"If we could buy a group of leading pharmaceutical companies at a below-market multiple, I think we'd do it in a second." - Warren Buffett

Recently, the 'Oracle of Omaha' took his own advice from 1999 and bought up more than $5 billion worth of big pharma stock in Bristol-Myers Squibb (BMY), AbbVie (ABBV), Merck (MRK) and Pfizer (PFE). Though following Buffett blindly has led some astray before, I believe it is a good time to take a look at the big players in the pharmaceutical industry. Below I have compiled a list of 10 big pharma companies along with their respective PE ratios, dividend yields and market capitalisations. After doing some research in a previous article, Finding Value As We Near A Possible End To The Bull Market: European Markets, where I searched European markets for undervalued names, one particular company caught my eye: Sanofi (NASDAQ:SNY). Though perhaps less well known than some others on the list, Sanofi shows signs of accelerating out of a malaise the business has found itself in for the last decade.

| PE Ratio | Dividend Yield | Market Cap | |

| Johnson & Johnson (JNJ) | 20x | 2.5% | $422 billion |

| Roche (OTCQX:RHHBY) | 23x | 2.6% | $305 billion |

| Novartis (NVS) | 16x | 3.2% | $218 billion |

| Merck (MRK) | 14x | 3.1% | $211 billion |

| Pfizer (PFE) | 13x | 4.3% | $204 billion |

| AbbVie (ABBV) | 11x | 4.7% | $195 billion |

| Bristol-Myers Squibb (BMY) | 11x | 3% | $250 billion |

| Amgen (AMGN) | 15x | 2.9% | $143 billion |

| AstraZeneca (AZN) | 13x | 1.8% | $135 billion |

| Sanofi (SNY) | 13x | 3.4% | $124 billion |

| Average | 16x | 3.2% |

Company Overview

Sanofi is a diversified global pharmaceutical company with three business segments: Pharmaceuticals (Specialty Care and General Medicines), Vaccines and Consumer Healthcare. What immediately caught my attention is its PE ratio of 13x versus an average of 16x in the above sample of ten big pharma companies. Its 3.44% dividend yield is also above the average of 3.2% within the sample. So why is this pharma giant trading at a lower valuation and paying a higher dividend than some of its peers? Let's first take a closer look at how and where it generates revenue.

Segment Breakdown

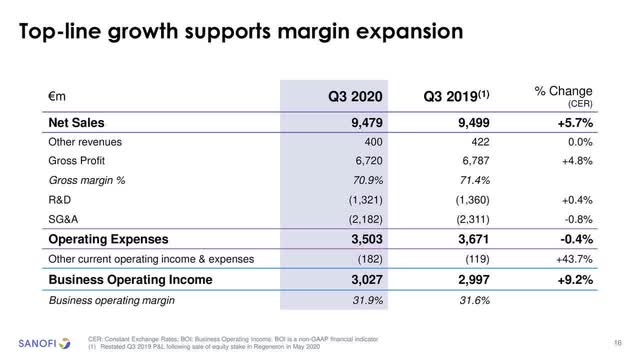

In its latest quarter (Q3), net sales were €9,479 million, up 5.7% at constant exchange rate (CER) and down 0.2% on a reported basis. Geographic breakdown was 42% in the U.S., 24% in Europe and 34% Rest of the World. Business EPS was €1.83, up 8.8% at CER and up 0.5% as reported. Free cash flow was €1,884m, an increase of 4.7% on the year before. Full year EPS guidance was also raised to an increase of 7 - 8% at CER, or between €6.05 and €6.09. Although this growth rate is less than some of its peers, I feel that the company is earlier in its current growth phase than others and will catch up to growth rates some other pharma companies are seeing right now.

