I last wrote about Bank OZK (NASDAQ:OZK) in late October 2020. This article is a fourth quarter and year-end 2020 update, with a view to 2021.

My OZK investment thesis hasn't changed materially. The business navigated a tough 2020. After rising a little over 50%, stock valuation is less attractive, but there's still value left. Go forward plans are not without risk, but experienced bank management continues to demonstrate focus and discipline.

My OZK investment thesis hasn't changed materially. The business navigated a tough 2020. After rising a little over 50%, stock valuation is less attractive, but there's still value left. Go forward plans are not without risk, but experienced bank management continues to demonstrate focus and discipline.

A Refreshed Investment Thesis

Bank OZK is one of the best-run regional banks in America. CEO George Gleason obtained control of the bank over 30 years ago; he's grown a local bank into a regional powerhouse.

Bank OZK utilizes a unique business model. It relies heavily upon high-profile, complex commercial real estate transactions, strict underwriting standards, and high loan-to-deposit ratio. For decades, the model has resulted in superior returns, spreads, and credit metrics.

Currently, OZK shares trade about 17% below my Fair Value Estimate.

Bank OZK just recorded excellent fourth quarter and full-year results. On the earnings conference call, management expressed cautious optimism. A post-COVID economy has the propensity to improve bank earnings in general, and Bank OZK in particular. A return to a semblance of economic normalcy may be a catalyst for shares to continue to move higher.

The dividend is secure, and the current 3% dividend yield offers investors a solid income stream. The payout has been increased for the past 42 consecutive quarters. (That's not a typo).

Analysis Process

Similar to my last article, we shall break down our analysis into several bite-size sections:

