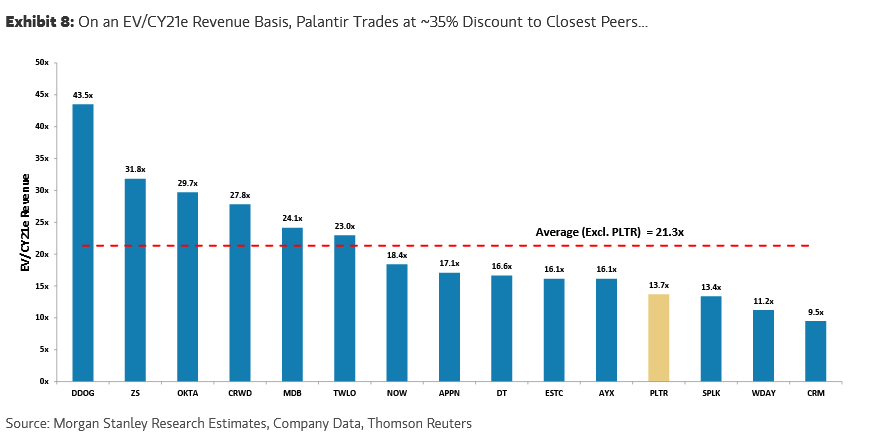

Shares are currently trading 40.3x/30.6x CY20/CY21 sales estimates per Bloomberg Earnings Consensus estimates (source: subscription required for Bloomberg Terminal). Post-IPO PLTR was trading at a discount to peers, now it is trading at a premium.

Post-IPO Discounted Trading, and no longer relevant

Post-IPO Discounted Trading, and no longer relevantFor core comparable companies, we use software companies with high growth estimates. For the broader comparable companies, we use a wider range of software companies. High growth software companies are currently trading at an average of 18.9x 2021 sales and the broader comparables market is trading at an average of 19.7x 2021 sales (largely due to Snowflake) according to Bloomberg estimates. Palantir is currently trading at 30.6x 2021 sales. Across every EV/Sales metric for the next 3 years, PLTR is trading at a significant premium over the core comparables, the wider broad comparables, and the total of both trading multiples.

However, this premium can be justified, because as we can see PLTR’s forecasted revenue growth is higher than the comparables estimates. However, PLTR also has higher customer concentration and lower revenue visibility than most of the comparable companies, so this premium is especially risky at current valuation levels.

These two factors combined: customer concentration + lack of revenue visibility (negative) and higher forecasted revenues (positive), does the stock deserve its premium?

Valuation

We use an Enterprise Value/Free Cash Flow valuation for this company. We get a $20 target price which is based on 37.5x EV/FCF multiple on 2025E Free Cash Flow of $1.165bn. We also get $4.44 bn in 2025e revenues. For reference, Morgan Stanley uses a 40x 2025e FCF source, Citi 35x 2026e FCF source, and Goldman Sachs uses a combined DCF and 13.0x revenue model source.

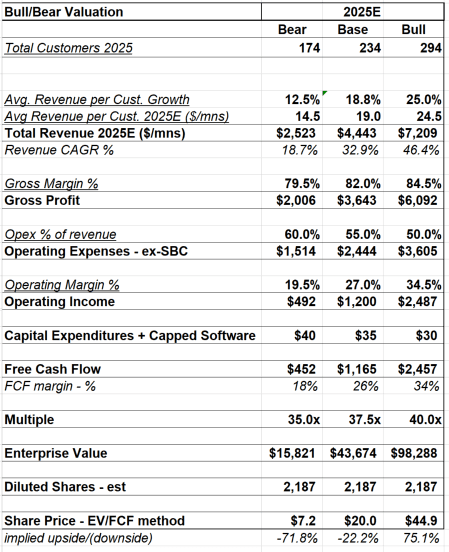

We lay out a range of Bear/Base/Bull cases with the main drivers of the valuation and our Base Case assumptions being:

- Number of net customer adds – 5 per year from current 131 customers to 234 customers in 2025.

- Avg. Revenue per Customer growth – 18.8% CAGR in avg. revenue per customer. From estimated $8mm per customer in 2020 to $19mm per customer in 2025e.

- Gross Margin % – a hefty 82% vs 81% last quarter.

- Opex Margin % – a hefty 45% vs 44% last quarter.

- Capital Expenditures – continuation of historical very low levels, tech companies usually have low capex.