Pharmaceuticals

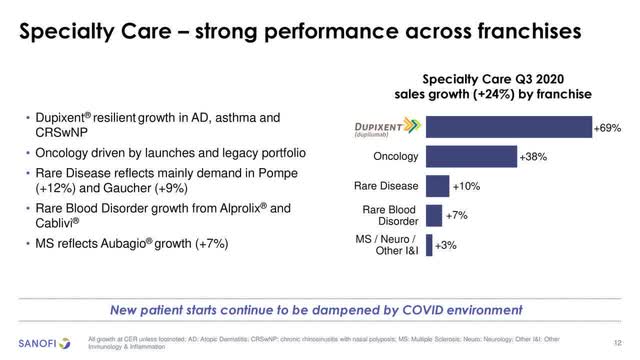

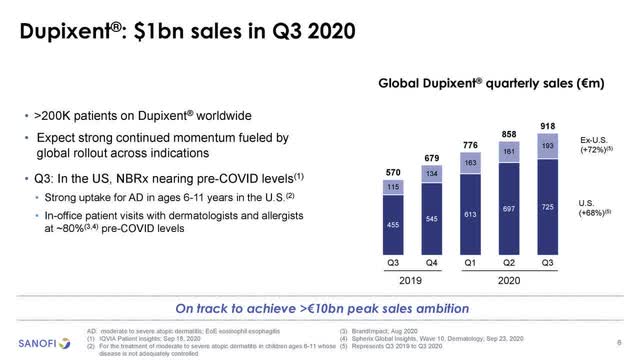

Double-digit sales growth in the quarter of the Specialty Care portfolio was mainly driven by the strong performance of Dupixent which offset a sales decrease in General Medicines due to pricing pressures in China and the Diabetes franchise in the United States. Dupixent is a 50/50 joint venture product with Regeneron Pharmaceuticals (REGN) that has been growing sales rapidly and is expected to be a major driver in future growth for Sanofi.

This segment is made up of Dupixent, as well as drugs used to treat multiple sclerosis, cancer, rare blood disorders, diabetes, cardiovascular diseases and other rare diseases. The company has made it clear it will continue to deploy R&D resources into growth areas such as oncology, rare diseases and immunology by announcing it has ended R&D investment in the diabetes and cardiovascular sub-segments. The company also announced this week that it will acquire Kymab, a UK biotech studying the use of new monoclonal antibodies in immune and inflammatory diseases, oncology and other indications with multiple candidates in its pipeline.

Sanofi 3Q Earnings Presentation

Vaccines

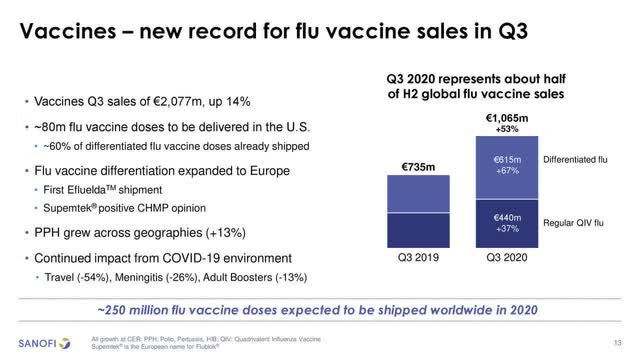

Vaccines sales increased 13.6% at CER to €2,077 million reflecting the strong influenza vaccines performance across all geographies. Sales are made up of vaccines for influenza, Polio/Pertussis/Hib, meningitis, and travel/endemic diseases.

Sanofi also has two COVID-19 vaccine candidates that it is developing with partners. The first is a recombinant protein adjuvant vaccine, or the 'regular' type of vaccine that has been used for many years. It is partnered with GlaxoSmithKline (GSK) and the Biomedical Advanced Research and Development Authority (BARDA) in the U.S. as part of Operation 'Warp Speed', for which it has received funding. However, this vaccine announced a delay last month due to an insufficient response in the over-45 age category for which a Phase 2b study with an improved antigen formulation (i.e. increased viral antigen concentration) is planned to start in February. The vaccine's availability is now expected in Q4 2021 pending successful trials. However the vaccine still has more than 600 million pre-orders once it does pass muster.