Asset Quality

Net Interest Income

Loan/Deposit growth

Capitalization, Returns, and Efficiency

Valuation

Risks to the investment thesis

Asset Quality

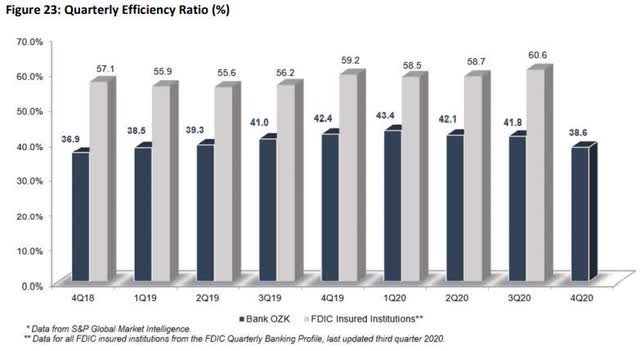

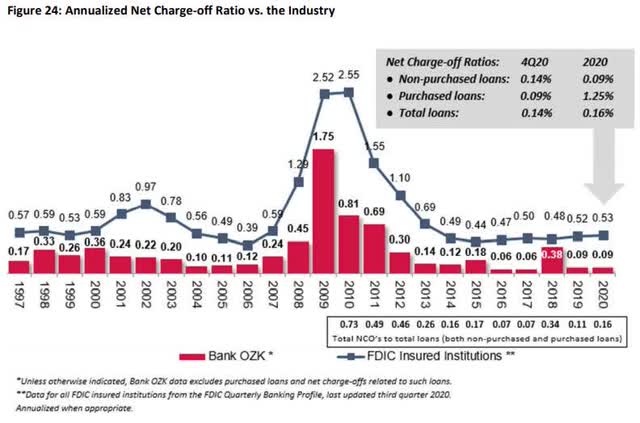

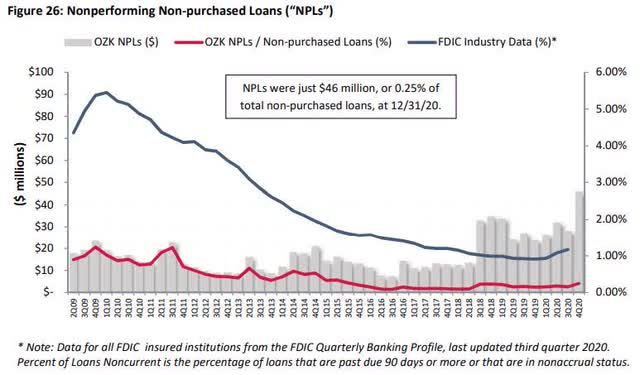

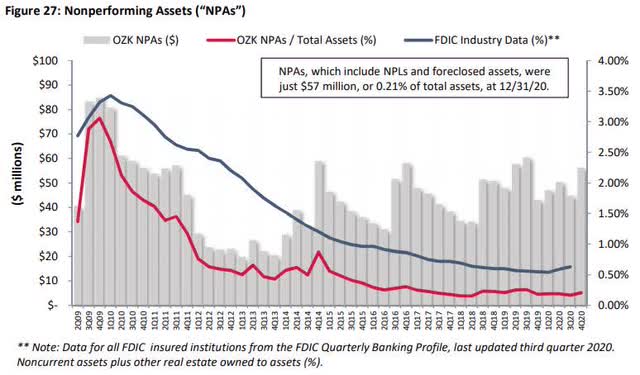

A continued focus upon asset quality permitted the bank to record a 0.14% net charge off rate for the quarter, and a 0.16% marker for the full year.

In addition, Bank OZK management likes to concentrate upon two other metrics: non-performing loans / total loans, and non-performing assets / total assets. These measures were also good. NPL / L was 0.25% for the year versus 0.15% in the prior year, and NPA / A for 2020 was 0.21% versus 0.18% in 2019.

Three charts highlight the long-term picture.

Note: Bank OZK graphics sourced via 4Q 2020 Management Commentary

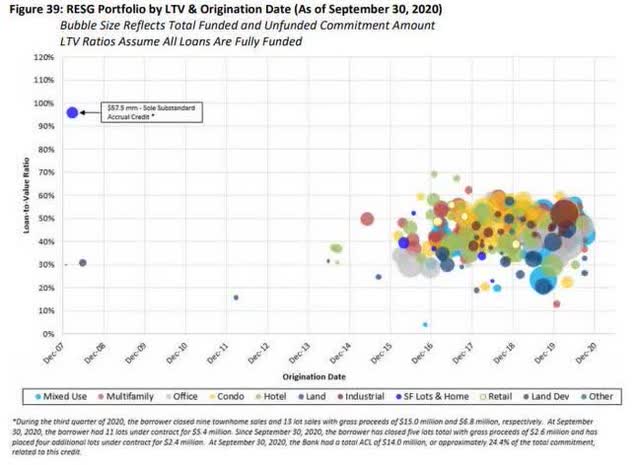

The bank does have one significant, substandard accrual credit. It's a front-and-center item when I review the quarterly reports. We will cover it in more detail in the "Bank OZK Risks" section of this article.

The bank does have one significant, substandard accrual credit. It's a front-and-center item when I review the quarterly reports. We will cover it in more detail in the "Bank OZK Risks" section of this article.

Net Interest Income

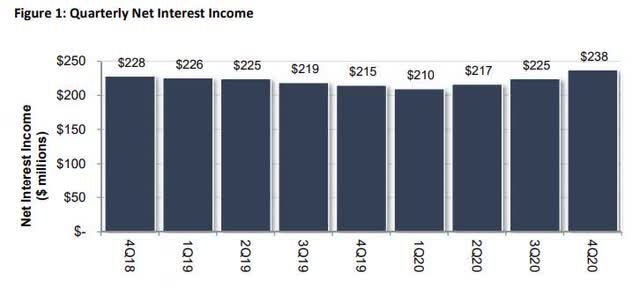

Broadly speaking, banks generate cash on the spread between what they make on loans versus what they pay depositors. Net interest income is a measure of what gets to the bottom line. It's a bank's bread-and-butter; NII is Bank OZK's largest single revenue line item.

For 4Q 2020, net interest income reached a new all-time high. The $238 million fourth quarter total was 10.5% higher than 4Q 2019. For the full-year, the firm squeezed out a nominal NII improvement.

Indeed, Bank OZK has now enjoyed rising net interest income over the past three quarters.

Investors should note 4Q results were favorably impacted by about $3 million due to certain one-off circumstances. This would not have changed the new NII quarterly record, nor the modest year-over-year improvement.

Investors should note 4Q results were favorably impacted by about $3 million due to certain one-off circumstances. This would not have changed the new NII quarterly record, nor the modest year-over-year improvement.

The good results are largely a function of another positive development: Bank OZK saw rising 4Q 2020 loan yield trends and net interest margin. The figures reversed a seven quarter string of declines.

