The service sector, including finance & insurance, in the New York Fed's district, reports rising prices and wages, despite further deterioration in business. Weirdest economy ever.

This is another moment in the Weirdest Economy Ever, driven by stimulus, forbearance, bailouts, record money printing, record government-deficit spending, exuberant financial markets, and record low costs of funding: For companies in the service sector, the service economy still sucks but now more so than in prior months, and these companies are still shedding employees but now faster than in prior months, and yet wages and prices are rising.

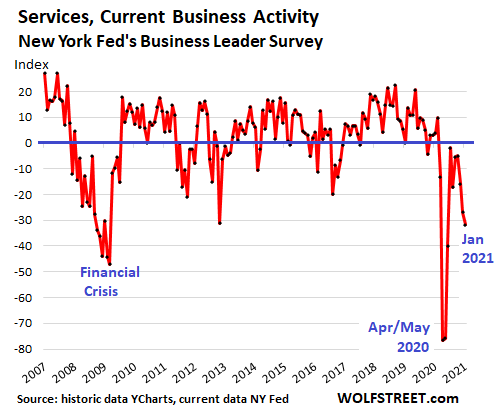

"Activity in the region's service sector declined at an accelerated pace," said the New York Fed this morning in its January 2021 survey of service sector companies in its district. The headline Current Business Activity index dropped five points to -31.8, the worst assessment of the service sector since June, which has now been on the decline for the 11th month in a row; and the decline has steepened over the past three months. Values above the blue line (zero) indicate improvement, values below the blue line indicate deterioration in this diffusion index (historic data via YCharts, current data via NY Fed):

Only 18.6% of the service sector executives in the survey reported that conditions improved during the month, and 50.5% reported that conditions worsened. The remainder reported "about normal" conditions (18.6% minus 50.5% = index value of -31.8).

The New York Fed's district includes New York State, Northern New Jersey, and Fairfield County, Connecticut. This is where the finance & insurance sector is concentrated, among many other services. Services in general account for nearly 70% of the overall US economy.

The New York Fed sends the survey on the first business day of every month to the same pool of 150 top executives of