- Free Cash Flow Multiple – 37.5x which is consistent with other high growth software data/analytics companies and between the Citi and MS multiples.

Source: our estimates

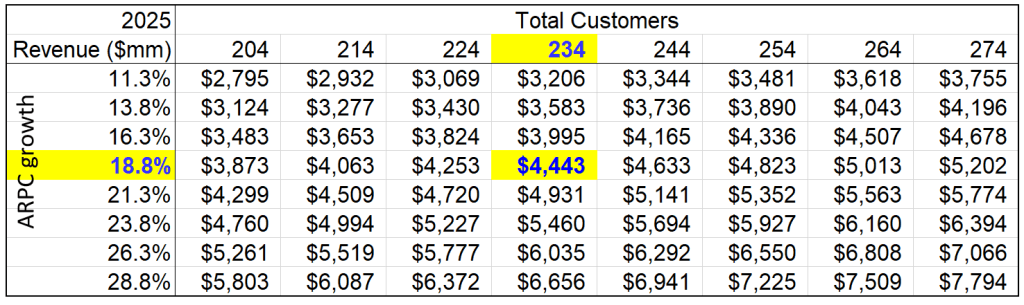

Source: our estimatesFor purposes of establishing a trading range for the stock, here is a grid of 2025e revenue scenarios given total customer count and ARPC CAGR. As you can see, the amount of revenue PLTR is able to squeeze from customers has a very large effect on the calculation.

Source: our estimates

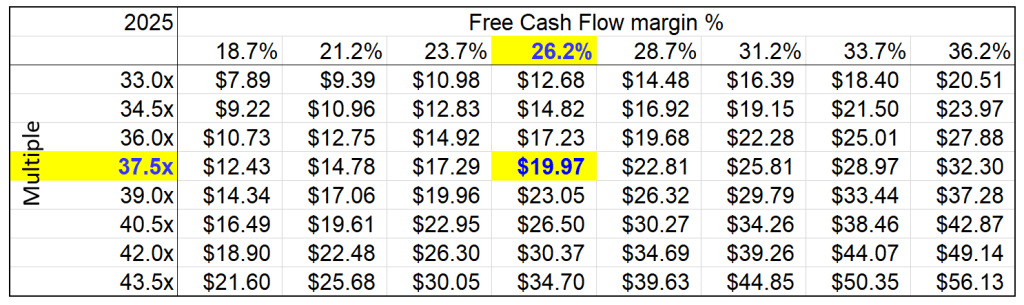

Source: our estimatesThen, depending on each of these future revenue scenarios, based on different free cash flow margins and valuation multiples, we get a range of stock prices. As you can see, for purposes of our Base Case, the FCF margin is 26.2%. The multiple and the cash flow margin have an equally large effect, with every 1.5x in the multiple adding ~$3 to the stock price in the middle range, and every 2.5% in FCF margin similarly adds ~$3.

Source: Our estimates

Source: Our estimatesKey Risks

Simply put, there are a lot of unknowns with this company. This is one of the most binary companies I have come across, it will either be a massive hit or a dud and I attempt to value it accordingly. This binary opportunity is primarily because of limited visibility into this company’s future sales. Palantir targets large-scale opportunities within large governments and commercial entities. These projects have high costs, long sales cycles, and are incredibly complex. A quarter’s earnings hit or miss and yearly growth can depend on a few contracts.

Customer concentration and a small base is another risk. Although PLTR has made some progress and decreased their total revenue attributable to the largest 20 customers from 68% the first 9 months of 2019, to 61% the first 9 months of 2020, PLTR has among the highest customer concentration in public growth software providers and the highest in their core comparables group (peer company table below). A significant decrease in revenue from a top customer can have an adversely large impact on the company.