Loan and Deposit Growth

COVID-19 put a damper upon 2020 domestic loan originations. Nonetheless, Bank OZK grew its loan book in the first and second quarters. In 3Q and 4Q 2020, total loans flatlined. Total 2020 loan growth was up 9.6 percent.

These results were in part influenced by a reduction in loan payoffs. COVID-related project delays extended certain loans. This took pressure off growing the overall loan book while concurrently fighting a volume of older loans rolling off. It's important to note such repayment delays were only temporary. In 2021, Bank OZK will be tasked with adding responsible loans while repayments snowplowed from 2020 into 2021 are combined with loans normally expected to be repaid in 2021.

On the other hand, throughout most of 2020, management curtailed a primary 2018 and 2019 loan growth driver: marine and RV loans. Bank OZK refused to chase loans (by compromising credit quality or lowering interest rates) and management elected to further slow the engine to rethink the situation.

However, in its 4Q 2020 Management Commentary, we now find:

During 2020, we implemented enhancements to our underwriting and pricing and are now increasing new originations with the expectation that we will maintain or improve on the portfolio’s already excellent credit quality while increasing margins and lowering premiums paid to dealers. We are slowly gaining momentum with this enhanced business plan, and we hope to see originations once again exceed pay downs from this portfolio sometime during 2021.

Later on, during the earnings conference call, management added color by indicating marine and RV loans are likely to contribute to loan book growth by mid-year.

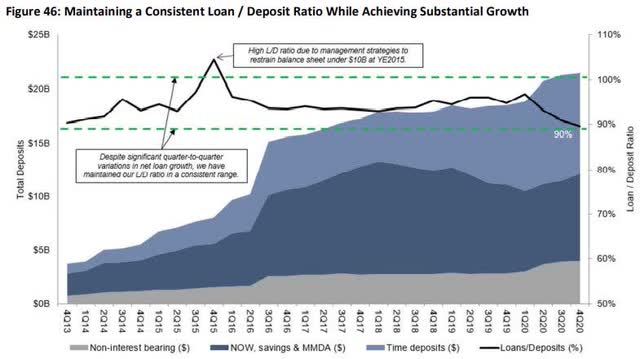

Meanwhile, deposits surged. 2020 deposit grew by $3 billion, or 16% versus 2019.

The deposit gains continue to silence certain bank critics.

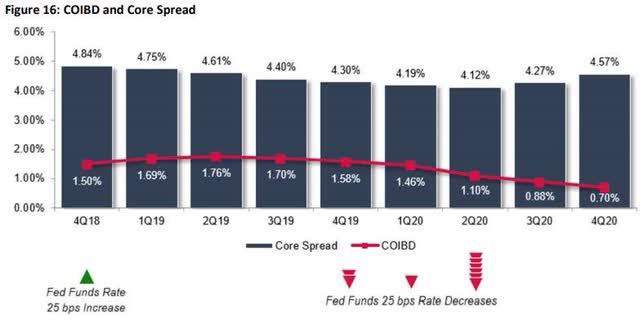

Bank OZK runs a unique business model. Traditionally, the loan-to-deposit ratio is targeted between 90% and 100%. Critics argue OZK is destined for liquidity problems; based upon the premise the bank chases too much “hot money” that will flee elsewhere for even marginally better rates. This hasn't been the case. Bank management has a deliberate, refined, and targeted approach to attracting and retaining deposits. Indeed, Bank OZK does pay higher rates than the national mega-banks. However, these rates (Cost of Interest Bearing Deposits) are balanced with non-purchased loan yields. The difference is what Bank OZK calls the “core spread.”

Core spread increased in both the third and fourth quarters.

Core spread increased in both the third and fourth quarters.

Bank Capitalization, Returns, and Efficiency

Bank capitalization offers investment insight as to how well an institution can weather a financial storm. Bank regulators set minimum requirements for several key capital ratios.

I like to key on CE/A or Common Equity over Assets ratio. Specifically, the preferred bank metric is CET1/RWA, or Common Equity Tier 1 divided by Risk-Weighted Assets.

As of year-end 2020, Bank OZK maintained a robust 13.3% CET1 ratio. The bank is very well-capitalized; the aforementioned ratio indicates OZK holds a buffer 6.8% greater than regulatory-driven requirements.

