The manner by which payment methods have evolved over the past couple of decades has been nothing short of impressive. One way to participate in this fast-growing market is through the leading Fintech company, Fiserv (FISV). Shares have performed well since my last bullish take on the company, with an 18% return since my article was published in September. This has far outpaced the 10.5% return of the S&P 500 (SPY) over the same timeframe. I see further upside for the share price, and evaluate what makes Fiserv a buy a the current price, so let’s get started.

(Source: Company website)

A Look Into Fiserv

Fiserv is a leading global payments and financial technology company. It provides innovative solutions to clients in the areas of digital banking, card issuer processing and network services, payment solutions, e-commerce, merchant services, and cloud-based point-of-sale solutions. Today, it has 1.4 billion global accounts on file, 6 million merchant locations globally, 10,000 financial institution clients, and handles more than 12,000 financial transactions per second. Fiserv is a member of the S&P 500 Index, and in 2019, it generated $10.2 billion in total revenue.

Fiserv continues to weather the current economic environment fairly well, with 3% YoY internal revenue growth in the third quarter, excluding currency effects and divesture adjustments. This growth was led by Fiserv’s merchant acceptance segment, which exhibited 6% YoY internal revenue growth. This is the largest segment and represents 41% of Fiserv’s total adjusted revenue. The other two segments, Fintech and Payments, were roughly flat, with 0% and 1% YoY internal revenue growth, respectively.

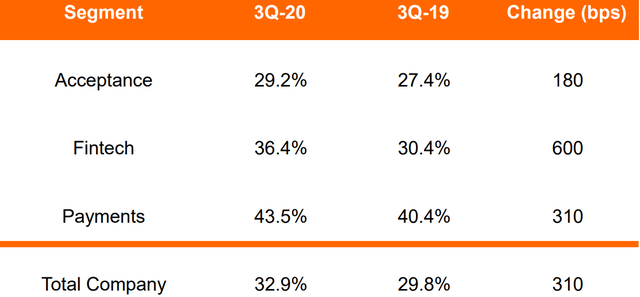

While the internal revenue growth was not too impressive, the bigger picture was driven by strong margin and free cash flow growth. FCF/share has grown by 13% YoY, to $4.88 per share for the trailing 12-months. Adjusted operating margin grew by 310 basis points on a YoY basis, with all three segments showing growth, of which Fintech leads the way. I see this as being a positive sign of Fiserv growing its economy of scale, through which incremental business lowers the infrastructure costs on a per transaction basis.

In addition, I see merger synergies stemming from the First Data acquisition (rolled into the Fintech segment) last year as bearing fruit. This is supported by the Fintech segment seeing the biggest (600 bps) boost to operating margin on a YoY basis, as seen below.

(Source: Q3’20 Investor Presentation)

Looking forward, I’m remain optimistic on Fiserv’s strong growth prospects, as demonstrated by Fiserv’s sales bookings increasing by 27% YoY in the third quarter, and 23% YoY for the first nine months of the year. In addition, Fiserv’s Q4 started on strong footing, with the signing of a long-term agreement with Alliance Data, to outsource processing for their co-branded and private label card programs. I see this as being a strong incremental value driver for Fiserv, given that Alliance Data (ADS) is the fourth largest card issuer in the U.S. by accounts, with many existing relationships with notable merchants, such as Wayfair (W), Pottery Barn (WSM), and Ulta Beauty (ULTA).

Plus, Fiserv continues to grow its relationships with banking institutions, and has a strong pipeline, as noted by management during the last conference call:

Our bank merchant synergy program also continues to make strong progress. In October, we signed our 200 financial institution since the merger. In the third quarter, we added 35 new bank merchant clients, bringing the total to more than a 130 new clients this year with about 60% of those as compared to takeaways. We have increased the pipeline to more than 500 financial institutions for one of the most important opportunities for the combined company.”