The second vaccine is an mRNA-based vaccine, similar to Pfizer and Moderna (MRNA), that Sanofi is developing with Translate Bio (TBIO) and is -on-track for a Phase 1/2 study starting early this year.

Sanofi 3Q Earnings Presentation

Consumer Healthcare

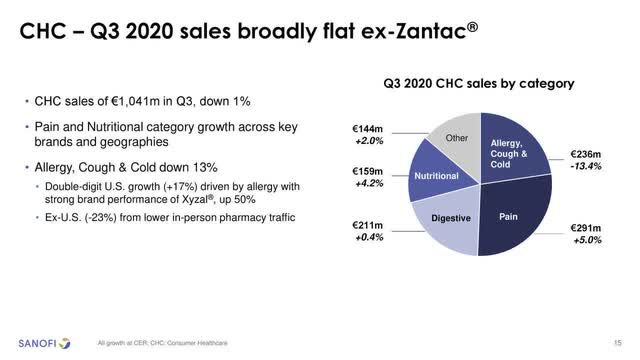

Sales decreased 1.1% to €1,041 million at CER, mainly reflecting lower in-person pharmacy traffic due to the COVID-19 pandemic and a lower demand for cough and cold products outside the U.S. Sales were also impacted by the voluntary recall of Zantac in October 2019. Excluding the Zantac recall, Q3 sales increased 0.1% at CER. Products sold include over-the-counter allergy, cough and cold medicines, as well as digestive, pain and nutritional products.

Sanofi 3Q Earnings Presentation

Sanofi 3Q Earnings Presentation

Company Future

So now that we know how the company makes money, we want to see how the company plans on growing itself, as well as growing shareholder returns. New CEO, Paul Hudson, took over in September 2019 and has gone about overhauling the company through efficiency measures (cutting €2 billion in costs by 2022, €1 billion already saved in H1 2020), focusing on deploying resources into growth areas (oncology, immunology), cutting debt and margin expansion due to these combined factors. This growth in margins can be seen in the latest quarter's numbers below.

Sanofi 3Q Earnings Presentation

Sanofi 3Q Earnings Presentation

Another way the company is looking to focus on growth markets is the planned spin-off of its Active Pharmaceutical Ingredient (API) manufacturing and marketing arm in 2022. APIs are the essential molecules used in the composition and the production of any drug, and are therefore vital in the supply of drugs around the world. The planned spin-off is a bonus after the already good work Mr. Hudson is doing in streamlining a typical 'big pharma' company that may have lost a little of its cutting-edge in the fast-changing world of pharma and biotech companies.

In a previous article, "The Best Way to Invest in Pharma and Biotech?", I talked about why investing in drug manufacturers may be a great way to earn good returns in the healthcare space without being subject to the constant 'scientific risk' pharmaceutical and biotech companies have to work with. The spin-off (named EUROAPI) will have a portfolio of more than 200 APIs and annual revenue is expected to reach €1 billion by 2022. In the highly fragmented industry for APIs, EUROAPI will be the largest manufacturer of small-molecule APIs and the world's second largest API manufacturer overall. Sanofi will spin-off the company debt free and retain a 30% interest in EUROAPI, thus allowing the company to focus resources on its drug pipeline while still having an interest in another growth industry.