Despite a high capitalization ratio, OZK maintains return-on-equity and return-on-assets materially above industry averages; in 4Q 2020, RoE and RoA were 11.4% and 1.79%, respectively. Both figures are far above most banking peers. This is a function of several factors, including superior NIMs and a lower efficiency ratio. Indeed, Bank OZK records one of the best efficiency ratios (non-interest expense divided by revenue) in the business.

Please see the following chart for more detail.

Valuation

Bank OZK continues to provide investors with strong fundamental performance. However, after a 50% runup in share price, is the stock still a buy?

Let's do some checking.

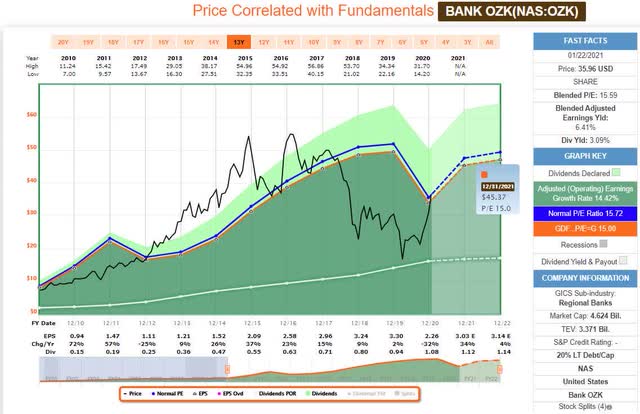

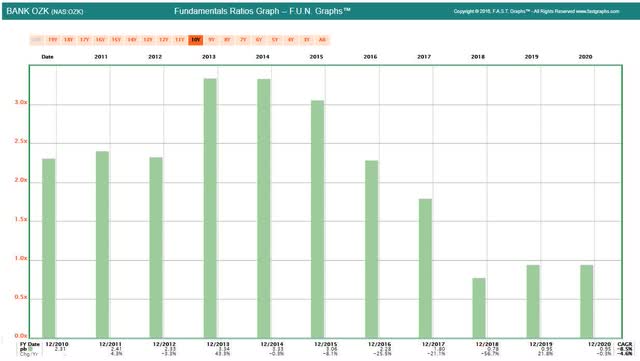

A F.A.S.T. graph helps illustrate the long-term price-versus-earnings relationship.

Back in October, when shares went for under $25, the stock looked like a screaming bargain. Now, with shares at $36 and change, I find the valuation less compelling; however, there's still upside.

The post-Great Recession trimmed P/E is just under 16x. If we round down to 15x, and accept consensus 2021 EPS estimates, OZK is a $45 stock. The current $3.03 EPS forecast for 2021 is 23 cents higher than October 2020 estimates. This reflects renewed confidence, expressed by management and the Street, that the COVID economic woes are going to fade. As such, the bank is poised to generate earnings on par with pre-2020 figures.

To be fair, one could argue the long-term 15.7x multiple is predicated upon a 14% EPS growth rate. That kind of growth isn't likely going forward; at least not looking out 10 or 12 years.

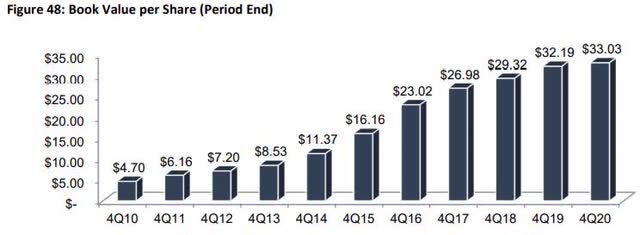

So let's look at another valuation metric: Price-to-Book value.

First, here's Bank OZK's year-end, post-Great Recession price-to-book ratios:

The 2020 marker is just under 1.0x, well below the historical norm. Adjusted for a recent price, the P/B is now about 1.1x.

The 2020 marker is just under 1.0x, well below the historical norm. Adjusted for a recent price, the P/B is now about 1.1x.

Even a 1.25x P/B indicates a $41 stock (OZK ended 2020 with a $33.03 book value). To boot, bank management has done an admirable job creating shareholder value. Since 2016, book value grew by ~12% a year.

Over the next 12 to 18 months, I believe OZK shares may be valued between $41 and $43 each. At midpoint, that suggests a potential 17% capital appreciation uplift from recent bids. The dividend is gravy. My revised FVE is ~14% higher than previous. This is based upon strong near-term execution / performance, a reversal of declining net interest margin / income, and abating COVID economic impact.

