Introduction

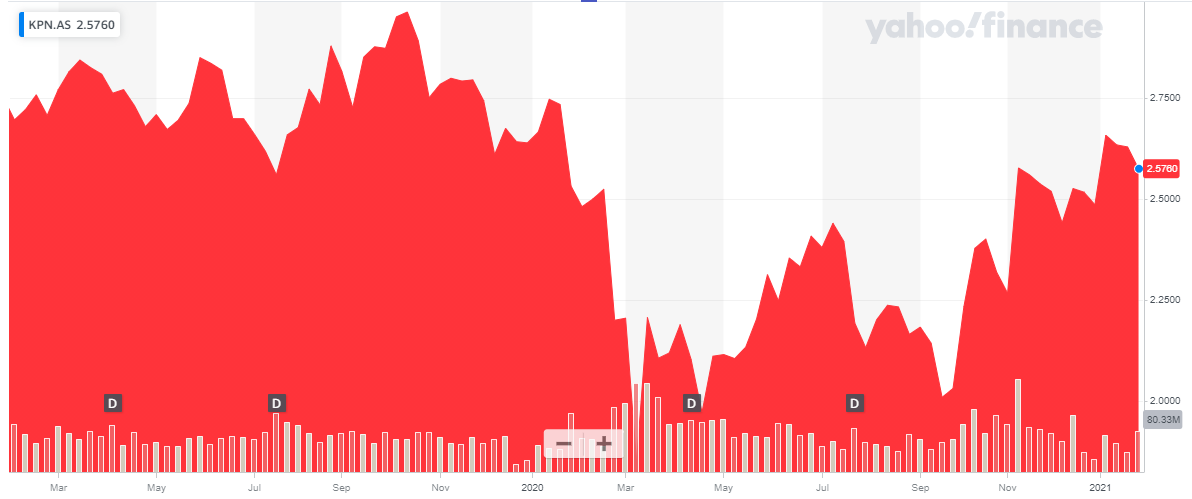

Back in 2019, I was getting interested in the Dutch telecom company Koninklijke KPN (OTCPK:KKPNF) (OTCPK:KKPNY) as the 4.4% dividend seemed appealing, and in this older article I explain why the dividend, which at that point was about 33% higher than the EPS, was still fully sustainable. Fast forward to January 2021 as KPN already released results for FY 2020, confirming a 13-cent dividend and confirming the expected dividend growth rate in the 2021-2023 time frame. As the share price is trading at roughly the same levels as where it was at in 2019, it’s perhaps time to give KPN another good look.

Source: Yahoo Finance

It’s hardly a surprise to see the company’s primary listing in Amsterdam is providing better liquidity than its North American listing. Trading with KPN as its ticker symbol, the average daily volume on the AEX is approximately 16 million shares, for a monetary value of approximately 40M EUR per day. As KPN trades in EUR and reports its financial results in EUR, I will use the Euro as base currency throughout this article.

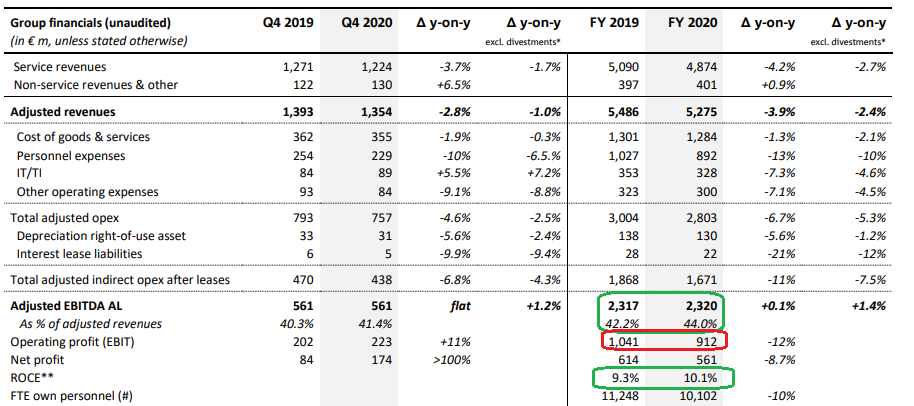

The FY 2020 results are now in, and KPN did pretty well despite the profit decrease

While my main focus is on the dividend sustainability which I will tackle in the next section of this article, it’s important to understand the starting point here. Although KPN reported a revenue decrease, its EBITDA (after lease payments) actually increased by a fraction of a percent thanks to a higher EBITDA margin which increased from 42.2% to 44%. This doesn’t mean the net income increased as well. In fact, the net profit decreased from 614M EUR to 561M EUR.

Source: press release

This actually confirms my thesis from 2019. The depreciation expenses are much higher than the sustaining capex which means the net income is not correctly representing the true underlying cash flow result of the company. Although the net income decreased by just 53M EUR, the EBIT actually decreased by almost 130M EUR as the depreciation expenses increased from 1.28B EUR to 1.41B EUR.