Debt

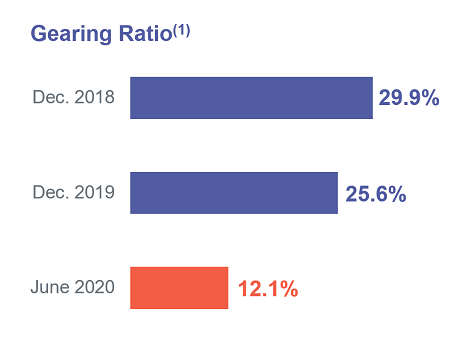

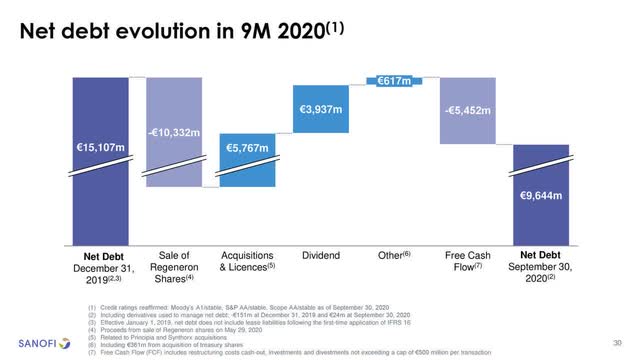

The company has suffered from high debt levels since its huge takeover of Aventis in 2004 and continued to buy up companies without a clear and sensible plan. This occurred as its major drug, Plavix, lost patent protection in 2012 and the company tried to replace its decreasing revenues. This period of unfocused acquisitions and resource deployment culminated in the 2019 appointment of the current CEO, Paul Hudson. The new CEO immediately set about making big changes to the company, one being cutting down on debt. The company's decreasing gearing level can be seen in the below graph, which will stand it in good stead with conservative investors who like to see strong balance sheets.

Net debt at Sanofi has been cut by 36% since December 2019 to €9.6 billion, with the sale of the non-core Regeneron stake bringing in more than €10 billion last May to plough back into the company's growth pipeline and debt repayment.

Sanofi 3Q Earnings Presentation

Sanofi 3Q Earnings Presentation

Pipeline

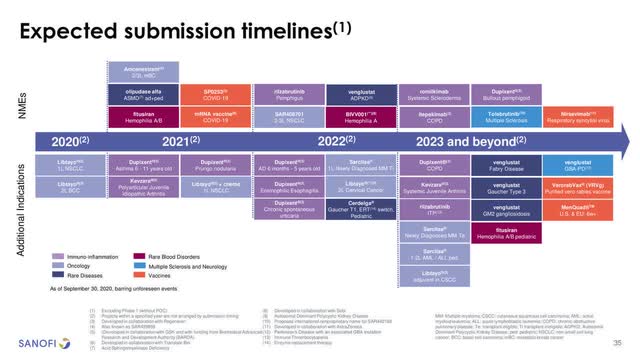

Under Hudson, the company has jumped on the success of Dupixent, a drug used in an ever-growing list of inflammatory diseases, and has focused its pipeline and resources into the growth markets of immunology and oncology. Sanofi has also gone the way of inorganic growth to strengthen its pipeline and future revenue potential, with small bolt-on acquisitions in areas the company has targeted. The $1.45 billion Kymab acquisition is the fourth since Hudson took over in 2019, with all the acquired companies developing drugs in the growing immunology or oncology fields. Below is a slide taken from the recent Q3 presentation that shows the large amount of drugs that are expected to be submitted for approval in the near future and beyond (correct as of September 2020). This is not even counting the numerous in-house and acquired drugs that are still undergoing Phase 1, 2 and 3 studies that could boost growth in the future.

Sanofi 3Q Earnings Presentation

Sanofi 3Q Earnings Presentation

Dupixent's current annual €3.5 billion sales are expected to peak at more than €10 billion a year with seven Phase 3 trials underway for new indications. In Dupixent, Sanofi has an impressively growing product whose cash flow will help the company invest in its future.

Sanofi Presentation at 39th JPMorgan Virtual Healthcare Conference

Sanofi Presentation at 39th JPMorgan Virtual Healthcare Conference

Who Doesn't Like Dividends!?