Over the next 12 to 18 months, I believe OZK shares may be valued between $41 and $43 each. At midpoint, that suggests a potential 17% capital appreciation uplift from recent bids. The dividend is gravy. My revised FVE is ~14% higher than previous. This is based upon strong near-term execution / performance, a reversal of declining net interest margin / income, and abating COVID economic impact.

Note to readers: I never chase stocks. When I seek to open a new position, I try to wait for a general market pullback before pulling the trigger. Then I buy in one-third or one-quarter position increments, hoping the stock will go down along the way.

Bank OZK Risks

All investments contain risk. Bank OZK is no exception.

I envision two primary risks to my current investment thesis:

Lake Tahoe Townhouse Project

In my earlier article, I highlighted this risk. Here is an update:

For several quarters, Bank OZK has been reporting a substandard loan for a single-family development in the Lake Tahoe area of California. The $57.5 million loan, funded during the Great Recession, has struggled. Bank management has taken a $14 million ACL (Allowance for Credit Loss) on it; or about 25% of the loan. The current loan-to-value is about 95 percent. The loan-to-value was last appraised mid-year 2020.

Bank management indicated 2020 was a good year for the project. The developer drew upon loan funding, lots / homes sold with ample velocity, and the Lake Tahoe SF real estate market and new home sales was very strong.

Nonetheless, this loan isn't out of the woods. The loan-to-value remains high, and the size of the loan amount is material. Investors should continue to monitor the dynamics of the Lake Tahoe market and this loan.

Over the past several years, Bank OZK has re-appraised this project annually. I expect another bank appraisal around mid-2021. If 2021 shapes up favorably to 2020, and the loan-to-value comes down, it may begin to crack the door for the developer to re-finance the project with another institution. The incentive would be to initiate a new loan at lower rates than those contracted with Bank OZK (Bank of the Ozarks) back in 2007.

Bank OZK publishes a quarterly "bubble chart," and this loan is always front-and-center when I review quarterly earnings.

The 2021 Treadmill

The unique business model augments management execution risk.

The Bank OZK business model generates above-average returns/growth through highly-focused, conservative underwriting and an exceptionally high level of loan-to-deposit deployment. When loan pre-payment velocity increases (as it's expected to do in 2021), it pressures the RESG (Real Estate Specialty Group) team to redeploy the capital quickly and efficiently. Otherwise, the loan-to-deposit ratio falls, and other growth metrics along with it. Bank OZK runs an unusually high L2D ratio: between 90 percent and 100 percent.

Between 2015 and 2017, the bank acquired several smaller banks. Purchased loans associated with these banks are rolling off the book quickly. In addition, low interest rates are encouraging accelerated loan pre-payments via the non-purchased loan book. Bank OZK is facing a stretch of unusually high pre-payment velocity. The pace started picking up in 2019; however, as noted earlier in this article, prepayments took a breather for much of 2020, largely due to the pandemic. But the underlying drivers behind these pre-payments haven't changed. Therefore, presuming CRE activity continues to move towards a more normalized cadence, management warned 2021 pre-payments are likely to re-accelerate sharply: a combo of a high level of expected 2021 repayments, PLUS 2020 repayments snowplowed in 2021.

Between 2015 and 2017, the bank acquired several smaller banks. Purchased loans associated with these banks are rolling off the book quickly. In addition, low interest rates are encouraging accelerated loan pre-payments via the non-purchased loan book. Bank OZK is facing a stretch of unusually high pre-payment velocity. The pace started picking up in 2019; however, as noted earlier in this article, prepayments took a breather for much of 2020, largely due to the pandemic. But the underlying drivers behind these pre-payments haven't changed. Therefore, presuming CRE activity continues to move towards a more normalized cadence, management warned 2021 pre-payments are likely to re-accelerate sharply: a combo of a high level of expected 2021 repayments, PLUS 2020 repayments snowplowed in 2021.

So long as the RESG team can keep the treadmill running, this development isn't a problem. A renewed emphasis upon marine and RV loans may also help mitigate matters. On the other hand, if the team fails to find enough sound new business to backfill these pre-paid loans there is a risk to the underlying business model.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock. Good luck with all your 2021 investments.