And that’s important. Because although the profits have been under pressure, the capex remained stable at approximately 1.15B EUR which means the delta between depreciation and capex has increased and while the net income has decreased in 2020 compared to 2019, the free cash flow result has actually increased from 726M EUR to 765M EUR. And that’s a vital part to understand why I’m bullish on the KPN dividend and dividend projections.

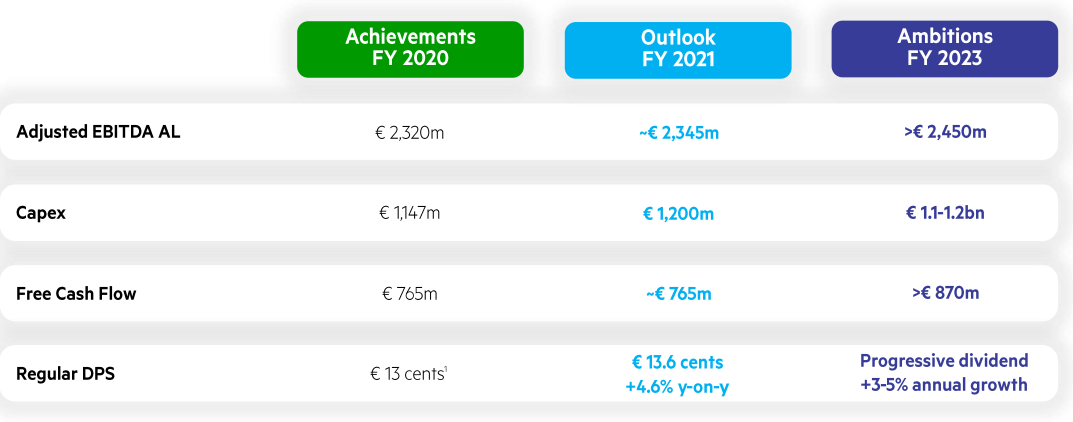

The outlook for 2021 and 2023 is very encouraging and implies a continuously increasing dividend from here on

For FY 2020, KPN has confirmed the full-year dividend will be 13 cents. Considering an interim dividend of 4.3 cents has already been paid, the final dividend of 8.7 cents will be paid before the summer, assuming the AGM approves the dividend proposal. Based on the current share price of 2.576 EUR for KPN, this represents a dividend yield of 5.05%. That’s great, but what was even more interesting was KPN’s official 2021 and 2023 guidance which includes targets for both the free cash flow result as well as the annual dividend.

Source: company presentation

So while the free cash flow is expected to remain roughly stable in 2021 (despite the 5% capex increase which indicates the operating cash flow will likely increase by a few percent to almost 2B EUR), the dividend will be increased by 4.6% to 13.6 cents. That’s good to know as the increased dividend represents a yield of almost 5.3% at the current share price. The standard dividend withholding tax rate in the Netherlands is 15% but the country has treaties in place with other nations to reduce the impact of the initial withholding tax.

But the guidance for 2023 is even more interesting. We see the capex will remain at roughly the same level while the EBITDA is expected to increase by approximately 4% resulting in a 15% increase in the free cash flow which is expected to reach 870M EUR in 2023 (up from 765M EUR in 2020 and 2021). The higher free cash flow will also underpin KPN’s ambition to continue to increase the dividend. Subsequent to paying the 13.6 cents over FY 2021, KPN is aiming for a "progressive dividend" with an annual growth rate of 3-5%. Applying a 4% growth rate would result in a dividend of 14.7 cents in 2023, for a dividend yield of 5.7% based on the current share price.

And while the dividend will increase, the free cash flow guidance implies the payout ratio will decrease. With a FCF per share of approximately 18.2 cents in 2021, a 13.6 cent dividend represents a payout ratio of almost exactly 75%. However, should KPN’s 2023 guidance for a free cash flow result of 870M EUR be correct, that would imply a free cash flow per share of 20.7 cents and a dividend of 14.7 cent would indicate a payout ratio of 71%.

Investment thesis

So while KPN increases the dividend, the dividend actually gets safer as the payout ratio will decrease in the next few years. This makes KPN an interesting investment for investors looking for a gradual dividend increase while making sure said dividends are actually sustainable. With a dividend yield exceeding 5% and a payout ratio of less than 75%, KPN’s dividend is safe. While the recent buyout rumors may or may not materialize, KPN is attractively valued in a buy-and-hold scenario and any M&A would just be icing on the cake.

I picked up a small long position during the March crash at around 2.20 EUR and may add on weakness. I’m confident the current dividend is safe and to see KPN increase its annual dividend the next few years in line with its guidance.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!