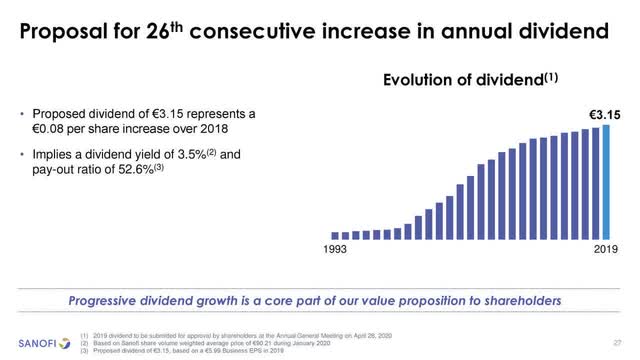

Another good reason to be positive when looking at Sanofi is its great dividend record. Although not the highest yield we can find in the market, the current 3.44% yield is nothing to sneeze at and with an annualised dividend growth of 44.2% since 2000, dividend growth investors can be happy in the knowledge that the company has been good to dividend investors. That thought is reiterated in the below image which shows the company's 26 years of increased dividends.

Sanofi 3Q Earnings Presentation

Sanofi 3Q Earnings Presentation

Risks

As with all investments, there are risks involved. Firstly as a large pharmaceutical company, the 'scientific risk' of big trials not succeeding and drug candidates falling by the wayside is the largest risk. However, with such a variety of candidates at different stages of the approval process, Sanofi has put itself in as good a position as possible by diversifying its drug pipeline. As one of many big pharma companies, Sanofi competes in many of the same markets as some bigger names. Another risk is that of large acquisitions that don't pay off, with inorganic growth a major way the company has grown in the past. Saying this, recent purchases have been small bolt-on buys to complement the existing pipeline so as long as that continues and there are some successes then I wouldn't be too worried. One final thing to think about is the currency risk involved with buying a company that has sales worldwide and is therefore heavily influenced by currency fluctuations. Buying the ADRs on the Nasdaq also mean you receive dividends in $US and therefore the Euro/$ exchange rate will influence the amount you receive.

Conclusion

After some research, Sanofi stood out as an interesting company trading at a discount to its peers in the pharmaceutical industry. I hypothesise that this may be due to not having many 'blockbuster' drugs that show a long runway of growth, and therefore cash flows, into the future. The market also doesn't seem to have rewarded the company after a good start to the new CEO's vision for streamlining and focus. However the company's excellent handling of Dupixent's growth, clear goal of margin expansion, debt repayment and focus on specific growth markets show me that the underlying company seems to be heading in the right direction even if the stock market hasn't caught on yet.

The company hasn't splashed cash on huge acquisitions, rather looking to small bolt-on buys to enhance its pipeline and future growth prospects. Its focus is demonstrated in stopping R&D spend in the increasingly-commoditised diabetes and cardiovascular drug segment and in its plan to spin off its non-core API manufacturing arm in 2022.

I think Sanofi is a clear buy at current levels, with the downside covered by an increasingly strong balance sheet and cash flow, as well as a dividend with 26 years of continuous growth behind it. Catalysts to drive the stock higher could be positive drug approval news, as well as continued strong growth in Dupixent sales. A near-term return to 'normal' life after COVID-19 vaccinations could boost revenue as well, with the Consumer Healthcare segment particularly geared towards this. Finally, any positive news in regards to the company's two COVID-19 vaccines would be very welcome not only to shareholders, but people around the world as we continue to wait to get back to our 'normal' lives once a sufficient number of widespread vaccination campaigns have been completed. Maybe then we can say "we beat it!".

I hope you all stay healthy and safe, and get vaccinated as soon as possible!

All figures are accurate as of the 17th of January, when the article was written.

Author's note: Thank you for your time and please comment if you have any suggestions for future articles or other thoughts! Please follow me at the top of the page if you're interested in reading more articles about my portfolio, my watchlist, or my investing world, and to keep up to date with the companies I cover.