| Company | Customers |

| Crowdstrike | 5,431 |

| Okta | 7,950 |

| ServiceNow | 892 |

| Dynatrace | 2,700 |

| Alteryx | 6,100 |

| Splunk | 19,400 |

| Avg. | 7,079 |

| Median | 5,766 |

Sources: Company 10-Ks

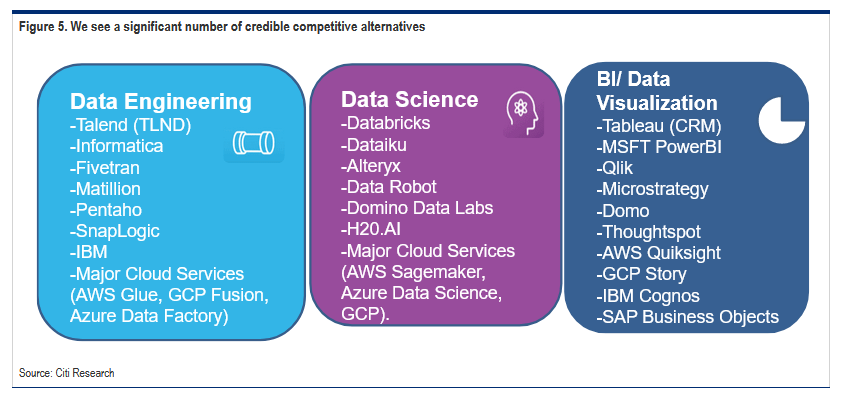

Competition is significant and PLTR’s full-stack approach may be abrasive and put it at odds with other tech vendors in the data/analytics space. Some organizations may see a relationship with PLTR as too limiting and would prefer more flexibility to use some of the best of breed tools from other software companies outside of PLTR.

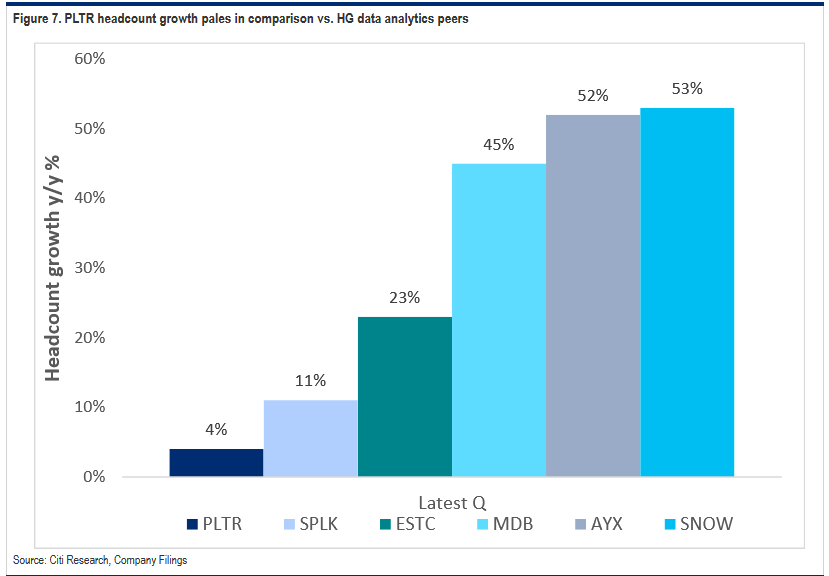

Recent and near-term expected hiring doesn’t inspire confidence in significant growth. Palantir expects to only grow headcount 4% in FY20 and operating expenses have notably declined, with guidance continuing this decline.

Palantir is not a young company, it was founded in 2003. Although PLTR is now hitting its stride and making significant progress and growth, the company has historically generated operating losses and negative cash flow per their SEC filings. This also ties in with the lack of detailed disclosures from the company. In its S-1 filing the company provided 6 historical quarters, but only included the income statement. Without more information, it is difficult to understand or predict the seasonality of the business appropriately.

Key catalysts

Increased commercial adoption is a massive catalyst for PLTR. If the company is able to improve adoption by introducing more flexible workflow solutions that meet a larger segment of the commercial market, the addressable market opportunity is incredible and can be swift. In addition, improving sales efficiency could drive higher profitability than we have currently modeled.

The company is currently profitable with 25% adjusted operating margins in Q3 2020. Management highlighted the release of Apollo, the continuous delivery software that powers the Foundry and Gotham platforms, as the main driver in these efficiency gains in their Q3 earnings call. The efficiencies generated by Apollo and more "productized" offerings have resulted in a lowered average implementation time and a subsequent decrease in the days it takes to ERP integration going.

In conclusion

Palantir has been traded with significant volatility but is still high above its IPO price of $10. This is a retail favorite and we expect more volatility short-term, especially as it has one of the most active options volume and an implied volatility of 61.59% at time of writing according to barchart options screener. We think that at these levels PLTR is still traded very richly and would wait for a price closer to our $20 price target in our Base Case before buying or increasing position size. However, if you are incredibly bullish on the company prospects, our $44 price target in our Bull scenario makes this name look cheap. If you are already a holder, we say enjoy the ride and stay long. This is a stock to watch.