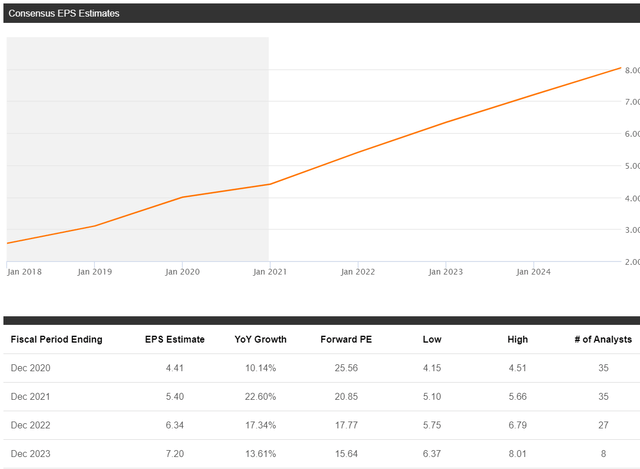

Turning to valuation, Fiserv isn’t necessarily cheap, at the current price of $112.63, and a forward P/E of 25.5. However, I find the valuation to be reasonable, considering the forward growth estimates. As seen below, analysts are forecasting double-digit EPS growth rates over the next few years, which brings the forward P/E down to 15.6, based on 2023 earnings projections.

(Source: Seeking Alpha)

As such, I wanted to calculate the PEG ratio, based on the following inputs:

- Price: $112.63

- EPS: $4.41 (based on 2020 estimate)

- Growth Rate: 17.85 (based on the average of 2021-2023 growth rates)

Based on the calculation above, I arrive at a PEG ratio of 1.43. While a PEG ratio of 1 is generally considered to be fair value, I use a range of 1.25 - 1.75 as my own basis for fair value for well-established and moat-worthy companies. In the case of Fiserv, I assign a PEG ratio target of 1.75, given the recession-resistant and fast-growing nature of the business. This implies a 22% upside (1.75 / 1.43 -1), from the current valuation and a $137.83 fair value estimate ($112.63 x 1.22). As such, I find the current valuation to be attractive.

Analysts appear to agree that the shares have upside potential, with a consensus Buy rating (score of 4.5 out of 5), and an average price target of $134 per share.

Risks to Consider

Revenue growth in the near-term could be challenged, given the surge in COVID infection rates over last two months. I expect this to remain a headwind as we enter the winter months, which could result in decreased consumer mobility and transaction volumes for Fiserv to process. The current stalemate between the President and U.S. Congress on the Covid-19 relief bill could add further stress to the economy, which could also be a negative for consumer spending, and thereby for Fiserv as well.

Lastly, Fiserv has a somewhat leveraged balance sheet, due to its M&A activity last year, with a debt to adjusted EBITDA of 3.7x. This is higher than the 2.5x level that I generally prefer to see. Fiserv’s total debt outstanding at the end of September 30, 2020 was $21.3 billion. However, Fiserv generates ample amounts of cash, with a levered free cash flow (after meeting financial obligations) of $3.8 billion for the trailing 12 months. Management is deleveraging the balance sheet with FCF, with the expectation of $1.5 billion in total debt repayments for full-year 2020. Investors should continue to look for progress in future deleveraging.

Investor Takeaway

Fiserv is weathering the current environment fairly well, with internal revenue growth, strong margin expansion, and FCF/share growth. It also has promising pipeline of banking relationships, and continues to grow its footprint in the card processing arena, including the recent signing of a long-term agreement with Alliance Data.

I’m encouraged by management’s deleveraging progress this year, and would like to see further debt pay downs going forward. As noted earlier, I find the valuation to be attractive, considering the strong forward growth estimates, and Fiserv’s moat-worthy position and relationships in the Fintech space. Buy for growth.

Thanks for reading! If you enjoyed this piece, then please click "Follow" next to my name at the top to receive my future articles. All the best.